CDP investigation Part 1: ANZ market closes in on 500 sites; Jetstar, News Corp, SCA, Chemist Warehouse, Karbon and CIAA unpack business impact; Segment dominates with over 330 customers, Tealium strong in enterprise, Lexer in retail, Adobe on the rise

Simon Hilton, Lizzy Foo Kune, Cam Strachan, Ben Hoefel, Pippa Leary, Kent Len and Keelan Howard.

The CDP market in Australia is running red hot, with circa 500 companies now using customer data platforms or currently implementing. Segment dominates in volume terms with more than 330 customers, up from 50 just three years ago. But Tealium is capturing a big chunk of the loot thanks to its enterprise dominance. Together with Lexer (70-80 clients covering almost 110 brands) and Adobe, these four vendors have over 90 per cent of the installed base that Mi3 has identified. But it's the brand stories that really explain the appeal. The experience of Jetstar, Chemist Warehouse, News Corp, Moët & Chandon, SCA and a bunch of others suggest major marketing efficiency gains, strong customer growth, more effective advertising and the ability to save a packet by avoiding wastage. Plus better using all that first party data in an ad ecosystem in the middle of major structural upheaval.

What you need to know

- Customer data platforms, or CDPs, in simple terms put customer data in one place, enabling deeper analysis, segmentation, profiling, consent management and a bunch of other stuff, depending on spec. Ultimately, brands can use them to power internal customer experience and outbound marketing, harnessing first party data as cookies and their purveyors die out.

- Hence the rush to integrate them, and why the Australian market is running hot.

- Segment, Tealium, Lexer and Adobe dominate the local CDP scene. Segment in particular stands out with over 330 paying customers. But Tealium is taking a hefty chunk of revenue from the market with between 70 and 80 customers skewing heavily in the enterprise market. Lexer and Adobe make up the big four. Lexer also has over 70 customers in Australia representing about 110 brands - principally in retail.

- Retailers are the biggest users. Finance, traditionally a tech early adopter in ANZ, is more reticent. Higher education is increasingly engaged.

- Brands are seeing good returns. Jetstar uses intent data to upsell customers to higher priced tickets,

- Chemist Warehouse uses its CDP to underpin its retail media strategy.

- SCA's Listnr cost per acquisition is down by more than 10 per cent.

- Meanwhile the Caravan Industry Association massively overachieved on a competition to drive off peak bookings: It expected 10,000 unique bookings, but ended up with over 800,000.

- And News Corp is finding new success and revenue further down the funnel by helping clients like Moët & Chandon better segment campaigns. The champagne brand achieved a 38 per cent increase in unaided brand awareness, a 32 per cent increase in footfall to their key suppliers, and a 10 per cent increase in purchase intent.

- But beware of the risks and the costs. Those hundreds of connectors the vendors highlight are often basic in nature and can require extra development. And simple things like identifying who has the credentials in your own organisation to enable access to the data you want can delay or even derail a project.

- So get IT involved early – and onside – or risk fighting over access to key resources during critical project moments.

- In this series, Mi3 investigates the business imperatives, the business case justifications and the business impact of CDPs. Plus the pitfalls.

- Read Part Two: Identity, media efficiency and effectiveness, personalisation and privacy driving uptake – prepping for AI could fuel a second wave

- Read Part Three: Integration challenges far more difficult than vendors let on; ANZ, Carsales on where to start, hot tips; experts on industrial sized cans of worms.

- Read Part Four: Chemist Warehouse, SCA, Nova, News, Carsales on how CDPs have changed operations, structures, capability – but why consent management may be next martech wave.

Meta will tell us one thing, Google will tell us something else, and Criteo Offsite will tell us something. But what we want is an aggregated, holistic view on what people were doing.

Gaining altitude

Sometimes it's right in front of you. Project insiders on Jetstar’s CDP implementation, which started in the middle of the last decade, say impressive results came very early. According to one executive familiar with the project, the platform from Boxever – now owned by Sitecore – was brilliant at using intent data to determine the propensity of customers to upgrade seats.

