Image by DALL·E Pic: Midjourney

Editors' Note: Many Fast News images are stylised illustrations generated by Dall-E. Photorealism is not intended. View as early and evolving AI art!

Bid for Rightmove fails,

REA Group's offer trails,

In market scales.

REA Group aims for third time lucky after second bid for Rightmove is rejected

REA Group is making its third attempt to acquire Britain's largest property listings platform Rightmove, after its second offer was turned down last week.

The parent company of realestate.com.au had upped its initial offer to nearly £7.50 (A$14.67) per share, valuing Rightmove at around $11.5 billion. Rightmove had previously dismissed REA Group's first bid, worth £7.05 per share, as 'wholly opportunistic'. According to a Bloomberg report, REA Group was considering a multibillion-dollar bridging loan to facilitate the acquisition.

REA Group's initial approach was made at the start of September and since then, Rightmove shares have risen by more than 20%. Under the original proposal, Rightmove shareholders would have held approximately 18.6% of the combined group's issued share capital after the proposed transaction.

The second proposal represented a 27% premium to Rightmove's share price on 30 August 2024, and a 29% premium to Rightmove's 6-month volume weighted average share price of 548 pence. Rightmove's EBITDA for the 12 months ended 30 June 2024 was £272 million.

Having been rejected, REA confirmed this morning it's making a third attempt. The latest 'further improved proposal' total offer value of 770 pence for each Rightmove share and values Rightmove’s entire issued and to be issued ordinary share capital at approximately £6.1 billion. The third offer would see Righmove paid 341 pence in cash and 0.0422 in new REA shares.

It's an increase of 9.2% on the total value of the Initial Proposal made on 5 September 2024, and a 39% premium to Rightmove’s undisturbed share price of 556 pence on 30 August 2024, along with a 41% premium to Rightmove’s 6-month volume weighted average share price of 548. REA said it's also a 43% premium to Rightmove’s 12-month volume weighted average share price of 540 pence, making the enterprise value multiple approximately 22.4x Rightmove’s EBITDA for the 12 months ended 30 June 2024 of £272 million.

REA Group CEO, Owen Wilson, reiterated his belief the combination of REA's expertise and technology with the attractive Rightmove business will create an enhanced experience for agents, buyers and sellers of property.

"We are genuinely disappointed at the lack of engagement by Rightmove’s Board and we strongly encourage the Rightmove Board to engage," he said.

"We live in a world of intensifying competition and this proposed transaction would bring together two highly complementary digital property businesses for investment and growth. We have today increased our proposal to an implied value of 770 pence – it provides a combination of immediate value certainty in cash and at the same time gives Rightmove shareholders an increasing opportunity in core digital property and adjacencies where we have much expertise."

The cash component of the Further Improved Proposal is expected to be fully financed through long-term third-party debt and existing cash resources.

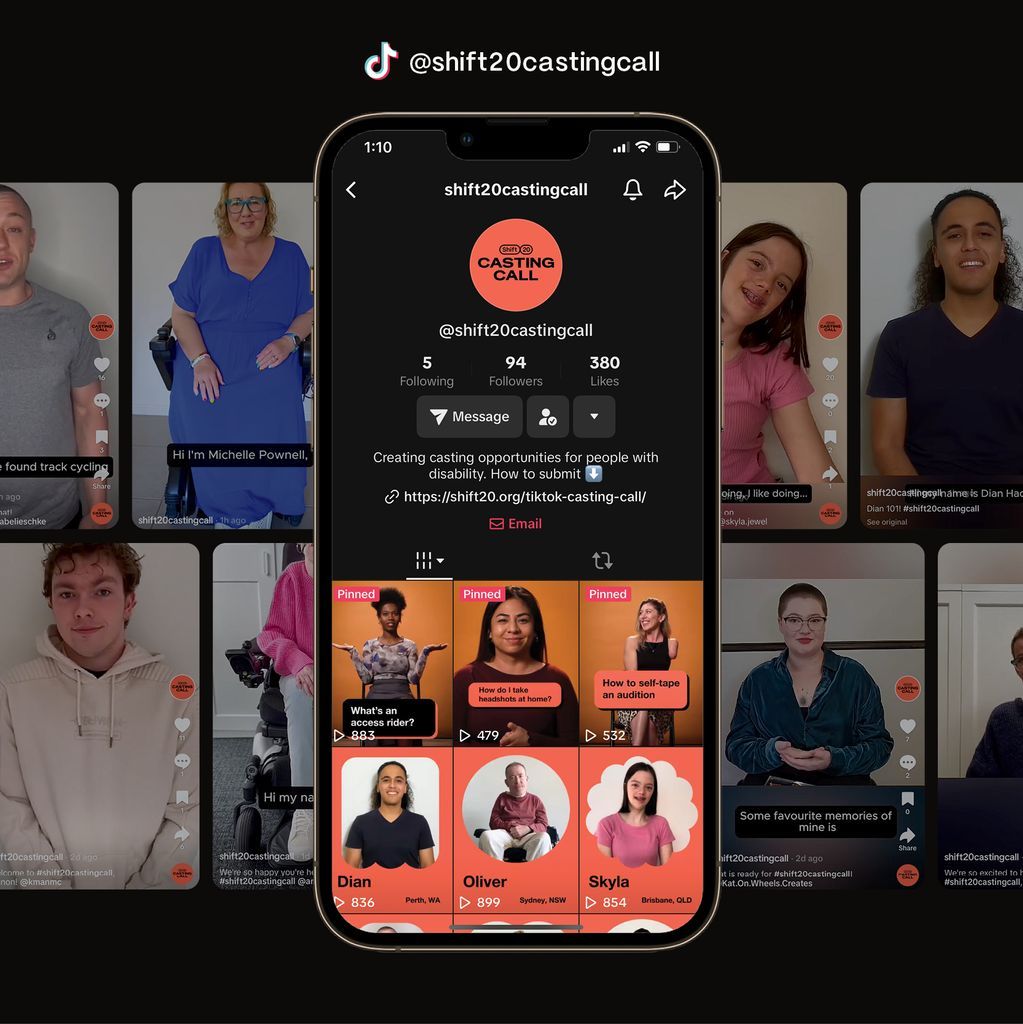

Partner Content from Salesforce

The AI Imperative: It’s Time for Financial Services to Embrace AI

How Trusted AI Opens Up New Possibilities for Customer Service