‘Elastic shield’: Apple’s moral high-ground torpedoed as US Justice Department calls bullshit on privacy claims, prepares to sue

Apple hobbled much of the digital ad industry in the name of privacy, conveniently kneecapping rivals like Meta in the process. But after Google, the US Justice Department is coming for Apple – and it alleges those claims of privacy are nothing more than “an elastic shield that can stretch or contract to serve Apple’s financial and business interests”. The DoJ pulls no punches, claiming: “Apple wraps itself in a cloak of privacy, security, and consumer preferences to justify its anticompetitive conduct … In fact, many alternative technologies that Apple’s conduct suppresses would enhance user security and privacy,” per the filing. “Apple is also willing to make the iPhone less secure and less private if that helps maintain its monopoly power. Similarly, Apple is willing to sacrifice user privacy and security in other ways so long as doing so benefits Apple.” A conga line of US states have joined the action, spearheaded by the same antitrust chief that convinced a federal court this month that Google is indeed a monopolist. Here’s what Apple’s accused of and must now defend against.

What you need to know:

- With days to go before Google faces its third and final antitrust case after two heavy losses, US government regulators are now turning their gaze to Apple.

- They’ll soon name a court date to sue the iPhone giant alleging it sells consumers’ privacy for profit, hikes prices, suffocates competition and holds back innovation.

- If it sounds similar to the Google case that’s because it is. It’s been brought by the same Department of Justice division under its leader Jonathan Kanter.

- Across 23,869 words, Kanter systematically accuses Apple of anticompetitive behaviour and selling its 1.5 billion active users’ privacy for profit.

Apple allows developers to distribute apps through its App Store that collect vast amounts of personal and sensitive data about users – including children – at the expense of its users’ privacy and security ... Apple also enters agreements to share in the revenue generated from advertising that relies on harvesting users’ personal data.

TL;DR

The DoJ alleges Apple uses a playbook to anticompetitively hike prices and constantly changes policies to protect its dominance.

Kanter accused it of “shapeshifting” rules “to extract higher fees, thwart innovation, offer a less secure or degraded user experience, and throttle competitive alternatives”.

“It has deployed this playbook across many technologies, products, and services, including super apps, text messaging, smartwatches, and digital wallets,” he says.

And he pulls no punches on privacy, alleging: “Apple wraps itself in a cloak of privacy, security, and consumer preferences to justify its anticompetitive conduct.

“In the end, Apple deploys privacy and security justifications as an elastic shield that can stretch or contract to serve Apple’s financial and business interests.”

Ouch.

Kanter to a gallop

The DoJ formally began its prosecution in 2019, but accelerated in recent months, drafting in more lawyers and making a flurry of demands for internal documents.

The action has now been joined by Apple’s home state of California, as well as New York, New Jersey, Arizona, Columbia, Connecticut, Maine, Michigan, Minnesota, New Hampshire, South Dakota, Oklahoma, Oregon, Tennessee, Vermont and Wisconsin.

The States Attorneys General are not happy.

California’s Rob Bonta said: “California’s economy thrives on entrepreneurship, serving as a driving force behind its innovation and growth.

“Consumers, innovation, and the competitive process - not Apple alone - should decide what options consumers should have.”

New Jersey’s Matthew J. Platkin said: “Apple’s dominance in the smartphone market is not an accident. The end result is you pay more for an inferior product - all while Apple collects billions in profits.

“We are standing up for consumers across the country and putting a stop to this monopolistic behaviour”

Washington’s Bob Ferguson added: “Apple harms users by denying them the ability to choose what banking apps to use as their digital wallet and prohibiting the creation of alternative app stores.”

And Minnesota’s Keith Ellison warned: “Smartphones are essential, but they don’t need to be as expensive or restrictive as they currently are.

“Apple’s exclusionary conduct makes it hard or impossible for people to switch to lower-cost iPhone alternatives”

Is Apple a monopoly?

While many doubted Google would be deemed a monopoly, it has been. The Apple case thought has one important difference. Apple doesn’t have Google’s penetration.

Google has a 90 per cent share of global search, and 95 per cent on mobile, so proving its dominance was not hard.

