Net Promoter Score elite: Insurance sector cleans up (except health) for best NPS scores; retail, auto soar but couriers, fuel are shockers

Mike Doyle, Christian Bowman, Tina Morrell, Lara Truelove, and Ben Sainsbury on the utility of NPS

There's good news for insurance customers (mostly). Whether you're signing up, setting up payments or navigating digital services, you're likely to feel well looked after and appreciated. Unless you're in health insurance, that is, where the same experiences are likely to leave you feeling queasy. And if you are buying fuel or waiting for a parcel delivery service, take a deep breath or, better still, a strong shot of whisky and get ready to rage-tweet, because the news is not great. That's according to a new national survey of 21 industries by Qualtrics and SAP, which looks to set an NPS benchmark against which performance can be measured in future. Brands Mi3 spoke to, such as NRMA, are achieving some extraordinary results, while acknowledging there's always opportunities to improve. Tina Morrell, General Manager, Customer Strategy & Experience Design and other executives Mi3 spoke with stress that NPS is just a number and what matters is what you do with the insights. And it's never to soon to start measuring NPS in the customer journey, say Entain's Christian Bowman, who has introduced NPS at three different organisations.

What you need to know

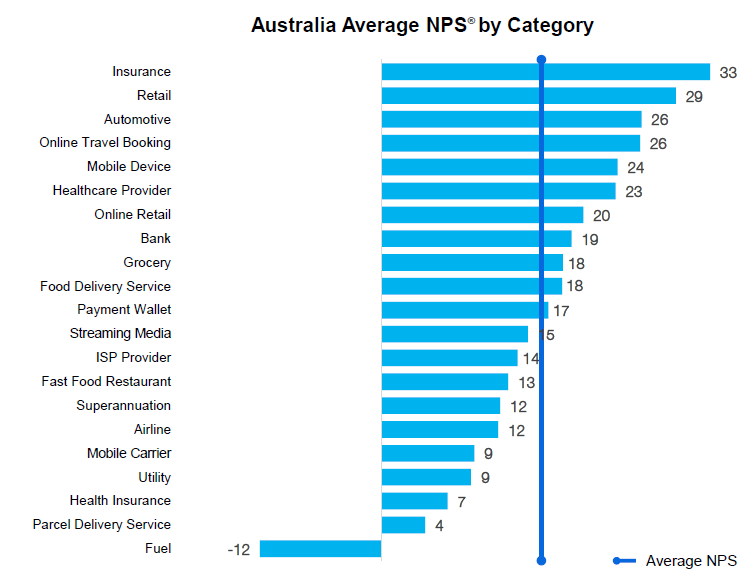

- A survey of 123 brands across 21 industries reveals that insurance companies earn the highest net promoter scores (NPS), with the sector getting a combined result of 33, double the national average of 16.

- Automotive, Retail and Online Travel Booking also rate well above the average.

- But health insurance, parcel delivery services and fuel have the worst scores, and couriers, in particular, ranks worst across a range of measures.

- Some brands are achieving astronomical NPS scores for some of their services – NRMA gets a huge score for its Roadside Assistance program and 55 for its membership services.

- And executives like Entain's Christian Bowman, who has introduced NPS at three organisations, says there is real value to be found starting NPS surveys very early in the customer journey.

- But they and other executives stress, its just a number. What matters is how you use the data to continuously improve.

The richness, and where people need to be using NPSs actually, is in the verbatim [responses]. We track all that data, apply analytics, and we leverage it using other tools to really dig into what the promoters are saying, the passives and the detractors.

Not too many brands can boast of a net promoter score of 86 for a product in their portfolio, but that’s the stratospheric result NRMA's break down service earns from its members. It’s one of a set of impressive NPS scores for NRMA, whose remit covers the wide set of offerings.

According to Tina Morrell, General Manager, Customer Strategy & Experience Design, “We do track a number of NPS scores”, noting that they are travelling reasonably well.

“We have a group touch point NPS, where we roll up everything into a score. That’s really at a senior balanced scorecard level where we track our main brand NPS," she said. "That’s really ‘Would you recommend the NRMA brand'. That could mean anything; it [depends on the] person we are asking. And that's a way for us to track against our competitors. That does quite well and it's been improving significantly. It’s over 30 which is quite high for an overall brand NPS."

“When you get into ‘would you recommend NRMA memberships in our scores are more like plus 55.”

It’s a solid set of numbers that compares favourably to the results of a new national study into the NPS ratings across 21 different industries, released today by the Centre for Experience Management that is run by Qualtrics and SAP.

That study, called The Customer Experience Edge, found that businesses in the insurance, retail and automotive sectors are delivering the strongest net promoter scores, while health insurance, parcel delivery services and fuel are the worst performers.

The goal of the study is to establish a baseline against which industry NPS scores can be tracked in future.

