Synthetic customers meet synthetic CMOs (and CFOs): Evidenza clones Sharp, Ritson, Binet & Field to build annual marketing plans in minutes; Mars, EY sign-up

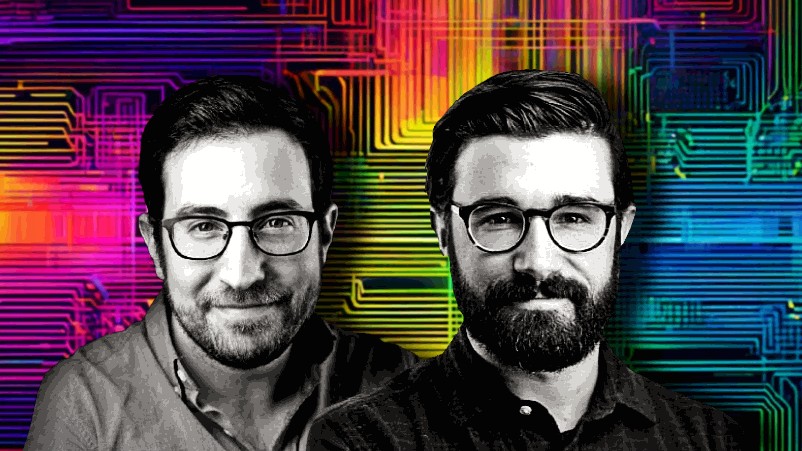

Evidenza cofounders Peter Weinberg (left) and Jon Lombardo have convinced some major marketers that synthetic is the new real, creating cloned customers – and marketing science-based marketing plans – on demand via large language models.

The effectiveness “revolution” is colliding with the AI-spawned efficiency uprising and it’s leapfrogging the early consensus on AI use cases in marketing around automating personalised content and communications. So much so Mark Ritson choked on his Wellfleet oysters when Jon Lombardo and Peter Weinberg told him they were leaving top jobs at LinkedIn-backed thinktank, the B2B Institute. Then they told him why. Ritson promptly joined their venture, along with what Weinberg calls “the advisory board to end all advisory boards”. Thus the synthetically-enhanced AI marketing outfit Evidenza was born. The founders claim their new piece of “synthetic customer” tech – which starts with creating AI copies of target customers – creates 95 per cent accurate customer responses. I.e. it mimics company CEOs, CFOs, CTOs, CIOs, CROs and the rest with strong correlation to the real thing. Those customers are really hard to find within B2B markets, which is why research is so expensive and takes so long. EY’s CMO – and a long list of others – verify that claim, because they’ve tested it head-to-head. “It can imitate essentially anyone by gathering and synthesising massive amounts of data,” per Weinberg. Evidenza claims it can also synthesise marketing strategy, science and the “pantheon” of effectiveness gurus, like Byron Sharp, Jenni Romaniuk, Karen Nelson-Field, Les Binet and Peter Field. Which means marketers can ask them what they ‘think’ of their plans. Evidenza has already cloned Ritson to deliver “a finance friendly marketing plan that used to take months in minutes”, per Lombardo. “Well, maybe a day.” Weinberg acknowledges cussing is a challenge. But they are actively debugging.

What you need to know:

- Evidenza founders Jon Lombardo and Peter Weinberg claim their new piece of “synthetic customer” tech creates virtual customers on demand – and is 95 per cent identical to the real thing. Which means research takes minutes not months and costs much, much less.

- Snake oil? That’s what EY thought, and Salesforce, and Mars. Now they are all buying in.

- It starts with creating AI copies of target customers and per the duo can create an annual marketing strategy, category entry points, messaging and positioning at a fraction of the cost of traditional market research and in a fraction of the time it takes for a marketing team to do the same.

- But as well as synthesising customers, the system also synthesises marketing strategy and science.

- Imagine on one side a synthetic combination of Mark Ritson, Professor Byron Sharp teamed with ad effectiveness maestros Peter Field and Les Binet. Then on the other side, hundreds of synthetic CEOs, CFOs, CTOs, CIOs, CMOs and each of those functions linked to the nuances of different industries and categories.

