CX disconnect: Banks, carmakers, telcos failing to join customer dots, ‘gaming’ NPS, measuring wrong outcomes, undermining martech investments – but universities nailing it

Despite billions invested in martech, CX is flatlining, per CSBA's data across 200 firms. Boss Paul van Veenendaal says businesses can fix the disconnect by plugging frontline teams directly into back-end overhauls.

The stampede by companies into CX, with massive associated investments into martech, specialists teams and organisational overhauls, is having little impact on customer experience scores – and big banks, telcos, and car brands are at best benchmarked as average, despite investing billions collectively. CSBA Managing Director, Paul van Veenendaal, has seven years of CX performance data from 12,000 annual assessments across 200 Australian firms and it’s a sobering read for those firms heralding their commitment to connecting up and improving the experience across all customer contact points. In short, all that tech investment is simply not hooked up to customer contact centres – and NPS scores, which many leadership teams have linked to performance and bonuses, are “being gamed”, he warns, for better but hollow CX benchmarks. No big brands feature in the top 10 of CSBA’s CX rankings, and only one, a superannuation company, makes the top 20. Chatbots aren’t up to scratch yet, says van Veenendaal, and companies have “pretty much parked” speech analytics. Meanwhile despite heavy investment in digital transformation, call centre volumes have not declined over the last seven years – and those call centres are focused on the wrong outcomes and metrics, he says. Hence underwhelming CX scores across CSBA’s rankings. But some sectors are nailing it: Universities and colleges, water companies and local authorities – the latter at least partially due to the policies of a one-time adman and former Victorian Premier. Here’s where van Veenendaal thinks it’s all going wrong – and how to fix it.

What you need to know:

- CSBA has been benchmarking customer experience at 200 Australian organisations for seven years – and in that time MD Paul van Veenendaal says CX hasn’t noticeably improved, despite massive tech investments and organisational overhauls.

- The average firm is sitting on a score of 49.9 out of 100. The best are benchmarking at 82 – but they are universities and local authorities. Big brands like banks, car companies and telcos are way down the order, early 50s at best.

- Meanwhile, although website, email and chat use has increased, that hasn’t reduced call volume – van Veenendaal says it is the same as it was seven years ago – because customers aren’t getting the answers they need first time.

- That’s where businesses should focus their efforts, he suggests, otherwise they risk measuring the wrong things – and “gaming” net promoter scores.

- Plus most companies have "pretty much parked" speech analytics, he says, because it is missing nuance. Chatbots deployments are patchy.

- Van Veenendaal suggests big CX and martech projects are disconnected from the front-line staff, who are “the canaries in the coal mine” on key challenges and where to focus efforts.

- He says top management needs to lead from the front on CX, set the direction and ensure front line staff are given sufficient training and more robust frameworks in order to move customer experience scores beyond the current average.

- Get the full download via the podcast.

Our research has pretty much demonstrated that in the last seven years customer experience has been flat. Basically across the sectors we measure, the scores have not really moved. Sure there's been exceptions, but in reality, not much has moved.

CSBA has been benchmarking customer experience at 200 Australian firms for the last seven years. It uses a simple but robust methodology – virtual professor Mark Ritson is a fan – where it essentially “mystery shops” those firms “every day of the week”, per MD Paul van Veenendaal, measuring organisations on success, ease and sentiment to create its benchmark. As well as calls, it measures email and chat interactions.

CSBA then gives a score out of 100. The average across those 200 organisations? 49.9 – and it hasn’t moved, which van Veenendaal says should worry those businesses.

“Our research has pretty much demonstrated that in the last seven years customer experience has been flat. Basically across the sectors we measure, the scores have not really moved. Sure there's been exceptions,” he says, “but in reality, not much has moved.”

Which implies that tens of billions of dollars invested in customer experience and martech aren’t connecting-up to the front line of customer service.

Some may point to net promoter scores (NPS) as a counterpoint. But van Veenendaal says such scores are often misleading – or in his words, “gamed” – because businesses are often measuring the wrong thing, especially when it comes to contact centres.

“Organisations are not clear on what their customer experience is, particularly for the frontline staff. They are besotted with digital, with apps, with websites, all these hard numbers.”

But it falls down at the contact centres, he suggests, because their standard approach to measuring performance is via post-call survey work to create a net promoter score. Van Veenendaal thinks these are often meaningless.

