CDP Investigation Part Two: Identity, media efficiency and effectiveness, personalisation and privacy driving uptake – prepping for AI could fuel a second wave

Pavel Bulowski, Billy Loizou, Liz Adeniji, Michelle Weir, Tim Armstrong, Kevin Doyle, Will Griffith, Gabbi Stubbs and Simon Pereira unpack CDP business imperatives – and where the gaps still lie.

There are north of 30 corporate use cases driving the current stampede for Customer Data Platforms (CDPs), per industry analysts like Gartner. But when Mi3 grilled tech industry heavyweights and their customers, only a few consistently emerged: digital identity, media efficiency and effectiveness, personalisation and regulatory compliance — especially privacy. And now there's a new incentive: It turns out the work required to get CDPs humming also helps organisations become more AI ready. In Part Two of our investigation, we spoke with marketing and digital leaders from University of Tasmania, Nova Entertainment and Suncorp about the business imperatives driving their decisions (they use Oracle, mParticle and Adobe respectively). Mi3 also interviewed execs from CDP platforms Segment, Tealium, Adobe, Salesforce, Celebrus, Amperity, Meiro, and more to get a handle on what's driving demand – and where capability gaps remain a challenge.

What you need to know

- University of Tasmania, Nova Entertainment and Suncorp – three very different business, but all are finding common cause when it comes to the business imperative behind their CDPs.

- The key business cases driving CDP uptake – now running hot in Australia – include digital identity, media effectiveness and efficiency, personalisation, and regulatory compliance.

- Among more than a dozen brands with CDPs either in place or being implemented that spoke with Mi3, the desire to have more effective and efficient media spend was often paramount.

- Brands are also looking for ways to extend and scale their data assets and to commercialise them in a different form.

- Retailers, who dominate the uptake of CDPs in Australia, have woken up to a looming threat. With major changes to privacy law incoming, serious regulatory and compliance concerns are no longer the preserve of industries like banking, finance and insurance, telecommunication, and healthcare. And now they are scrambling.

- But there is an upside. The co-founder of Wondaris, Simon Pereira, sees a potential boon for CDP vendors – and their clients – from AI. "All of the work required around a CDP is the same foundational work you need to do to get AI ready for the AI projects that you will have to execute in the next five to 10 years."

- Changing regulatory policies, especially in Europe and the US, and Apple's full frontal assault on ad tracking and measurement burst the data management platform bubble, and forced marketers to rely much more heavily on their organisation's own first party data, driving the uptake in CDP sales.

- Before CDPs emerged, tech providers claim brands were solving the problem with sticky tape and string, using technology that was far from fit for purpose.

- Step one was to identify and unify the data in the organisation. But it is not straightforward, especially when data quality is poor. And even with a CDP, companies must sometimes compromise on the level of detail available – because not all data transfers easily into new systems.

- While the market is rapidly expanding, Australia is still in the first wave - most implementations are greenfield and there's not much CDP rip and replace. Yet.

- Those involved in customer data should read Part One of Mi3's CDP series here.

- Read Part Three: Integration challenges far more difficult than vendors let on; ANZ, Carsales on where to start, hot tips; experts on industrial sized cans of worms.

- Read Part Four: Chemist Warehouse, SCA, Nova, News, Carsales on how CDPs have changed operations, structures, capability – but why consent management may be next martech wave.

We knew as a business, based on the way radio is being consumed and audio is evolving, that we needed a platform that was going to allow us to standardise and centralise the collection of customer data.

Everything, everywhere, all at once

The business imperatives fuelling the surge in CDP sales include: digital identity; more efficient and effective media spending; better compliance, especially in the context of proposed privacy law changes; and the ability to personalise customer experiences, increasingly in real-time. All of which is happening in the context of an increasingly complex regulatory environment where data privacy has taken top billing.

