Pic: Midjourney

Editors' Note: Many Fast News images are stylised illustrations generated by Dall-E. Photorealism is not intended. View as early and evolving AI art!

Super's new campaign,

Engage more, grow wealth, retire,

AMP's plan takes aim.

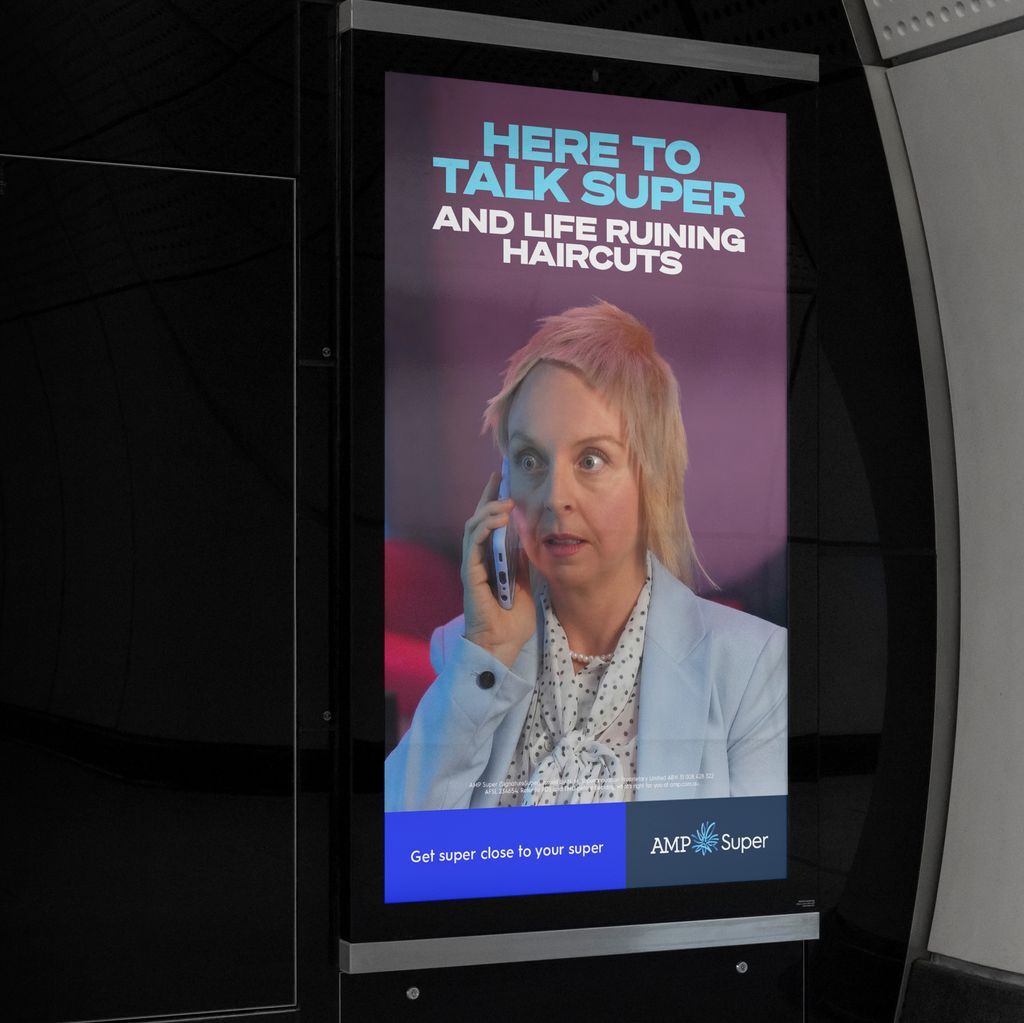

AMP, CHEP launch first super campaign in years: 'Get close to your super'

CHEP Network and AMP Super have launched a national campaign aimed at encouraging Australians to engage more with their superannuation titled 'Get super close to your super'.

This is AMP Super's first major initiative in many years, launching across TV, OOH, radio, social and digital platforms. The campaign is based on research showing that many Australians don't engage with their super until they near retirement age. It is part of a long-term commitment to help Australians engage more with their super.

The campaign features a TVC directed by Damian Shatford at Sweetshop, showcasing Australians confiding in AMP Super about personal topics. The campaign's objective is to position AMP Super as an active partner in helping Australians grow their wealth and achieve their retirement goals through initiatives like super coaches and digital tools.

Melinda Howes, AMP’s Group Executive Superannuation & Investments, said: "Our research showed us that many Australians are disengaged from their super and that it’s only when they get nearer to retirement that they appreciate its importance to their quality of life in retirement. Through this creative and light-hearted campaign, AMP wants to encourage more people to ‘get close to their super’, so they can make the most of their working years and maximise their retirement savings."

The campaign's humorous approach is evident in the TVC, which features a scenario where an individual wonders if their barista crush can be their super beneficiary. Gavin McLeod, Chief Creative Officer at CHEP Network, said: "Staying on top of your super is a smart move. To highlight this, we had some fun showing how AMP’s Super Coaches are on call to help you understand whether your barista crush can be your super beneficiary. Spoiler alert: they can’t."