In the cutthroat low-cost airline business that kind of data-driven yield management is a fast path to better profitability. Little wonder Tiger Airlines soon followed suit. Air New Zealand’s investment in Sitecore's CDP suggests it’s not just low-cost airlines that spy pay dirt.

On a webcast last year, Jetstar’s Ben Hoefel, who at the time was senior manager, Digital Sales and Service, seemed to confirm what Mi3 was told about the implementation.

“I think back to when we started. We knew we were capturing a lot of data about our customers, but we weren't using it in a way to make the experience more tailored and more personalised.”

The airline wanted to combine its behavioural intent-based data sets captured from its website and marketing orchestration tools and then match those with historical transactions from the reservation system.

Hoefel, who has since moved to ANZ Bank as Head of Personalisation Acquisition & Onboarding Value Stream, told the audience “Using a CDP was seen as the key way in which we could join those two data sets so that we could leverage the actions and the intent the customer was showing as they were browsing and searching for their next trip."

That then enabled Jetstar to better understand customer preferences and make just-in-time recommendations.

Expect turbulence

Jetstar’s experience is demonstrative of the upside of customer data platforms, one of the hottest segments in martech. Other brands Mi3 interviewed identified a long list of measurable benefits including increased sales or subscriptions, better advertising returns and the ability to avoid wastage in paid media.

But they also stressed that like any major tech implementation, CDP investments are not without risk and potentially significant costs. Some brands now out the other side of major deployments said project budgets can run anywhere from two to 10 times licence costs. Integration and implementation are the big risks. Vendors like to fall back on the large list of connectors they offer out of the box, but they rarely identify the basic nature of many of those connectors, and the fact that additional work could be required. Then there's the cost and management overhead of maintaining and updating any development work around the connectors.

Implementers meanwhile said marketers often fail to involve IT early enough in the project meaning tech resources may not be available when needed. Something as simple as data ownership and determining who has the credentials to allow access to a dataset within an organisation can delay or even derail projects.

Mi3 was told of one bank implementation that took almost four years to deliver on specification. As ever, the issue of data silos reared its head repeatedly across the market.

Where next?

Mi3 has interviewed brands, vendors, agencies, implementers and industry analysts to determine the current state of the CDP market in Australia. The resulting editorial series focuses on three key areas:

- Business imperatives: What is driving interest and uptake and what are the most common use cases?

- Business case justifications: Unlike many tech investments, CDPs are hard to justify based on cost-out alone. That means greater scrutiny and scepticism from CFOs. So what are the winning arguments, and what are the metrics marketers and data leaders are using to get sign-off? Just as importantly, what are pitfalls to look out for – and what are the things the vendors often forget to mention in the glossy sales pitch?

- Business impact: We interviewed a dozen marketing, technology, and data leaders who shared the business impact, and also the lessons learned during implementation.

