Image by Midjourney Pic: Midjourney

Editors' Note: Many Fast News images are stylised illustrations generated by Dall-E. Photorealism is not intended. View as early and evolving AI art!

Virtual cards rise,

APIs drive the surge,

A new era dawns.

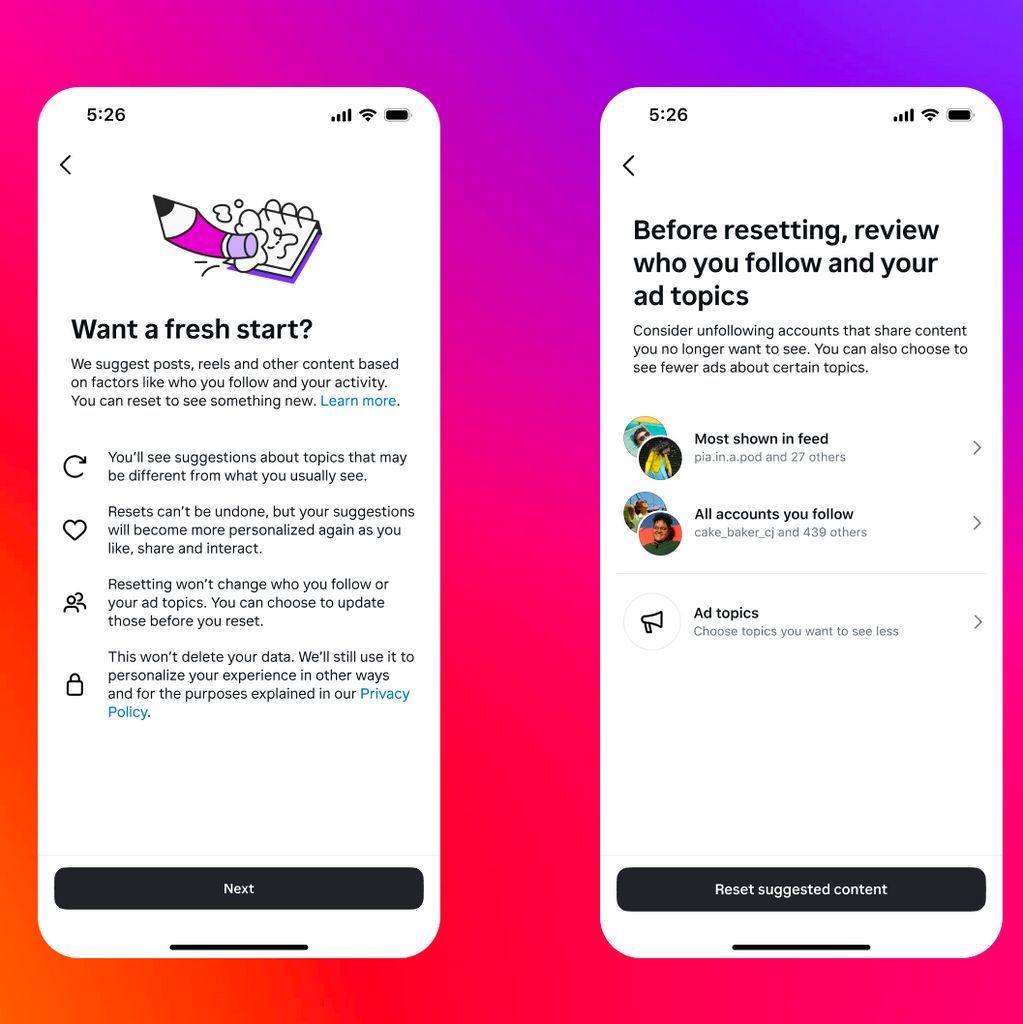

Virtual card spend set to skyrocket to $13.8 trillion by 2028, says Juniper Research

A new study by Juniper Research forecasts a dramatic surge in global virtual card spend, predicting a 355% increase to reach $13.8 trillion by 2028, up from $3.1 trillion in 2023. The primary catalyst for this growth is anticipated to be the adoption of API-based virtual card issuing platforms.

Virtual cards, which utilise randomly generated, typically temporary card numbers linked to a payment account, are replacing traditional payment details. They offer a secure and swift method to distribute funds and manage spending limits. API-based virtual card issuing enhances the process of card issuance, making it more seamless and cost-effective, thereby improving efficiency and expanding use cases in both B2B and consumer payments.

The Juniper Research Competitor Leaderboard report identifies Stripe, Revolut, and Marqeta as frontrunners in the virtual cards space. Their success is attributed to intuitive, API-based platforms that securely deploy cards and manage spending restrictions.

Research author Daniel Bedford is quoted as saying, 'Virtual cards offer an adaptable solution that can be heavily customised, including spending limits and restrictions; enabling businesses to significantly improve their spend management, while reducing costs.'

In a competitive consumer virtual cards space, Juniper Research advises vendors to offer loyalty- and rewards-linked cards to distinguish themselves. Exclusive offers on partner products, rewards points, and cashback on specific merchants can stimulate virtual card spending and customer retention.