CDP Investigation Part Four: Chemist Warehouse, SCA, Nova, News, Carsales on how CDPs have changed operations, structures, capability – but why consent management may be next martech wave

Michelle Weir, Paul Blackburn, Kent Len, Vanya Mariani, Cameron Strachan and Chris Brinkworth

Beyond the conversion rates, the upsell, and the media efficiencies, the stand out feature of many of the CDP projects interrogated across Mi3's four-part market investigation was the wider impact on the organisations and the role the CDP projects play in driving organisational and cultural change. In this final edition, CDP program leaders unpack how their new capabilities and insights are changing the way the company works – future-proofing against major data privacy shifts now washing through the entire digital landscape. Alongside the tech, the series wraps up by looking at capability investments brands must simultaneously make in order to generate the best return from a CDP investment – and not be left with expensive kit they can't properly operate. Plus, why consent management platforms, or CMPs, may need to sit at the top of the martech stack.

What you need to know

- Latest data suggests demand for customer data platforms – CDPs – has doubled in Australia the last 12 months.

- Marketers say CDPs address many of the contemporary and looming challenges they face such as new privacy rules and the impact of cookie deprecation.

- But they are just as often also employed to improve existing martech.

- IAB Australia says CDPs are typically used to centralised unify and enrich data, which is then analysed to (hopefully) throw up new insights into customer behaviour, such as propensity to spend, or to identify were ad spend would be wasted, and to activate effective and efficient campaigns.

- More than a dozen interviews with organisations who have already implemented CDP revealed something a little more unexpected — often the process of implementation led to both organisational and cultural change.

- Marketing and data leaders from Chemist Warehouse, SCA, NOVA, News Corp, and Carsales shared insight into how such changes manifested within their own organisations.

- Looking ahead, marketers would be well advised to keep an eye on the emerging field of consent management. At least one data and privacy specialist believes consent management platforms (CMPs) could ultimately supersede CDPs.

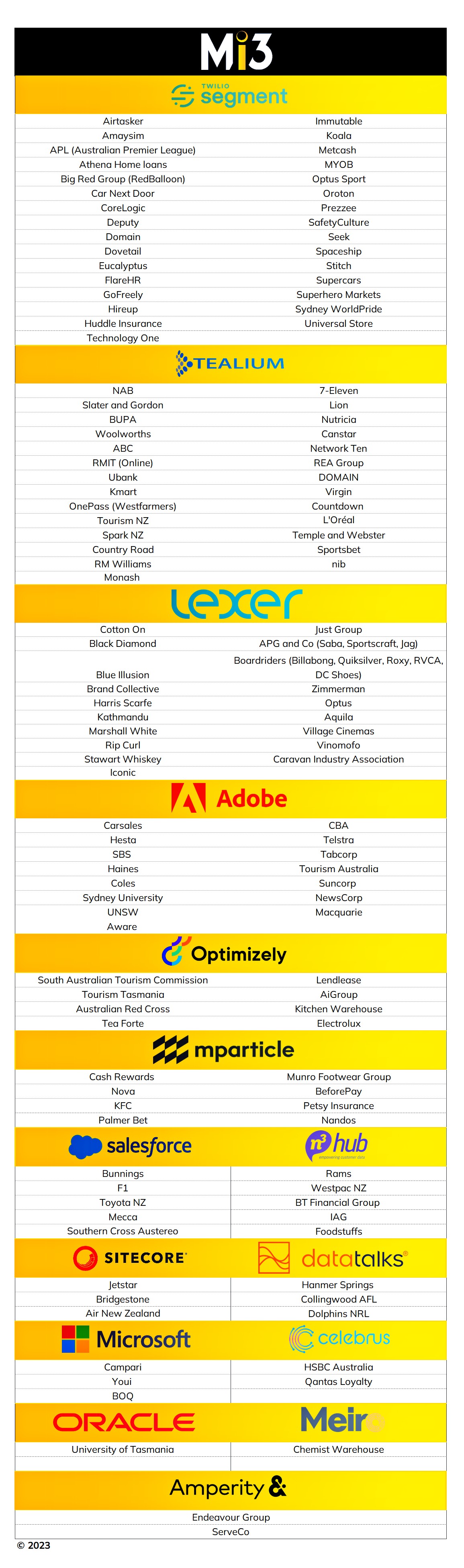

- This is the final in a four part series on CDPs which Mi3 has published over the last month. Part one examined the current state of the local market, and identified four market leaders — Segment (on volume) Tealium (by revenue), home grown retail specialist Lexer, and Adobe. All up we now believe there are more than 550 CDP implementations locally, and about 20 active suppliers. Some vendors — Hubspot for instance — provide CDP-like capabilities, and there is a growing trend toward composable CDPs that companies build themselves.

