The big squeeze: Freedom Furniture, ING, Menulog, SPC CMOs unpack what they will and won’t do to get through FY25

From left: Menulog's Simon Cheng, ING's Danielle Hamilton, Freedom Furniture's Jason Piggott and SPC's Peta Allsopp

Freedom Furniture GM of marketing, Jason Piggott, sees it as a see-saw: “Adjusting the now, while still keeping an eye on the future”. Marketers from across industry sectors are all too aware of the impact ongoing economic uncertainty and cost-of-living woes are having on customers’ hip pockets, sales and salience. But marketers at Freedom, ING, SPC and Menulog are largely sticking to their guns when it comes to the way they plan out their FY25 budgets, key initiatives and how they manage agency partnerships.

What you need to know:

- With the tough economic macro trends continuing into FY25, Mi3 asked four marketing chiefs how this is impacting their FY25 planning, programming, agency partnership models and whether it changes where marketing needs to place its bets.

- The consensus across ING, Freedom Furniture, Menulog and SPC is to keep betting on those big, strategic brand and marketing plays – even as they battle short-term deteriorating retail conditions and cash-strapped consumers hunting value.

- Customer retention and lifecycle is a big one for these marketers in particular, with all indicating emphasis on these efforts.

- Hedging bets is the name of the game however, and there’s a mix of pre-programmed budget planning and quarterly flexibility in train across all the brands Mi3 spoke to.

- Both long-term and project-driven agency partnerships are equally in play, with ING upping its in-house performance media capabilities to mobilise for agility even as SPC puts more work in the hands of its creative agency partner.

We haven't shifted our planning cycles as such, but the current uncertainty weighs heavily on the investment posture – particular in terms of driving retail sales today and building the brand for tomorrow. The result is a constant evolution of the tactical elements of our plan and recalibration of when and where we are investing, particularly non-media marketing investment and unlocking latent value in our loyalty program to drive repeat visitation and sales.

You’re not going to find many marketers who aren’t looking to optimise and gain a lift from reassessing some aspect of their marketing in this current economic climate. In Freedom’s case, there’s been a trimming of the sails, and the need to fine-tune the retail promotions calendar and short-term wins to cope with consumers struggling to commit to that final purchase, says marketing boss Jason Piggott.

Over at ING, mobilising for agility through an in-house performance media team plus overt brand acts to help consumers get through these tough times are sitting alongside “big rocks” where advanced planning is delivering additional value, says CMO, Danielle Hamilton. For Menulog, quarterly planning cycles, focusing harder on customer retention and a combined project and retainer-based agency approach enable flexibility with long-term budgets and allow the team to adjust investment as required, says director of marketing, Simon Cheng.

Meanwhile, SPC CMO Peta Allsopp’s touting laser focus on strategic areas of growth, saying no to activities that could distract from bigger objectives, and acknowledging economic conditions are not expected to change substantially anytime soon all feeding into how she’s steering the FMCG ship through FY25.

Yet as much as the budgets, planning cadences, agency approaches and action plans differ across the four marketing leaders Mi3 spoke to, what’s evident is an ongoing commitment to ensuring tentpole marketing initiatives not only survive but thrive in the midst of uncertainty and bad economic weather.

At the end of the day, retail is detail and while we play the long game of building brand and demand to encourage more Aussies to switch their banking relationship to ING, we will continue to also have a very focused eye on the monthly, weekly, even daily account, revenue and balance numbers.

FY25 budgets and planning cycles

The macro trends surrounding brands and businesses as 2024 kicked off have persisted as we’ve made our way through this calendar year: Dour economic conditions, a cost-of-living crisis, stubbornly rising inflation and a deteriorating jobs market.

In Mi3’s new Marketing & Customer Benchmarks: FY2025 Outlook report, this manifested in an even three-way split across marketing budgets. While one-third have entered the new financial year with additional funds in the kitty, another third are simply holding dollars on last year’s budgets; and one-third have less to spend.

But given the longevity these economic conditions are exhibiting, Mi3 also wanted to know how this has taken its toll not just on the dollars available to marketers, but the way they’re planning and structuring their FY25 approach.

“The weak retail market across H1 of 2024 has definitely been challenging, and from a marketing perspective we've had to focus on 'trimming the sails' and focusing on the key marketing initiatives that deliver in the moments that matter for our customers,” responds Piggott. “While we are still seeing robust category interest and intent from consumers, the cost-of-living challenges are weighing large on the final decision to purchase and to combat this we are having to fine tune our retail promotions calendar to ensure that we are delivering the right value equation, driving sales and mitigating the impact on margins.”

From a planning perspective, the challenge for the Freedom marketing team “has been around adjusting the now, whilst still keeping an eye on the future”, says Piggott. Such an effort was particularly trying across H1.

“The impact of this will be felt over the next 12 months as we play catch up on initiatives in the first half of 2025,” he says. “We haven't shifted our planning cycles as such, but the current uncertainty weighs heavily on the investment posture – particularly in terms of driving retail sales today and building the brand for tomorrow. The result is a constant evolution of the tactical elements of our plan and recalibration of when and where we are investing, particularly non-media marketing investment and unlocking latent value in our myFreedom loyalty program to drive repeat visitation and sales.”

