'Five years since we advertised price’: Top Kia execs hold on brand spend only, no discounting as sales surge; $100k EV6 rocket a “halo” to smoke prestige Euro rivals; EV 'tipping point' 2032

L-R: Roland Rivero, GM Product Planning; Damien Meredith, COO; Dean Norbiato, GM Marketing; "Our key brand metrics are up 125 per cent over the last three years," says Norbiato.

“It’s been five years since we advertised price – you’ve got to hold your nerve,” says Damien Meredith, Kia’s Chief Operating Officer and number two Australian exec to CEO Joonsu Cho. Meredith cut his teeth in sales but is unwavering on brand investment for long-term growth – not price discounting or short-term "sales events". Marketing head Dean Norbiato says Kia's executive leadership are “100 per cent aligned”, even around the “ESOV” [excess share of voice] marketing rule that dictates growth will follow a brand that spends beyond its marketshare. The upshot is electric vehicles will “democratise” prestige auto brands and Kia sees the new EV6 GT (0-100kmh in what Norbiato describes as a "teeth-whitening" 3.5 seconds) as the next lever to continue its Australian romp – it outmuscled Mitsubishi and Hyundai last year to become the third biggest car seller in the country.

What you need to know:

- Kia has invested in brand marketing only for the past five years to take on premium Euro brands and break from “cheap and cheerful”, now owned by Chinese auto brands.

- Product first – smarter design, tech and performance allows brand-only investment.

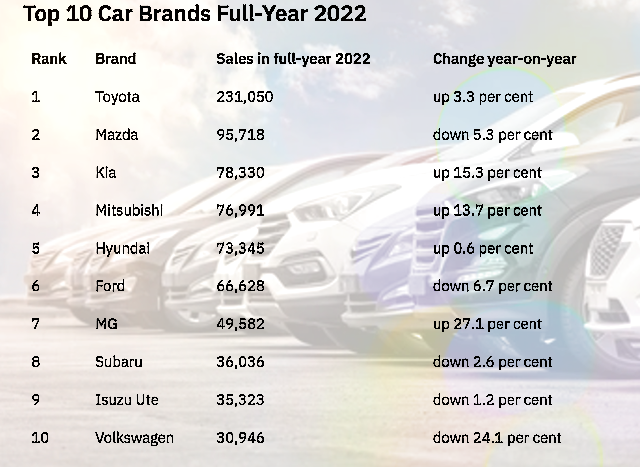

- Kia jumped two spots to become Australia’s third biggest car seller in 2022.

- The internationally acclaimed $100k EV6 GT leads the brand charge in Australia for 2023 but it’s designed as a ‘halo’ strategy – bend consumer perceptions for Kia and sell the entire range.

- Kia’s Australian romp has the local unit pushing global for a ute to take on top selling Hilux and Ranger.

- EVs are levelling the brand battle against prestige Euro marques but consumer demand drivers are less about saving the planet as many believe – performance, tech and cool are on the rise.

- Kia’s entire management team backed an ESOV [excess share of voice] strategy three years ago – marketing and advertising budgets are higher than Kia’s marketshare.

- Kia coinfident the Australian market will defy a gloomier international economic outlook.

I'm a sales guy, but I've learned over a long period of time that if you really want to make a difference to the positioning of your brand, that's where your focus has to be.

The sales guy backs brand

Sales surged for Kia last year by 15.3 per cent to 78,000-plus cars, outpaced only by the “cheap and cheerful” Chinese brand MG, a positioning Kia has been working feverishly to shake-off for at least the past five years as, much like TV sets, the Chinese takeover from the Koreans for entry level product.

Kia’s top execs here say their romp last year from fifth to third top selling carmaker in Australia has been a long-term strategy focusing on brand that is now paying off handsomely.

“I'm a sales guy, but I've learned over a long period of time that if you really want to make a difference to the positioning of your brand, that's where your focus has to be,” says COO Damien Meredith, who joined in 2014 and has been leading the brand focus since. “You can't dilly dally with price and and sale events. The senior management team are all committed to the road that we're taking and we've been able to do good things.”

But a warning to brand and communications aficionados – brand starts with the product and Meredith says “we were getting great product through to help us along the way to maintain our strategy in regards to brand.”