- Put them all into an AI blender, and you get what Lombardo and Weinberg think is an efficiency revolution in marketing fused with the effectiveness revolution from the marketing academics.

- The upshot for marketers? “A finance-friendly marketing plan that used to take months now takes maybe minutes, but more likely, a day,” per Weinberg.

- According to Lombardo that’s good news even for traditional market researchers. “Everyone is going to get better. Average is over.”

- So what’s left for the humans? The synthetic duo say the smart stuff – experience, strategic frameworks and brand and category nuance, for instance – that makes the machines do better.

- Get the full, human-based download via the podcast.

The first thing we do is create this ‘silicon sample’ of your customers. So you put in your brand, you put in the category, you put in the audience you care about, and then we'll create a bunch of those customers. We basically give you customers on demand.

Synthetic customer breakdown

Peter Weinberg was sufficiently convinced of the accuracy of synthetic customers that he quit his well paid job when his wife was seven months pregnant.

Which must mean Mrs Weinberg was equally convinced. But first, some basics – what is a synthetic customer?

Per Weinberg, the simplest way to describe is as “an AI generated copy of a real customer”.

How does one go about building that copy?

“Well, imagine these large language models going out and reading what every CFO has said about a given professional topic – like tax advisory services.

“So you go out and you read every earnings call, every analyst report on the sector, all the websites of all the tax advisory firms, every newspaper article about tax laws, tax changes, academic, economic papers – this huge, massive data set, until you have a very good understanding what is being said about the category of tax advisory services, and by whom,” says Weinberg.

“And once these large language models have all of that context, they're then able to start impersonating different types of category buyers, whether it's a CEO or a CFO or a left handed mom in Lithuania, it can really imitate essentially anyone by gathering and synthesising massive amounts of data.”

The Salesforce epiphany

Weinberg and Lombardo hit upon the idea of using synthetic customers for market research when doing a major CRM category entry point project for Salesforce. They were then still employed by LinkedIn, where their remit was basically “helping big, mostly B2B companies adopt Ehrenberg-Bass style marketing”, says Weinberg.

They’d identified 30 different category entry points for when businesses would need to think about buying a CRM, and presented the research to Salesforce.

“I had a lot of mixed emotions, because the meeting went really well, but I just couldn't get over the fact that it didn't really scale very well – because that form of research is super valuable. But it had taken eight months and it had cost a couple of hundred thousand dollars – these things tend to be slow and expensive [via] traditional market research,” says Weinberg.

That’s largely because getting a decent and willing sample of execs who buy CRM to take a survey is really hard work.

“They don't take 60 minute surveys for a $100 Applebee's gift card. That's a tough sell. These are hard to reach professionals,” says Weinberg. “Then we sort of stumbled upon this idea of synthetic market research…”

In short, Weinberg asked ChatGPT to identify some of the CRM buying situations he’d just handed over to Salesforce. “It spat out a list, I compared it to the actual research we had done, and it was basically identical. It was … 91, 93 per cent the same.”

But that was for a relatively simple task. To go further, they needed to build “an entire synthetic panel of different types of CRM buyers, to ask multiple questions in a row, to understand their brand preferences – and you can't really do that in ChatGPT.”

Which is when they called one of Weinberg’s old college friends – “an extremely talented engineer” and ex-Facebook exec called Brian Watroba – who started to produce synthetic market research reports via multiple large language models.

“So instead of surveying real CROs or CEOs or CFOs, [surveying] synthetic approximations of those audiences. When we compared the answers, we found them to be incredibly similar, and we thought that could be a really big business – and we subsequently quit our jobs.”

Watroba did likewise, joining Weinberg and Lombardo as a co-founder.

Getting people with teeth to take a survey [for a toothpaste brand] is a pain in the ass. But it's not like trying to get the CEOs of the five biggest airlines to take a survey. That's close to impossible. Because the pain is so much more acute in B2B as it relates to getting access to the customer, the value proposition of being able to have your synthetic customer on demand is just more compelling.

Customers on demand

So what can Evidenza’s platform actually do for marketing?

“A lot,” says Lombardo.

“Most great marketing plans – that's where we're trying to build, finance-friendly marketing plans, things you can show to sales and to finance to get funded – they start with great research.