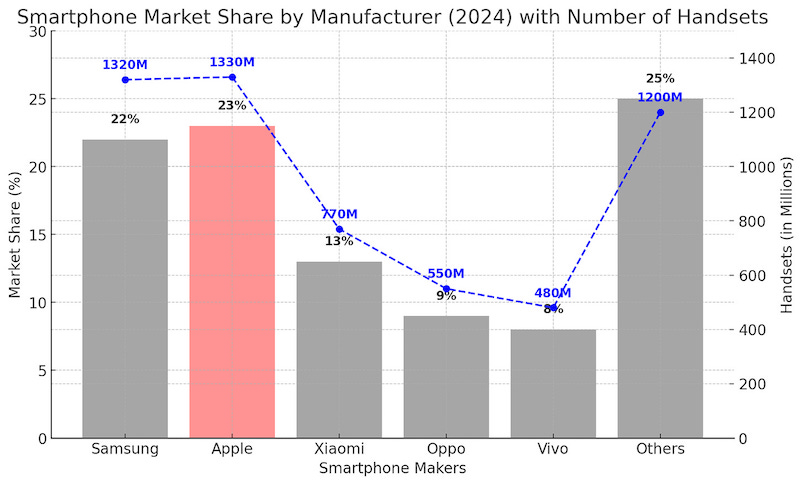

It will be harder with Apple. It has only a smaller share of the smartphone market, and all its rivals; Samsung, Xiaomi, Oppo and Vivo, use Google’s Android.

Global smartphone market share and number of active devices.

Apple will argue it can’t be a monopoly with a 23 per cent share and stiff competition.

Google tried a similar argument, saying it wasn’t a monopoly because ‘general search’ didn’t exist, pointing to high search volumes on Amazon, Yelp and more. It lost.

The DoJ will need to convince a court that premium smartphones are different to Android, and a distinct market dominated by Apple. That might be hard.

Profit over people

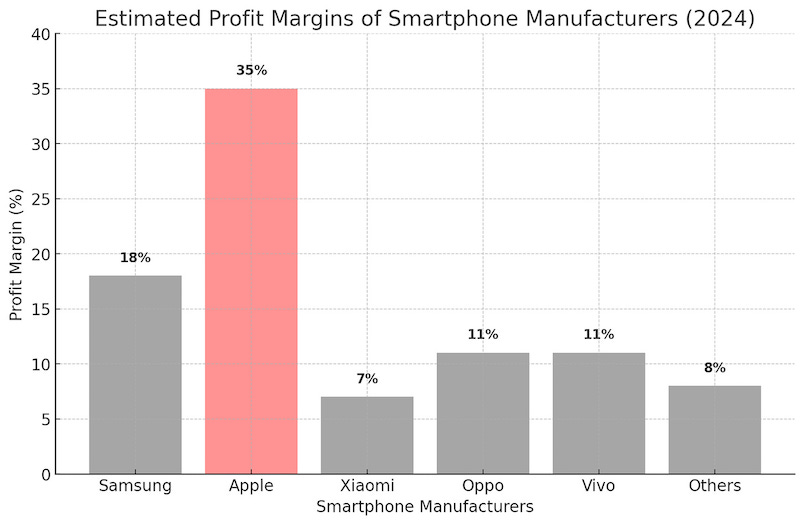

Easier to show will be how Apple has controlled its market to drive super-profits.

Apple is the most valuable company in history today, worth a startling $3.4 trillion. That’s neck and neck with the GDP of the UK or India.

Apple’s share price since it went public on December 12, 1980.

Jobs was ousted in 1985, but returned in 1997, to launch the iPod. He died in 2011.

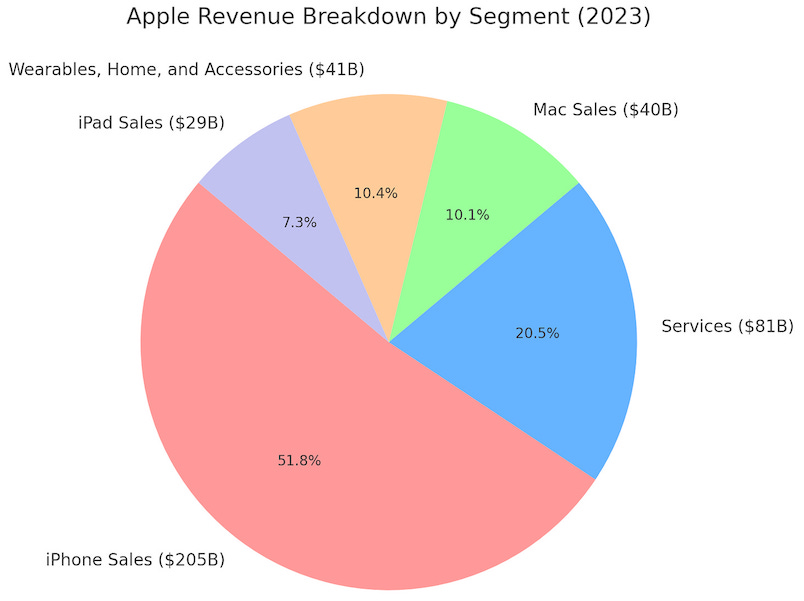

More than half of Apple’s 2023 earnings of US$383.3 billion came from the 1.33 billion active iPhones it has in circulation worldwide.