Indeed Kia’s long road to success here has been a combination of a beefed-up range focused on technology and design, a seven year warranty, the clever use of “lighthouse” performance models like the Stinger and now the internationally acclaimed EV6 GT that challenge public perceptions of what Kia is, and in Australia at least, an entire management team from CEO to sales obsessed on investing in brand building over price-driven volume.

At times you can be tempted by the sugar rush you get off a sale event. But what does that do for the brand? What does that say to customers for what Kia actually stands for?

No discounting sugar hits

“Being the marketing GM and having a former sales manager turned COO who's more adamant on brand than the marketer is a really interesting, almost paradigm shift between the two,” says Kia marketing boss Dean Norbiato, who joined Kia from agency land four years ago.

“But it does means that I stick the course as well. At times you can be tempted by the sugar rush you get off a sale event, for instance. But what does that do for the brand? What does that say to customers for what Kia actually stands for? So it's not an easy path to take at times but we know as a business collectively it’s the right path to take for sustained long-term brand growth and where we have our vision of the brand going in the Australian market.”

Says the straight talking Meredith: “I suppose the best way to sum it up is from a communication point of view is it's been five years since we've advertised price. It's been three or four years since we've had a sale event. So the focus has been on the brand, on the product, what it brings to market.”

Meredith acknowledges Covid’s impact on the supply chain has meant less pressure to discount by all manufacturers but that’s now starting to creep back into market among some rivals. Kia is having none of it.

The ambition, says Meredith, is to have Kia competing in the top 25 per cent “of that pyramid of desire” – read European prestige brands particularly.

EVs democratise auto brands

Kia starts its brand efforts every year with its 20-year sponsorship of the Australian Open and this year its internationally acclaimed, teeth whitening $100,000 electric model, the EV6 GT, serves as the brand building trojan horse for Kia.

Meredith thinks electric vehicles are a democratising force in the auto sector. “The reality is EVs are a bit of a leveller and what I think is going to happen is that will democratise the brands of interest.”

Norbiato says Kia’s EV6 is already proving that after about 700 cars arrived last year here – 80 per cent of buyers were new to Kia “with the majority coming from prestige brands like BMW and Mercedes”.

The cheap and cheerful brand positioning has now been taken over by the Chinese brands and we couldn't stay there. It just wasn't feasible and commercially viable to stay in that price-driven segment.

EV tipping point 2032

Still, despite the EV hype Meredith predicts the tipping point for Australian roads having more EVs than petrols and diesels is still nearly a decade away.

“I'm a little bit different,” he says. “I think 2032 will see the tipping point where there will be more EVs in market than internal combustion engines. So I still think it's a little bit off, but it's going to happen. We need everyone to wake up to the fact that we need some consistency in legislation in Australia. I believe that the EV rebates that are being given should never be given. That should have been put into infrastructure [charging stations and housing development planning for instance]. That hasn't occurred. Rebates have occurred.

"The issue of rebates is that when rebates stop the sales stop. I hope that doesn't happen with EVs. There’s probably a bit of price pressure and models coming in with probably smaller range batteries so the pricing will be more favourable to the lower end price points," he says.

Either way, "there’s a lot happening. It's pretty exciting.”

Hello halo

The perception-bending EV6 GT is now being unleashed on the masses this year – Kia launched its flagship brand ad campaign last week at the Australian Open around the EV6 – about 2,000 of them will arrive here in 2023 – but it’s designed to do the heavy-lifting for other models in the range.

“Obviously it would be fantastic if we would sell a lot more EV6s but the purpose of it is a Halo model that will sell the range,” says Norbiato. “We’re tracking more across the entire Kia fleet versus just one model to determine success. That's how we will benchmark the EV6 because it really is that lighthouse model for the Kia brand.

"Later in the year, we're looking at the EV9, which is a large seven seat SUV that will fit alongside the EV6 from a halo standpoint. So we've got some really exciting models coming that are going to play that lighthouse role for the Kia brand. And that's what we deem a success: Not just selling one model but selling the range and selling the Kia story. We feel this car definitely epitomises where we’re headed," he adds.

Building HQ creds, market shifts

In terms of brand metrics, the overall approach is paying off in spades, per Norbiato. We're up 125 per cent over the last three years in terms of positive perception, consideration and future consideration.”

The performance of Kia’s Australian arm has given it global clout with HQ in Korea to the point where it’s the locals here who are pushing for a Kia ute to take on the top selling Toyota Hilux.