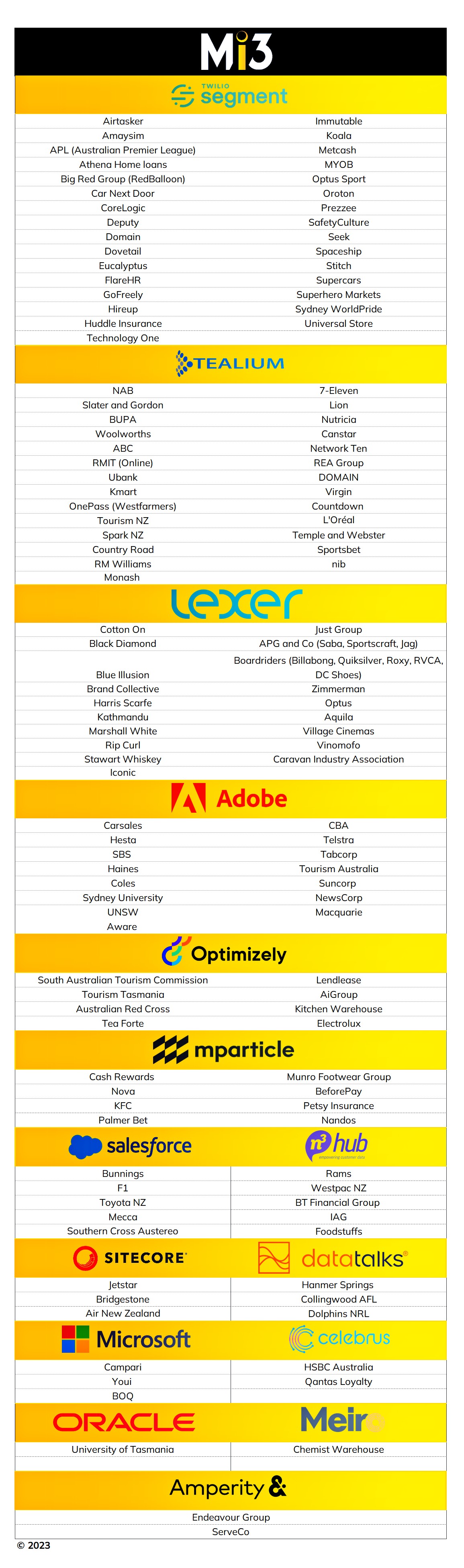

CDP leaderboard

With over 330 customers Twilio-owned Segment dominates the local market by volume. Together with Tealium, Lexer, and Adobe these firms represent more than 90 per cent of the installed CDPs Mi3 was able to uncover in ANZ. These vendors also account for 92 of the 126 CDPs we identified by name.

There are at least 20 active CDP vendors in Australia. In total we found 15 vendors with CDP implementations in ANZ: Adobe, Amperity, Celebrus, DataTalks, Lexer, Meiro, Microsoft, mParticle, n3 Hub, Oracle, Salesforce, Segment, Sitecore, Optimizely, and Wondaris.

Acquia, Insider., Lemnisk, Blueconic, and SAP, all have CDP products, but we were unable to confirm any local clients. Mi3 believes SAP has no local customers – the company declined to comment when contacted, and company insiders indicate there is no local CDP activity. Acquia and Blueconic are believed a have a small number of local customers but we have not been able to independently verify this. Likewise, we have not yet been able to identify any Insider CDP customers. AIA uses Lemnisk in its Philippines operation but we were unable to establish if it is used locally.

Hubspot offers "CDP like" capabilities but toss a coin as to whether you want to include them in the list.

Beyond that there is a gathering push, particularly in the mid-tier towards 'composable' CDPs – in practical terms this involves building CDP-like functionality using existing martech and data capabilities, delivering some but not all of the functionality of off-the-shelf packages.

Agencies we spoke with said they often nudge their clients down the composable route when CDP use cases identified by clients lack the sophistication or complexity to justify another major piece of martech.

While not a complete list of all the CDP implementations – most suppliers were reticent to share details of customer sites, citing client confidentiality, the list Mi3 has managed to independently verify throws up some interesting insights.

Segment dominates, with close to 70 per cent of the installed CDP base in Australia that we can identify. Its customers include brands like Oroton, MYOB, Metcash, Deputy and Airtasker.

But that does not necessarily translate into revenue leadership. That's because Tealium dominates the enterprise space, counting brands such as NAB, BUPA, Woolworths, Virgin, Domain, REA Group, Sportsbet and Network 10 on its roster. Mi3 understands that the company has between 70 and 80 ANZ customers.

Adobe counts Westpac, Carsales, Hesta, Aware Super, Tabcorp and News Corp in its camp, while specialist retail CDP Lexer has the likes of Cotton On, Rip Curl, Iconic, Kathmandu and Just Group on the books.

Retail companies are the biggest users of CDP in ANZ, according to our analysis which tallies with vendor feedback. Finance, typically an early adopter in other markets, is thinly represented, while Australia's Universities, which face a particular post-Covid marketing challenge, are now piling in. Media companies, particularly those with an eye on commerce media, are likewise engaged.