Menulog is operating in a highly competitive industry, which means staying agile when it comes to marketing planning is a pre-requisite for Cheng.

“It’s no different for FY25, even with changing economic conditions,” he says. “Certainly, like all businesses, we’re not immune to the current economic pressures and it's been key for us to gauge customer sentiment at a time where discretionary spend is limited, due to the cost-of-living crisis. At Menulog, we’re focusing on customer retention, ensuring we continue to keep those already engaged with the platform long-term.

“However, this doesn’t mean we’re not focused on acquisition; our industry is very dynamic, and we are always looking for new and innovative opportunities to get new customers into the category.”

Allsopp points out the tough economic conditions are not new – SPC has had to operate in this climate for the last 12 months. “I’m not expecting significant changes for FY25,” she tells Mi3.

“The cost-of-living crisis is real, and we have plenty of data points around how consumers are behaving, what they are looking for and how brands can help. This hasn’t changed our business planning cycle – we started our budget planning process in January, which was completed in May, endorsed by the board and now live.”

As discussed in a recent CMO profile with Mi3, SPC recently completed its whole-of-business strategy, focused on growth plans for the next five years. That’s now been shared with teams, providing a clear set of strategic choices Allsopp hopes will align the total business around profitable growth in FY25.

“From a marketing budget perspective, I am laser focused on investing in strategic areas of growth,” Allsopp continues. “The marketing budget for FY25 has increased from FY24 and I have planned the spend by quarter based on some exciting key initiatives we will be launching in FY25.

“We are doing fewer, bigger, better. We have made very clear choices on where we will compete and how. Our marketing investment will drive growth in core areas as well as launch new innovations to delight consumers. We know consumers want real value and they are only spending their hard earned dollars on items that really meet their needs. We have some bold plans in place for FY25 and to achieve this, we will be laser focused on these key consumer-led activities.”

That means saying ‘no’ to many activities likely to distract SPC’s marketing team from achieving its bigger objectives.

“Prioritisation is about choices. We are only investing in activities that will turn the dial,” Allsopp adds.

We are doing fewer, bigger, better. We have made very clear choices on where we will compete and how. Our marketing investment will drive growth in core areas as well as launch new innovations to delight consumers. We know consumers want real value and they are only spending their hard earnt dollars on items that really meet their needs. We have some bold plans in place for FY25 and to achieve this, we will be laser focused on these key consumer-led activities.

How marketers are budgeting

As part of Mi3’s Marketing & Customer Benchmarks: FY2025 Outlook, we asked marketers to share how they’re setting budgets to understand more adaptive versus tried-and-true ways of employing these dollars. What emerged was a heavy skew towards planning against sales targets (69 per cent), followed by year-prior (66 per cent) and revenue objectives (61 per cent). Much further down the list are zero-based budgeting (23 per cent), and competitive benchmarking (14 per cent).

Despite the current economic climate, Menulog continues to favour shorter planning cycles [quarterly]. “We always need the ability to be flexible with our long-term budget,” Cheng says.

From a business planning POV, and as a subsidiary of a large global bank, ING Australia is doing a combination of annual planning across marketing strategy, investment principles, portfolio planning, then more tactical quarterly planning.

“At an enterprise level, we have a strong quarterly business planning framework with plans being ‘committed’ a quarter out,” Hamilton explains. “However, this year has been a great example of requiring ongoing agility through these quarterly planning cycles to pivot our resources – both marketing dollars and teammates – towards outcomes that require the additional focus and investment.

“For 2025, we’ll again deliver an annual plan to enable us to align on the holistic marketing-driven contribution of our investment against core bank outcomes – across brand / reputation, customer, revenue. This is our contract with the business so to speak. At the end of the day, retail is detail and while we play the long game of building brand and demand to encourage more Aussies to switch their banking relationship to ING, we will continue to also have a very focused eye on the monthly, weekly, even daily account, revenue and balance numbers.”

While the retail environment remains weak, Freedom’s business focus on growth is holding, and it’s driving the marketing investment posture, Piggott says.

“The weakening media market, our focus on growth and the Freedom brand’s ability to deliver sales even in the current retail climate means we are in a position to be bold and continue to invest for growth across H2 and into 2025. Whilst we continue to be positive about the next 12 months, there is no doubt we are being tested and need to work harder to ensure we get the results that we are chasing,” he says.

Certainly, like all businesses, we’re not immune to the current economic pressures and it's been key for us to gauge customer sentiment at a time where discretionary spend is limited, due to the cost-of-living crisis. At Menulog, we’re focusing on customer retention, ensuring we continue to keep those already engaged with the platform long-term. However, this doesn’t mean we’re not focused on acquisition; our industry is very dynamic, and we are always looking for new and innovative opportunities to get new customers into the category.

