CDP Investigation Part 3: Buyer Beware – integration challenges far more difficult than vendors let on; ANZ, Carsales on where to start, hot tips; experts on industrial sized cans of worms

To CDP or not to CDP, that is the (first) question. Clockwise from top left: Sean Cooper, Vanya Mariani, Richard Taylor, Nigel Dalton, Gagan Batra, Jo Gaines, Andrew Palmer, Adam Barty.

ANZ Bank's digital sales by volume has surged from 28 per cent a few years ago to 70 per cent today. That creates a huge lake of first-party customer data that can be deployed to optimise media, build better CX and ultimately increase the share of wallet and lifetime customer value. It’s little wonder then that the bank is now investigating a CDP. Carsales is at the other end of the journey. Its CDP went live in Q2 2022, and it's starting to reap the rewards, including match rates for clients closing in on 60 per cent. So one brand is just getting started and the other is live. But in Part Three of our investigation of the CDP market we interrogate the difficult in-between moments marketers must navigate, and – buyer beware – it’s much messier and more complicated than the slick sales pitches let on. Fights over data ownership, significant technical integration problems, and serious limitations with all those out-of-the-box connectors the vendors like to brag about creates risks to project deadlines, and in the worst cases, career advancement. Sometimes just identifying who has credentials and getting them to share can take months. And then there’s the simple (yet apparently not) question of whether you need a CDP at all.

What you need to know

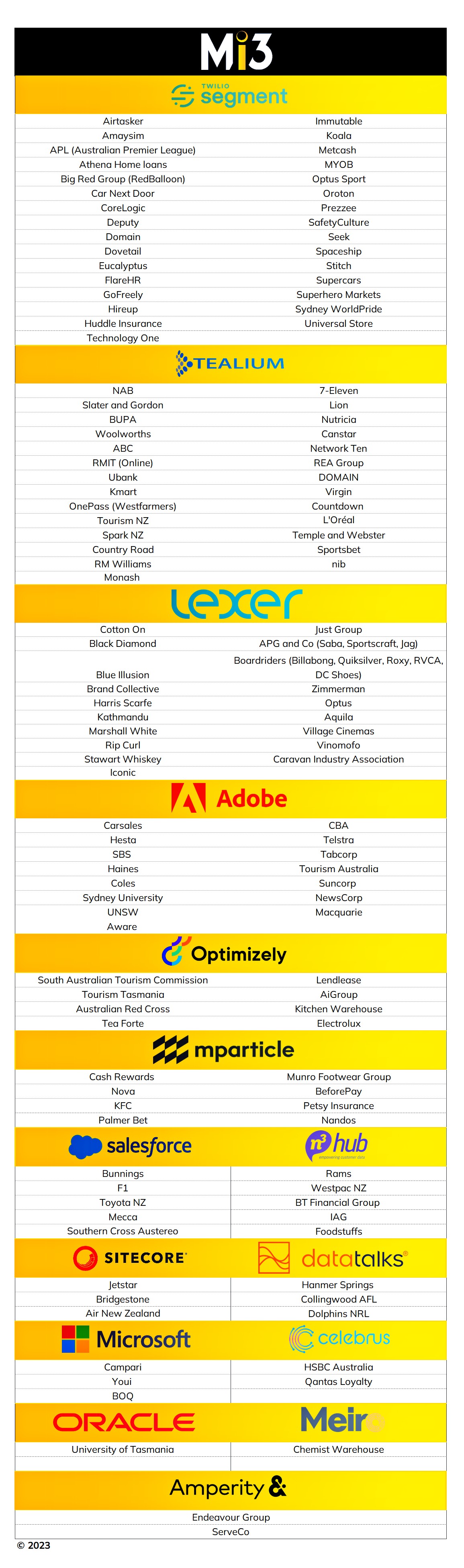

- Brands are piling into customer data platforms, and Mi3 has identified at least 550 implementations in Australia.

