Investors spooked over Google’s ‘break-up’ penalties for US search monopoly trial – $15bn Chrome browser sale, Android operating system, AI restraints proposed

Months after Google was ruled an illegal monopolist in its search business that paid handsomely for market dominance, crushed rivals and hiked prices at a whim, the proposed penalties and remedies are known, including more transparency in ad pricing and open data flows for advertisers – a long-held market frustration.

What you need to know:

- The broad scope of the recommended penalties underscores how severely regulators operating under President Joe Biden’s administration believe Google should be punished following an August ruling by U.S. District Judge Amit Mehta that branded the company a monopolist.

- Online ad veteran Ari Paparo told the Washington Post: “If Microsoft owns it, it just directs people to its search engine, and you have the same problem. If Amazon owns it, it reinforces its monopoly in commerce. If it’s independent, it likely starts mining people’s data to make money.”

- The DoJ has made extensive and detailed demands that Google “increases transparency and control for advertisers” after criticism during the trial.

- The goal, it says, is “to reduce entry barriers, afford advertisers better data to inform product choices, and pry open the monopolised markets to competition”.

- It specifically calls out “providing advertisers with information and visibility into the performance and cost of their Google Search Text Ads and the ability to optimise…”

The US Department of Justice (DoJ) has issued a long list of remedies to the US District Court judge presiding over the search monopoly case, starting a countdown to what could be the largest corporate break-up in history.

The ramifications for publishers, advertisers, and four billion consumers worldwide are immense. It may force Apple into search and spark a browser-war.

Needless to say, Google is furious and says it will appeal the ruling for years, but this is the timeline, and what you need to know.

Most headlines have focused on the DoJ’s two main demands.

- That Google is forced to sell its Chrome browser, which has a market-leading 65 per cent share and is used by 3.45 billion people, and

- Potentially making it sell Android, the mobile operating system used by Samsung, and others, to run 3.9 billion phones.

These are huge, but the DoJ’s other demands also have important implications for marketers and publishers.

These include:

- Making Google be more transparent on ad supply and data

- Banning it from paying Apple and others to be the default search engine

- Forcing Google to sell its investments in fast-growing AI contenders, and

- Letting publishers opt-out of having their content used to train Google’s AI

The Associated Press reported that the demands “threaten to upend a business expected to generate more than $300 billion this year”.

The DoJ’s demands appeared to catch Google and Wall Street offguard.

Google called it “staggering” and “wildly overbroad” and promised to appeal. Google’s stock plummeted six per cent wiping $119 billion - or half of Google’s annual ad earnings - off its value.

For its part, the DoJ is adamant it is not just trying to slow Google down, but is intent on cracking open its monopoly to enable new entrants.

Its 23-page demand calls for a dramatic break-up and a fundamental reshuffling of Google’s quarter-century rule over digital advertising and global web traffic.

Google has until April to make counter-arguments before the judge makes a final ruling in September. Google will then be able to appeal.

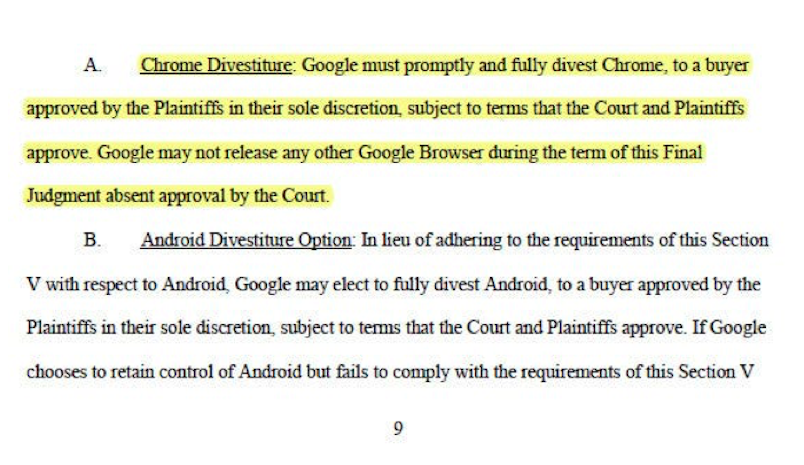

The Chrome browser

Chrome controls how four in five users enter the world wide web, what they get to see, what gets monetised, and by whom. It also directs billions of searches.

Chrome decides whether billions of clicks go to YouTube, or to Australian publishers, and who gets to bank the ad revenue associated with it.

The court heard Google delivers 13 billion ads a day, and nine in 10 global publishers, and eight in 10 advertisers, rely on it for traffic and revenue.

The DoJ’s case is that Google uses Chrome as a chokepoint, and forcing its sale will “permanently” remove its control “and allow rival search engines”.

Winners include Apple’s Safari, Microsoft’s Edge, Firefox, and others.

And because Chrome sends so many search queries, the Wall Street Journal reports “even a small loss could upend an industry”.

