Physical retail suffers as cost pressures drive consumers online for discounts; crunch will stretch into 2024; young vs old spending divide continues; Victoria, NSW hardest hit – Commbank

Tough times ahead: Commbank chief economist Stephen Halmarick and Commbank IQ Head of Innovation and Analytics Wade Tubeman warn that there are lean months ahead

Analysis of 7 million Commbank transactions in August paints another bleak picture for advertisers, particularly physical retailers of furniture, household appliances, clothes and luxury goods, with households in Victoria and New South Wales cutting back most sharply. There are pockets of growth – but when inflation is factored in, much of the economy is in real term doldrums. Cashed up older Australians remain less shackled. Others are heading into discounters and buying more secondhand goods. Commbank said while rate rises have peaked, consumer cutbacks will roll well into 2024.

What you need to know:

- Commbank spend data suggests physical retail sales are slowing in key categories – furniture, appliances, clothes and luxury goods – as rate rises curb spending, driving consumers online – and into discount and second hand stores.

- Spending on big entertainment events – Women's World Cup, Barbenheimer and Taylor Swift has been buoyant of late, but millions are cutting back elsewhere. Victoria and New South Wales are hardest hit over the last 12 months, though recovered slightly in August, WA remains best insulated.

- Food and beverages spending is flat and hospitality is down, although people are seem to still have the cash for fast food, restaurants and pubs. Breweries and wineries and venues are feeling the pinch.

- Per earlier CommbankIQ data, the two-speed younger versus older spending divide remains pronounced.

- Commbank expects people to keep curbing spend well into the new year.

The swing back to physical retail slowed last month for furniture stores, household appliances, fashion retailers and hardware stores per latest Commbank spend data.

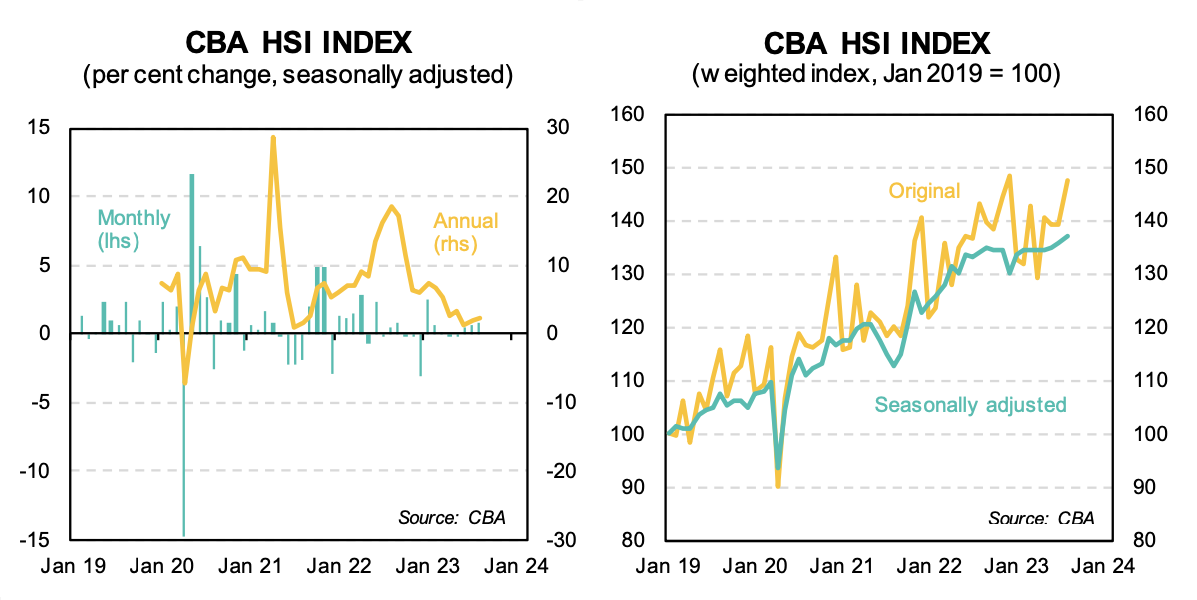

According to the bank’s transaction data from 7 million accounts and circa 30 per cent of all consumer transactions, household spending in August was back 3.6 per cent year on year.