- There are common use cases; digital identity, media optimisation, personalisation, but there are also many common problems during the implementation, and the costs are material, running into the tens and even hundreds of thousands of dollars if you don't get the scope right.

- Integration challenges top the list. On the technical side, those much vaunted connectors the vendors like to brag about are basic in nature and often require significant modification. Then they have to be maintained.

- Some connectors work out of the box when they are connecting to a vendor's own apps (but not always) and in other cases, it's an absolute nightmare, says Revium founder Adam Barty.

- All that integration work also creates stickiness – and some would argue lock in – for the CDP providers. Rip and replace projects are rare. Partly that's market maturity but it also reflects the pain involved in going back to the drawing board if you want to swap suppliers.

- Organisational impediments abound: getting partners to share admin level access can be painful, and sometimes just identifying who has the necessary credentials can be problematic. "It's a can of worms," says Insighten's Gagan Batra.

- Access to technical resources is another bug bear – so make sure you bring in all the key stakeholders as early as possible.

- And don't get cheap on external expertise, per Carsales Head of Commercial, Media, Vanya Mariani whose CDP has been live for a year and is delivering strong results: "The hot tip if you want to go down this path – hire some kick-arse solution architects and ensure your requirements gathering is solid."

- ANZ Bank is at the start of its CDP journey, following what's considered best practice – define the use cases and run proof of concepts before you even think about writing the business case. It's already far enough along to have had conversations with Adobe, Salesforce and Tealium, says Andrew Palmer, head of personalisation and digital sales.

- Implementors and brands alike we spoke with said it's important to ask the question: Do you actually need a CDP. Per Jo Gaines, "Do they need a CDP? You might be doing personalisation, but not really need CDP. Whether it's optimisation, AB testing, or for better targeting, they may not need a CDP but it's still a CDP-like use case."

- Is the composable approach, which proponents say delivers faster speed to value at the cost a some functionality actually a better bet?

- Finally, think about how you implement your CDP. Rather than building one layer upon another and discovering too late you have a problem, build a 'think layer' that spans the whole stack, says Thoughtworks Nigel Dalton.

- In part one of our examination of the local CDP market we looked at what CDPs the brands were buying to determine which vendors are leading the market, while in part two we interrogated the business imperatives driving uptake. Along the way we heard from Jetstar, News Corp, SCA, Chemist Warehouse, Karbon, CIAA, Nova Entertainment and University of Tasmania.

- Now in part three we reveal the impediments, pitfalls and complications brands should expect (and plan for) in the business case.

- Read Part Four: Chemist Warehouse, SCA, Nova, News, Carsales on how CDPs have changed operations, structures, capability – but why consent management may be next martech wave.

Some [connectors] work out of the box. Others are absolute nightmares and don't work. You have to work really hard to maintain them – and then that's an issue across a whole bunch of areas.

Building a business case for a customer data platform (CDP) demands some serious Buyer Beware sensitivities. Start with use cases, involve all stakeholder early, and ask a lot of questions, starting with do you really need one. Recognise up front that the pain is in the integrations, and connectors are not a magic bullet.

Get it right and the returns are significant, according to more than a dozen brands Mi3 has interviewed during its CDP market investigation. Get it wrong and it's nightmare territory.

ANZ Bank is on the CDP journey. It's very early days, per Andrew Palmer, Head of Personalisation and Digital Sales at ANZ, but he’s already had discussions with Adobe, Salesforce and Tealium. With media optimisation proof of concepts already complete, the bank is now moving to the next phase.

“I think as the landscape becomes more complex, and as cookies start to degrade closer to a date – which is obviously a shifting date – the need for CDPs becomes more critical,” he told Mi3.

Hence the bank starting to ask some pretty fundamental post-cookie questions: “Do we have the data, the right location, the right quality infrastructure to leverage it more effectively, then how do we solve some of those use cases.”

