'Not a midlife crisis': Sorrell's outgoing S4 APAC boss opens up on grinding workloads, West missing human impact of draconian Covid lockdowns as US brands, tech retreat from Asia - and why holdco's have outpaced challengers

"I'm not at rock bottom": Michel de Rijk says APAC suffered a "double whammy" of Covid hardship and challenging trading conditions

In a frank and unfiltered interview with Mi3, the former WPP exec running Sir Martin Sorrell's S4 APAC operation, Michel De Rijk, explains how years of harsher regional Covid lockdowns, including too many deaths among family and friends, and a brutal work schedule integrating a series of S4 acquisitions left him fried and heading for an exit before he left it too late. De Rijk says US and European companies and peers didn’t understand the impact of Asia’s draconian lockdowns on colleagues, and laments investment from US multinationals in the region has been “pulled back to the mothership”, hollowing out the APAC adtech and digital sector that S4's Media.Monks has hitched its disruptor agenda to. While global agency and holdco structures remain challenged and troubled, their diverse investments meant S4 was "way more exposed" through Covid than its bigger rivals.

When Covid hit India we literally were driving around on a motorbike with cash to buy oxygen for family members in hospitals. I’ve attended tonnes of funerals virtually or face to face...That stuff hits you hard and it all builds up.

What you need to know:

- In 2019, Sir Martin Sorrell hand picked former Xaxis APAC boss and global chief growth officer for WPP’s Performance Media Group to lead his APAC business.

- The group has grown at a frantic pace – 33 acquisitions, including nine in APAC.

- But then Covid hit Asia, and de Rijk’s personal and professional life got tough, very tough.

- Some of the world’s most draconian lockdown restrictions took a toll on his personal life and mental wellbeing.

- Working around the clock while parts of the West “moved on” and “pulled back” bit hard.

- De Rijk explains that holdcos were more resilient to market forces than S4 Capital, even though he maintains Sorrell’s vision will ultimately succeed.

- Media.Monks LATAM boss Ignacio Liaudat will take the reins of APAC while De Rijk's successor is found.

Michel de Rijk doesn’t have long Covid, but he is still feeling the pain the pandemic wreaked on his professional and personal life more than a year after Singapore’s lockdown restrictions were phased out.

As media and advertising executives revelled in Cannes last week, the S4 Capital and Media.Monk’s APAC boss was preparing to drop a bombshell – that he is burnt out and leaving the business he helped build from the ground up.

In the interim period, Media.Monks LATAM boss Ignacio Liaudat will oversee its APAC content business while a permanent successor is found. Sydney-based Kenny Griffiths remains as head of Media,Monks Data and Digital Media division across the region.

De Rijk spoke to Mi3 this week to explain what triggered his sudden exit, and offers a cautionary tale about how Covid not only impacted him and his colleagues, but also S4 Capital. He laments that during Covid, APAC largely felt abandoned by parts of the West – leaving him “frustrated” and under constant pressure until he hit near breaking point and pulled stumps for time out.

His Australian colleague and former ANZ MD of Media.Monks Content, Rich Lloyd, has done likewise, saying in a LinkedIn post of his own that "I'm taking a moment to focus on family, health and home...I'm looking for a role to start in mid-2023, assuming jobs for humans still exist by then."

De Rijk says a big part of his reason for quitting the next-generation, digital-first holding company rival, was the real and unrecognised impact that Covid has had in APAC. “When Covid hit India we literally were driving around on a motorbike with cash to buy oxygen for family members in hospitals," he says. "I’ve attended tonnes of funerals virtually or face to face. Even though Singapore is a great place to live, not being allowed to go onto the street for four months straight or fly back home to attend funerals or weddings…That stuff hits you hard and it all builds up,” he says.

“There was a disproportionately bad impact of Covid on our region versus other regions (like the US and Europe) and a lack of understanding from people outside of our region. There's a bit of frustration in that to be honest,” he says, pointing to parts of North America which moved on from Covid lockdown measures relatively quickly compared to the three-plus years Singapore imposed.

“On top of that, the cost this is having on businesses in our region, especially in the ad tech space is huge with layoffs, but also client side, and US companies are pulling back investments into the mothership and de-prioritising other regions, including APAC. It feels like a double whammy.”

‘We were more exposed’

When Mi3 caught up with de Rijk in August 2020, he was bullish about S4 Capital’s rapid growth trajectory and said the group’s digital content, data and tech focus, single P&L, unitary structure and ability to make decisions at speed, put it at an advantage to holdcos that operated as fiefdoms of competing agency interests.