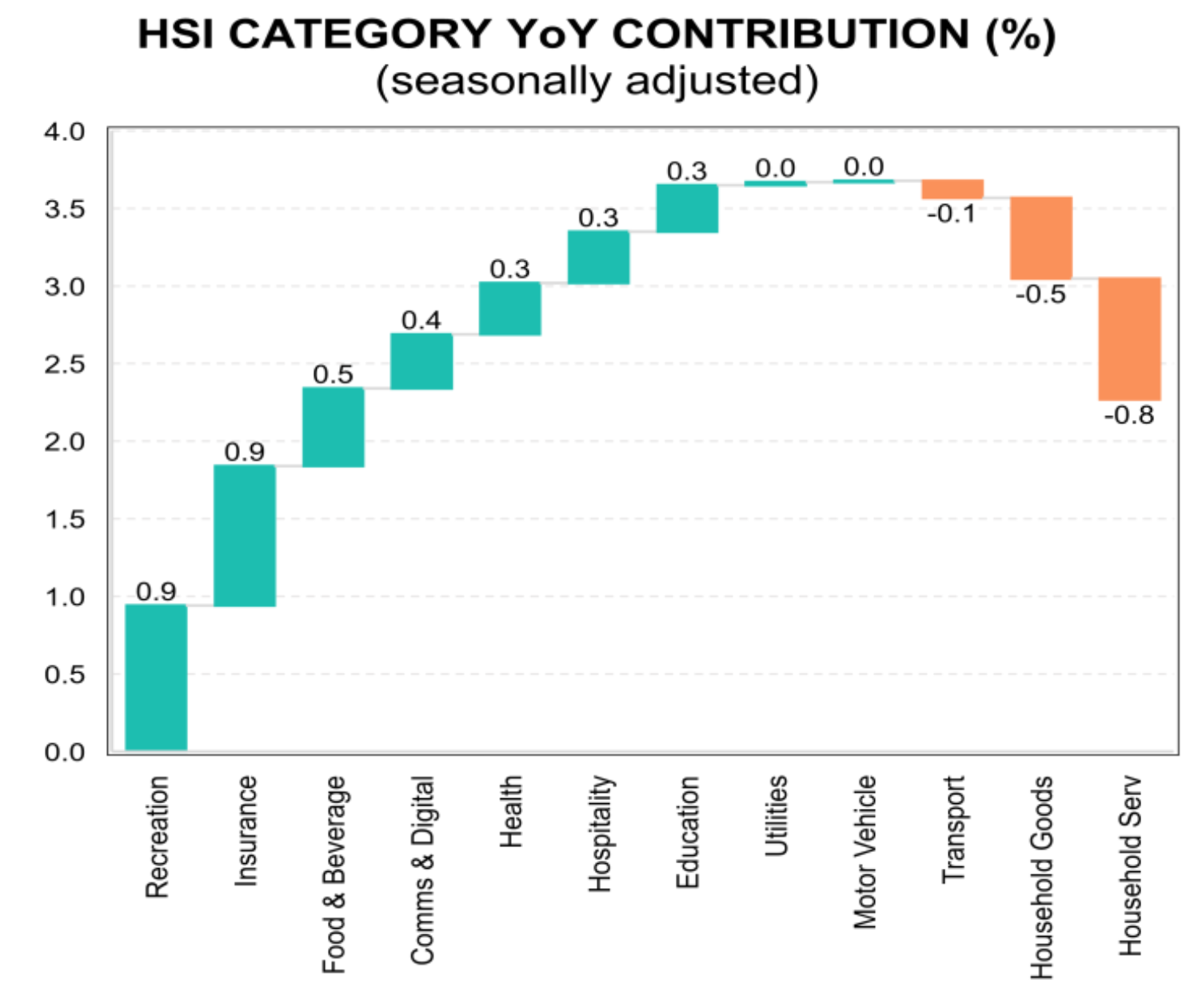

Household goods declines were partially offset by higher spending in ecom marketplaces, discount stores and second hand goods stores as millions of consumers continue belt-tightening in response to cost pressure across the economy.

Household services spending was also “very weak”, back 8.4 per cent on August last year, according to the CommbankIQ data, which the bank compiles in partnership with Quantium. Spending on trading platforms, superannuation and other financial services took a hit.

That shift comes as people are paying more for insurance across homes, vehicles, health, travel and pets, with insurance spending up 13.5 per cent on August 2022.

Across Australia, Victorian households appear to be cutting hardest, with zero growth over the last 12 months, followed by New South Wales, up 1 per cent.

Commbank said while it believes rate increases have peaked, it forecasts more pain to come as people deal with the fallout of higher mortgage costs, rent, food and fuel prices. “We continue to expect household spending to weaken further over the remainder of 2023 and into 2024,” per the bank’s Household Spending Index report.

While some sectors are technically growing, most bar recreation, insurance and education, are far below the rate of inflation “implying a fall in real terms,” per CBA.

Overall, the two-speed economy between older and younger Australians previously flagged by the bank remains at play.

CommBank Household Spending Index trends between January 19 to August 23 Pic: Commbank IQ

Plus points

Entertainment and recreation spending received a Barbenheimer and Taylor Swift shot in the arm, while the Women’s World Cup powered a 70 per cent rise in ticketing sales.

Retail spending rose by 0.2 per cent in August, and 0.9 per cent in the past year, below non-retail spending (1.9 per cent and 5.8 per cent). Spending on essential goods was up 1.2 per cent in August and 2.5 per cent yearly, compared with discretionary spend up 1.6 per cent in August and 3 per cent yearly.

Education spending climbed 14.7 per cent as international students returned.

“We can see a clear change in the pattern of spending behaviour where we're spending more money on things like education, insurance, health and some recreation, but spending significantly less money on household goods and household services,” said Commbank chief economist Stephen Halmarick.

“[The data shows] that these big events, like the movies and the FIFA Women's World Cup, Taylor Swift, are seeing an increase in spending for those events. People are still keeping some money for these big recreation events, and post-Covid we're all keen to get out and do things, but certainly we are reducing spending on household goods and household services.

“We think this softness in consumer spending, as measured by HSI, is going to continue through into 2024 as the lag effect of higher interest rates continues to impact on household balance sheets. The RBA will be able to start lowering rates in the first half of next year.”

The categories that are increasing and declining most to overall spend Pic: Commbank IQ

Boomer and bust

Those aged 50 and above, who aren’t being shackled as much as their 20 and 30-year old children by mortgages and interest rate hikes, continue to spend, confirming trends outlined in previous Commbank IQ report that underlined that younger demographics prized by advertisers are in retreat, reducing consumption on essentials, and will remain up against it for some time.

“It’s older Australians where spending has improved the most and that clearly relates to homeownership status,” Halmarick told a press briefing.

“Clearly the big increase in housing costs – mortgages and rent – are having a big impact on spending elsewhere. So if you have got a mortgage, you're more likely to be in your 30s, 40s and 50s… and if you're renting you are likely to be a little bit younger.”

A breakdown of spending trends by state Pic: Commbank IQ