[We worked with a telco that did] net promoter scoring at the end of every call. But 50-plus per cent of the calls that come in are people are asking for a password reset. That's very easy to do, takes maybe a minute, and at the end, how would you rate us? They will get nine or ten out of ten. Guess what happens to the overall NPS? It's fantastic .... [because] it is being gamed.

'Gamed' NPS scores

“Just about every contact centre we deal with has a Net Promoter Score of +50 or more – they are all fantastic. So the person in charge of marketing or sales asks the person in charge of operations in the contact centre, how are we going? ‘Oh, we've got a really good Net Promoter Score’. High fives, move on.”

He says CSBS’ work with a telco to illustrates the problem with that approach.

“They do net promoter scoring at the end of every call. But 50-plus per cent of the calls that come in are people are asking for a password reset. That's very easy to do, takes maybe a minute, and at the end, 'how would you rate us?' They will get nine or ten out of ten. Guess what happens to the overall NPS? It's fantastic,” he says.

“It's being gamed – take that information out, put it on a on an app or something to make it automated … but then focus your NPS on the really high quality interactions you're having with your customers and understand what you have to do to improve it. That's what should happen.”

Call centres have been trying to tackle the wrong problems, suggests van Veenendaal, with outsourced operations usually focused on efficiency, minimising cost per call, over quality. That means they are focusing on “hard numbers, like abandonment rate, people not get getting through to the contact centre, call duration” instead of things like first contact resolution.

But unless it’s an emergency, CSBA’s data suggests people don’t mind waiting in a call queue provided they get their issue resolved first time, says van Veenendaal.

“If you're ringing up, inquiring into an organisation, you can wait up to 13 minutes. As long as you get a first contact resolution – you get an answer to your question – there is no difference between your customer satisfaction [levels]. Everybody has been measuring answer the call in 20 seconds or whatever. No, the focus should be giving people a first contact resolution … People need to understand what is the purpose of the call and what the focus should be.”

Super funds seem to have grasped the need to refocus call centre priorities, with some now reversing a decades-long trend of outsourcing and offshoring. Van Veenendaal says Aware and Spirit Super are two standouts in that regard, with the latter topping its latest sector benchmark. But it still only scores 60.5 per cent overall, which puts it well outside the top 10 of the 200 organisations covered by CSBA’s benchmark pool overall.

The number of calls to call centres in Australia are flat – they have not declined in seven years ... So what's happening is that people are using the web or the app or whatever, but … they're not getting the answers they want, and they want to talk to someone. So even though the volume is going down, in terms of people ringing up for the easy questions, they're still getting more calls on their harder questions.

Ifs and bots

Chatbots and speech analytics aren’t making much difference, suggests van Veenendaal.

“It’s early days for both of them. As far as speech analytics is concerned, a number of organisations have jumped into it headlong and said, ‘this is fantastic, we don't have to do quality assurance of 10 per cent of our phone calls, with speech analytics we can now do 100 per cent of the phone calls, nail down triage of what the issues are and improve the experience’,” he says. “What we found is that what you see is not exactly what is happening. And [so] many organisations have pretty much parked that for the moment until it gets more up to speed. It’s machine learning and they're going to learn and they will get better. But…”

He thinks there are good chatbots in service, citing Expedia’s as “very good ... But others are still not quite there yet … and about 50 per cent of people that [use] chatbots end up ringing an talking to a human being.”

Some organisations would see that as a good result. But van Veenendaal says it hasn’t affected overall call volumes.

“You could say I've lost 50 per cent of my calls. But let me be very clear, the number of calls to call centres in Australia are flat – they have not declined in the seven years [CSBA has been benchmarking] – it’s same and that's the same around the world.

“So what's happening is that people are using the web or the app or whatever, but … they're not getting the answers they want, and they want to talk to someone. So even though the volume is going down, in terms of people ringing up for the easy questions, they're still getting more calls on their harder questions.”

Van Veenendaal says the “latest data we have seen” suggests in-person customer service enquiries, i.e. in-store or branch, has dropped “about 8 percentage points, from about 42 per cent to 34 per cent” over the last four years. Customers are instead visiting the website, which he says is “growing by about 1-2 per cent to 25 per cent of all contact”. Contact over the phone is “around 16-17 per cent”, while email over the last four years “has gone from 6.5 per cent to 11 per cent.” Apps, per van Veenendaal, “have gone from 3 per cent to 6 per cent. Web chat, 1 to to 2, 2.5 per cent … But text, social media posts are all around 1 per cent … noise in the scheme of things.”

