Image by DALL·E Pic: Midjourney

Editors' Note: Many Fast News images are stylised illustrations generated by Dall-E. Photorealism is not intended. View as early and evolving AI art!

Prices rise, trust falls,

Consumers tighten their purse,

Marketers, heed the call.

Neuro-Insight study reveals consumers feel governments have lost control of rising prices

Neuro-Insight has conducted new research into consumer's neurological responses to current economic challenges, revealing that a strong sentiment that governments have lost control of inflation.

Using a representative sample of typical consumers Neuro-Insight measured neuro responses to a range of stimuli featuring different statements about interest rates, the economy, the cost of living and spending. The method provides insights into the inner emotional state of consumers, with long term memory encoding also measured.

"What consumers think and feel drives what they do. However, what is much more challenging to understand, prioritise and quantify are consumers’ emotional states. That’s because they are beyond conscious reach – normally the remit of surveys and the like. Emotions and memories ultimately drive consumer behaviour and decision-making," said Neuro-Insight principal consultant, Peter Pynta.

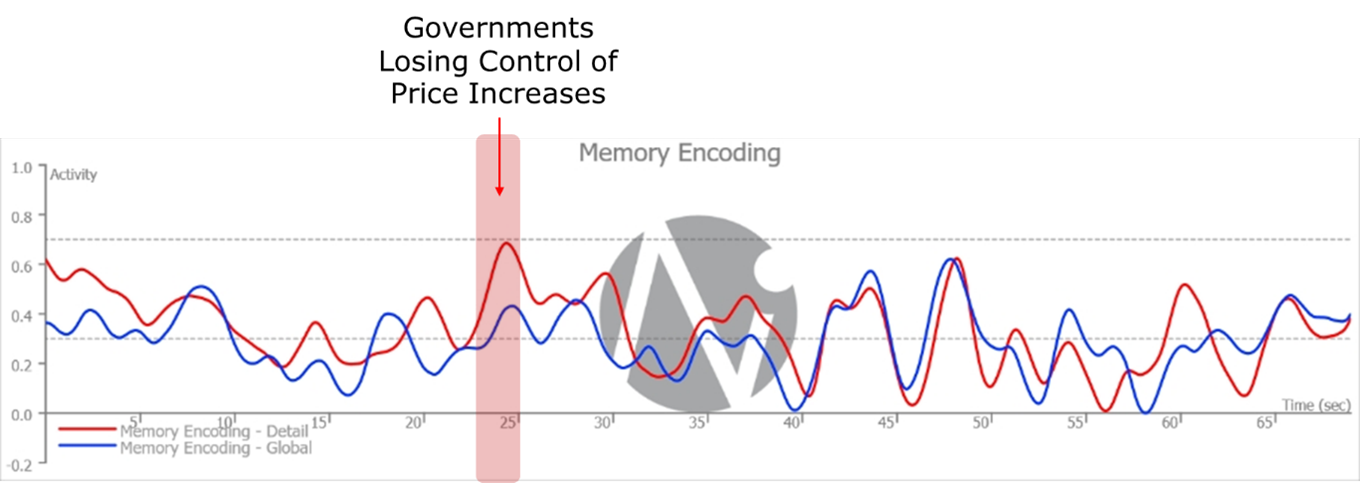

Consumer responses to a statement about governments losing control of price increase were the strongest measured in the study, peaking at 0.68 - almost twice that of the project's average.

"Whilst the government will definitely offer cost of living relief, it’s communications may be over-shadowed by ever-more discerning and critical consumers (voters) who seem to be questioning who really is in control. They may seek to take back more control themselves!" said Pynta.