Fuel is especially bad, the only one of the 21 industries studied to return a negative result of -12. Even parcel delivery services – almost a meme for poor customer outcomes – returned a score of four.

At the other end of the scale, the insurance sector with an NPS of 33 returned more than double the national average of 16.

Source: The Customer Experience Edge

The study is based on a panel survey of 3150 adult consumers and involved 123 brands. In addition to relational NPS (which measures the quality of customer relationships), the survey also tracked overall customer satisfaction and future intent.

Across all brands the highest individual NPS was 45, while the lowest was -25, according to SAP executive Lara Truelove, author of The Customer Experience Edge: Australia and Program Leader for the Centre for Experience Management.

As to what distinguishes the leaders from the laggards, Truelove told Mi3 the real insights were in the qualitative responses offered by participants in the survey.

For instance, comments about the insurance industry which returned the strongest result as a sector, reflected the investments made by those businesses into process efficiency.

“I saw many verbatim (answers) along the lines of ‘streamlined processes and easy to launch online, efficient repairs, easy to make payments, easy to make claims.’ “

While acknowledging the general nature of the observation, Truelove said insurers have doubled down on their processes and used digital interfaces to make some of these processes more convenient for consumers.

“The other factor in insurance is the helpfulness of people. [Respondents said] things like ‘On the phone, they were helpful. You always talk with the person and you feel heard and valued straightaway'," she said.

“When we talk about helpfulness and knowledge of the frontline staff, behind that is the training that they're getting, the ability for them to focus on the work, and the ability for them to have agency to solve problems for customers as well.”

However, the results of the study told a very different story for one particularly category of insurance – health.

Truelove said verbatim responses from consumers indicated high levels of frustration with the very processes that other parts of the insurance sector seem to have nailed down tightly.

She indicated consumers responded with expressions such as, “The processes are not working, there are long queues, the people aren't helpful and knowledgeable and I get bounced around.”

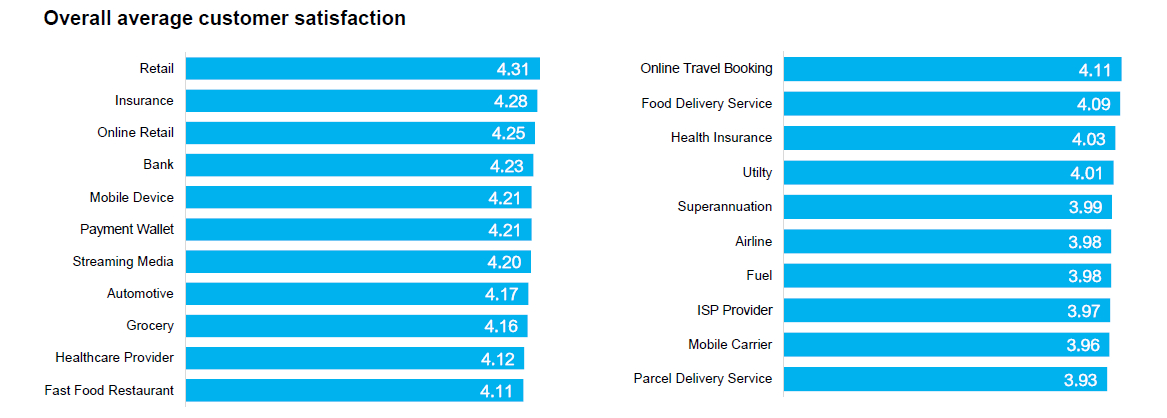

When it comes to overall customer satisfaction Retail outperformed Insurance, and Online Retail came third, while ISP’s, Mobile carriers and Parcel Delivery Services rated most poorly.

Source: The Customer Experience Edge

Unsurprisingly, given how poorly it performed on NPS and overall customer satisfaction, consumers say they are least likely to continue purchasing from Parcel Delivery Services (although ironically, they have little say in the matter). Super funds also took a hit on this measure, but that might have as much to do with poorly-performing capital markets over the last year. Fuel could be suffering for the same reasons.

As to what consumers want, the report says, “When it comes to the improvements people would like, helpfulness of representative is the most common and a top three improvement area in nine categories. Mobile app ease of use is the second most common improvement area, appearing as a top three in seven categories. Whilst improvements in payment options, speed of delivery, quality of location of physical space and speed of problem resolution are all frequently occurring improvement areas. The reality is that the focal areas differ depending on the category very much.”

Just a number?

Of course, NPS is just a measure and what really matters is what you do with it, says marketers and other CX professionals.

NRMA’s Morrell outlines how the organisation used the fact that its membership NPS was stuck around 50 and it needed to identify how it could improve customer experiences.

