Retail media eats Google search dollars, display tails off, broadcasters moving towards ad model tipping point, next year’s growth biggest to 2028 – PwC

There's some light at the end of a brutal tunnel for parts of Australian media, according to PwC's Australian Entertainment and Media Outlook report, released this morning. Retail media – particularly Coles and Woolworths – will take a bigger chunk of search revenues. Consumers will keep spending billions of dollars on content, though much will be soaked up by telcos. Broadcasters are managing the transition to streaming better than newsmedia went digital – but are currently in the transition danger zone. Digital out of home is on a tear although the network growth which has underpinned revenue growth may have reached equilibrium according to capex spend analysis by the consultancy. Gaming is finally benefiting from the immutable law of advertising - money follows the eyeballs, whether that's all those eyeballs down in the basement playing League of Legends, Call of Duty, and Halo, or on the train to work playing Monopoly Go, Roblox or Candy Crush. Either way, next year looks likely to be the best revenue wise from here to 2028.

What you need to know:

- PwC's Australian Entertainment and Media Outlook report finds the local media sector underperforming the global average, although its performance is comparable to peers in established markets.

- Revenues for the Australian entertainment and media (E&M) market rose by 2.8 percent from A$60.6 billion in 2022 to A$62.3 billion in 2023. By 2028 that will swell to $70.45bn.

- One bit of partially good news, next year is expected to be the best one of the five-year outlook with a CAGR of 3.4 per cent.

- News media continues its precipitous decline although the transition to reader revenues continues.

- Perhaps all those publishers at the start of the decade should have been a little more skeptical of the "Information Wants to be Free" crowd, including PwC which was advocating for the "freemium" model at the time.

- Broadcasters like Nine, Seven, and Ten are currently in the middle of the messiest and most dangerous part of their transition – while they are doing a much better job holding onto their revenues than their print peers at the turn of the century, hundreds of millions are still leeching away.

- The fight will get tougher as the international streamers introduce their blended ad-supported packages.

- Search continues to power – but not for once because of Google. Instead, the impact of the growth of Cartology and Coles360 has started to be reflected in the search revenue numbers. And of course, Amazon, the Leviathan of retail media, sees a huge opportunity in Australia.

- The out of home sector digital transition is now very mature, and capex spending by the incumbents suggests they realise network penetration has likely reached the point of diminishing return.

- And finally, there's gaming, a huge opportunity just at the beginning of its growth curve, assuming the immutable law of advertising that says ad dollars follow eyeballs holds true.

The two big players, Cartology and Coles 360, have done an amazing job at connecting their data. So they have a unique advantage. They capture all the data through their customer loyalty programs, and they can directly track consumer behaviour with the adverts that they're following on their website

