Peace and synthetics: YouTube finally joins BVOD in IAB-Ipsos connected TV currency, thanks to 500,000 synthetic viewers

Synthetically enhanced viewing (l-r): Ipsos' Heather White, IAB's Gai Le Roy and YouTube's Caroline Oates

Artificially constructed Australian YouTube viewers, known as synthetic audiences, have provided the breakthrough for YouTube to finally subject itself to an independent research currency, joining OzTAM's VPM data for BVOD in the digital audience currency run by the IAB and Ipsos. Although still based on log level data supplied by YouTube across its self-selected top 100 viewed channels, Australia is the first market outside the US where the video giant is muscling up against broadcaster digital audiences and potentially other streaming services for a single view on connected TV viewing. Ipsos also flagged its interest in cross-media measurement, a long-held ambition of advertisers globally who see efficiency gains by eradicating duplicated reach and frequency of audiences across different publishers and channels. Emerging measurement players like Adgile and Beatgrid are gaining momentum here via their cross-media measurement capabilities – Beatgrid, for instance, has been working with the likes of UM and Kmart and Virgin and PHD to develop custom cross-media measurement reporting with a methodology that captures viewing data on the walled gardens and platforms independent of their self-reported figures.

What you need to know:

- For the first time Australian advertisers, media owners and agencies see BVOD and YouTube connected TV data side by side, live on Ipsos iris since Thursday.

- Synthetic audiences have provided the catalyst for YouTube's white flag on external measurement - 500,000 modelled viewers are fed baseline data from YouTube's top 100 channels along with other publishers feeding the IAB-Ipsos currency to provide broad demographic segmentation and viewing time.

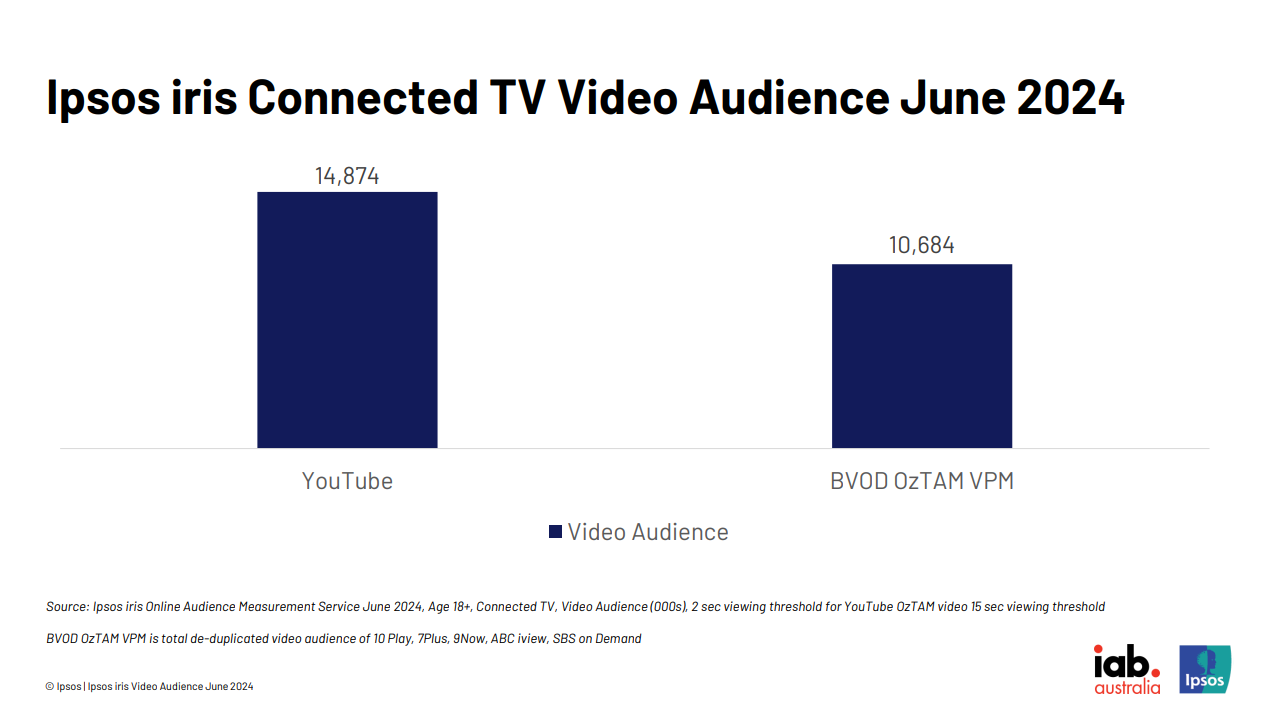

- The first round of CTV reporting for June puts YouTube at 14.8 million viewers versus BVOD at 10.6 million (BVOD figures come via OzTAM's VPM feed into the Ipsos iris digital currency). Foxtel's streaming figures are not incorporated into the VPM BVOD data used by Ipsos which would close the gap between YouTube and broadcast streaming services each month by an estimated 1-1.5 million people. Foxtel is understood to have opted not to release its VPM data to Ipsos for CTV reporting.