“The first thing we do is create this ‘silicon sample’ of your customers. So you put in your brand, you put in the category, you put in the audience you care about, and then we'll create a bunch of those customers. We basically give you customers on demand,” he adds.

“Then you can start to understand those customers by talking to them – that's qualitative research, almost like a focus group. Or you can do quantitative research, where you write a survey and you field a survey to them.”

EY buys in

According to Evidenza’s case studies for Salesforce and EY, the results hold water.

EY Americas CMO Toni Clayton-Hine was one of the first people Lombardo and Weinberg approached with their new tech. She thought is sounded too good to be true. So she asked them to test head to head against her own data and gave them “the survey questions she had just asked CEOs of companies with more than $10bn in revenue in the US,” per Weinberg. “It was a big, complex survey … and she said ‘you produce the synthetic answers and I will compare the two.

“So we went off to our secret laboratory, which is in a volcano in Brooklyn, produced synthetic CEOs, got them to take the survey and submitted our answers to Toni. She compared them, and we reached 95 per cent of the same conclusions as her actual survey,” he continues. “And that is not a one-off. We’ve probably run 60-70 head to head tests at this point to prove that you will essentially get the same answers from synthetic respondents as you would from real human respondents.”

As for EY, it’s “been a fantastic client ever since.”

Per Evidenza's testimonials there is only one business, Service Now, that bucks the trend. "I'd recommend NOT working with the Evidenza team," states brand chief Jim Lesser. "We'd like to keep the competitive advantage for ourselves."

Marketing plans… in minutes

Research, says Lombardo, is the critical first part. But then brands need to use the data to make decisions and build a coherent marketing plan.

“So we then actually channel those customers and those customer insights into segmentation, targeting, positioning. We then can help you with creative and distribution. We can help you think about measurement.

“If you stitch all that together and assign financial values – which is something we don’t do enough in the world of marketing effectiveness – then you get end-to-end, a really finance-friendly marketing plan that used to take months, and now takes maybe minutes,” he says. “Well, maybe more like a day.”

We basically took Ritson’s brain and turned it into code. We had Ritson build us the ultimate platonic form of a marketing plan – and we now have a software system that can programmatically build and spit out Ritson-style marketing plans. F*cks keep slipping in. But we’re working on that. We are debugging.

Easing B2B pain

There’s deeper need for Evidenza’s synthetic approach within B2B due to the nature of narrower market niches. But it’s applicable within B2C, just in different ways.

B2C companies are “very focused on CEPs [category entry points] or what they call occasions or moments. Because in some senses, if you're selling toothpaste, you're selling to anybody who has teeth. Beers, you’re selling to anybody who drinks. So you don't need as much segmentation – it’s 18-plus or everybody with teeth. But they really do need to understand is what are the most valuable situations or occasions, and how can I rank them by financial value so I position my brand against the most valuable moments or need.”

The B2B marketers need much more end-to-end help, “they need everything”, per Lombardo, because they are often not trained marketers. “They want the research, they want segmentation, targeting, positioning, creative testing.”

But it’s the research that comes first – and that’s one of B2B’s biggest stumbling blocks. “Getting people with teeth to take a survey is a pain in the ass. But it's not like trying to get the CEOs of the five biggest airlines to take a survey. That's close to impossible,” says Weinberg. “So because the pain is so much more acute in B2B as it relates to getting access to the customer, the value proposition of being able to have your synthetic customer on demand is just more compelling in a B2B use case. And obviously that's where a lot of John and my relationships and expertise has been.”

Cloning Ritson

Deep B2B relationships also enabled Evidenza to put together what Weinberg quips is “the advisory board to end all advisory boards.” It includes ex-GE marketing chief “Linda Boff, probably the most famous B2B CMO in the world” as well as former AB InBev CMO Chris Burggraeve and LinkedIn chief product officer and AI expert Tomer Cohen. There’s also Carey Dorman, CFO at NYSE-listed chemicals business Element Solutions, plus as a research partner Professor Stefano Puntoni, who leads the AI centre at Wharton. Not to mention virtual professor Mark Ritson.

