The late show: VOZ trading to land in December, industry braces for competing TV-streaming currencies, more complexity

Six years in the making, total TV currency VOZ is finally set to make its trading debut – on 29 December. OzTam chief Karen Halligan insists the TV currency is 'ready to go', but the new timeline gives agencies time to prepare for a fresh start in 2025. The new era of TV measurement should be a boon for advertisers and agencies, but with a rival currency for Foxtel Media looking inevitable, OMG's Kristiaan Kroon says things are going to get complex. Magna's Lucy Formosa-Morgan urges collaboration between TV industry rivals, because the market is not yet ready for multiple currencies.

What you need to know:

- VOZ is set to become OzTam's official trading currency two days before the end of the year.

- The timeline aligns the new measurement system to the new calendar year, with TV network's rate negotiations for 2025 to be based on VOZ.

- It's not as soon as the August date flagged by OzTam boss Karen Halligan earlier this year, but she insists this is not another delay – the industry has agreed the later launch date should make for an easier transition.

- OMG's Kristiaan Kroon and Magna's Lucy Formosa-Morgan, both members of the OzTam MFA steering committee, are well aware of the work that's gone into bring VOZ trading to life, but said ongoing hurdles and delay have irked industry.

- With Foxtel Media pressing ahead to build its own currency – with ex-OzTam CEO Doug Peiffer on the payroll – Kroon says the measurement landscape is growing increasingly complex.

- Formosa-Morgan urged TV and currency rivals to set aside differences and bring the two conversations together – or the industry suffers.

I recognise those delays have been long ... but we’re here ... We've got a globally leading product, we've got support from everybody to do it, and we've got the right ecosystem around it for it to be a success.

VOZ trading has finally landed – well, nearly. Six years after OzTam announced its new total TV metric, everything is in place for legacy audience data to be officially switched off in six months’ time.

Sunday 29 December is go live with TV networks' annual rate negotiations for 2025 to be based on VOZ Total TV data for the first time when they kick off in Q4 of this year. OzTam boss Karen Halligan says the industry is well placed for a smooth transition, thanks years of consultation with key stakeholders.

The TV networks, Regional TAM, the Media Federation of Australia (MFA), Independent Media Agencies of Australia (IMAA), the Australian Association of National Advertisers (AANA), Nielsen and third-party software suppliers like MediaOcean have all been party to the process, and per Halligan, pretty much everyone is supportive of the timeline.

While it’s not the August launch she’d flagged at Future of TV (citing integration with MediaOcean as a hold-up), Halligan shuts down any suggestion that there’s been another delay.

“That is the day that everybody collectively agreed on, the optimal day that they wanted,” she asserts. “All of the systems are pretty much ready to go now, but working with the partner agencies, they all suggested that [the end of December] was a really clean opportunity to do it.”

“We collectively decided what the most appropriate window was that allowed everyone to do great change management, ensure that they had communication through their agency and also aligned with the negotiation structure.”

MediaOcean is now ahead of its timelines, per Halligan - along with other third party software suppliers it's landed VOZ Gold Standard accreditations. And while others close to the process reckon VOZ trading couldn’t quite go live tomorrow, they say it’s just about there.

“I recognise those delays have been long, and they did sort of happen before my time here, but we’re here,” says Halligan. “We've got a globally leading product, we've got support from everybody to do it, and we've got the right ecosystem around it for it to be a success.”

The VOZ currency will bring together linear and BVOD audience data to create a national picture of Total TV viewing

No easy task

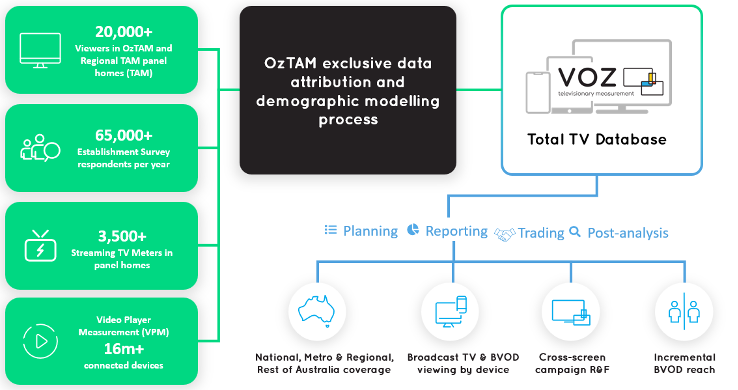

Produced and delivered by Nielsen, the new currency measures all free-to-air and subscription TV networks, bringing together linear TV and BVOD audience data for a national picture of Total TV viewership, and will enable advertisers able to plan, trade and analyse campaigns by either individual metropolitan and regional markets, or at the national level.

It's been hard yards to get there, but buyers are optimistic that the new currency will deliver on its promises.

“We should acknowledge there’s been a lot of frustration at the time it’s taken to get to this point, but I still think it remains a positive for the industry,” says Omnicom Media Group’s chief investment officer, Kristiaan Kroon.

“The investment from publishers has been really big over multiple years. I think over the last year, the investment from holding groups through the MFA has also been significant from our specialist operational teams – the hours it has taken to make the VOZ a currency-ready data set has been huge.”

Not only will VOZ start to de-duplicate reach and frequency (in turn driving efficiency), but Kroon says its use cases for BVOD trading, and even clean room solutions down the track, present another opportunity for innovation.