He also talked up S4 Capital’s suite of services: “a full spectrum of programmatic media execution, data insights, analytics, content creation and production into the full end-to-end consumer journey, the digital transformation piece”. This, he argued, was a wiser focus than investing in declining legacy media.

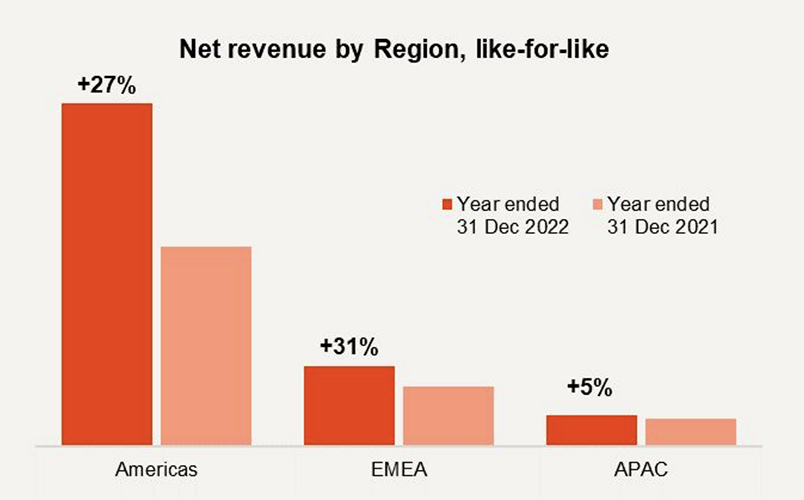

In a resignation note posted on LinkedIn last weekend, de Rijk cited how in five years S4 Capital has grown revenues by 700 per cent and onboarded 33 acquisitions (nine in APAC). But revenue growth in APAC has been harder to come by in recent times (see chart below).

When asked if his thinking about holding companies and the market challenges they faced has changed, the former WPP and Xaxis veteran said “no”, but S4 Capital’s fortunes have taken an unexpected turn.

“The disruption that Covid brought and the crisis after it hasn’t helped the challenger groups and we’ve seen it in our results,” he says. “We were way more exposed to lower revenue streams and less diversification, for example, and we were hit pretty hard in markets like China when the second lockdown hit there. The holding companies, because of just the sheer size of their business, they're probably a little bit more robust against things like that."

S4 Capital's net revenue in APAC has grown more modestly than other regions Pic: S4 Capital 2022 Annual Report

I'd say mental health within Asian countries is under-prioritised. When it comes to that, there's still this notion of if you can't see it, it almost doesn't exist, which I think is a really bad thing,

Growing pains

Moving at breakneck speed from a 500-strong company that began life in digital asset production to one that adds 33 companies and 9,000 staff across digital business and marketing transformation has been hectic - much of his energy has been spent integrating scores of acquisitions and people and constantly rebuilding processes and structures.

De Rijk stands by his previous claims that buying 100 per cent of a company is better than buying a 50-60 per cent stake in a business, whose owners hang on for several years and wait for earnouts. But he admits the ambitious pace of S4 Capital’s aggressive M&A strategy consumed “the majority” of his time, and frustrations crept in because senior staff were often stretched thin balancing the onboarding process of new acquisitions and client service.

De Rijk accepts the relentless cycle of long hours, early and late calls he devoted to the business over a number of years, combined with the seemingly permanent crisis of Covid, had taken a toll and if he had his time again he might have struck a better work-life balance.

But racing in fifth gear is less a problem with any individual, organisation or even the wider advertising and media industry; it’s more symptomatic of the working culture of Singapore, where he has lived for more than 13 years.

“I'd say mental health within Asian countries is under-prioritised. When it comes to that, there's still this notion if you can't see it, it almost doesn't exist, which I think is a really bad thing.” He says while his Australian peers and rivals have a better track record on addressing mental health, even Western work cultures have now shifted to survival and turning a profit. “It all becomes a little bit less important when shareholders complain,” he says.

Running on empty

On the topic of his own mental health, while accepting he had drained his batteries and needed to step away, he wants to make it clear: “I’m not at rock bottom”.

So what lies next?

“I had a joke with someone not long ago as part of my midlife crisis, if cars and convertibles would not have been as expensive in Singapore, maybe I would have bought one. On a serious note, there’s a feeling maybe I should do something that gives me a little bit more purpose in life…or maybe I’ll take a bit of time off and more of a portfolio approach inside or outside of the industry or a combination of both. But I’m not stuck in Singapore, it might be the chance to move around the world."

De Rijk will remain with S4 Capital during a transition period until September, and is in no hurry to plot his next move: “Until the end of the year, I am going to let it all sink in.”