- The new CTV viewing data follows the IAB-backed digital audience currency's initial foray into CTV with OzTam's BVOD data in February, and adds to the mobile, tablet and PC video audiences that YouTube began providing the third-party measurement system in March.

- For YouTube, it marks the first time its CTV data has been provider to a third-party in this market, and only the second time globally. The Google-owned video platform has been under pressure for years to play ball with the TV industry on cross-channel measurement, though had cited privacy concerns in declining the invite to join OzTam.

- Google Head of YouTube & Programmatic Sales, Caroline Oates, says Google's priority is in building future-fit measurement and is still backing the Video Futures Collective which includes a working group from Foxtel, Samsung Ads, Netflix, Amazon Prime and Youtube. Oates said she sees the Video futures Collective as "additive" to YouTube's other measurement conversations.

- IAB Australia boss Gai Le Roy says Iris CTV reporting provides a holistic, deduped view of the entire ecosystem, but that it won't go quite as deep as "siloed currencies" - i.e. they're not looking to put the likes of OzTam out of a job.

- While digital is the focus for now, both the IAB and Ipsos have postured that a complete cross-media currency that encompasses traditional media could be a possibility in future. Per Ipsos' director of digital measurement Heather White, agencies want a "single solution".

Apps versus apples

Agencies and advertisers can for the first time view BVOD and YouTube audience data side-by-side, bringing Australia one step closer to a complete cross-platform currency – if only as a planning resource, for now.

The latest advancement to what was already touted as a world first CTV measurement system with the inclusion of BVOD data in February, YouTube’s connected TV (CTV) data has been live in the IAB Australia-backed Ipsos iris platform since Thursday.

It’s the first time Google has handed CTV data for its video platform to a third party in this market, and globally, we’re behind only the US.

For IAB chief Gai Le Roy, it’s a testament to “the power of our local [cross-platform] currency ... We haven't seen it anywhere around the world from an [agreed] currency point of view,” she tells Mi3.

Le Roy reckons the progress is down to Australia’s “practical”, “bottom up” approach to cross media measurement – keeping one eye on what’s going on overseas, while building out a currency “one piece at a time”.

And it has been one piece at a time. But in the circa 18 months as Australia’s digital audience currency (after Nielsen got the boot via IAB’s strategic review in 2021), Ipsos iris has had a couple of big pieces fall into place, especially within video. First came OzTam’s BVOD data in February of this year, providing deduplicated audience data across CTV, smartphones, tablets, and computers. In March, a new partnership between Google and IAB saw the integration of YouTube’s viewing data across mobile, desktop and tablet, with CTV now seemingly closing that loop.

But Le Roy says it’s not just about “the video pieces coming together for the first time” – it’s the ability to compare audiences and behaviour across the entire digital ecosystem, she suggested.

“From a planning point of view, if I’m a big supermarket brand, I’m looking at the video behaviour, I’m looking at my own customers, [and] I can actually look at that media side of things in one place, from one panel,” she says.

For clients and agencies, Le Roy says it enables a planning platform that goes beyond the “siloed systems” of trading currencies, while media owners will have oversight of where they should be focusing their content strategy.

“There's not that detailed view of the whole digital behaviour ecosystem anywhere else – like having that monthly understanding [of a category audience] connected to the media market. It's not sitting just as a media tool, it's a whole behavioural tool.”

But Le Roy is quick to clarify that it’s use case is as a planning resource, rather than a trading currency.

The data on iris is only “top line” and won’t give users the same of depth as they would get separately, per Le Roy. For BVOD, audiences can be viewed by genre, rather than at the program level, and YouTube’s log data is even more blunt than that. “So, you know, we’re not putting [OzTam’s Karen Halligan] out of a job."

YouTube plays ball

YouTube has spent years resisting calls to join OzTam’s VOZ currency, but Google Head of YouTube & Programmatic Sales, Caroline Oates, says this time is different.

(More broadly platforms have been reluctant to let third parties get into their numbers at any level of granularity, for privacy reasons or otherwise – though platforms such as Adgile and Beatgrid have developed cross platform ACR-based workarounds.)

Still, Oates had been steadfast that “a common language” was necessary, and that YouTube should be inclusive of any ‘total TV’ conversation. At the same time, she made clear that Google's appetite for new currencies was predicated on “not building for yesterday”.