The table below shows just how dominant that slick brick in your pocket is to the company’s fortunes, and shareholders.

How Apple’s 2023 revenues broke down.

The US$81 billion it made from services came from the App Store ($30 billion), iCloud ($16 billion), Apple Music ($12 billion), Apple Pay ($7 billion), as well as AppleTV+ bundled with others another $5 billion.

While the iPhone matters for revenue, it has an even greater contribution to top line revenue as it by far the most expensive, and the most profitable, with margins that dwarf its rivals.

The DoJ’s case leans in on these numbers, alleging that Apple has manipulated the market to force consumers to pay more, and stifle competition to keep prices high.

Kanter launches his 88-page case with a 14-year-old email from Steve Jobs…

The Jobs mail

It begins:

“In 2010, a top Apple executive emailed Apple’s then-CEO about an ad for the new Kindle e-reader.

“The ad began with a woman who was using her iPhone to buy and read books on the Kindle app.

“She then switches to an Android smartphone and continues to read her books using the same Kindle app.

“The executive wrote to Jobs:

“Message that can’t be missed is that it is easy to switch from iPhone to Android. Not fun to watch.”

“Jobs was clear in his response: Apple would “force” developers to use its payment system to lock in both developers and users on its platform.

“Over many years, Apple has repeatedly responded to competitive threats by making it harder or more expensive for its users and developers to leave than by making it more attractive for them to stay.

“Apple has built a dominant iPhone platform and ecosystem that has driven the company’s astronomical valuation.”

Five-pronged attack

The DoJ is suing under the Sherman Act. It’s the same law that it used to prove Google was an illegal monopoly.

To win, it has to prove that Apple has a smartphone monopoly, that it uses conduct that hampers innovation, and it acts to suppress competition.

The DoJ points to five examples it claims proves this:

-

Lock-Ins: It alleges Apple deliberately creates high switching costs for users, making it difficult for them to move away from iPhones to other devices.

-

App Store: It alleges developers are forced to use Apple’s payment systems and it limits apps with the potential to compete with its own.

-

Anti-choice: It alleges Apple deliberately limits consumer choice and suffocates competition in high-end smartphones.

-

Suffocation: It argues Apple has limited innovation and consumer choice by preventing potentially disruptive technologies.

-

Restriction: Apple is accused on constricting the ability of rivals to offer cross-platform services, that could decrease reliance on the iPhone.

The DoJ doesn’t need to win all these to prove that Apple’s a monopolist. Google won many arguments, including being the best search engine, but still lost.

That’s been expensive. Google’s lost $47 billion in value since the antitrust ruling. And it has sparked a shake-up in the future of search.

Shapeshifter

The DoJ has adeptly used internal emails to reveal the inner workings of Big Tech. Internal comms left Google looking very bad at the end.

In its Apple complaint, the DoJ flags another mail, this time from an Apple manager worried about the rise of smartphone rivals.

“Imagine buying a [expletive] Android for 25 bux at a garage sale and it works fine… And you have a solid cloud computing device. Imagine how many cases like that there are.”

Apple feared “disruptive technologies and innovative apps, products, and services” would make users “less reliant on the iPhone”, the complaint alleges.

Apple’s strategy was not to compete by lowering prices or providing better products, it goes on. Instead, it imposed rules and App Store guidelines to hobble competition.

“Apple would meet competitive threats by imposing a series of shapeshifting rules and restrictions in its App Store guidelines and developer agreements that would allow Apple to extract higher fees, thwart innovation, offer a less secure or degraded user experience, and throttle competitive alternatives.

“It has deployed this playbook across many technologies, products, and services, including super apps, text messaging, smartwatches, and digital wallets, among many others.”

It concludes: “Simply put, Apple feared the disintermediation of its iPhone platform and undertook a course of conduct that locked in users and developers while protecting its profits.”

News as collateral damage

This approach “reverberated” through the economy, hurting the news industry, as well as financial services, fitness, gaming, social media, and entertainment.

The DoJ warns: “Unless Apple’s anticompetitive and exclusionary conduct is stopped, it will likely extend and entrench its iPhone monopoly to other parts of the economy.

“Apple is rapidly expanding its influence in the automotive, content creation and entertainment, and financial services industries…

“And often by doing so in exclusionary ways that further reinforce and deepen the competitive moat around the iPhone.

“This is about restoring competition to lower smartphone prices for consumers, reducing fees for developers, and preserving innovation for the future.”