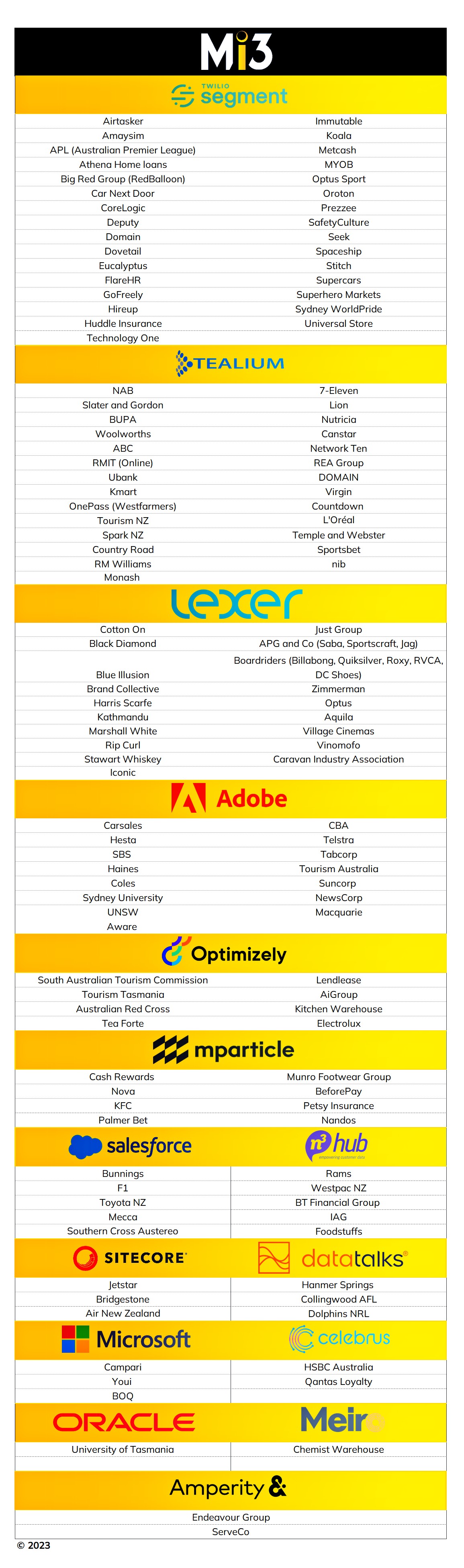

That's a motherlode to grapple with. So Mi3 spoke to APAC and ANZ top brass of nearly a dozen CDP vendors - in addition to Salesforce, Adobe and Tealium, the line-up includes Segment (which has the largest installed CDP base in Australia) Celebrus, Meiro, mParticle, Amperity, and XPON to understand the biggest problems they say their customers need help fixing – and how they are going about it.

But first, here's what three companies operating in very different spheres – a university, radio network and financial services giant – told Mi3 lies behind their decision to invest in a CDP, and what they need it to deliver.

University challenge

Concerns over a cookieless future kicked off the conversation about a customer data platform (CDP) at University of Tasmania. But that was just the start of it, according to CMO Michelle Weir, who told Mi3 her team had to grapple with the kinds of complexity that comes from disparate data silos that held as many as five records for a single student.

"In a complicated university environment the data is in so many different systems and often those are not integrated."

That's a problem, because each student is worth thousands of dollars per year to higher education providers – and competition is increasingly cutthroat while marketing budgets across the piste are under pressure.

"We just really wanted to be able to use our own first party data to supercharge our targeting efforts."

Hence recently implementing a CDP. Based on the Oracle Fusion Cloud, the deal is so fresh that when Mi3 started compiling a list of Australian CDP sites two months ago, it didn't even register with internal Oracle staffers or external Oracle partners. Higher Ed should provide a happy hunting ground for Oracle, given the strength of Eloqua in the sector.

Weir said broader business gains helped get the CDP investment over the line.

"There's obviously lots of other benefits of using one which is why it got boosted to an institutional project. And the 'golden record' [i.e. one per student, not five] was one of the motivators for that."

Marketing at the university is centralised – that's not the case at some other universities in Australia.

"This is one of the main reasons why the CDP was going to bring the biggest amount of benefit to us – to get a bigger bang for the buck and also to be able to be really target right down to course level to very particular students," said Weir.

"This opens opportunities for us around audience targeting and personalisation, maintaining data quality, ease of data access and of course the golden record. As part of the CDP ecosystem we have implemented a CDP to build audience profiles and drive targeted advertising leveraging first and third party data," she added.

The implementation remains in its early stages in terms of reportable results. But Weir is already planning the next phase, including "automating the integration of lead capture from advertising to inform the information provided to students in more relevant and ways", while freeing-up human resource.

