The real reason behind Nike’s US$27.5 billion loss: A cautionary tale of growth gone wrong

Three months back, Nike's share price nose-dived US$27.5 billion in a single day. John Donahue's grand plans to make the 60-year-old athleisure brand into a direct-to-consumer hadn't played out as he had imagined, and now, he's paid for it with his job. On October 13 he'll be replaced as CEO by former Nike stalwart Elliott Hill. Affinity CEO Luke Brown lays out the play-by-play of where it all went wrong, and what business leaders might stand to learn from Nike's mistakes.

John Donahue walks into the Nike boardroom and drags out a seat, his head slumps on the table. It’s midday and the office behind him is deathly silent. $27.5 billion has just been wiped off their enterprise value. This is not what his board had in mind when they set Donahue up for this day back in January 2020.

$27.5 billion. That’s more than the entire market cap of Coles Group gone in one day. On LinkedIn and other channels, the usual pundits have framed this momentous loss as a brand marketing versus performance marketing debate or various other tactical agendas. It’s rare to see such a self-inflicted destruction of value play out in real time, it felt important to look at this from a broader business perspective.

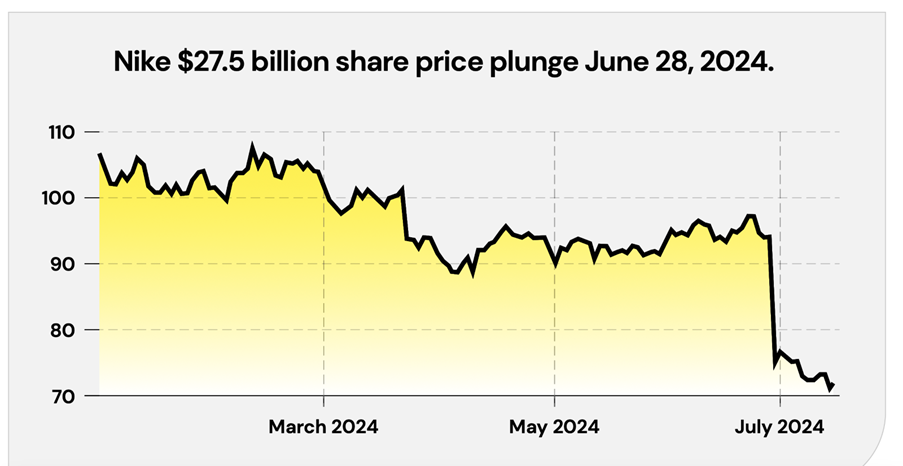

For those who haven’t been following the saga, Nike’s stock took a nosedive of 20% in late June 2024 after the company slashed its full-year guidance, predicting a 10% drop in sales for the current quarter. The warning signs, they said, included soft sales in China and “uneven” consumer trends globally. Nike’s finance chief, Matthew Friend, tried to reassure analysts by saying, “A comeback at this scale takes time. While the next few quarters will be challenging, we’re confident that we’re repositioning Nike to be more competitive, with a more balanced portfolio aimed at driving sustainable, profitable, long-term growth.” In other words, they know they’ve got some serious work ahead to claw back from this setback. The funny thing was that sales in China actually beat Wall Street estimates – it was the only small glimmer of light in a set of disastrous numbers for the athletic brand.

Nike $27.5 billion share price plunge June 28, 2024.

What we’re really looking at here is a textbook case of why messing with physical and mental availability can be catastrophic for a brand. If you’ve ever doubted the importance of these concepts, Nike’s misstep should make you a believer. The more we dig, the clearer it becomes that these principles are genuine bedrocks for business growth. And this is the largest case I’ve seen and it’s playing out in real time. In fact, I would have loved to give Nike’s executive my copy of Byron Sharp’s “How Brands Grow”.

The twin engines of growth: Physical and mental availability

First, let’s revisit the principles of physical and mental availability — two concepts championed by Professor Byron Sharp and the Ehrenberg-Bass Institute, critical for brand growth. Physical availability is all about ensuring your product is easy to find and purchase. Think of it as being present wherever your customers shop — whether it’s in stores, online, or both. Mental availability, on the other hand, is about staying top of mind for consumers when they’re making purchasing decisions. It’s why you think of Nike when you need new running shoes, even if you haven’t actively been searching for them.