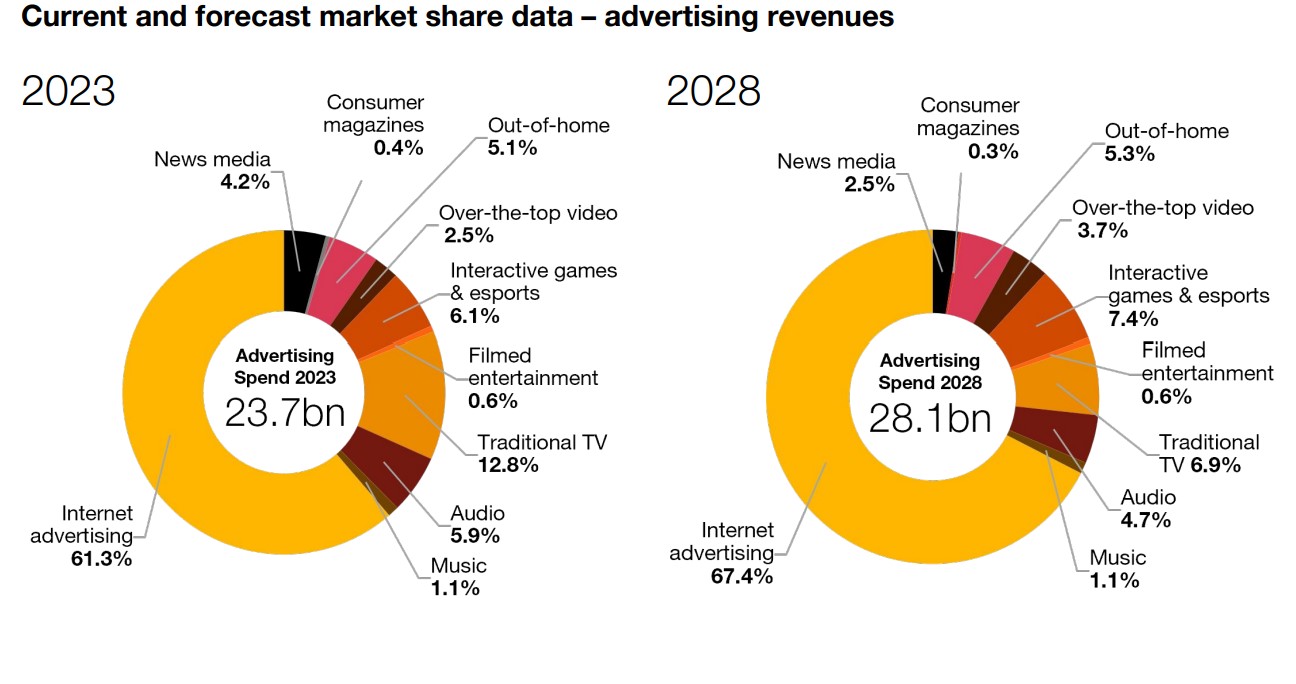

October 27 will mark 30 years since AT&T famously asked the readers of Wired Magazine's website Hotwired, "Have you ever clicked your mouse right HERE?". In the three decades since that very first banner ad was published in the US, revenues have followed the immutable law of advertising and chased eyeballs far away from traditional media and into the swelling bank accounts of digital platforms. Today, according to this year's Australian Entertainment and Media Outlook, Perspectives Report 61.3 percent of the total $23.7bn advertising spend in Australia last year went into internet advertising. And it's still migrating. By 2028 internet advertising will account for 67.4 per cent of a $28.1bn pie.

Zoom out further and the collapse of traditional media spending across channels such free to air TV, and newspapers and magazines is even more pronounced. In 2010 traditional media had sunk to 46 percent of the total entertainment and media market spend across both advertising and consumer revenues. Last year it was 30 per cent and in five years' time it will have dropped to just 21 per cent.

Vale the rivers of gold.

The news media, and especially print failed spectacularly to transition to the digital world. It now captures just 4.2 per cent of total ad spend and 2.8 per cent of consumer spending. By 2028 those figures will have fallen to 2.5 and 1.9 respectively, circa another 40 per cent decline over five years. All those publishing wunderkinds who convinced their boards that information wants to be free, and that consumers would never pay for content, might be surprised to learn that over the top video now attracts a double-digit share of consumer media spending and will grow from 10.8 per cent share of consumer revenues last year to 13.4 per cent in 2028.

In fact, it turns out consumers love paying for content. "Digital news media and magazine circulation revenues are expected to grow to A$690 million in 2028 by a CAGR of 6.1 percent and 4.6 percent respectively," according to PwC but this growth is not expected to offset the declines experienced by print formats. They advise, "Increasing engagement with paid subscribers will be an important imperative for news and magazine publishers over the forecast period."

And its not not news content or consumer magazine content. In fact consumers last year dipped into their own pockets to the tune of 38.6bn — most of that was for internet access, and the pie will grow to $42.3bn by 2028. Many of those news journalists in Nine's metro newspapers and the Fin Review, a reasonable chunk of whom (along with their managers) opposed paywalls when they were introduced, no doubt filled their downtime watching paywalled streaming services like Netflix and Amazon Prime, confirming at least that irony has a sense of humor.