The European Union recently required Chrome to offer alternative search engines. The WSJ reported: “DuckDuckGo said queries rose 75 per cent”.

Bloomberg estimates buying Chrome would cost $15 billion, with another $4 billion-a-year in running costs.

When the Opera browser was sold in 2016, it fetched $600 million and had 350 million users. Chrome has 3.45 billion users today.

Any potential buyer will need deep pockets and be able to overcome antitrust scrutiny.

Online ad veteran Ari Paparo told the Washington Post: “If Microsoft owns it, it just directs people to its search engine, and you have the same problem.

“If Amazon owns it, it reinforces its monopoly in commerce. If it’s independent, it likely starts mining people’s data to make money.”

EMarketer analyst Evelyn Mitchell-Wolf added: “My inclination is to look at US-based AI players.”

OpenAI announced days ago that it had poached key Chrome staff to begin work on an AI-enhanced browser. Elon Musk’s also been named in the US as a possible buyer.

Focus then falls onto Android

The DoJ is demanding Android is regulated by a Government-appointed committee to ensure it does not prioritise its own products or degrade rivals.

This has the effect of putting the Google division that runs the operating system of almost four billion people on parole.

And it comes with teeth. The DoJ says that if these changes still fail to spark mobile competition, then it wants the power to force Google to sell Android down the track.

The Verge reported: “While the government isn’t going as far as to demand Google spin out its Android business, it’s leaving the option open.

“The possibility of an Android spin-out could hang over Google’s head to incentivise it against circumventing other remedies.

“But the government says a spin-out could also be mandated should those other solutions prove ineffective at restoring competition to the market.

“The DOJ says Google might even choose divestiture itself if the company doesn’t want to comply with some of the other rules the government is proposing…”

Android employs 12,500 people and Samsung, Google, Xiaomi, Oppo, and others rely on it to power 71 per cent of the global mobile market.

During the antitrust trial, the court heard that a Samsung-funded search start-up called Branch was killed when Google decided it could become a competitor.

When Samsung asked Google to soften its stance, emails revealed in court showed executives saying “Google just did a f*ck you to Samsung”.

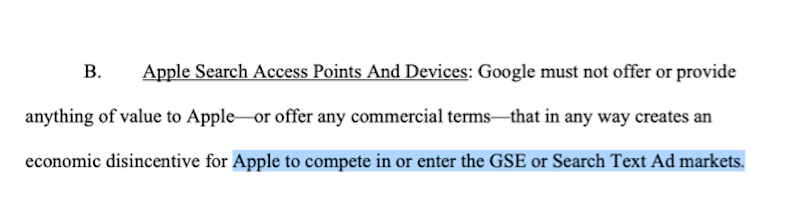

The DoJ wants to outlaw Google default deals

The trial heard Google search enjoys a 95 per cent share of mobile as it owns Android and pays Apple $20 billion-a-year to be the default on the iPhone.

That, plus Google’s 90 per cent share of web search, are the backbone of the data that enables its US$238 billion ad empire.

The DoJ wants the judge to ban default deals, triggering Apple to enter the general search engine market (GSE) and lead to new innovations in products and pricing.

I predicted this a year ago in my newsletter Future Media.

The DoJ also wants Google to be forced to offer users a choice screen to pick their search engine, rather than having Google installed automatically.

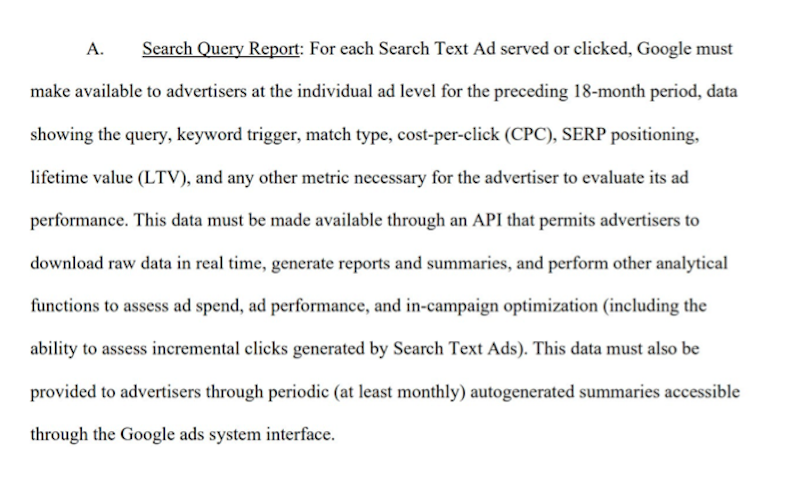

New ad transparency

The DoJ has made extensive and detailed demands that Google “increases transparency and control for advertisers” after criticism during the trial.

The goal, it says, “are to reduce entry barriers, afford advertisers better data to inform product choices, and pry open the monopolised markets to competition”.