A CDP is an important investment — averaging a few hundred thousand US dollars annually — for marketers aiming to achieve data-driven marketing and make the best of their first-party data. You’re unlikely to get a positive return on your CDP investment, however, unless you prepare for and implement it well.

Analyst arithmetic

Getting a read on the size of the local CDP market is difficult – frankly getting agreement on what constitutes a CDP is hard enough. International market data outlines the size of the prize, though it varies widely.

At the high end, Data Bridge Market Research suggests that the industry will grow from US$4.7bn last year to $47bn by the end of the decade – an average CAGR of 33 per cent. That estimate is at odds with London-based Juniper Research, whose number are more commonly cited. It put the size of the global CDP market last year at US$1.7 billion with retail and ecommerce accounting for just over a third of the revenue. Juniper initially suggested the market would grow to US$6bn by the end of 2027 but has now wound that back to $5.2bn by 2028.

Juniper also flags Oracle, Adobe, and Salesforce as having the leading CDPs – based on what it describes as product offerings, partnerships, and innovation. But that view does not reflect the practical reality on the ground in Australia.

Within APAC, the Australian CDP market sits squarely in the centre of the market growth engine, while the Greater China market is running hot according to Forrester Research, and based on self-reporting by 26 vendors.

According to Singapore-based Xiaofeng Wang, Principal Analyst, Forrester: “A CDP is an important investment – averaging a few hundred thousand US dollars annually – for marketers aiming to achieve data-driven marketing and make the best of their first-party data. You’re unlikely to get a positive return on your CDP investment, however, unless you prepare for and implement it well. Marketers in APAC who are interested in investing in CDPs should do their homework before investing in a CDP.”

While numbers aren’t publicly available, Wang identifies the most common use cases in the region in a Forrester blog:

- A single view of the customer

- Data orchestration for campaigns

- Segmentation

- Reporting and Dashboards

- Data management

That aligns with what's driving uptake in Australia, per vendors, and Gartner suggests similar market drivers.

Lizzy Foo Kune, VP Analyst in the Gartner Marketing practice told Mi3: “We’ve documented about 30 common use cases, based on our inquiries with clients, discussions with CDP providers, and various primary research studies that we’ve run. Marketers are typically formulating use cases to support capabilities for customer data collection, marketing activation, segmentation, customer profile unification, and prediction and decision.”

We typically advise clients to document their use cases and audit their martech stacks. Then, look at how well your existing martech accomplishes those use cases. Where are the gaps? Can those gaps be filled by taking advantage of new features or functionality of your existing martech? Are those gaps due to low utilisation?

Platform proliferation

Gartner has also tracked an increase in the number of discrete CDPs installed per customer (its clients tends to skew toward high-end enterprise).

According to Foo Kune, “Organisations deployed 2.9 CDP vendors on average in 2022, up from 2.3 in 2020. There are some instances where multiple CDPs can be justified… an organisation may use a data integration CDP for data management and operations alongside a smart hub for orchestration. “

But she also cautions that – as ever – growth in suppliers within an enterprise is leading to feature overlap and overspending. “That’s why it’s essential for organisations to really have a good think about their CDP investment.”

“We typically advise clients to document their use cases and audit their martech stacks. Then, look at how well your existing martech accomplishes those use cases. Where are the gaps? Can those gaps be filled by taking advantage of new features or functionality of your existing martech? Are those gaps due to low utilisation?”

And in comments that may reflect why Juniper downgraded its forecast of growth, Gartner’s Foo Kune says, “Our data shows us that CDP utilisation dropped significantly from 2020 to 2022, shifting from one-third of survey respondents “highly utilising” their platforms in 2020 to only one-fourth doing so in 2022.”

“If, after looking at addressing gaps with new features or by increasing utilisation, you still can’t accomplish your use cases, then we can discuss whether a CDP – or a related technology – is a good solution.”