- Part Two revealed that Identity, media efficiency and effectiveness, personalisation and privacy are driving uptake – and that prepping for AI could fuel a second wave.

- Part Three unpacked the often significant integration challenges faced by brands which are far more difficult than vendors let on. ANZ Bank and Carsales also outlined where to start with CDP implementations, and what to expect; while implementers reveal the industrial sized cans of worms brands might be opening for themselves.

It's really the ability to have a look at our leads and understand them through lead scoring. The CDP helps with this, it doesn't do all of the work. But it helps.

For all the complexity that attends a large CDP implementation, the organisations making the investment are often looking to solve very familiar and recognisable problems.

Take higher education, where Mi3 is told interest in CDPs is rocketing. University of Tasmania's decision to move to a CDP was motivated in part because of the need to do lead scoring better, though that was by no means the only reason. It chose Oracle's CDP, making it one of the first users of that platform in Australia.

"It's really the ability to have a look at our leads and understand them through lead scoring. The CDP helps with this. It doesn't do all of the work, but it helps," University of Tasmania CMO, Michelle Weir, told Mi3.

"You can lead score to understand the higher propensity of students to enrol and stick with a particular course of study. And you can use a blend of the information that you've gathered, and also their digital behaviour on you site and other sites, to understand and ascertain how you would score that lead. Then you can prove that they stick or they don't – and if they do, then you can find more students who look like them."

Arktic Fox's Digital Marketing in Focus report authored by founder Teresa Sperti and published earlier this year, identified the rise in demand for CDPs as one if the biggest changes in CMO thinking over last year.

According to the report, last year 21 per cent of leaders polled suggested that CDP investment was an area of focus but that has almost doubled to 40 per cent for 2023.

"As brands wrestle with the challenge of bringing together an increasing number of disparate data sources to activate data and effectively report on performance, the demand and need for CDPs has risen," per the report. "With the rise of data sources comes the challenges of integration. Integrations topped the list of challenges leaders and teams are facing when it comes to martech."

The use cases Mi3 encountered throughout this series were fairly consistent, and hewed closely to those identified by IAB Australia when it published a data collaboration platforms explainer earlier this year. It said CDPs have four primary purposes:

- Centralising and unify data.

- Adding value to the data through enrichment – which can involve incorporating 2nd/3rd party data or segmentation modelling.

- Exploring and providing intelligence that allows for the surfacing of audience insights and high-value segments for targeting.

- Enabling activation, either directly via the platform or through pushing audience segments to digital activation platforms such as DSPs or offline sources like direct mail houses or email and short message service providers (EMS/SMS).

Many of the CDP projects studied in Mi3's series tapped into all of the above elements. But these CDP projects were also characterised by another key theme – organisational change. Which is why the final and fourth part of the CDP series focuses on key user insight about how their CDP implementation and new capabilities have changed both how they work and how they do business.

Some teams have changed their structure [as a result of the CDP implementation]. We’ve also hired some great people in marketing who [better] understand digital ... We've made significant strides in our data understanding and maturity.

Southern Cross Austereo - structural capability shift

CDP: Salesforce

Proof point: Cost of acquisition down by more than 10 per cent.

For Cameron Strachan, Head of Data and Analytics, SCA, one of the most important impacts of the CDP project was the rallying effect on the team, but also the benefit it provided in helping people to understand what is possible.

“That’s very important. We are live with personalisation campaigns on the actual app [it's 'uber app', Listnr] and website as well. That was core to the implementation to go live with a campaign. And just the knowledge sharing about what that meant and how that works.”

He also said SCA has refined the way it does analytics. “That includes internally how we label things and the importance of metadata. And there have just been enormous changes and benefits from a process perspective."

From a campaign perspective, he said there is a much better appreciation of what is possible from true multichannel and the benefits to be had from sequencing.

“That is eye-opening. We are getting significant uplift from our personalisation campaign.”

He added: “I think the power of it, particularly when we are sharing visuals is powerful.”

