Acquisitions, aggregators, price pressure, physical assets: Retail media signals what’s next for owned media as banks, utilities, telcos, servos start selling ads

Owning it: Sonder co-founders Jonathan Hopkins (left) and Angus Frazer forecast owned media's trajectory to steepen - with paid market impacts.

Commbank’s push for high margin ad revenues from its owned media and data will likely see more banks, telcos, utilities, petrol-convenience stores and travel companies break cover – and could spur further acquisitions in the mould of Woolworths $150m swoop for screen network Shopper Media. Owned media specialist Sonder has just polled 50 global marketers across brands including Accor, BP, BT Group, Citibank, Emirates, Hertz, Hilton, ING, KFC, Marriott, Mastercard, NAB, Nokia, Shell, Tesco, Turkish Airlines, Verizon, Visa, Vodafone and Western Union – and their answers imply a doubling of owned media and first party data monetisation within two years. But the report also suggests some amateurish approaches could prove costly – especially if owned-retail-paid media converge.

What you need to know:

- A poll of 50 marketers at 40 global brands suggests those monetising owned media – i.e. selling it to brands for cash – will double within two years.

- That piles further pressure on traditional media owners while adding to increasing competition within retail/commerce media markets.

- Those best able to hold cash rates, or best value leverage with partners, will be brands that firstly understand the true value of owned media assets, don’t discount and best harness first party data such as loyalty programs, per Sonder co-founder Angus Frazer.

- For those selling media outright, it might be time to hire actual media pros.

- Meanwhile, don’t overlook the impact of physical assets and footprint in a crowded digital environment, per Sonder’s report – with further potential M&A incoming.

- Sonder also sees an emerging role for owned media aggregators – third parties that can open up owned media inventory across markets and verticals.

Know your worth. That's the one thing that Kanye West said that actually made any sense. If you’ve been through a [valuation audit] process, you know your worth and can maintain [owned media prices] and keep integrity.

Commbank’s push for high margin ad revenues from its owned media and data will likely see more banks, telcos, utilities, petrol-convenience stores and travel companies break cover – and could spur further acquisitions in the mould of Woolworths $150m of screen network Shopper Media.

Owned media specialists Sonder has polled 50 senior marketers in a global sweep of brands including the likes of Accor, BP, BT Group, Citibank, Emirates, Hertz, Hilton, ING, KFC, Marriott, Mastercard, NAB, Nokia, Shell, Tesco, Turkish Airlines, Verizon, Visa, Vodafone and Western Union.

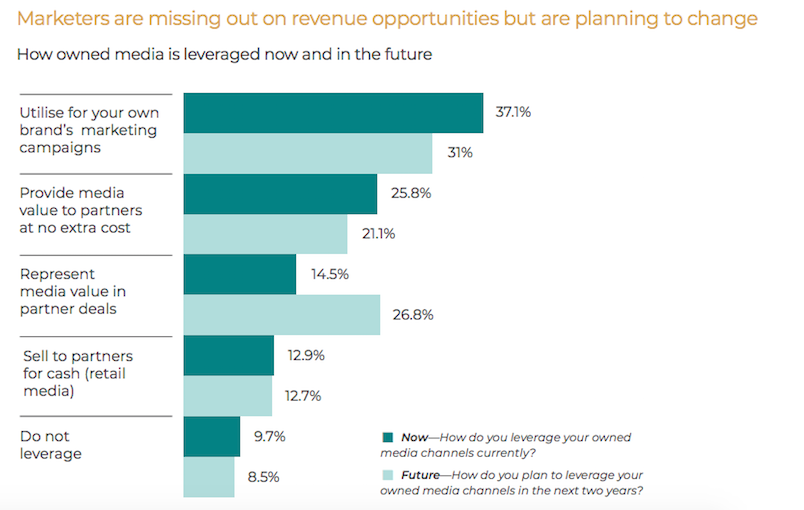

Its latest report finds that while circa 13 per cent of those firms currently leverage their owned assets and first party data to sell ads to brands for cash (i.e. a retail media model), that number is set to double over the next two years.

Pic: Sonder 2025 Global Owned Media Market Report

Whether selling their inventory for hard cash like a traditional media business or leveraging it financially with partners, the report suggests the majority of global brands are not valuing their media properly: the majority of the brands polled do not even have a rate card.

“The gist of the research is that brands are using it [owned media] for their own comms, and they've invested in these platforms [and the martech], but they haven't yet realised they can turn them on for partner commercial messages as well and leverage their first party data in a way that's really compelling for a partner,” per Sonder’s Jonathan Hopkins.