When you start tampering with either of these engines of growth, you’re asking for trouble. And Nike, in its quest for short-term gains, decided to take a joyride right through the middle of this marketing minefield.

Nike’s great shelf-space shrinkage: A physical availability fumble

Here’s where things started to unravel. In what might have seemed like a genius move at the time, Nike decided to pull its products from third-party wholesalers like Footlocker and Macy’s and focus on selling more through its own stores and online platforms. The logic? By cutting out the middleman, Nike could increase its margins and boost short-term profits. And it worked – for a while. Margins went up, stock prices soared, and everyone in the C-suite was popping champagne and receiving stock options.

But here’s the kicker — by reducing its physical availability, Nike made it harder for people to buy its products. You can’t grow a brand if people can’t find it. Upstart competitors like Hoka and On, plus more seasoned rivals like New Balance, who would have been thrilled for years to snag that precious shelf space, jumped at the chance. No retailer would have willingly taken Nike from its shelves given its dominant market share (#1 in every category) – this had always been part of Nike’s competitive moat – now gifted to competition. Imagine an FMCG marketer saying, “Nah I don’t want any shelf space”. With Nike no longer in store customers just bought other brands. Nike realised this in April 2024 but once you lose that physical presence, getting it back is no small feat. It’s not just a matter of flipping a switch – those shelves are now occupied by brands that now have taken a bite out of Nike’s market share.

Losing brand relevance: A mental availability crisis

As if making their products harder to find wasn’t enough, Nike’s strategy also dealt a blow to its mental availability. The company decided to restructure its operations (profit maximising cost out decision), moving away from divisions focused on individual sports, like basketball, to broader categories like men’s, women’s, and children’s sales. On paper, this might have looked like a way to streamline operations, but in reality, it diluted Nike’s connection with the very sports that had made it a go-to household name.

By neglecting these niche but powerful segments, Nike began to lose its relevance. Then Nike compounded its mistake by trying to copy a central bank and print money. Remember when everyone wanted a pair of Air Jordans or Air Force 1s? By making these iconic products too ubiquitous, Nike eroded the scarcity that had fuelled their desirability, and more importantly their place in culture. Instead of being the brand that athletes and enthusiasts turned to, Nike became just another sports shoe option. The result? A brand that once dominated the sportswear world is now struggling to maintain its foothold.

The real-world impacts

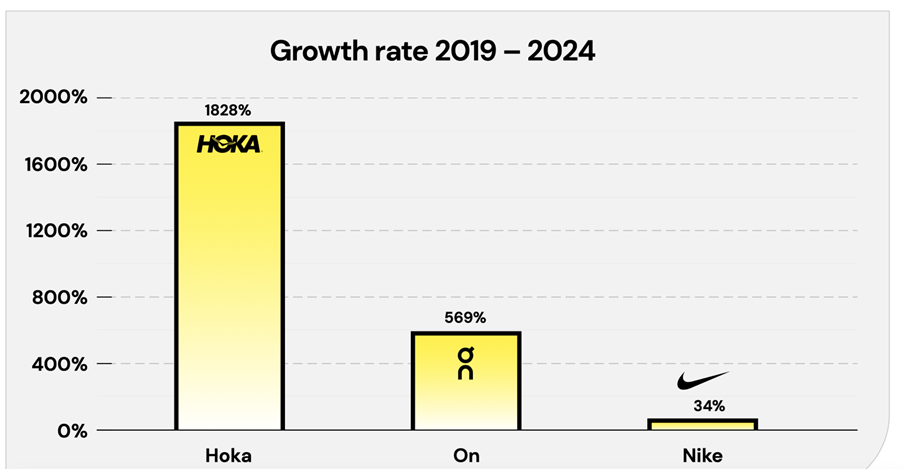

Over the past four years, emerging sportswear brands Hoka and On Running have made significant strides in capturing market share, all while spending an amount that Nike typically burns through in just two weeks, according to TD Cowen. Both brands have experienced a meteoric rise in sales. Hoka's sales surged from $223 million in 2019 to $4.3 billion by 2023, and On Running followed a similar trajectory, with sales increasing from $314 million in 2019 to $2.1 billion in 2023. Although these figures are still small compared to Nike’s growth from $39.1 billion in 2019 to $52.2 billion in 2023. Whilst supporters have been excited that Nike hit the $50 billion mark for the first time, inflation can take credit for the majority of Nike’s revenue growth. It also makes the rise of Hoka and On Running even more remarkable. They've grown from accounting for around 1% of Nike's sales to over 10% in just four years — a growth rate that would have seemed unimaginable in 2020

Funnily enough, every single self-destructive change wrought by Donahue and team has now been reversed. And whilst these short-term decisions might not inflict fatal wounds to Nike, they’ve significantly damaged Nike’s position in the market, and it’s unlikely whether the brand will ever recover its former dominance.