Nova overhaul

Nova Entertainment's CDP is a little further along. Tim Armstrong, Director of Digital Technology, Platforms and Data at the Lachlan Murdoch-owned radio network said Nova invested in an mParticle CDP because its existing systems weren't "future fit" to support first party growth and customer experience. "And to be honest, the utilisation of the platforms that were in place was was very low."

He and the leadership team at Nova are also no doubt aware of the success Melbourne-based rival SCA is claiming with its investments in data capabilities, including a Salesforce CDP. SCA CFO Tim Young, told Mi3 that Listnr churn rates are already half that of the SVOD streamers, and can charge five times more for true one-to-one personalisation. Meanwhile, SCA chief marketer Nikki Clarkson is talking up 30 per cent efficiency gains in terms of digital marketing and audience acquisition.

Per Armstrong: "We knew as a business, based on the way radio is being consumed and audio is evolving, that we needed a platform that was going to allow us to standardise and centralise the collection of customer data."

The use case, while based on Nova's audio business dynamics, will be familiar to marketers across all sectors. "We need to create insights for our business to help better understanding about the digital customer listening experience. From a behavioural point of view, we wanted to be able to feed information out to marketing to drive acquisition. We want to drive insights to support other commercial activity, we need measurement to support programming, and insights as well, and to be in a position where we are able to create audiences and cohorts."

Suncorp scale-up

Implemented in 2021, Suncorp's CDP project is the most mature of the three. "The CDP allows us to house data in one place, enabling greater speed to market across channels. With customer at the heart of everything we do, this is a key enabler for our customer obsessed culture," a spokesperson told Mi3.

"It allows us to engage with relevance consistently across owned and earned media, and through one-to-one communication brings the marketers closer to customer segments, such as demographics or lifecycle stage.

"It also enables personalisation at scale ... while maintaining strong controls to manage risk and privacy. By understanding customer intent and digital usage, we can help customers understand how to engage with us easier through our digital channels such as claiming or updating details online."

Suncorp's insurance business is in the midst of a circa $300m transformation called Digital Insurer, and its CIO, Adam Bennett told Mi3 than a critical aspect in success of component projects such as the CDP implementation has been close cooperation between the different disciplines inside the group. That might seem like table stakes – and it is for Suncorp. But vendors caution that's not always the case.

In the majority of cases our new customers don't have anything that's doing this, they're solving the problem with sticky tape and string, and with a number of non fit-for-purpose components.

Regulatory drivers

In the early days of data management platforms – often considered a precursor to CDPs even though they evolved in parallel, marketers could do their job by getting second and third-party data mostly from publishers to augment first-party data, says Kevin Doyle, regional VP, Salesforce.

They would use that to build out profiles to understand who their audience was, or to do smart segmentation to deliver the right message to the right person at the right time, "which would hopefully drive the right type of outcome," he said.

According to Doyle, with the emergence of more robust regulatory regimes – of which GDPR is the poster child – marketers were forced to take another look at the first-party data that was available to them.

Companies need to make sure that they see themselves as a custodian of the data and not owners of the data. Customers want to control the data and they want you to use that data to serve their needs. And they want to make sure you use that data to serve them.

Compliance imperative

Compliance is an increasingly critical business driver, said Billy Loizou, area vice president for CDP provider Amperity. ”With the introduction of GDPR, CCPA, APP, things like data, deletion, data transparency requests are becoming common vernacular. Companies need to make sure that they see themselves as a custodian of the data and not owners of the data. Customers want to control the data and they want you to use that data to serve their needs. And they want to make sure you use that data to serve them.”

Simon Pereira, now an advisory board member of the Customer Data Institute, but also a co-founder of XPON group's Wondaris CDP, said sectors that are highly-governed such as financial services and telcos already understand the risk of tightened privacy rules, given their long history of heavy regulation. But retailers will need to increasingly focus on compliance as the local privacy regime evolves in Australia, he said.

It’s especially true given Australia’s Attorney General Department has given some pretty clear signals about where the laws will go, especially around privacy and consent.