Follow the money

There are billions of people who would argue that Apple devices are the best, the most desirable, and that they are happy to pay for them.

The DoJ aims to shake-out internal behaviour and business practices that it argues will reveal Apple’s slick marketing is a sham that hides its true motive is profit.

-

Privacy

The DoJ pulls no punches, alleging: “Apple wraps itself in a cloak of privacy, security, and consumer preferences to justify its anticompetitive conduct.

“Apple markets itself on the basis of privacy and security to differentiate itself from what competition is left in the smartphone market.

“Indeed, it spends billions on marketing and branding to promote the self-serving premise that only Apple can safeguard consumers’ privacy and security interests.

“Apple selectively compromises privacy and security interests when doing so is in Apple’s own financial interest – such as degrading the security of text messages, offering governments and certain companies the chance to access more private and secure versions of app stores…

“In the end, Apple deploys privacy and security justifications as an elastic shield that can stretch or contract to serve Apple’s financial and business interests.”

Later in the complaint, the DoJ says: “Nor can developers rely on alternative app stores even though this would benefit developers and users.

“For example, developers cannot offer iPhone users an app store that only offers apps curated for use by children, which would provide opportunities to improve privacy, security, and child safety.

“By contrast, Apple allows certain enterprise and public sector customers to offer versions of app stores with more curated apps to better protect privacy and security.”

And: “Apple often claims these rules and restrictions are necessary to protect user privacy or security, but Apple’s documents tell a different story.

“In reality, Apple imposes certain restrictions to benefit its bottom line by thwarting direct and disruptive competition for its iPhone platform fees and/or for the importance of the iPhone platform itself.”

It concludes: “In fact, many alternative technologies that Apple’s conduct suppresses would enhance user security and privacy.

“Apple is also willing to make the iPhone less secure and less private if that helps maintain its monopoly power.

“Similarly, Apple is willing to sacrifice user privacy and security in other ways so long as doing so benefits Apple.

“For example, Apple allows developers to distribute apps through its App Store that collect vast amounts of personal and sensitive data about users – including children – at the expense of its users’ privacy and security.

“Apple also enters agreements to share in the revenue generated from advertising that relies on harvesting users’ personal data.”

-

Default deals

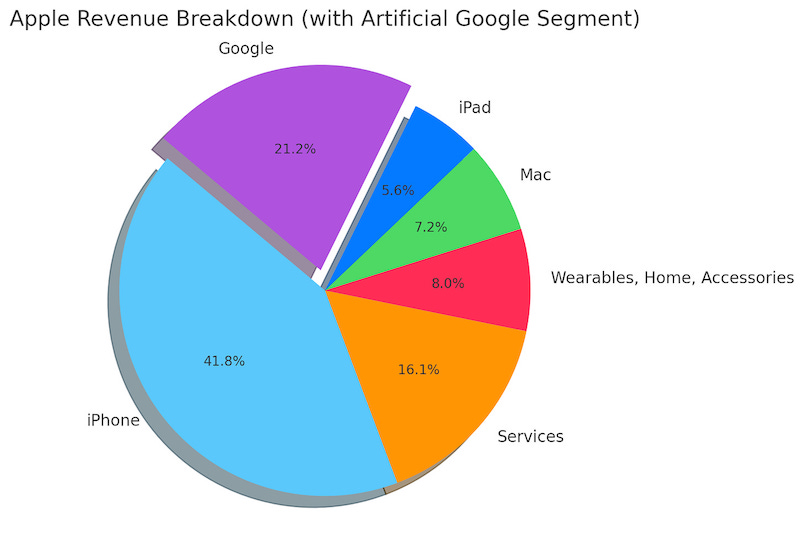

It was revealed at the Google trial, that Apple signed a secret $26.3 billion-a-year deal to make Google the default search engine on iPhone, Macs, and the Safari browser.

Google paid Apple the massive lump sum, plus, a witness let slip, another 36 per cent revenue share on ads the partnership generated.

The DoJ alleges this reveals a profit motive as Apple accepted “billions of dollars each year for choosing Google when more private options are available”.

Google’s default search deal is a material segment of Apple’s total earnings.

-

Future of search

The judge in the Google case may rule that this deal must end. If so, Apple will lose the money and have to give consumers a choice of search engines.

Or, it will need to build its own search capability, which will take time and cost ~$8 billion in CAPEX and $4 billion a year in OPEX.

Two months ago, Apple signed a deal with OpenAI (part-owned by Microsoft) to integrate its AI into the iPhone to bypass search. This too is under regulatory investigation.

Apple has a lot on its plate.