What good looks like

Universities and colleges are nailing CX, says van Veenendaal, with Holmesglen Institute of TAFE topping CSBA’s latest highest education rankings and placing second overall across all 200 organisations benchmarked.

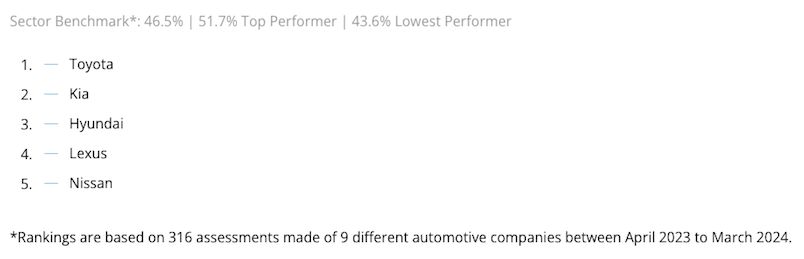

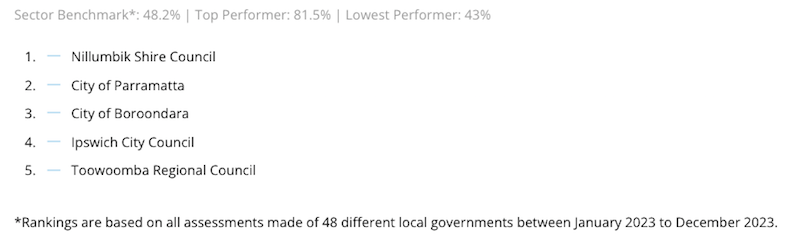

There are six other education providers in the top 10 – Massey University, Australian National University, Deakin, Western Sydney, Federation and Edith Cowan University. There are also two water companies – Melbourne Water and Barwon Water. Top of the pile? Nullumbik Shire Council. Big brands like banks, telcos, and carmakers don’t appear in the top quartile of CSBA’s data – and most are middling at best.

Universities have some of the sharpest incentives to deliver excellent, joined-up CX, says van Veenendaal, given customers will be “paying between $10,000 and $400,000 for a course in Australia” within a highly competitive future student market.

Many of those students are coming from overseas, and so will be more reliant on email or chat for communications if English is not their first language, he says.

“It's not as easy as on the phone, but when they're communicating across those channels, you have to make sure that person can feel that the person [on the other end] is listening to them. If someone says 'I'd be interested to know what hobbies or interests you have, because we’ve got these facilities to help you' … that's better than saying, ‘you have to get grades of X,Y,Z to come to our university and it's going to cost you this amount of money’.

Water companies likewise have strong incentives to deliver better customer experience – with Victoria in 2016 tying the amount water utilities can charge directly to consumer engagement and service delivery. NSW is now following suit, says van Veenendaal.

Meanwhile, local authorities, particularly in Victoria, are also strong CX performers thanks in part to former Premier (and one time adman) Jeff Kennett.

Back in the late nineties, Kennett “decided he wanted to measure the customer experience of every council. So all 79 councillors in Victoria every year are tasked with doing their customer service satisfaction score – and that's played out in a real focus on customer experience across the council sector,” says van Veenendaal.

Hence the likes of Nillumbik Shire Council sitting top of the CX pile.

“Nillumbik have done a great job … and there is a link behind that. Have a look at their website, have a look at their customer service strategy – very clear, very easy to understand. Everybody in the organisation is clear on it. They're getting scores around 82 per cent."

What average looks like

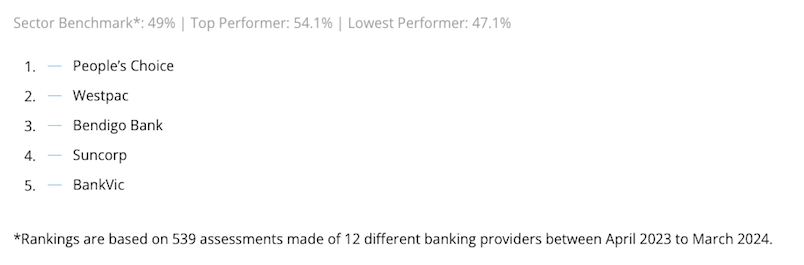

Banking – or at least some big banks – are lauded within marketing circles for the digital CX capabilities they have built out, with CX underpinned by huge data and tech investment and smart partnership strategies. But asked how the sector is performing overall, van Veenendaal’s response is blunt.