At IPG Mediabrands' Magna, managing director Lucy Formosa-Morgan says the industry is “absolutely ready for change”.

“It’s certainly been a long time coming but let’s be honest OzTam have had to go through an extremely rigorous process to get this far,” she tells Mi3. “To change the currency, the industry demanded the tool be independent, reliable and transparent and to do that, OzTam had to work collaboratively with the MFA and industry to ensure they roll out a currency that’s gold standard certified.”

Long time coming

OzTam first told the market of its new Virtual Australia (VOZ) metric in July 2018. Conceived and developed alongside Nielsen, the combined linear and online TV database – as it was then positioned – would bring together OzTam TV rating and Video Player Measurement (VPM) connected device viewing data. It was slated to rollout in the first quarter of 2019, but the rollout overshot by a year and then came the pandemic.

The wobbly timeline made for confusion and frustration amongst buyers by the time early test data was scheduled to start rolling out to agencies in July of that year. But by May 2021, OzTam’s subscribing clients were still waiting. VOZ got off the ground several months later, but further confusion ensued in the following years as new innovations rolled on and off the agenda of Australia’s TV networks and plans for a programmatic BVOD marketplace using the OzTam identifier were re-scoped.

Five years in, VOZ launched its daily overnight viewing data in May 2023, marking the start of the long-awaited transition to the new TV currency – while the data couldn’t yet be traded on, the intent was for the industry to get used to the new data before it was officially switched on in 2024.

OzTam will just meet its 2024 deadline, provided there are no further delays.

Playing catchup

In the absence of a total TV currency, others moved to fill the void.

The Video Futures Collective broke ranks earlier this year after Foxtel Media recruited YouTube, Samsung Ads, Disney ESPN and SBS to join a rival alliance. Foxtel is meanwhile contemplating how to bring econometrics into a new measurement model – and ultimately an alternative currency – that could later be lifted by Video Futures Collective.

But fracturing currencies is not just a matter for the TV industry. Kroon points out that measurement is growing more complex in every channel.

“We’re seeking currency around audio, Ipsos is the endorsed digital currency instead of Nielsen – all of that is happening in quite a compressed amount of time. So where trading currencies were a background conversation, we think over the next 18-months plus, it is going to become very much a forefront. Because, the simple things you do [from] how you price things year on year, through to how [you] decide whether a channel or a medium is effective – all of them at their source points are evolving, and that requires multidisciplinary skill sets," per Kroon.

“An area that was very static ... becomes more dynamic, and from the advertisers’ perspective – and for agencies – that’s an awful lot to take on.”

In other words, prepare for even more complexity.

Bigger data required

Magna's Formosa-Morgan says that OzTam will needs to ensure that the VOZ trading is just “phase one” and beefing up the currency with big data needs to be phase two in short order.

“The Australian industry needs to not just sit back and pat ourselves on the back for this launch but continue driving this project forward at pace to be able to genuinely offer advertisers a Total TV perspective,” she says.

According to OzTam, that is already on the agenda, and exploratory discussion with potential big data partners are underway.

What’s next

With the countdown for the new currency officially on, training and education efforts are underway to ensure that planners and buyers are prepared for the switch come the end of December.

“We’ll be updating the [MFA’s] TV training fundamentals, we’ll be doing a VOZ bespoke asset talking about what VOZ is, and then we’ve basically got a long list of assets that will tackle specific subjects like, how do you handle transition to VOZ with market mix models? How do you handle resetting benchmarks with your clients? Those assets will be made available to all our stakeholder cohorts,” per Halligan.

She's watching from a distance as Foxtel and the Future Video Collective plot their next move, and while it’s looking likely we’ll see multiple currencies in this market, she says it'll be down to agencies to decide how they interact.

“Foxtel are still a client of ours right now, they’re still in VOZ right now, we have continued conversations with them as to the nature and construct of our relationship into the future, so I can’t really comment on where they’re at with their currency journey – I don’t actually know.”

Halligan is across their plans to bring ROI into measurement – which she says is something FreeTV has been working away at for some time.

“It will be something that we look to into the future. I think it's really important for advertisers to be able to understand the contribution of the channels in which they advertise, and it's in our interests to ensure that people understand the important role that television actually plays and BVOD actually plays.”

Magna's Formosa-Morgan says the greatest progress will come from collaboration, and to that she urges Foxtel or any other of the connected TV players to work with OzTam to bring their two efforts together “rather than continuing down separate paths". (Foxtel's Peiffer has also underlined that Foxtel needs a panel solution as well as big data.)

"I know there have been conversations but not with actionable outcomes as yet," says Formosa-Morgan. "That needs to change."

While some point to the fact that multiple currencies exist in markets like the US, she argues that Australia is not yet ready.

"Those [US] currency providers had to go through a very rigorous process set out by the US Joint Industry Committee (JIC) to evaluate and validate vendors' measurement data and ultimately endorse which currencies get approved," says Formosa-Morgan. “The JIC is made up of buyers and sellers and has been a collaborative process to build a sustainable, fully endorsed and aligned measurement ecosystem for the future.

"That is what we need in Australia – guardrails, process and aligned endorsement."

Either way, as OzTam can attest, building new currencies takes time – and VOZ may yet find itself with at least some open water ahead.