It’s also led to some structural changes. “Some teams have changed their structure to better reflect this, which is a positive. We’ve also hired some great people in marketing who understand digital. I very much feel that we're now a business that is very aligned on where we want to get to, and we've made significant strides in our data understanding and maturity.”

The level of insight that we get, and can surface – it’s the science before we even get to the art form. The science informs that art, and that is something that's been fantastic.

News Corp - Sell outcomes, not ads

CDP: Adobe

Proof point: Moet Chandon, a News Corp Client achieved a 38 per cent increase in unaided brand awareness, a 32 per cent increase in footfall to their key suppliers, and a 10 per cent increase in purchase intent.

One of the bigger impacts of the CDP upon how the commercial group at news works, and which Paul Blackburn, Commercial Director, Data, Video, and Product – News Corp says is probably undersold, is the level of insight that the company now gets around what consumers are interested in. Those insights are now used for internal planning purposes, he says, and also for commercial content.

“The level of insight that we get, and can surface – it’s the science before we even get to the art form. The science informs that art, and that is something that's been fantastic.”

That’s true across a range of News Corp businesses that Blackburn calls out including its content agency, its video production business Visual Domain – a producer of high-volume, short-form commercial video.

“Just getting that level of insights that helps with planning out content campaigns or finding those nuggets to really help you to be able to differentiate your products based on the zeitgeist of that audience's current behaviours. That's been that's been really handy,” he says.

Likewise, measurement and attribution have been sharpened, helping News push back against the laziness of last-click attribution.

“The measurement and attribution part is absolutely key. There are so many different ways to segment, it's what the advertising industry has done since the beginning of time. But being able to do that with us, and then show the measurement and the outcome with links back to the media in our environments, that is a real change agent for us.”

“That’s what marketers are wanting to buy. They want to buy the outcome.”

We allow the business to see user data and insights on things that they've never seen before.

Nova - Distributing marketing capability

CDP: mParticle

Proof point: Falling churn rates and strong efficiency gains.

It is still early days at Nova where the company has implemented an mParticle CDP.

But already it is driving organisational change.

According to Tim Armstrong, Director, Digital Product, Technology & Data, "We now have a connected audience marketing manager on the marketing team. Marketing no longer sits with me, which is great."

With the new hire in place, marketing can now leverage the engagement platform and the CDP to support and help drive strategy around customer acquisition.

"It’s still early," says Armstrong. "We're still we're still working through trying to the value of the efficiency that's been created off the back of it. There’s not a lot to compare to before CDP, but we talk a lot about the fact that we allow the business to see user data and insights on things that they've never seen before."

The biggest shift is that we can log into the CDP, and we can build pretty much whatever audience we need to. Then we can get a view of what that segment is doing.

Chemist Warehouse: Sharper propensity modelling

CDP: Meiro

Proof point: Greater visibility over propensity to spend.

Chemist Warehouse uses a Merio CDP to underpin its significant retail media business. The retailer is inching closer to that all-important holistic customer view.

“Customers are interacting with [supplier] brands and our brand at Chemist Warehouse. We on-sell that data set to these brands as well. The biggest shift is that we can log into the CDP, and we can build pretty much whatever audience we need to. Then we can get a view of what that segment is doing,” per performance marketing boss Kent Len.

Once you have those insights, it’s easier to properly personalise, “and get one-to-one messaging across all the all the activation channels that we've got plugged into the CDP”, he adds.

"Because of our holistic view of the customer we therefore have better insights to what that customer is doing. That can drive predictive models in Meiro – meaning we can predict what they're going to buy next.

"Or filling in some data gaps. So we may not capture male or female but based on the categories that they search, based on what they buy, we can make a predictive assumption that they are male or female. We can have propensity models and RFM models over the top."

The win for the customers is a more personalised experience. For Chemist Warehouse, ultimately it's about selling more product and driving revenue growth while propensity modelling – knowing how likely a customer is to purchase specific products within the next 90 days, for example – can also feed into stock and inventory management.

Any concerns our leaders had around the timing were eventually overcome because we were able to demonstrate to the business and the wider market more importantly, that we are ready for the changes that will inevitably have an impact on everybody, the entire industry.

Carsales: Future-proofing against cookies, privacy

CDP: Adobe

Proof point: Match rates for client close to 60 per cent.

For Carsales, the CDP helps future-proof the business against Australia's incoming privacy overhaul and ongoing tracking changes by the major digital platforms, says Head of Commercial, Media, Vanya Mariani.