“Not too good. They’re a bit below the average [benchmark] of 50 per cent. We do see regional [and smaller] banks like Bendigo or People’s Choice with great customer service and getting it right, but the bigger banks not so much at the moment.”

CSBA’s latest sector rankings actually have Westpac in second behind People’s Choice, which suggests its travails in some technical CX projects have been counterbalanced by other aspects of its customer service approach. Meanwhile the bank is now plotting a $4bn CX overhaul.

What about Commbank? “They're pretty much middle of the pack,” says van Veenendaal. “The ease is just not there. They still haven't got the focus on making it easy for a customer,” he suggests, with work to do after the next best decision in terms of helping customers to actually navigate to the end state of that decision.

But even banks with the best overall scores are only scoring 54 per cent. Van Veenendaal suggests that is underwhelming.

“Is that a great score? I don't think so. If I was running a bank, I would be saying, ‘how do we get to 80 per cent?’” The answer, he says, is firms demonstrating that they are listening to customers and making it easy for them to get first contact resolution. Getting to that point requires leadership to be laser-focused on customer experience, be willing to invest in staff to deliver it and drive it culturally throughout the business.

How to be better

Van Veenendaal says those elements are common amongst the organisations with the highest CSBA benchmark scores – and likewise internationally.

“First of all, the leadership have got a very clear understanding of what a good or great experience looks like, and they can articulate it.

“You just have to look at Disney overseas and how much effort they put in to focus on the experience at every touch-point and the clarity that has. That is that is what we see as paramount,” says van Veenendaal.

“Secondly, the amount of effort these organisations put into training their frontline staff is a high priority. You have to take the time to help them understand what a great experience looks like, and coach and train and give them feedback so they can give a great experience. All these people want to give a great experience to the frontline. No one wants to come to work to do a bad job, they want to do a good job – you provide a framework for them,” he adds.

“The third thing is that they are engaging everybody in the organisation. A good example is if we are trying to get everybody to use the app. So if somebody rings up an organisation, one of the questions they should ask is ‘have you downloaded our app?’”

If the response is no, says van Veenendaal, a prompt to download it when they have time helps solve problems for next time around. “If they say yes, then [the operative] says ‘now at the top of the app in the right corner you’ll see blah, blah, blah… At the end of the call, the clarity they want is somebody saying 'that was easy, I don’t know why I called you in the first place, I didn’t know the app was there’. But I can’t think of one organisation that I've spoken to more recently that has said, ‘have you downloaded the app?’ But that's what smart organisations are doing – linking CX strategy to what the frontline should be doing."

My big takeout is with all this investment in the technology, it is paramount that you involve the frontline in what's going on with the deployment. They're talking to the customers every day. They are the canary in the coal mine. Keep them involved in that program.

Back-end to front-line disconnect?

Van Veenendaal thinks a back-end to front-line disconnect is why the billions of dollars invested in CX and martech hasn’t really moved the customer needle within CSBA's data pool.

“My big takeout is with all this investment in the technology, it is paramount that you involve the frontline in what's going on with the deployment. They're talking to the customers every day and so can give some fantastic feedback as to where the focus should be. They are the canary in the coal mine. Keep them involved in that program,” he says.

“Secondly, with all this technology deployment, you need to be very clear what success looks like. And you have to get the right exception reporting in place.

“Thirdly, don't underestimate the burden that you're putting on the business when you're increasing these channels, putting an app in place, a website plus a call centre. We are increasing the amount of touch points – and it's making it harder and harder to get a consistent experience. You need to work very hard to get that consistent experience across all touch points.”

All that said, van Veenendaal thinks there is another rogue element – the consumer.

“Don't ring on a Monday morning, make sure you’ve got your account details there – and treat the person like a human being. Because if you are the person at the other end of the line and someone treats you with respect, then guess what? They're going to treat you back with respect and help you solve your queries.”

Ranked: Super, auto, telco, water firms and local government