“Why do we have these people? I think because John and I see an opportunity to bring together cutting edge thinking with cutting edge technology,” says Weinberg. “Eventually there'll be a lot of synthetic research companies. The question will be what do you use the synthetic panel to actually do? And there you need to actually have deep expertise. You need to be versed in this effectiveness revolution to take advantage of the efficiency revolution of AI.”

Hence the likes of Ritson providing access to what a good marketing plan actually looks like.

“We basically took Ritson’s brain and turned it into code. We had Ritson build us the ultimate platonic form of a marketing plan. And we now have a software system that can programmatically build and spit out Ritson-style marketing plans.”

How hard was it to train the AIs not to cuss?

“Fucks keep slipping in,” acknowledges Weinberg. “But we’re working on that. We are debugging some of Ritson’s spicier commentary.”

Either way, Lombardo says the point is that assimilating and synthesising marketing effectiveness greats via AI creates “augmented intelligence” that will improve all marketers and their output.

“There's an enormous amount we're all going to learn from this augmented intelligence. Because you can literally talk to Ritson, you could talk to Jenni [Romaniuk], you could talk to Byron [Sharp], you could talk to Les [Binet], you could talk to Peter [Field], talk to Karen Nelson-Field, to Grace Kite, whomever… You can learn from those people in a way that you never could before.

“So everybody's going to get better. Average is over … The level is going to raise for marketers,” says Lombardo.

“And the machines are probably as dumb as they are ever going to be right now.”

MMM does measurement at the end. We do measurement at the start … If you get a couple of key decisions up front right, then everything else will be more effective downstream. So I have respect for MMM. I think it makes a lot of sense, but that's at the end. We think there's actually enormous value in measuring at the start, not at the end.

MMM twist

Lombardo and Weinberg agree that Evidenza can dovetail with marketing mix modelling (MMM).

“They can co-exist,” per Weinberg. “In our ideal world, you would use something like Evidenza to figure out, here's my marketing plan, here's the return it's going to generate. I got funding, I'm going to go run it. Then you use things like MMM to understand what the financial impact was when you actually put it into market. Ideally, these two things start to feed each other over time – so you've got a flywheel where you can put the results from execution back into planning, and both sides of the house get smarter and smarter.”

But Lombardo suggests Evidenza removes the guesswork upfront.

“MMM does measurement at the end. We do measurement at the start … If you get a couple of key decisions up front right, then everything else will be more effective downstream. So I have respect for MMM. I think it makes a lot of sense, but that's at the end. We think there's actually enormous value in measuring at the start, not at the end.”

Everyone [in market research] is dead!

Research market disrupted?

Asked about Evidenza’s disruptive impact on traditional market research firms, Lombardo is largely circumspect.

“Market research industry people are too interested in their competition. They should be much more interested in their customers … I'm sure that they will continue to do well.” He says, because, particularly in B2B, there is a dearth of research “and not enough insights full stop … So there is plenty to go around.”

Weinberg interrupts with a more succinct take. “Everyone’s dead.”

Jokes aside, he says most of the market researchers they have spoken with see upside.

“They don't like being the people in the company who you come to and they say, ‘Oh, yeah, I'll get you that in 12 months. It's going to cost you a million dollars and if it comes back and isn't exactly what you wanted, you're shit out of luck.’ They see an opportunity to add a lot more value internally by being able to do more research faster, more cost efficiently than they could before. So ultimately, I think it's a big opportunity to elevate the profession of market research,” says Weinberg.

“In theory, it's probably the most important function in marketing, because it's about the customer and what the customer needs, and every successful marketing decision ideally should be anchored in the voice of the customer. So we definitely see that as a big opportunity.”

Self-serve incoming

Seven months into launch phase, Lombardo and Weinberg acknowledge it is very early days for Evidenza.

“But we're off to a very, very strong start. We have over 30 customers. They're some of the biggest brands in the world. We're bullish on the business – we would not have quit our jobs with my seven month pregnant wife if we weren't,” says Weinberg.

Right now, Evidenza is packaged as a managed service.

“But we certainly plan to build a self-service offering in the future,” he says. “That is the opportunity to democratise market research and marketing strategy.”

Got this far? Get the richer, 100 per cent human-based download via the podcast.