So, why did Nike make these missteps in the first place? What’s Nike doing to turn it around? And how does this even relate to brand versus performance marketing?

The beginning of the end by dreaming big

John Donahue steps into his new office at Nike’s Beaverton HQ, the ink barely dry on his contract, and dreaming big. It’s 13 January 2020, and he’s ready to make his mark on a global sports goliath. His impact will make him immortal in the annals of business.

Armed with decades of experience at eBay, ServiceNow, and Bain & Company (none in athleisure you’ll note), Donahue envisions a future where Nike dominates not only in sportswear but also in the digital marketplace. Already on the Board, it’s this vision that gives the Board the confidence that he is their guy. The world is his for the taking, and Nike’s direct-to-consumer (DTC) model is the obvious play to boost margins.

It all seems perfect. Then COVID-19 hits, and suddenly, the DTC plan looks even better— after all, stores are closed, and digital is king.

According to Nike marketing insider Massimo Giunco who worked at Nike for over 20 years. “After a few months and his first tour around the Nike world, the CEO announced – via email – his decisions (using the formula “Dear Nike colleagues, this is what you asked for…”):

1) Nike will eliminate categories from the organisation (brand, product development and sales)

2) Nike will become a DTC led company, ending the wholesale leadership.

3) Nike will change its marketing model, centralising it and making it data driven and digitally led.”

Terrifying.

The DTC dream & playbook that led Nike astray

Donahue’s vision wasn’t just ambitious it was reckless. Rooted in his past success with digital-only businesses, it was also aggressive. During the 2010s, the stars aligned for e-commerce growth: Facebook’s CPMs were low, and platforms like Shopify and Magento were giving rise to a whole new wave of direct-to-consumer darlings — Smile Direct, Dollar Shave Club, Glossier, and Allbirds. For a CEO who lived and breathed digital, leaning hard into DTC made all the sense in the world.

Cutting out wholesale partners like Foot Locker and Macy’s... why not? Nike could keep more margin and have more control over the customer experience. Make some optimisation and rationalisation to some ranges to save costs and again boost profits. At least, that was the plan. The board had hired Donahue for his digital commerce and transformation experience, but his plan was unhinged. And as we know now, it resulted in a $27.5 billion faceplant and destruction of enterprise value for Nike in a single day. According to Massimo, DTC lowered Nike’s margins did not improve them.

The tactification of marketing: Brand marketing vs. performance marketing – an unnecessary war & narrative

As alluded to already, pundits have framed Nike’s troubles as a failure of brand marketing. The argument goes that the company abandoned long-term brand-building efforts in favour of short-term performance marketing tactics in their push to DTC.

So, everyone is up to speed here, performance marketing focuses on driving immediate actions, such as clicks, conversions, and sales, while brand marketing is about creating mental availability and fleeting emotional connections. It’s one of many pointless false dichotomies argued over incessantly in marketing. To paraphrase Associate Professor Mark Ritson, marketers need to take a ‘bothism’ attitude. Using AND rather than the tyranny of OR more often is the right approach – the required mix depends on your business’s circumstances.

There is no denying the explosive growth in performance marketing to drive traffic to Nike.com. Making Nike.com the centre of all activity meant that instead of focusing on creating future demand, they focused on harvesting existing demand and talking to their existing customers. Again, if they had my copy of ‘How Brands Grow’, they’d know for such a giant brand this is the fastest way to shrink your sales.

However, Nike’s failure was not just in deciding to do substantially more performance than brand marketing, this is a way too tactical assessment.

Adding kerosene to the fire: iOS 14.5 and the DTC apocalypse

In fairness, the plan would have always failed. However, Apple’s introduction of App Tracking Transparency (ATT) with the iOS 14.5 update on April 25, 2021, compounded the plans problems. ATT required apps to ask users for permission to track their data across apps and websites. Unsurprisingly, the vast majority — about 80-85% globally — opted out.