Not surprisingly, the bank already has systems in place to tackle the single view of the customer problem – a typical CDP use case, and as such it is already looking beyond that problem.

“We leverage that [single view] to make sure we're personalising at the right moments as well. Where a CDP does help is stitching those things together, so stitching all the behavioural and transactional information to the customer,” said Palmer.

He describes the status as 'pre-business-case'.

“We have gone through the cases that we feel a CDP will help solve for us as a group. If we want our customers to be able to get more value from their products or services, then what will we require to get there? What data do we need to make that happen? How do we stitch it together and how do we enact that as well? What's the data we need that we stitch together? Is it behavioural, or is it transactional? Do we have tools to align that or not which is where the CDP comes in? And if we do that, what’s the value for both customers and the business?”

We have seen match rates with two leading Australian Insurance businesses at 45 per cent to 60 per cent, which is the first win. We are in the process of tracking uplift for customers using this solution that fits their specific objectives.

Carsales: The pay off

At the other end of the implementation cycle, Vanya Mariani, Commercial Director of media at Carsales, has been running a live CDP for more than a year, and can now measure impact.

The project sought to address three specific, largely external, through broadly related issues: third party cookie deprecation; changes in privacy legislation and; the challenges with sharing of app identifiers.

It’s important to view these in the context of the business Carsales wants to build.

“Ultimately, we see ourselves as a data and tech business. We saw a great opportunity to get ahead of the changes that were coming our way because as a business, the breadth and depth of data we have is actually quite extraordinary,” she said.

Buyers of big-ticket items like cars, boats, bikes, and caravans use Carsales as a key research tool, and that generates a tonne of data, per Mariani.

“So in the value exchange, we not only capture PII (personally identifiable information) data to help people along their journey to ownership, but rich behavioural signals as well.

“We had this burning desire to be able to organise this information, to reach and understand people, not devices, and to be able to do that at scale.”

The classified giant went live with its Adobe CDP in Q2 2022 and has already racked up some impressive wins, not least of all resurrecting its Safari audience, after Apple moved early to cull third-party cookies.

The real win for Mariani and her team is the positive impact for customers in the group’s media business.

She told Mi3, that Carsales match, its people-based marketing solution, “has seen match rates with two leading Australian Insurance businesses at 45 per cent to 60 per cent, which is the first win. We are in the process of tracking uplift for customers using this solution that fits their specific objectives.”

By combining its CDP with its identity solution Mariani says that Carsales can now deliver a fully addressable, non-third party cookie reliant, and privacy compliant environment that advertisers can tap. “In simple terms, the digital cliché of reaching the right audience, at the right time in the right place can now be realised with precision," she said. A lot of people claim the same capability, but the reality is that few publishers and platforms can actually deliver it.

Hot implementations tips

While Carsales is now netting that all-important return on investment, Mariani’s experience of the challenges of implementing a CDP is demonstrative of the kinds of issues brands should expect to face – and in Carsales' case it was relatively straightforward implementation.

“The hot tip if you want to go down this path – hire some kick-arse solution architects and ensure your requirements gathering is solid.”

“I wouldn't say it was a breeze. But I think that we set ourselves up for the whole of business to buy into the value exchange,” said Mariani.

“We all agreed that the key challenge was getting that alignment across the entire business. We wanted to position it is a full data eco play, which extends it beyond just a martech solution. And it's very easy for businesses just to look at it as a martech solution,” she added.

“In the creation of the business case, we made sure that we positioned it as a central piece of orchestration tech that could add value in other areas of the business, for example, to enhance our user experience journey, as well as all our media – like marketing comms. It was actually about setting the tone early and getting all the people across the business involved early so they could fully understand the value of what it means across their [part of the] business.”

Boss level engagement

Engagement always comes with an overhead – including executive leadership scrutiny. But doing deep detail upfront means those driving CDP projects are likely to emerge intact, and with a better chance of landing the funds.