It was on that basis that YouTube signed on to Foxtel Media’s Video Futures Collective earlier this year, alongside the likes of Netflix, Samsung Ads and Disney+. The video and streaming ‘think tank’ could eventually come to market with its own measurement currency as part of a multi-phased effort to build unified video standards and definitions, but Oates says it’s not a question of one or the other.

“We’re absolutely still a part [of the Video Futures Collective] … It's bringing together different conversations and thinking through some of the challenges that we need to solve from a streaming perspective… I think that's additive to this conversation we're having with Ipsos and the IAB.”

As for Ipsos, the perceived “fairness” of its third-party measurement – compared to a system funded by Australia’s commercial broadcasters – was a green tick. As was the company’s privacy-centric and transparent methodology, involving panel data and synthetic audiences.

And of Google’s emphasis on building for the future, Oates says those synthetics are a step in the right direction towards tomorrow’s measurement system.

“It’s a combination [of synthetic and real data] … It is looking to what is available, and how can we best put it to use? And I think it’s really interesting when you look across globally, there are different experiments happening in different markets, and I don't think anyone would say that we've landed where it’s going to [be] – it's going to keep evolving.”

In other words, there's some hedging at play.

Either way, Oates credits Ipsos’ ability to collaborate locally to achieve a certain “speed to market” from an “industry perspective” – iris has been three years in the making, but it’s less than the six-year timeline it took OzTam to land it’s total TV metric.

Now with the first tranche of CTV data in tow, backdated until April, Oates says YouTube’s June CTV audience stood at 14.8 million Australian adults (18+). Across all devices, the platform reaches upwards of 97% of the Australian adult population.

“We often talk to streaming is going to be on the rise, and I think those CTV numbers show that the scale is well and truly there in Australia, which is really exciting,” she adds.

How it works

Getting Google and commercial TV broadcasters to put aside their differences is no easy task, but the promise of a level playing field goes a long way – as does an official IAB endorsement.

As for methodology, Ipsos iris works off synthetic audiences, projecting real data onto a simulated population to create a synthetic panel of 500,000 Australians. The synthetic dataset incorporates inputs from an establishment survey, site tagging, and a single source passive panel that collects data every second from 8,000 mobile, PC and tablet devices – all of which is integrated with audience data from media owners.

In the case of CTV, Ipsos iris integrates OzTam’s panel of 16 million devices, and YouTube’s raw log data, with that synthetic panel to provide insights into audience reach and behaviour.

“We take the panel data that we have already across small devices - it helps us to inform our synthetic panel of half a million Australians - with the information that we know about their CTV behavior…combined with the data from the volumetric standard that we get that's all independently verified from Google for YouTube. We can combine those things together in a modeling process to produce an audience number,” explains Ipsos Director of Digital Measurement, Heather White.

YouTube’s data only includes time spent and number of views per use, with “some demographic data” – i.e. age, gender and location – that is fused with the synthetic panel “in a completely privacy compliant way”, allowing users in the Ipsos iris interface to pull segments and insights that go well beyond the scope of the raw data.

For example, if a client like Woolworths wanted to know how many of their customers who had “been to the Woolies website or used the Woolies app” had also visited YouTube via CTV or a small device “you could pull that number out”, says White.

What next

It’s still early days for the Ipsos iris system, and Le Roy has made clear that the long-term plan is to gradually move towards a true cross-media measurement currency, being careful not to run into the failures seen by the likes of the UK’s Origin.

While the two biggest commercial proponents of the CTV ecosystem on board had been a priority, she says the door is now open to other CTV integrations, and beyond.

“There's definitely room for continuing to expand with that and think about how it lives with other currencies.”

In terms of which platforms come next, White says it's down to their capability to deliver log data to partners. Some, she says, are not so “technically advanced” as Google.

Big picture, White says the demand from agencies seems to be for “one solution that has everything” (both legacy and digital media), and conveniently, Ipsos has the infrastructure to deliver. “Basically, if you can pick the signals of what that content is, then we can measure content that way”.

Already, Ipsos has proven that capability in its delivery of BBC Compass – the UK broadcaster’s 360 measurement platform – since 2019. Though in terms of a ‘total future’ for the whole Australian market, White admits the Ipsos panel is not big enough on its own – i.e. they wouldn’t be looking to replace the likes of OzTam or GFK.

But “if there was a desire to bring these things together”, she says Ipsos could potentially “be the hub” to integrate all of that data data to provide top lines on deduplicated audience, frequency and reach across everything bar print.

That’s if someone else doesn’t get there first. The officially currency provider is up against other single source panel providers that are racing to deliver cross-media audience insights as Ipsos iris takes shape. That includes the likes of Beatgrid, which has been deployed in this market by IPG’s UM and Kinesso for Kmart in a trial across linear TV, BVOD, YouTube and in-store footfall.

Wherever Ipsos and the IAB look to go next, it’s unlikely the market will be happy wait around.