The dream that online ads on the news sites would replace print advertising revenues proved illusory. Nonvideo general display advertising is the sick puppy of internet advertising.

According to PWC, it is the smallest category of the four behind classifieds, video display, and search, and it will halve over the next five years. Growth in video advertising should help cauterize the wound somewhat, but that assumes that the news media businesses can out-compete Meta's Instagram, Google YouTube, and the newest video giant, TikTok.

The big winner in the internet advertising category is search which is set to grow its share from 39 per cent of a 23.7 billion pie to 44 per cent of a 42.3 billion dollar pie. PWC doesn't break out the numbers that build the search category number but the report makes it clear that the search component of retail media is a big driver of that growth, and the winners in that world are Woolworths Cartology and Cole365.

According to Louise King, Technology, Media, and Telecommunications leader, PwC Australia, "The two big players, Cartology and Coles 360 have done an amazing job at connecting their data. So they have a unique advantage. They capture all the data through their customer loyalty programs, and they can directly track consumer behaviour with the adverts that they're following on their website."

"The other thing that they've got the benefit of with digital, and this is a benefit across all digital platforms, digital is time adjusted. So you know, you can have McDonalds putting out a digital out-of-home display at seven o'clock in the morning to advertise their breakfast, and then they can have another advert flowing at 11 o'clock to advertise a coffee break."

That digital flow is directly meeting the needs of consumers, she said. "And it's flexible, it's agile, it's quick."

"But the challenge that all these digital players have got in the shift to digital, is that investment in capex is required."

In advance of the release of the report this morning, Mi3 spoke with King about the key trends the data reveals, across the sector.

At a headline level, King says, 2024 is tough for media companies in Australia due to macroeconomic conditions such as the cost of living crisis, and that's consistent with other mature media markets like the US and Europe.

"Our growth is slower. We're at the CAGR of around 2.9 per cent whereas the globe is more like 3.9 per cent but that's because the global [result] includes a number of high-growth jurisdictions like China, Indonesia, and India, which are each collectively growing at around 7 per cent CAGR.

"But when we compare Australia to the more mature markets, we're probably in line with them. What we're seeing in those high growth sectors is the spend on internet advertising is growing."

That's also true in the mature cohort.

"Australia, internet advertising set to grow from 61 per cent of our revenue here to 67 per cent by 2028. but in the global setting, it's growing much, much quicker.

Digital channels are also more diverse, and all those new digital options eat into time. You can grow budgets, you can raise prices, or capture market share, but time is immutable. There will only ever be 24 hours in a day

Where the print publishers or radio stations in the mid-2000s had to compete with Angry Birds and Frogger during the morning and evening commute after iPhones and Androids suddenly burst onto the scene, today services like TikTok that are capturing the eyeballs and attention, particularly of Gen Z.

According to King, "It's certainly been a phenomenon that's been happening for some time. We talk about the third screen phenomenon. I think advertisers are struggling with how to de-duplicate those eyeballs. If [consumers] are spending 30 seconds on this, and 30 seconds on that, and 30 seconds on something else, how effective is that advert ?"

King told Mi3, "It is going to be a very difficult area to measure going forward. It certainly challenges advertisers, but it continues to evolve, particularly as consumer preferences change and people want access to media and advertising 24/7. As those change, the opportunity is for the advertisers and the media players to keep ahead of that change and make sure that they've got content that is attractive."

She stressed they have to grab the audiences because nothing stays static in this market. "The biggest opportunity is to predict what's over the horizon and get their platforms delivering the service and the media that those consumers desire."