“Given the scale of the investment and the scope of the impact, executive leadership were not shy about their concerns or their questions," per Mariani. “I wouldn’t say skepticism... but look, it was a big investment.

“Given the amount of capital and operational investment that this type of implementation would require, and considering the change and potential disruption to the business workflow, of course the leadership team had to make sure that we could answer all of the questions they might have. All it meant was that we had to demonstrate confidence in execution excellence.”

There was a particular focus on timing, she said.

“With Google changing the dates around third party cookies, the question was, ‘Is the timing right, do we have to do this now or is there something we can do it later down the track?' Now by this stage, we'd done a considerable amount of work to understand the as-is state versus where we wanted to be. That was the big communication piece with the business – and that gap between the two states formed the basis of our detailed requirements, which we then took into the RFP process.”

They've gone through all the pain for it with not really much of an outcome.

Cart, then horse: Do you really need a CDP?

In both the case of ANZ and Carsales, there was a fundamental question that first needed to be answered – do you even need a CDP?

Jo Gaines is an independent consultant with with extensive experience in the CDP landscape from her time at Salesforce.

While she appreciates the benefits of CDPs, Gaines said they are not always the answer.

"Do they [actually] need a CDP? You might be doing personalisation, but not really need a CDP. Whether its optimisation, AB testing, better targeting, they may not need a CDP – but it's still a CDP-like use case. That's the challenge. There are lots of people doing great things in personalisation, getting the right message to the right person at the right time, no matter what channel they're on. And it's not just CDPs that can do that," said Gaines.

"Salesforce have their own personalisation tool [which started as a CDP]. And I know a bunch of the other technology companies also have their own personalisation tools," she said.

Invest in analytics brains or waste the tech

While more than 550 companies have answered yes to the CDP question already in Australia and New Zealand, according to Mi3’s research, too few firms apply a strict enough discipline to the question of whether they actually need one. Gagan Batra, a director at marketing analytics and technology consulting firm Insighten, operates on the front line of the growing demand for CDPs.

“Often for most of what they need to do, they can do it with the existing tech that's out there, whether it's their own stack, or whether it's functionality that's offered through something like a Google or a Facebook,” he told Mi3.

Worse, he said, once businesses get through the whole implementation process and actually start using it, some are still only doing what they previously did pre-CDP: “They've gone through all the pain with not really much of an outcome".

Another mistake is to underestimate the internal capabilities required to leverage the CDP investment, i.e "building a team of marketing and analytics people,” per Batra.

“Most companies do not have access to that. The likes of a Suncorp or a CBA would, but most organisations just do not have the capacity and capability to do it – so they end up just spending all this money on another implementation, and adding more ongoing [cost of] maintenance of that platform.”

One alternative that seems to be growing in popularity, especially for mid tier companies, is the idea of composable CDPs – i.e. unbundled systems that act as an activation layer that sits atop of wherever a customer's data resides, rather than a standalone, all-singing and dancing system.

Typically the biggest media uplift is to remove the 20 percent of an audience who are least likely to buy, by negatively targeting this segment, along with activating first-party data.

Composable CDPs: mid-tier alternative?

Audience Group director Sean Cooper says clients are looking at composable CDPs as an alternative. The goal is to deliver speed to value for mid-sized clients – those typically spending $2m to $5m-plus per annum on media and marketing.

“The tech solutions we are working with all have a 'pay as you go' approach to pricing, which means we can be looking at getting a proof of concept for a CDP up for $30-$50k in the first 12 months.”

“The business need is typically focused around cost savings – data security and operating efficiencies – followed by customer optimisation [i.e.] segmentation and executions,” per Cooper.

The approach involves pulling together a coalition of providers across cost optimisation, security and customer optimisation.

Once the CDP has been “composed” – either in total or in part – brands can start measuring cost savings and security uplift, alongside marketing optimisation, with increases in sales and lifetime value, and media efficiencies, said Cooper.