Fears about the consequences of breaches will grow, per Pereira, with the prospect of $50m fines. "For a small business that's trying to execute activity like this, it's a minefield for them. The question is, if you're a small business or medium-sized business, and you're looking at potentially those fines, what value exchange does a vendor have to put on a CDP to justify the potential risk?”

He describes this as a massive issue.

“In the US, UK or in Europe, where you've got massive markets, a five per cent increase in marketing efficiency could be worth millions of dollars, so maybe it's worth that risk.”

But in Australia with smaller budgets, a 5-10 per cent increase in sales is not enough to justify a $50m dollar risk. Marketers need to understand the trade-offs beyond risk and reward, he said.

Capability crunch

The ability to meet even some of the basic requirements, let alone the more sophisticated use case, was hamstrung on a lack of internal technical capability says Tealium’s VP and GM APJ, Will Griffith. And in many instances he said that’s still the case.

“When we onboard a new customer, in the majority of cases our new customers don't have anything that's doing this, they're solving the problem with sticky tape and string, and with a number of non fit-for- purpose components."

Griffith believes we are still in the first wave of deployments in Australia. Rip and replace CDP implements are still rare he said.

“Everyone’s either thinking about buying one, or they have bought one and are putting it in or optimising, and trying to improve how it works."

Until recently, many brands have been trying to make do with existing capabilities. “They have been trying to make do with legacy customer data stores or databases, They've been trying to make do with martech investments.”

The problem is, that creates a piecemeal approach. “Maybe they've got their email channel working really well, and maybe they got a web content management tool working really well, but the two don't talk to each other. So it’s all compromise, compromise, compromise,” Griffith said.

But implementing a CDP will not necessarily solve those problems. Gabbi Stubbs, who heads APAC product strategy and product marketing at Adobe, told Mi3 that not all CDP capability, or all organisational capability, is equal.

“The very first thing people want to do is be able to unify the data and segment, they're the first two changes that you effectively get with a CDP. Your basic vendors would be able to deliver it to those scenarios. That's just your MVP."

Where it starts to get into some of the more advanced [territory] is when you're trying to advance first-party data strategies, "making sure you have the ownership of the relationship and the ability to be able to operationalise the data that you do have" is fundamental, she said.

Which means a lot of legwork within client organisations is required before they even get to CDP selection stage.

Typically an important part of an engagement involves helping brands understand where the data resides in disparate siloed systems, be it email marketing platforms, web apps, or point of sell, then to unify that data into a single profile, through ID resolution.

Taming identity

According to Segment’s regional VP Liz Adeniji, “typically an important part of an engagement involves helping brands understand where the data resides in disparate siloed systems, be it email marketing platforms web apps, or point of sale, then to unify that data into a single profile, through ID resolution. Then activate upon that data into downstream tools do things like personalising the engagement with your customer so they perform an action, they spend more, or they become more loyal.

"It could be to make your marketing or advertising budget more efficient."If there’s an active case with the call centre, for example, where there's a highly-disgruntled customer, "you don't want to advertise or market to that person until that case is resolved."

Bad data

Doing that successfully means solving the digital data problem which Chicago-based Celebrus CEO Bill Bruno identified as a key business driver amongst his customer set.

According to Bruno, “organisations have this idea that they're going to get a single view of the customer. But they've got poor data coming in, and they don't have a solution for digital identity. And so they're missing the mark, and they don't have anything they can use in real-time.

“They don’t have enough data, or it's not accurate, or it's incomplete or cumbersome to manage. CDPs can address this issue.”

Bruno, however, cautions that CDPs can also contribute to the problem. “It is not uncommon to lose data as it is being imported from older systems."

Mi3 was told by Richard Taylor, managing director of Melbourne based digital agency Digital Balance, that data loss could be as high as 20 per cent in the case of legacy systems.

“You might successfully move data from 100 per cent of customers, but you might only get 80 per cent of each record to transfer successfully,” he said.

It’s not so much doing Facebook remarketing off of your email list, but doing a very, very structured, identity resolution-based segmentation for audiences, whether you are on buy or sell side of the media world.

Paid, owned

Among more than a dozen brands with CDPs either in place or being implemented that spoke with Mi3, the desire to have more effective and efficient media spend was often paramount.

While CDP business cases are often built upon the promise of greater revenue from better customer experiences, managing media spend can offer the CFO something they instinctively understand – reduced overall spending, or at the very least better bang for the buck.