It specifically calls out “providing advertisers with information and visibility into the performance and cost of their Google Search Text Ads and the ability to optimise…”

It also asks the judge to require Google to allow advertisers unlimited access to export real time data on all their ads and campaigns “including placement or performance”.

It also wants Google to be forced to tell advertisers if it makes changes to its Search Text Ads auctions.

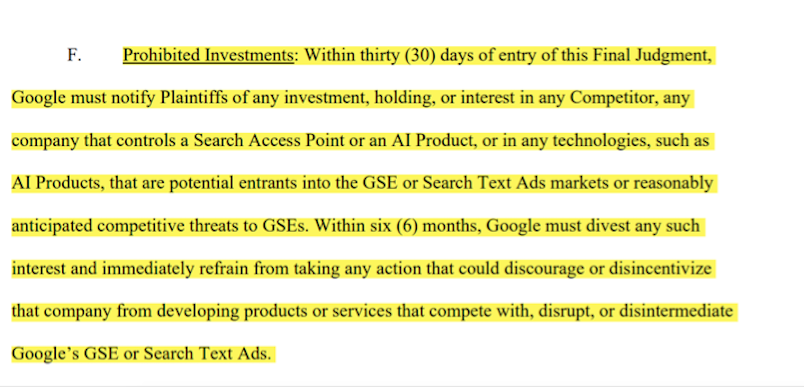

Levelling the playing field

It’s clear throughout that the remedies the DoJ is seeking are designed to halt Google’s dominance, but also to stop it using its scale to build another monopoly in its place.

It says: “Restoring competition will require reactivating the competitive process that Google has long stifled.

“The remedy must enable and encourage the development of an unfettered ecosystem that induces entry, competition, and innovation...”

To do that, the DoJ wants Google banned from buying or investing in rival companies, and it wants billions of dollars of Google’s previous investments unravelled too.

Top of the list is Anthropic, which Google has ploughed $2.3 billion into over the years.

The DoJ wants Google to be forced to sell the Anthropic stake within six months, if the judge upholds its demand.

It will have the effect of forcing Google to compete on AI on its own work, something which has mainly gone badly with Gemini and AI Overviews.

Within hours of the DoJ demand going public, the Wall Street Journal reported Amazon doubled its investment in Anthropic to $8 billion.

Separating search and AI

The DoJ’s demands contain good news for publishers who want to sell their content for AI training, and create a market to trade journalism for AI-enabled search.

Google and others have side-stepped copyright and used all content on the open web to train AI models claiming its fair use under American law.

Publishers that refused to allow this were told they would need to delist their sites from Google search, and suffer catastrophic traffic and revenue declines.

This process was called tying during the court case, where two distinct users were connected by Google to force customers to use both or get nothing at all.

The DoJ has asked the judge to rule that Google must separate the two, so publishers can stay in search and sell their content for AI training.

News Corp’s deal with OpenAI for training was US$250 million, so this is a significant opportunity for publishers.

The future of the web is being decided

This has a long way still to run, but these are the first tremors of a coming megaquake that will reshape the digital economy monopolised and monetised by Google over two decades.

The judge in the case, Amit Mehta, will hold a mini-trial in April before ruling on the punishments in September.

Google will then be free to appeal, all the way to the US Supreme Court if it wishes, which would take years.

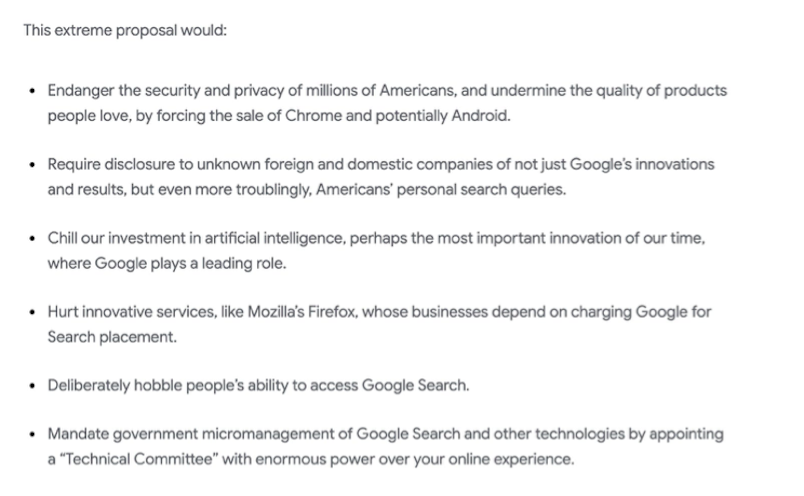

Google’s reaction has already been strong. Lead lawyer Kent Walker blogged the DoJ’s demands were “staggering”, hurt consumers, and would sandbag US tech leadership.

“The DOJ’s wildly overbroad proposal goes miles beyond the court’s decision,” he wrote

“It would break a range of Google products - even beyond search - that people love and find helpful in their everyday lives.”

He wrote:

Change is coming, but how much, and how fast, well, we just don’t know yet.