Faustian or not

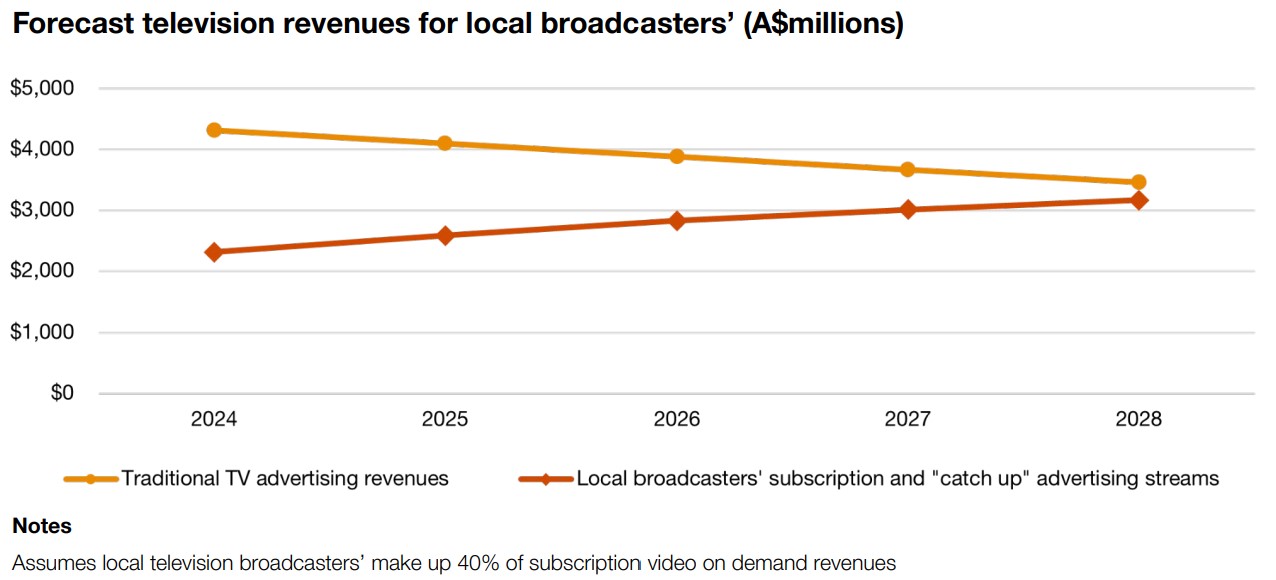

That's certainly something television executives are confronting as they manage the transition from free-to-air to Connected TV. The bargain they believe they are striking is a loss of revenue in the short term paid for by growth over time. It's yet to be seen whether that's the same Faustian pact that sunk print publishers 20 years ago in the transition to digital as audiences splintered, inventory — constrained only by Moore's Law — exploded collapsing yields, turning CPMs from dollars into cents.

Right now the broadcasters are living through what is the most dangerous moment – the transition. But the encouraging news in the PwC forecasts is that while the decline in FTA advertising revenues looks baked in over the next five years down from over $4bn to approximately $3.5bn, by 2028, growth in the local broadcasters streaming subscription and advertising revenues will almost overtake traditional TV ads. But on current form, it will likely be next decade before those revenues return to current levels – and that assumes there's not another Instagram or TikTok or YouTube waiting to burst into the mix.

And that the newcomers – international streamers – don't come up with a radical new technology or business model innovation. Or that Amazon doesn't replicate the success of Prime here with its deep data, retail media expertise, and its sheer scale.

According to King, "The streamers are obviously getting most of their revenue from streaming [subscription] revenue, but even those companies, like Netflix, Disney, Paramount are capping out, there's only so much population in the world that they can reach. Some of those are now turning to advertising models and [to see if they can] vary the revenue streams through [those]advertising models.

"They are realising is only much so much share of wallets. And with this cost of living crisis, people are now starting to look at all the different methods that they consume TV through, and we've seen a consolidation through the market."

"I think it's got some way to play out over the next couple of years."

But King says the local media big guns retain some advantages over the international interlopers.

"They do have the benefit of Australian content, and they know Australian consumers better than anyone. They also have access to local sport. And we are a massive sporting nation."