That was a key concern the team needed to address with the company leadership when pushing for CDP investment.

“Any concerns our leaders had around the timing were eventually overcome because we were able to demonstrate to the business and the wider market more importantly, that we are ready for the changes that will inevitably have an impact on everybody, the entire industry,” she told Mi3.

Mariani describes Carsales as a data and tech business – "this is our jam” – and says the CDP project has given the business a greater measure of control over its own destiny.

“We didn't want to wait for our hands to be forced to adopt a change later. This has given us the breathing space to do things right the first time and to deliver that executional excellence.”

Commercially there has also a big benefit from moving early.

“We had lots of clients approaching us to help them on their own transformation journey, and also wanting to activate on some of the solutions we had created, that weren't third-party cookie reliant but were privacy-compliant," per Mariani.

“By going down the CDP path, communicating to the market what our journey has been, and what the outcome of that has been, we've kind of taken the risk out of doing business.”

For a CDP to truly shine, you need data science to sort out the crucial data, business analytics to translate it into actionable insights, and a sharp marketing strategy.

Just the start

While the brands above are well into their CDP journey, many of the projects Mi3 identified are still being implemented – with a hard row yet to hoe.

According to Chris Brinkworth, Managing Partner at consultancy Civic Data and co-chair of IAB Australia's Data Council, "Setting up a CDP is just the beginning, and the importance of managing expectations between the CDP vendor and the end user is vital. Navigating the day-to-day use is where the real work starts."

He told Mi3 it's crucial to focus in the skills and capabilities needed to leverage the investment.

"We often come in when essential roles have been overlooked, leading to bumps in the road. For a CDP to truly shine, you need data science to sort out the crucial data, business analytics to translate it into actionable insights, and a sharp marketing strategy."

IT must be agile to ensuring a smooth blend with the CDP, Brinkworth suggests.

"A change management leader should be there guiding teams through the transition, while an architect ensures the system's foundation is robust. With the increase in 2nd party data sharing and changing Australian privacy laws, a firm grip on privacy, governance, and contracts becomes paramount."

Brinkworth said it is little surprise that CDP projects are triggers for cultural change within organisations.

"Customer data activation requires a collaborative, data-driven culture across technology, marketing, sales and IT – data must inform decisions, but you must be aware data may be collected incorrectly or become illegal to use or store in certain ways, or simply cannot be activated as planned due to authentication and permission issues."

He said organisational changes like dedicated data teams require clear communication and transparency.

"Systems must align with evolving standards and their political/technical impacts. Teams need to understand their role. This customer data journey needs trust, understanding, and foresight for the unexpected."

Rise of consent management platforms?

Brinkworth says he comes across serious problems with the way businesses collect data and manage consent – and tags – on a daily basis. He thinks there is cautionary note for both the buyers and sellers of CDPs as regulations tighten, with consent at the heart of Australia's Privacy Act overhaul.

"Large clouds now aim to own these capabilities to remain entrenched. However, concentrating consent and governance within clouds contradicts decentralisation trends. We are seeing the rise of composable stacks as marketers assemble tools managing consent, governance, and activation. This blend of best-of-breed point solutions delivers flexibility lacking in consolidated cloud ecosystems."

Integration may enable efficiency he says, but customers now demand control over their data and adaptability as regulations evolve.

This, he believes, will require consent and governance to stand hierarchically above CDPs. Which means consent management platforms, or CMPs, may supersede CDPs – and potentially become the next 'must have' element in the martech stack.

"Either way, protecting consumers and avoiding penalties starts with removing non-compliant tags, data collection, activation, re-identification etc. – before reconsidering foundational data practices."

Last word

Demand for CDPs in Australia continues to rise, with more than 550 current implementations and 20 active vendors. The Arktic Fox report from earlier this year suggests marketers are hoping CDPs are the Rosetta stone to help them unlock the gold buried within many disparate data sources.

The business imperatives fuelling the surge in CDP sales include: digital identity; more efficient and effective media spending; better compliance, especially in the context of proposed privacy law changes; and the ability to personalise customer experiences, increasingly in real-time. All of which is happening in the context of an increasingly complex regulatory environment where data privacy has taken top billing.

To get a better understand of the market, the business imperatives and the challenges brands face implementing CDPs read parts One, Two and Three of Mi3's CDP series.