"Typically the biggest media uplift is to remove the 20 per cent of an audience who are least likely to buy, by negatively targeting this segment [i.e. supression] along with activating first-party data."

For IT the biggest wins come from reducing costs and security risks.

The composable CDP also creates the platform to enable things like customer segmentation and media mix modelling without having to set up separate data “projects” to get the data required in the right format, or structure, or time periods" he said.

But while the composable approach might provide a better path for some clients, it won't eliminate all the issues that plague bespoke CDPs such as aligning organisational siloes and factions. It also means dealing with and managing multiple vendors, and sacrificing the simplicity of having a single CDP vendor – creating compound challenges.

Plus, there is still the need to integrate with applications. On that front the CDP brands have a simple and arguably highly simplistic answer: connectors.

What struck me when helping with the Tealium implementation for a large services firm, I naively thought their matching process would be more advanced than it is, but it's not.

Yeah, about those connectors…

Integration costs are the most common bugbear in the SAAS implementation we track, and it's as true for CDPs as other martech.

But CDP vendors almost all fall back on the same answer when the question is asked: “Don’t worry, we have hundreds of connectors out of the box.”

That’s true, but it's essentially meaningless, per implementors Mi3 spoke with.

A connector is a piece of code that helps systems that don't know each other to talk to each other. System implementors consistently told Mi3 that out-of-the-box connectors are often basic, meaning they have to be modified and maintained, creating additional and permanent costs.

What’s more, it risks creating vendor lock-in – the very thing Saas is supposed to help you avoid, because if you want to replace the CDP down the track all that development work will need to be redone.

That work can be complicated even for what might be considered common use cases – and technology is not always the biggest problem.

It’s an issue Insighten's Gagan Batra has encountered all too often.

“Google and Facebook, are easy right? We were connecting one of the many CDPs to DoubleClick. The connector is 'out of the box'... But it took two months.”

Connecting to The Trade Desk demand side platform (DSP) out of the box took even longer.

“It literally took the client six months of back and forth with the agency support team. Six months later by the time it was raised, the agency was not using The Trade Desk anymore," said Batra. "It was just insane.”

'You need a miracle'

Asked about what causes the delays, Batra said it was basically a catering sized can of worms.

“In order to connect a CDP to a DSP the client needs admin-level access – which the agencies do not want to give.

“Most agencies are not transparent in their media buying practices. They use their own DSPs just to have margin and they do not provide access to the DSPs that they use," said Batra.

“You need a little miracle, bringing the agency, the CDP, the client, support, and whoever else is required to be on that discussion so that everyone can get together, have the right levels of access… and that's just so they can test," said Batra.

“The testing itself can take ages.”

The weakest links

The difficulty of connecting to ad tech systems came up repeatedly. That should be a concern for many CDP brands for whom media efficiency and effectiveness are often the initial use cases.

Audience Group’s Damon Mudge, Director of Operations and Marketing at the Brisbane-based advertising services agency is surprised – and dismayed – by the immaturity of CDP/adtech integrations.

“What struck me when helping with a Tealium implementation for a large services firm, I naively thought their matching process would be more advanced than it is, but it's not."

He said his observation was not restricted to Tealium.

You end up with completely different data architectures between one and the other. So then when you go to plug it all into a CDP, you're unraveling layers and layers of 10 years of bullshit, in completely different directions, to get it to come into one.

The limitations of connectors extend far beyond ad tech, as Revium’s Adam Barty told Mi3.

“Some of them work out of the box, others are absolute nightmares and don't work. You have to work really hard to maintain them – and then that's an issue across a whole bunch of areas.”

Out of the box connectors can actually work – but only if its a "vanilla install", per Barty.

"As soon as anything's different from the standard install, that's where you have trouble. And the challenge is, you've got to decide between whether you then stuff around with your Marketo or your [Salesforce application] to get it to align to what the CDP wants, or you go the other way.”