This privacy shift severely undermined Nike's ability to target and optimise digital ads effectively. Without access to user data through the Identifier for Advertisers (IDFA), Nike's digital marketing became less efficient and more costly. A Marketing Science Institute report quantified the fallout: click-through rates dropped by 37%, and revenue for businesses heavily reliant on platforms like Meta decreased by 39.4%.

Despite these signals, Nike did not pivot its strategy in time. The combination of a flawed DTC approach and the diminished effectiveness of performance marketing post-ATT should have been a wake-up call, especially as competitors like Hoka and On were gaining significant market share.

The surprising lack of a business measurement framework

One of the most startling aspects of Nike's downfall was the apparent absence of a robust business management framework to monitor and adjust their strategy. Despite clear indicators that their DTC play was faltering— loss of market share to competitors like Hoka and On, brand perception dropping, and the diminished effectiveness of digital marketing post-ATT—the company stayed the course. In business, making a wrong strategic choice isn't necessarily fatal; what's critical is the ability to recognise when a strategy isn't working and to pivot accordingly. By 2022, the klaxons should have been deafening, signalling the need for a strategic reassessment. Yet, Nike seemed blinded by their initial plan, possibly falling victim to the sunk cost fallacy— grinding on with a failing strategy due to the resources already invested. Without an effective framework to evaluate and respond to these warning signs, Nike missed the opportunity to course-correct before the situation escalated.

A self-inflicted destruction: What’s Nike doing to turn it around?

Recognising the scale of its missteps, Nike is now scrambling to correct course. They’ve brought back Tom Peddie (out of retirement), a 30-year veteran of the company, to patch up the physical availability mess. But it might already be too late. With competitors like Hoka and On gaining more ground every day, Nike’s efforts to reclaim lost territory are an uphill battle.

The decision to prioritise immediate profitability over long-term business health has cost the business dearly. It’s like pulling the rug out from under your own feet and then wondering why you’ve fallen flat on your face.

The question is, why did Nike pivot so aggressively toward digital commerce while making what seemed to be knowingly foolhardy strategic choices?

The final decision that helped wipe out $27.5 Billion can be summed up in one word: incentives.

Incentives as a driver of decision-making

When Donahue first stepped into the CEO role, his compensation package sent a clear message: “Boost the stock price by 20%, and you’ll be generously rewarded.” It wasn’t just a pay check — it was a beacon guiding Nike’s strategy. This is a classic example of how financial incentives drive critical business decisions, and Donahue’s focus on short-term gains was no accident. His base pay was only $1.5 million but Donahue has managed to earn around $30 million a year in incentives and stock options.

The CEO’s time horizon is the truly critical element. If the reward structure pushes for quick wins, the entire organisation will follow suit. In Nike’s case, the extreme DTC pivot made sense in the short term, but it came at the expense of long-term business health.

After nearly for years of watching a slow-motion car crash, it was clear Donahue’s time as CEO was untenable. As soon as next month, he’s stepping down and retiring from his role on the board of directors. Donahue’s legacy will be taught in business for years to come, as a cautionary tale. Not the legacy he had dreamt of. To avoid a repeat of their past, Nike have dragged Elliot Hill out of retirement, a former executive of 32 years, to become CEO and help get the business back on the rails.

The real lessons for business

Nike’s $27.5 billion own-goal is a stark reminder that even the most well-established brands can lose their way when they stray from the fundamentals of business growth. There are three additional and important take outs:

-

Physical and mental availability are not just buzzwords – they are foundational elements of business health that need constant attention.

-

When short-term incentives take the wheel, long-term business health gets left by the wayside. All significant incentives should align to the longer view.

-

All businesses need a better measurement framework to determine whether their business strategy is on track.

In the end, Nike’s $27.5 billion fall from grace is a cautionary tale that even the most legendary of businesses can make catastrophic mistakes. And if you don’t apply these lessons, you might just end up in the headlines for all the wrong reasons.

Every business has challenges – nothing is certain. Whether the need is to strengthen long-term growth plans, just stay on track or manage inevitable change, external expert advisory offers the perspective that clearly even the greatest of businesses need.