There’s this faction of CDPs that are nothing more than data management platforms. Remember the old adtech DMPs, they just woke up one morning and realised, ‘We don't have anything because no one wants to manage their cookies anymore. We're dying.'

Ancient grudge, new mutiny

CDPs are not new technology. They emerged out of the parallel world of DMPs – those giant third-party cookie databases that helped marketers track customers around the web, but which fell afoul of regulators, and more recently Apple, which effectively throttled their use through its privacy policies.

Brands read the runes and flipped to first-party data.

Meanwhile, the DMP vendors and tag management companies scrambled to reposition – with mixed results according to Liz Miller, Principal Analyst, Constellation Research.

“There are some truly terrific CDPs out there and they fall into a couple different categories. There's the enterprise-wide customer data platform – and you might hear terms like data fabric, data mesh. They are trying to call it something different because they don't want to call it a CDP anymore,” per Miller.

“Then there's this faction of CDPs that are nothing more than data management platforms. The old adtech DMPs woke up one morning and realised, ‘We don't have anything because no one wants to manage their cookies anymore. We're dying. We're going to strip away the language that identity stitching is cool, we're going to stop talking about that nonsense, and we're going to call ourselves a CDP.”

Miller is also sceptical of tag management companies that have reinvented themselves. She declined to call out any by name, but said they made up a "large portion of the market" at least in volume terms.

“Those organisations are taking event-based data, attaching a tag to that event-based data and then running it through the algorithms. And that’s fine, you can still use them in ad markets. But if you're looking for a CDP — you [really] are looking for a platform that can ingest persistent data collections, standardise and normalise. It's about the harmonisation and normalisation of data," says Miller.

“It's about normalising that data so it can be called to an interface that then needs to create a segment intelligence understanding about a customer, a customer segment, or an individual market. It is that space where you should be able to query pretty much anything you need to know about your customer from a massively large pool of both structured and unstructured data.”

Miller’s view about the attraction of the CDP moniker was shared by at least one vendor interviewed. Bill Bruno, CEO of Chicago-based Celebrus, has Australian clients including Qantas Loyalty and HSBC Australia. He said the firm is stepping back from the CDP association for several reasons.

“We've gone by a CDP moniker in the past, we've removed it from a lot of our messaging now because from what we're seeing in the market, it's just become a very confusing title," he told Mi3. "We are really starting to simplify things and just get down to the brass tacks of what we do for customers."

In the case of Celebrus, which specialises in highly regulated markets such as banking, finance and insurance, along with US healthcare, that means focusing on three areas. Firstly, the quality of digital data which he says is often inaccurate, incomplete, or hard to manage. Next comes digital identity, alongside compliance and regulatory issues.

Other vendors locally are still more than happy to be associated with CDPs, given red hot customer interest – and it needs to be said, a growing body of evidence of solid and positive return on investment across of range of business cases.

By helping Moët & Chandon parse a campaign into three specific segments, they were able to achieve a 38 per cent increase in unaided brand awareness, a 32 per cent increase in footfall to their key suppliers, and a 10 per cent increase in purchase intent.

Brand stories

Repeatedly, brands interviewed by Mi3 were able to identify measurable returns from their investments. Some were happy to share the numbers.

Chemist Warehouse uses a CDP from Singapore-based based Meiro to help extend its retail media play. “We monetise a lot of our data through activations against first-party audiences and segments,” per Kent Len, head of performance marketing. He said the main reason for investing in a CDP was to get a holistic view of the customer.

“More to the point how [customers are] interacting with all the different channels that we're buying media through. So obviously Meta will tell us one thing, Google will tell us something else, and Criteo Offsite will tell us something," he told Mi3. "But what we want is an aggregated holistic view on what people were doing.”

Southern Cross Austereo is utilising the CDP on Salesforce Data Cloud to deliver a single customer view, smooth segmentation, and drive marketing advertising efficiency according to Cam Strachan, SCA’s head of data and analytics. It's early days but already Strachan is seeing measurable returns, especially for SCA's Listnr business.