"We had a mission to lift it. We did a deep dive into the data," she said. "The richness, and where people need to be using NPSs actually, is in the verbatim [responses]. We track all that data, apply analytics, and we really it using other tools to really dig into what the promoters are saying, the passives and the detractors."

To respond to the issues they identified, NRMA created cross-functional teams from marketing, analytics and technology, and in the first sprint everybody had to read the verbatim data, Morrell told Mi3.

One of the areas NRMA tracked was digital experience. "They had to read every comment that was ever made around that digital experience, get underneath opportunities," she said. "The next sprint identified opportunities for improvement, and broke these down into solutions Then we start to trial, test and learn and then implement."

The focus worked and NRMA's digital experience NPS grew by 6 points.

Initially, some people questioned whether or not you would use an advocacy metric very early on in the customer lifecycle.

NPS insights can provide value to brands from very early in the customer engagement, according to Christian Bowman, General Manager of internal project for Entain Australia, the local arm of one of the world’s largest sports betting and gaming groups.

Bowman has introduced NPS to three organisations in his career, most recently at neds and Ladbrokes, which are both owned by Entain; he was the GM CX and Innovation in both instances. He said NPS can provide valuable insights very early in the customer relationship.

“Initially, some people questioned whether or not you would use an advocacy metric very early on in the customer lifecycle,” he said.

It’s not a view Bowman shares.

“In the first week we would send a message out after they sign up, as a new customer. The reason why it was still a good metric to use, compared to say, customer satisfaction, or customer effort, is that in my view the customer has already gone through a lot to get to that point.”

Bowman explained, “The signup process in its own right isn't the only interaction a customer would have had with a brand. Even at this point, which is early on in the grand scheme of the lifecycle, that they've consumed a lot of content, they’ve been through a lot of decision making, they might have heard from one of their peers and had a recommendation to try us, they definitely have had to go through the signup process. And they also go through a depositing process as well.”

They have been through a lot, he said, whether that’s consuming marketing, going through that sort of conversion by clicking on ads or, typing in the webpage or installing the device.

All of these factors led to the decision that NPS was a good survey to use at that time, a choice borne out by the 25 per cent response rates Ladbrokes achieved. “For a company like us where we just have such high volume in terms of acquisition, and particularly at that point in time, that's a really high response rate to get for a survey response," Bowman added.

But more important was what happened next. Ladbrokes focussed on the detractor scores, and built a work process where they contacted detractors.

“Even if there wasn't anything that was instructional in terms of needing to find out more information our call centre would call them and thank them for the feedback within the first seven days," he said.

“Once we captured that feedback, the first thing we would do is acknowledge the response and offer gratitude. It was our big opportunity to start the relationship with these clients.”

After about six months the company had a big enough data set to start to make judgements about what drives retention. “We found that clients that gave us a nine or 10 out of 10 were 35 per cent more likely to be with us the next month.”

They were also able to make changes based on customer feedback to improve the experience and, importantly, communicated back to customers who made the feedback so they understand that their concerns had been actioned.

“Customers started to feel like they were involved with, almost, product decision making, like they were part of the team.”

Beautifully dangerous

Marketers have something of a mixed relationship with NPS, it is not universally applauded.

According to Mike Doyle, now a consultant, but previously a CMO at brands such as Verve Fitness, Brisbane Airport Corporation and City Beach Australia, “I've taken a real journey with NPS in all of the businesses I've worked for.”

He arrived at to a point a few years ago where he felt it didn’t really work and needed modernising, however his view has evolved since then. Now he said, “It's beautiful in that it can mold your application, but it's dangerous, because it depends on the user. And so there is no nuance in it unless you deployed it in a nuanced way.”

Ben Sainsbury, practice lead, marketing transformation at Collagis, an agency that focuses on optimising workforce and organisational effectiveness, also acknowledges concerns about NPS, but describes it as a powerful tool when used the right way, and especially at an episodic level.

“We break down the customer journey into very clear episodes of value for the customer and for the business. Those are probably most easily translated in service episodes, for instance where there are clear boundaries and there's a consistent experience expected by both the customer and the business.”

When things go wrong in those instances, NPS is a useful tool for helping to understand what went wrong to then rectify it.

“Where I find it doesn't work as well is when it's across more of a generic journey. Those boundaries haven't been set, so it's really hard to measure with an NPS and then put that into action.”

A new focus

So can the Customer Experience Edge study offer any insights into emerging areas of customer concern? SAP’s Truelove said she was intrigued by how frequently payment options emerged as important drivers of customer experience.

“I think it's a little bit different from five to 10 years ago, capabilities now like 'buy now, pay later', or warranties attached to payment wallets.”

She said payments is a space that CX practitioners will need to pay close attention to in the future. “The goalposts are moving on what payments is and what it isn’t. There is a whole ecosystem around payments.”

And, Truelove said, the effect of payments on NPS can be both for good and ill.