Agency partnership models

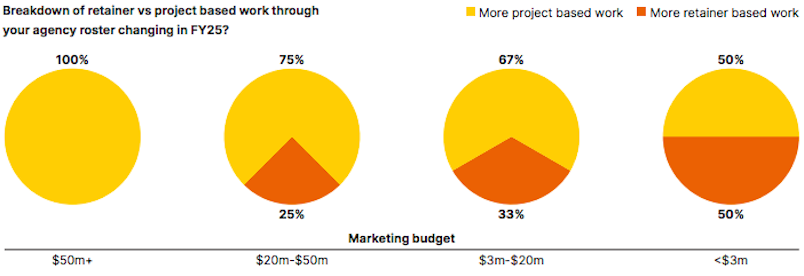

Another trend which came through Mi3’s FY25 report is growing preference towards project-based agency partnerships over retainer models, especially for brands with budgets exceeding $20m and seemingly entirely at the top end of town.

For example, while those with more $50m+ budgets saying their agency models are mostly project-based, for those with between $3m – $20m in annual spend project-based models are in play two-thirds of the time but one-third is still retainer. Marketers with under $3m evenly split between project and retainer-based agency partnerships.

Menulog is one of those brands hedging its bets in terms of agency spend. “We have always opted to have a mix of retainer and project-based work, which means we get consistency and the best people allocated to Menulog, while also having the ability to adjust the investment as required,” Cheng comments.

One way ING has mobilised for agility is by in-housing the majority of its digital performance media. Hamilton describes this as a “very purposeful approach”.

“This ensures we have in-house capability to plan, buy, execute and optimise in performance channels at pace and in response to market, competitor and customer context,” she says.

Over at SPC, Allsopp has mostly consolidated key creative activities with its lead agency Akcelo. “We are partners in creating brand fame for our iconic SPC brands. We can both derive far more value from our partnership as we are all fully invested in the same goals, rather than working project by project with different firms where you don’t necessarily get that same level of thought or understanding and output,” she says.

For Freedom, broader cost pressures with agencies post-Covid, which became acute over the past 12 to 18 months, led to more focus on the return on investment. To help, Piggott is exploring advances in technology such as AI to drive efficiencies and cost savings.

“This is to help when and where we are investing with agency partners on activities where they can add the most value, strategy, creative, measurement and less on the non-value-added areas such as administration or low value executional elements,” he says. “We'll kick off work in this space with creative and media agencies in H2 to find savings that can be diverted into marketing activities with greater returns.”

Marketing program plays

There are the other ways the scowling economic climate is bearing down on marketing programs in the second half of calendar 2025. All marketers indicate it’s influenced or resulted in adjustments in their choice of executions. Yet at the same time, all believe in the value of sticking to longer-term, strategic marketing efforts and are working conscientiously to make that happen. Marketers like Hamilton haven’t forgotten brand purpose either.

“We've actually increased our marketing spend this year, to ensure we’re top of mind for customers and demonstrate we’re helping them get through these turbulent times.”

Marketing program and brand act examples she points to in 2024 include a Sunrise / Channel 7 finance news partnership featuring ING’s head of consumer and market insights, Matt Bowen, aimed at helping consumers make sense of complex consumer finance stories in really relatable way.

ING also has a ‘Refer a friend’ program, which Hamilton claims is one of its most efficient and effective acquisition channels. This sees existing customers incentivised to refer as well as new joiners signing up. Brand partnerships are another way to provide more value to ING customers and Hamilton indicates more are on their way shortly.

“Understanding the temptation in these tough economic conditions of moving more investment to short term conversion activities, we continue to maintain a balanced strategy, supported by a balanced scorecard, which enables us to continue to invest in longer term brand demand generation activities- like ATL media, meaningful brand partnerships – while also being heavily focused on new customer acquisition, cross sell and retention,” Hamilton says.

“I still hold a firm belief that there is benefit in locking in on some ‘big rocks’ where advance planning helps deliver additional value – like partnerships and upfront media investments. Our Channel 7 finance news partnership is a recent example of this. However, the lion’s share of our working dollars will remain somewhat flexible through each quarter to enable us to pivot based on audiences, channels, propositions, partnerships that are delivering the most volume and/or value.”

In concert, Hamilton notes sizeable customer growth continues to come through organic channels, buoyed by deep advocacy in the customer base.

“Deepening and delighting existing customer relationships has always been a part of our growth strategy and as such, lifecycle marketing continues to be where a lot of the team are focused,” she says. “This will absolutely continue through 2024 and 2025.”

Over at Freedom, Piggott is also touting a clear focus on strategy, objectives and executional plans for the next 12-plus months even with the pressure on sales and consumer skittishness.

“This is about growth and new customer acquisition,” he says. “The great news is the current overall business and retail environment has us questioning more before we commit – measure twice, cut once! Does it align with our strategy? Will it enhance our customer’s experience and engagement? Is there an opportunity to optimise the investment – including taking advantage of some of the great deals you can strike in this environment?

“It’s a great time to do a contract review. I think of the old saying: Never waste a downturn or recession, look for the opportunities with fresh eyes and consider different approaches. This could be the time to make a bold move.”