Booming shopping apps Temu and Shein trigger surge in digital ad costs, pressure ecom pureplays

Caila Schwartz: "These new shopping apps are buying up a tonne of inventory – driving up costs for what’s left."

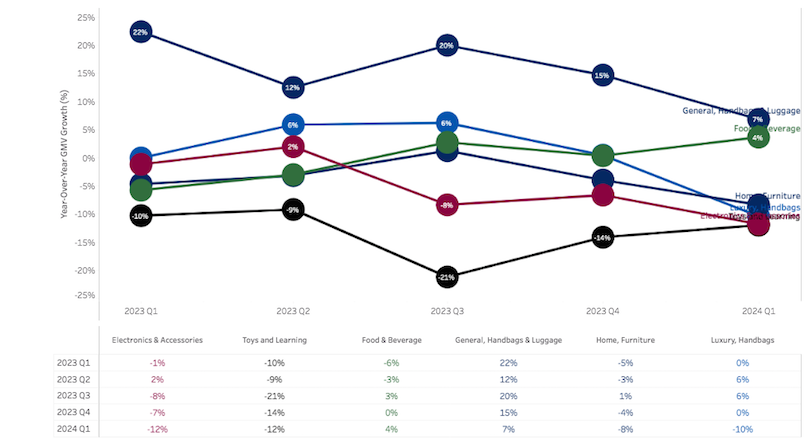

Australian ecommerce sales grew 4 per cent in the March quarter but China’s surging shopping apps, led by newcomers Shein and Temu, are outbidding rivals and pushing up digital ad costs globally. It’s partly behind retailers refocusing on loyalty programs and loyal shoppers for growth instead of more expensive customer acquisition via media channels – search and social particularly. Shein and Temu are both nudging $1bn in online sales each in Australia. According to March Quarter digital commerce data from Salesforce, luxury handbags, toys and consumer electronics were categories hit hardest while budget and mid-range handbags increased 7 per cent and health and beauty overall was pacing at a 12 per cent increase.

68 per cent of shoppers in the last six months have said that they've made a purchase on these apps [Shein, Temu, TikTok, Ali Express or Cider] and that's across the Western markets – Australia, Canada and the US. When we asked about the holiday season 63 per cent said that they plan on starting their shopping journeys there.

Australian ecom is still growing, per latest ABS data, but remains sluggish in key categories. Retailers report that shoppers are laser focused on price and continue to trade down. At the lower end, they are piling into cheap shopping apps.

Other data sources suggest high end categories like luxury handbags (-10 per cent) notched steep ecom declines in Australia in Q1, as did consumer electronics (-12 per cent) and toys (-12 per cent) as non-essential spend is further pared, according to latest Salesforce shopper data (which breaks out country and category). Home furniture (-8 per cent) likewise continues a downward trend.

Budget and mid-range handbags – clearly essential – are still in growth (+7 per cent) although slowing. Health and beauty (+12 per cent) skincare (+5 per cent) and makeup (+3 per cent) likewise remained resilient in Q1 as did active footwear and apparel (both +6 per cent, with apparel recovering from a flat 2023) and online food and beverage (+4 per cent).

Source: Salesforce shopper index.

Shein, Temu pounce

Continued pressure on consumer wallets is forcing many retailers to take a hit on margins – but is delivering a tailwind for China’s cut-price online retail marketplaces Shein and Temu.

Shein’s Australian revenues nudged a billion dollars in 2023. Temu is forecast to top $1.3bn in Australian revenues this year. For context, Amazon reported Australian online store sales of $1.57bn in 2023 – six years after entering the market. Temu has been in market locally for a year and a half.

Globally the two marketplaces are fuelling bumper profits for the likes of Facebook and Google as they seek to reel in Amazon. Temu was estimated by Goldman Sachs to have dropped $1.2bn on Meta ads in 2023 and Meta told analysts earlier this year that China-based advertisers now contribute circa 10 per cent of global revenue.

Their concerted spree is nudging up digital ad costs – and that’s hurting rivals. Etsy’s CEO Josh Silverman has complained Shein and Temu are “almost single-handedly” hiking ad costs as they outbid competitors.