“The appetite for SUVs and light commercials is huge in our market,” says Kia’s GM for product planning, Roland Rivero. “Ranger and Hilux dominate for a reason. They're a perfect fit for Australia and for us. We've got our hand up asking Korea to develop one for Kia so that we can satisfy a huge part of the market. It's not only a workhorse but it's also a family car on weekends. Imagine if you brought one of those in both say a diesel and an electric. Kia could definitely see some serious market share growth. Demand for passenger cars, in contrast, is coming down and a lot of brands are actually exiting passenger cars and investing in just SUVs or light commercial vehicles.”

Premium's next phase

For Rivero, like his colleagues, electric vehicles present a new opportunity to entrench Kia’s climb up the premium brand ladder.

“Because we've already gone through a journey with the likes of the Stinger and Proceed GT, we felt that the brand was already moving in that kind of direction – being seen as a bit more upmarket as opposed to cheap and cheerful. I think the cheap and cheerful brand positioning has now been taken over by the Chinese brands and we couldn't stay there," says Rivero. "It just wasn't feasible and commercially viable to stay in that price-driven segment. We had to push up market because Covid didn't help. Obviously with semiconductor shortages, we were struggling to get supply and if you're struggling to get supply, you might as well get supply for your more profitable big SUVs.”

Rivero says Kia’s “electric platform” can house numerous models with a plan in place globally for 14 EVs to be developed. “We're putting our hand up for as many of them as we can get to span multiple segments, multiple price points over the next few years.”

EV drivers – green v cool

But there’s interesting dynamics afoot in EVs for premium and budget positioning – and consumer demand, which is not as environmentally-leaning as many believe.

Rivero says Chinese EVs are pouring in with lower specification models while other brands, like Kia and the Europeans, are using it to hold or position further up the food chain.

“Some brands have decided EV is a brand statement,” he says. “For us it’s to showcase our tech, it's to showcase how advanced we are as a brand and it's fundamentally something that's going to be a halo product for us that people will aspire to own and have this cascading or halo effect on the rest of our range. Someone may aspire to get an EV6 but because of family circumstances or what have you, their budget doesn't stretch that far. But they know that if Kia can make an EV6 that good, then the rest of their range must be pretty decent too.”

Rivero credits Tesla for making EVs cool.

“A lot of people that buy a Tesla aren't in it to save the planet,” he says. “It's just cool. It's something that you're proud of and you want to show off to your friends. The fact that it's zero emissions, no pollutants is a bonus. But that's not the driving force behind their decision. The same thing will apply for the EV6. And then most of the people that are looking at an EV, they're not here to save the planet. It’s more about driving a product that excites them, that makes a statement about themselves – driving a product that gives them driving enjoyment.”

Indeed, Norbiato says Kia’s ongoing research into demand drivers for EVs is signalling exactly that.

“In terms of the reasons for purchase, a lot of people are leaning into it based on the performance and the tech credentials of the car,” he says. “Whilst the sustainability element is important, when it comes down to actually purchasing, whether that plays as instrumental, we’re interrogating that at the moment. I don't have the answer right now, but we are looking into it. But it is interesting around the role performance, tech and sustainability plays – whether they're saying sustainability, but actually purchasing it because it's what it says about them.”

ESOV works

Finally, for the marketing and advertising technicians, Kia’s management team are ESOV practitioners – that is, investing in marketing and communications beyond what a brand’s marketshare typically dictates.

“Excess share of voice was another challenge that we had,” says Norbiato. “We were below our market share with regards to our share of voice. We addressed that two or three years ago working in conjunction with our head of sales and our COO. Damien was very adamant about that. If you look at our percentage in 2022, we were spending above for I think every month with regards to our share of voice versus share of market," he adds.

"So now we're starting to have a voice in market. We need to now build on having that share of voice. We need to be quite salient and actually cut through and stand for what we want to stand for through consistency. And I do believe that breaking convention is a fantastic way of doing that and focusing on creative is a way that gets you noticed. We've got a little hint of nostalgia in our latest EV6 GT ad that I'm excited about.”

So expectations for this year? Meredith says Kia will sell 5,000 vehicles more than last year.

“We're really confident that will continue,” he says. “There's a lot of uncertainty globally. Historically Australia tends to bat that back. We tend to make our own luck in in that regard, so we're confident that the market will hold up. It won’t be as drastic in Australia as maybe in other parts of the world.”