“The initial key drivers were getting better segmentation into the audio ad server, getting a better understand of the funnel, and using marketing to drive audience growth,” says Strachan. There has been an early cost payoff with a double-digit decline in cost per acquisition through more effective suppression of paid media spending to the existing database. SCA CMO Nikki Clarkson is fan, reporting "monumental gains" in marketing efficiency.

At News Corp, Pippa Leary, Managing Director, Client Product told Mi3 the publisher’s investment in Adobe’s Real-Time CDP has significantly broadened revenue opportunities.

“We've very much occupied the upper funnel for 60 years. We've done well in the upper funnel. What pulling together these audience insights in the CDP has done is allowed our attribution suite to move really far down the funnel. As we talk about getting audience engagement and client outcomes, we can now prove those outcomes – because that's a big differentiator for us.”

It's also delivering strong client outcomes. For instance by helping Moët & Chandon parse a campaign into three specific segments, the Champagne brand achieved a 38 per cent increase in unaided brand awareness, a 32 per cent increase in footfall to their key suppliers, and a 10 per cent increase in purchase intent, according to Paul Blackburn, News Corp Commercial Director, Data, Video and Product.

The Caravan Industry Association, a Lexer client, says it exceeded a competition target by 700 per cent in a campaign designed to help park operators recover from two years of Covid losses by encouraging off-peak bookings, with the carrot being the chance to win $1 million.

"We had essentially reached saturation of our known audiences, so the next step was identifying more consumer types," says Marketing Director, Keelan Howard. "I felt our assumptions about our audiences were limiting us, but needed the data to prove it.” The association was expecting 10,000 unique entries, but the campaign – which generated 23 million impressions across email, paid, organic, and social –attracted over 850,000 entries (with a lot of multiple entries – but a million bucks is a million bucks). Most importantly, its research indicated that 1 in 3 campers were influenced by the campaign.

The problem is that whether it’s a product like Amplitude or Google Analytics you are writing their code into your product. If we want to change providers later we have to take all that code out of our app, which costs us just as much. And then we have to put someone else's code back into the app, which costs us triple as much.

The use case described by Simon Hilton, Product Director at Karbon – a software-as-a-service (Saas) practice management platform for accountants – was one of the more unusual Mi3 encountered, although Hilton says it's not uncommon in the Saas world.

"For a software company one of the most important things for us is to have good analytics and metrics around how people use the product. And that is quite a technical investment,” he says.

"The problem is that whether it’s a product like Amplitude or Google Analytics you are writing their code into your product. That requires a huge amount of investment on your part, not just from a monetary point of view, but from a time, effort and engineering point of view.”

And that's just for starters.

“If we want to change providers later we have to take all that code out of our app, which costs us just as much. And then we have to put someone else's code back into the app, which costs us triple as much.”

Hilton says there's a huge cost benefit in using a CDP as an orchestration tool.

“It allows us to say, 'hey, we've embedded Amplitude, but now we want to go to Mixpanel' – and we can configure that without the manual investment of an engineer's time. Rather than spending that time on changing code no one cares about, we go spend that time on building features, and things customers actually want.”

Back on the runway, the Jetstar experience and Hoefel’s description of the opportunity its CDP delivered bring together the elements of business imperative and business impact.

“I think our biggest opportunity to improve is how we get the content right," he told the webinar audience. "And I think the two worlds [content and data] coming together will help us in the future. Because it isn't just making sure you're giving the customer the appropriate offer at the right time, it is about how you tend to talk about that to the customer too," per Hoefel.

"I think once we can combine those worlds in a better way, we will see our results continue to grow as well.”

Clarification: We originally reported that Oracle has no clients in Australia. University of Tasmania contacted us to say they have recently implemented Oracle's CDP.. The have also updated the list of CDP providers, and will update the table on an ongoing basis as new information comes in over the next week, as the series rolls out.