King said, "Channel Nine has done an amazing job of the Olympics. Channel Seven did a great job with the Women's Football World Cup last year. Hanging on to those sporting rights is going to be very important. But then getting access to the local content, and investing in local content is going to be really important. They need to stay on top of what their consumers value."

From ancient grudge, new mutiny

Two of the star performers over the next five years, according to PwC are digital-out-of-home (DOOH), and gaming. According to the report, "The post-pandemic rise of out-of-home (OOH) media is a notable trend in our forecast period. Digitisation, improved measurement of audiences and population growth are the factors driving this trend." PwC forecasts that digital-out-of-home’s share of the OOH market will increase from 74 percent in 2023 to 89 percent in 2028.

PwC believes this will grow OOH’s expected growth in the share of the total advertising market from 5.1 percent to 5.3 percent over the forecast period. "Programmatic DOOH (PDOOH) is a small but fast-growing method for buying DOOH, especially in retail media panels as it enables dynamic creativity that changes with conditions such as time of day and weather."

"It's cost a lot for the out-of-home players to invest the capital. The digital screens are really expensive. Just getting them shipped from overseas during Covid has been difficult, but I think that that's largely played out now, and now what we're seeing is the capex draw on those companies is starting to come down a little bit.

"That says to us that they believe that perhaps they've reached a level that's suitable for the market at the moment in terms of those digital screens."

Growth is being driven by network reach and measurability. "They've got screens in all the places where they are going to get loads of eyeballs, all the transport hubs, buses, trains, airports, But they've also invested heavily in measurability."

Gaming is also starting to attract brands, especially eSports, although off a low base.

The report quotes data from the Interactive Games and Entertainment Association (iGEA) which claims that 81 percent of Australians now play digital video games, up from 67 percent in 2022, and that 48 percent of Australian players are female.

The growth in what PwC calls ‘play’ revenues follows this pattern.

"Traditional consumer spending on video game software and services has been reinforced by the growing popularity of social and casual gaming, conducted largely on a mobile phone, and also by the availability of digital games subscriptions and additional downloadable content via online stores like Steam and Xbox Games Store. "

PwC notes that advertising revenue in digital games is growing: "In-app advertising and integrated advertising (equivalent to product placement within a game scene) are expected to increase by 7.6 percent CAGR to reach A$2.1 billion by 2028."

There are also some powerful crossovers with other channels. For instance, according to TikTok, "50 per cent of daily users on TikTok [worldwide] watched gaming-related content in 2022, amounting to over 3 trillion views. 82 per cent of gamers on TikTok play games weekly. After seeing gaming content on TikTok, 41 per cent downloaded the game and 36 per cent purchased to play."

The report also calls out the Australian games production sector. "Another bright note is the growth of the Australian games production sector. In 2023, A$345.5 million globally is attributable to games developed in Australian studios, an increase of 21 percent on the previous year.12 The growth in income for Australian developers contributed to an increase in full time employees working in Australian game development studios to 2,458 million, a 17 percent increase on the previous year"

The internet took 30 years to grab a share of wallet commensurate to its share of eyeballs, and gaming is likewise likely at the start of its growth journey. There are several challenges to meet – such as offering an environment for attractive and effective creatives, then there are also the almost comically awful brand safety issues on gamer environments like Twitch and Discord.

PwC tracks in-app advertising, casual gaming, and eSports and King believes that in-app advertising is most likely to to take off first. "Globally we're predicting a CAGR of 15 per cent (eSports is 10 per cent but off a very small base currently.)"

Per King, "Some of these technologies just take time to get momentum and get a market. And that's certainly what we're seeing now in the gaming sector. The technology is becoming smarter and more intelligent at serving up ads to consumers in the apps. In terms of future growth, we're really excited about new technology coming onto the market around VR, the headsets, holograms, and how your personal data, can be connected in with the game itself."