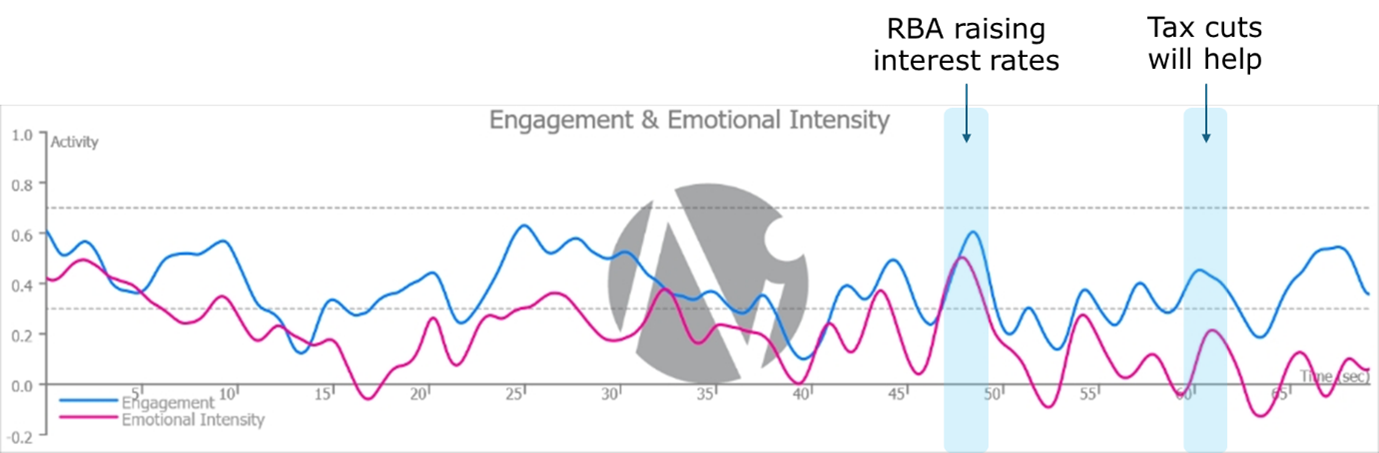

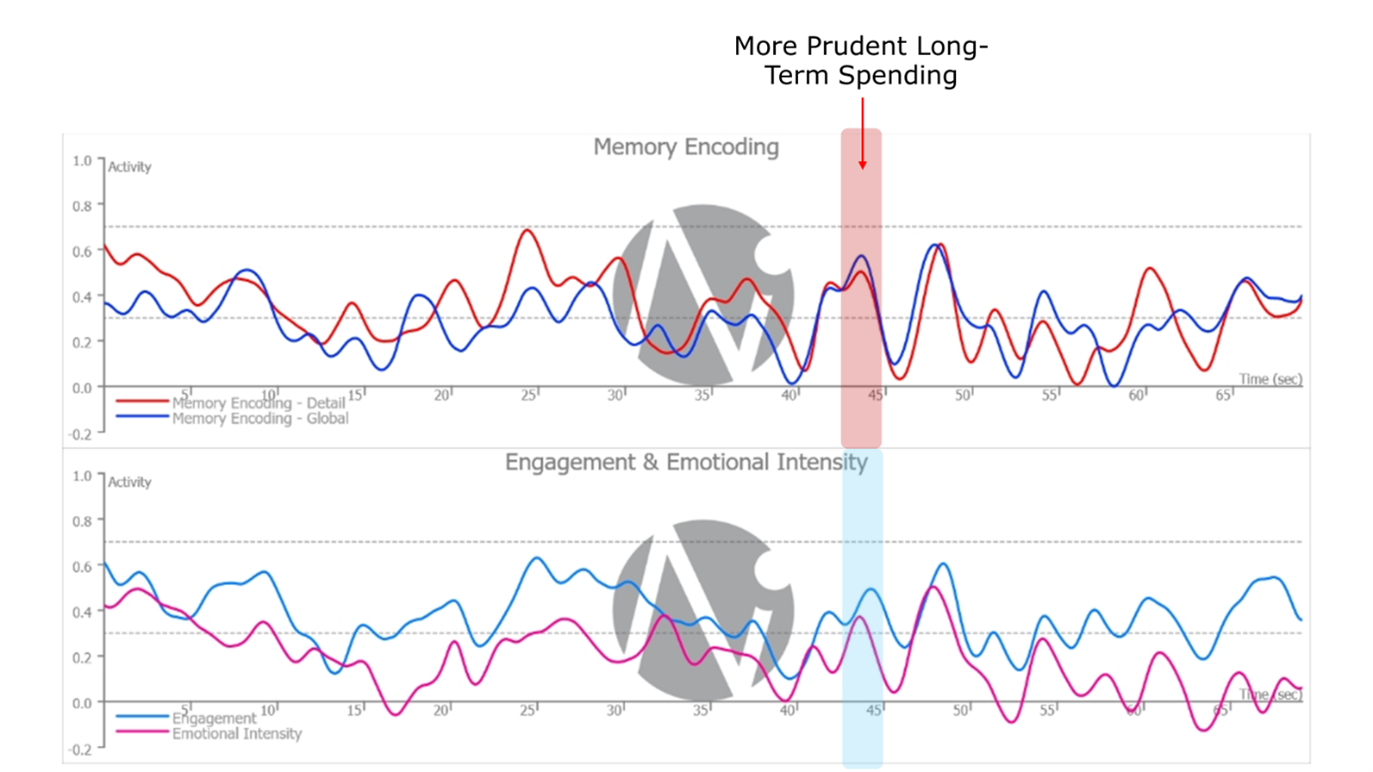

The research also found that consumers are highly engaged in the RBA's interest rate policy and future tax changes. Meanwhile, the notion of more prudent spending also received strong responses, which Pynta said is likely to suggest longer term reductions in consumer spend.

"Another finding which will have marketers fighting harder for discretionary household budgets is the fact that consumers also responded strongly to notion of more prudent spending in the longer term as well – even after to pressure subsides. So, this could mean that the good times won’t simply snap back. Consumer spending could remain challenged for longer," he said.

In Pynta's view, consumer's budgetary challenges will force advertisers to work a lot smarter and harder to stimulate the same returns that they're used to.

"One option – target those Spending Power segments. Those consumers who earn an income from interest rates – and still have spending power – rather than those who are exposed to debt," he said.

Partner Content from Salesforce

A Guide to Personalised Marketing That Keeps Customers Engaged

Customer Service Makes a Strategic Shift for ANZ Organisations