According to Barty: “What you end up doing … you have to build little bits of API layers – little bits of tech – that sit between the application and the CDP’s out-of-the-box connector to transform the data into a way that people accept it.”

Which means extra hassle and cost that probably wasn't factored into the original budget.

Much of the trouble comes down to the way the big martech stacks have developed and grown through acquisition. The problem is that the data architecture for modules even within a dedicated stack is often different, said Barty.

“All these systems were put in years ago and since then they have hodgepodged layer upon layer to make it do all these different things.”

Add a little something here for sales, another for service, another for marketing and the can of worms will probably feed an army.

“You end up with completely different data architectures between one and the other. So then when you go to plug it all into a CDP, you're unraveling layers and layers of 10 years of bullshit, in completely different directions, to get it to come into one [system].”

They kind of just leave you on your own when you've got the connector. They'll say to you, we can plug into something. Here it is, here’s documentation, go nuts...

Need help? Cue tumbleweeds...

Don’t expect huge amounts of help with those connectors either suggested Digital Balance’s Technical Lead, Paul Broomfield.

“They kind of just leave you on your own when you've got the connector. They'll say to you, we can plug into something. Here it is, here’s documentation, go nuts.”

Data transformation is a big problem, he said. That includes issues such as rationalising name or date fields, or character-based or number-based fields.

“It can be very tricky doing all the mapping of all the different fields. Transformation is a big thing. And data transformation is also trying to map out the fields you actually want to capture as well.”

Broomfield gave the example of a client who wanted to connect their Voice of the Customer application to a CDP.

"They wanted to pull the data [from experience management platform Medallia] into their CDP. The fields inside Medallia are just random numbers and letters. So the discovery session with the Medallia team goes ‘Is ABC-123 the first name or is it the last name? That needs to be mapped into whatever the first and last name are in your CDP platform'.”

Richard Taylor, Digital Balance Managing Director said the example creates a compound problem – connectors within the connectors.

“In that case, there's a Medallia team that owns the platform. They own the credentials for it there. And the logins for the CDP team might be different with their own set of credentials, and no access to Medallia themselves. So, who talks to whom in the business? And how do you get those people to find each other in some instances, to allow that connection?”

It's called a thin slice. Honestly, that's how you survive in 2020s.

Don’t boil the ocean

Brands can also avoid a lot of pain by adopting an implementation strategy that surfaces potential problems early per Nigel Dalton, a technologist and social scientist at Thoughtworks.

He said the traditional approach to implementation is to analyse all the business rules, then layer applications or web sites over that, and then test.

“The temptation is always to build the systems that support each step, layer by layer. A better approach is to stand up a piece of each of the stack and prove you can sign a customer into the system, that it can pass the information to the accounting system, that it can then authorise the creation of a product for them – and it can dispatch it and you can take a support call in the CRM.

“It's called a thin slice. Honestly, that's how you survive in 2020s.”

When it came down to the other product solution, people-based marketing, it is true not all customers are investing or are ready for it, but that's changing. Vanya Mariani, Head of Commercial, Media Carsales

Are brands ready to trade via CDPs?

For media, and retail media, there is a final potential complication to consider. You can build it but will they come?

For Carsales Vanya Mariani, the answer depends on the customer.

The characteristics of businesses that are best able to leverage the new Carsales capabilities include the scale of the audience underpinned by both the ability and the desire to deliver their service and create value through technology.

“There were some benefits [to customers] from implementing the CDP where the customers didn't have to do anything. That’s things like us having an audience that was 100 per cent addressable. The benefit to the client was fully realised without them having to do anything different. They were just briefing us the same way," she said.

“When it came down to the other product solution, people-based marketing, it is true not all customers are investing or are ready for it,” per Mariani, but she stresses that’s also changing quickly.

“The amount of inquiries we've had, in the recent months, compared to 12 months ago… is really chalk and cheese. It is increasing considerably.”