“Where you've got 60 per cent without a rate card, that tells you that the majority aren't charging for it.”

Pic: Sonder 2025 Global Owned Media Market Report

Margin pressure

Sonder estimates average incremental revenue available by properly leveraging owned media is $48m per business per annum – with a typical 90 per cent profit margin.

But maintaining that value and margin hinges on understanding the value of owned channels and customer data in the first place, said Sonder co-founder Angus Frazer, which in turn will help shield owned media operators from the increasing price pressure now being felt within retail media – with Chemist Warehouse a recent example.

While consensus locally has retail media still growing at 10x the broader media market, all media businesses – bar perhaps the global platforms – are feeling the effects of sustained soft market conditions as a result of constrained consumer spending in tandem with a flood of inventory as more sellers come to market and agencies seek best prices and incentives.

“The race to the bottom in retail media has begun before the race has even started,” said Sonder’s Angus Frazer.

“We counsel clients to not fall into that trap and to be very considered around auction-based media solutions, because you're marginalising the value straight away.”

Avoiding the trap starts with the fundamentals, said Frazer.

“Know your worth. That's the one thing that Kanye West said that actually made any sense,” he suggested. “If you’ve been through a [valuation audit] process, you know your worth and can maintain it and keep integrity.”

In the longer-term, the ability to hold the line on rates could get “blown out of the water” if owned and paid media markets ultimately merge, per Frazer. But he said brands with strong first party data – particularly those with loyalty programs – stand a better chance of maintaining value.

Amex says to David Jones, ‘We've got 300,000 lapsed luxury shoppers who haven't been in your store in the last six months. Do you want them?’ They'll snap your hand off.

Loyalty bonus

Either way, Sonder’s Hopkins suggested American Express is a standout in leveraging owned media’s true value with partners without actually selling it.

“Amex is running 6,000-plus offers with merchant partners per annum. They're the benchmark,” he said. “They're not yet charging for that, but the ROI is more offers programs with more brands – and bigger offers.”

Should the likes of Amex and others start selling media for hard cash, they will not be short of takers, given the strength of first party card transaction data with “zero wastage and incredible targeting” capability, said Hopkins.

“Amex says to David Jones, ‘We've got 300,000 lapsed luxury shoppers who haven't been in your store in the last six months. Do you want them?’ They'll snap your hand off.”

Acquisitions incoming?

Which is the opportunity the likes of Commbank can likewise tap via ATM and in-branch screens as well as in-app and when customers are logged in.

Hopkins said Commbank is now competing with the likes of Ooh Media and JC Decaux for digital out of home dollars dollars and Sonder’s report suggests physical assets in and around stores and branches will become increasingly important as owned media and its retail media offshoot continue to mature towards ‘full funnel’ plays, i.e. brand through to conversion and post-sales – which could also spur further deal-making and acquisitions.

Per the report:

“We’ve already seen the likes of Walmart in the US and Cartology in Australia make significant investments into acquiring paid media businesses. Growth through acquisition will likely continue in this way for the immediate future and may accelerate. This might also inform other, non-grocery businesses, what’s to come for them.

“Would an office stationery retailer acquire a screen network in office buildings? Or a small business magazine? Would a bank purchase a financial newspaper? Or a travel company securing the rights to sell airport advertising? All could be valuable extension of their owned media and blur the lines between paid and owned media further.”

Media pros required

But for brands at an earlier stage of owned media monetisation, Hopkins and Frazer say internal structures that can relieve the tension between merchandise teams that have traditionally bundled-in trade media to client deals and the marketing/media teams now aiming to take over may be crucial.

“Owned media operators must be people who understand media and package the media to align with partner objectives. This might mean that the new team need to reframe themselves as a media business – which has different dynamic to legacy operations,” states the report.

Owned aggregators

Should the number of brands selling owned media for cash double over the next two years, as the brands polled indicated it will, Sonder’s report also highlights an emerging role for owned media aggregators that can package up access to owned inventory across banks, telcos, utilities and the rest.

Per the report: “This will be a new model where businesses find partners to work with and pool customer data and media inventory to create scale. For example, just as Instacart and Uber Eats already aggregate demand in grocery and restaurant sectors, new platforms will emerge that will aggregate data from multiple businesses, offering advertisers a single entry point – a platform that can scale and compete with the largest retail media networks.”

See the full report here.