Amperity's Billy Loizou said issues such as profitable customer acquisition are often top of mind for marketers.

“Understanding who your high-value customers are, how you acquire them, what strategies are working? That's an imperative. And I say that because the cost to acquire a customer is going up.”

Third-party cookie deprecation is a big part of that, he added. “We know some of the signal losses that have been put in thanks to Apple or Google. How can we find more high-value customers and stop paying for the wrong customers? The other one I’d mention is reducing the wastage of ad spend. That’s similar to profitable acquisition, but profitable acquisition is the ‘ideal customer’. Reduced ad spend on the other hand is about making sure you are not wasting money targeting the same customer multiple times due to deduplication challenges."

He quotes figures from Next&Co's annual Digital Media Wastage Report suggesting marketers wasted $5.46 billion in 2022.

Pavel Bulowski, co-founder and chief product officer for Meiro, which among others provides Chemist Warehouse with its CDP, said he has customers who are either very strong in one of those use cases, but not in others. "It’s not so much doing Facebook remarketing off your email list, but doing a very structured, identity resolution-based segmentation for audiences, whether you are on buy or sell side of the media world. That really works, especially as that whole space is moving into a cookieless world with identity-based advertising and targeting.”

He describes this as a "super strong" proposition.

As you go up that maturity chain, some of those additional problems ... include looking for ways to be able to really extend and scale their data assets significantly more, and in some ways to be able to commercialise those assets in a different form.

CX accelerator

The need to create a more personalised experience, and often in real-time, was mentioned more by the CDP providers than their customers (for now), although it did come up in more than half of the customer interviews.

Adobe’s Stubbs said she is seeing increasing interest in using the unique ID capability that a CDP provides to deliver real-time-based activation. “So [it’s about] being able to respond to a person at the right time at the right moment so you don't miss those opportunities or present different risks.”

She contrasted the capabilities delivered by a CDP with more traditional approaches that could take weeks and months to activate some of those opportunities, or to answer some of the questions raised by an insight that lead to an activation.

“As you go up that maturity chain, some of those additional problems...include looking for ways to be able to really extend and scale their data assets significantly more, and in some ways to be able to commercialise those assets in a different form."

All of the work required around a CDP is the same foundational work you need to do to get AI ready for the AI projects that you will have to execute in the next five to 10 years.

AI readiness

There is a tonne of work organisationally and logistically ahead of brands bidding to shift from third party to first party worlds. That's a challenge if results don't quickly follow. But the Customer Data Institute's Simon Periera sees bonus upside: the role CDPs will play in getting brands AI-ready – a major challenge that sooner or later, everyone must face.

“AI does not provide you a competitive advantage, it is an equaliser, it helps you catch up. If you don’t have the creative resources that a big tech company has, you don't have the wealth of knowledge around marketing processes it helps you catch up, but it does not deliver a competitive advantage.”

Instead, he says the only way you drive competitive advantage from AI is by utilising your own data.

“All of the work required around a CDP is the same foundational work you need to do to get AI ready for the AI projects that you will have to execute in the next sort of five to 10 years."

We're still we're still working through trying to measure the efficiency value that's been created off the back of the CDP.

Is it working?

Brands are looking to solve a plethora of problems stemming from the need to better understand data, to better scale it and to better commercialise it – hence hundreds of them investing in CDPs to tie everything together. But as outlined in Part One of Mi3's CDP investigation, sometimes the benefits are not immediately obvious. The reality for most marketers is that measurable benefits that actually move the dial – and satisfy the CFO – will take longer to emerge.

The experience of Nova’s Tim Armstrong is typical.

“It's early days yet,” he said. “We're still working through trying to measure the efficiency value that's been created off the back of the CDP.”

The issue Armstrong and his team face is that there’s not much to compare it with. But one area already benefiting is culture change.

“We talk a lot about the fact that we allow the business to see user data and insights on things that they've never seen before," he said.

“In the early stages, it was very much us telling them what they need. And then we've kind of gone through the process where they are starting to tell us what they need. That’s the cultural shift that has been achieved during the implementation."

Part Three of Mi3's CDP investigation examines business case justifications – how brands have got their CDP investments over the line.