That compounds existing challenges for retail advertisers, per Salesforce director of consumer insights and strategy for retail and consumer goods, Caila Schwartz – leaving some trying to squeeze more out of existing customers than face a sustained bidding war for new customers amid marketing budget constraints.

“Digital marketing costs are increasing … It’s getting a lot more expensive and [due to tightening privacy restrictions and signal loss] a lot less targeted,” Schwartz told Mi3 at the company's recent Connections marketing and commerce conference in Chicago.

Acquisition pullback

Looming US elections are behind some of that ad price inflation as campaigns buy up space. “And then these new shopping apps are buying up a tonne of inventory – driving up costs for what’s left.”

As such, she said, “It's really hard to get in front of the right customer. So we're seeing retailers refocus their efforts on loyalty programs, doubling down on loyal shoppers versus the efforts to build out an expensive and aggressive customer acquisition channel.”

The problem is, belt tightening across the board challenges those economics. Per Salesforce’s data, only 15 per cent of consumers are not actively trading down. “They are still buying with abandon. But 85 per cent say they are making these big changes [in what they will buy and how much they will pay],” said Schwartz.

She added that disposable income priorities have flipped. “Last year, the priority order was physical goods, then experiences, then savings. This year, it's completely switched to savings, then physical goods, then experiences.” (Prioritising savings includes paying down debt.)

Which means shoppers are still hunting cheaper good – with Schwartz pointing to Walmart’s increasing capture of higher earners in its delivery business as another key indicator of overall belt tightening.

“Retailers and brands are having to react to a very price-conscious shopper. They are very much looking for discounts and free shipping and are willing to trade down on quality.”

Which in turn pushes the volume end of the market towards the new-breed cheap marketplace apps, creating a vicious circle. So what’s the antidote?

“I’m not sure anyone’s figured it out yet,” said Schwartz. “But we’re seeing some big retailers adjusting to price sensitivity – Target just announced that they're cutting prices on 5,000 SKUs for their brand. So we're seeing some real time reaction to the fact that consumers are leaning into these apps.”

That may create higher discounting pressure ahead of the December quarter online sales events and critical Christmas period.

Vicious circle

“Based on our research, 68 per cent of shoppers in the last six months have said that they've made a purchase on these apps [Shein, Temu, TikTok, Ali Express or Cider] and that's across the Western markets – Australia, Canada and the US,” said Schwartz. “When we asked about the [upcoming] holiday season 63 per cent said that they plan on starting their shopping journeys there.”

If those consumers do what they say, Australian ecom pureplays already grappling with a post-boom environment – Kogan delivered a soft trading update in April and Catch increasingly appears an expensive acquisition for Wesfarmers – will feel further heat.

Meanwhile, physical retailers are not immune. Woolworth’s ecom business remains buoyant – with retail media helping to power profit – but discount department store Big W is feeling the pinch. H1 sales were back 4.1 per cent and earnings plunged 60 per cent as customers “were increasingly cautious and traded down” per outgoing CEO Brad Banducci.

Schwartz doesn’t see that changing in the short-term.

“As long as we're in a high interest rate environment, I think that consumers are going to stay price-conscious. [Globally] consumers are taking on more credit card debt. They are carrying more than they were last year and if you chart it out, it’s a very high slope … not only that, it’s at a high interest rate … which affects their home repayments, car loans … That's not a great recipe for consumer optimism. But once we see some relief there, we’ll see consumers take a breath.”

A convenient truth

Despite negative market sentiment, Schwartz thinks ecom’s mid-term trajectory remains healthy. It’s just been “comping on a big number”. Take out Covid and look at CAGR growth over five years and “we're still growing at double digits … so that’s still really strong.”

Meanwhile, she predicts retailers that can nail pricing, availability and blend online ordering with same day in-store pick-up will prosper – especially in the run up to Christmas.

“We see a lot of shoppers leaning into tools like buy online, pick-up in store over the holiday season. Over 40 per cent of purchases online, in the couple of days right before Christmas, were for buying online and collecting in store,” said Schwartz.

“There is a convenience factor at play.”