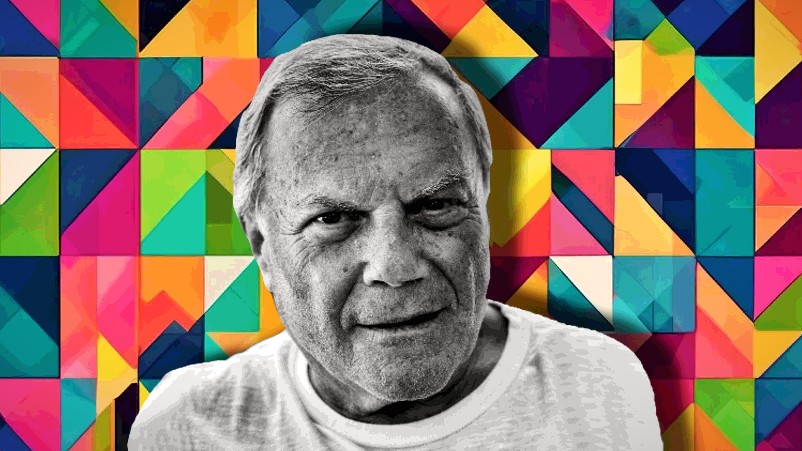

Sir Martin Sorrell on the $9bn valuation wipeout of his new world holdco S4Capital – and why Publicis, Omnicom, Havas are ‘premier league’ players - Dentsu, WPP, IPG ‘second division’

Reality bites, but S4Capital chief Sir Martin Sorrell usually bites back.

Part One: It's been three years since Sir Martin Sorrell was last on the Mi3 podcast – he declared then a mea culpa of sorts: he didn't, and couldn't, transform WPP, the giant marketing services holding company he founded in the 1980s, fast enough because it was listed, hampering transformational efforts that would likely spook the investment community. At the time in 2021, Sorrell’s next generation digital holding company, S4Capital, was firing with a market cap of circa £5 billion (AUD$9.6bn), just three years after a street fight with WPP’s board saw him exit and build WPP 2.0. He was bleak on the future of his old British firm, along with WPP’s French and US-based global holding company rivals. But since then S4Capital’s market cap has plunged more than 90 per cent to £300 million (AUD $582m) as the tech sector, representing 45-50 per cent of S4’s £1bn in revenues, slashed their own marketing budgets globally. But there’s more to it – another mea culpa even – and more of Sorrell’s scorecard on his big holding company competitors along with Accenture Song’s dive into media, a move peculiar to Australia, he argues.

Money talks

It wasn’t meant to happen like this. S4Capital executive chairman Sir Martin Sorrell has been a rowdy agent provocateur, challenging the viability of the big marketing services holding company structures he all but engineered 40 years ago when he formed WPP.

But investors have been harsh, wiping circa $9bn off the market cap of the snappy, scrappy, challenger business in which Sorrell retains control and last year generated revenues of just over £1bn. S4Capital is expected to report its first profit in 2025.

Aside from Sorrell’s view that S4Capital should currently be valued in the £800 million-£1.8bn range, there’s some surprising basics the renowned hard numbers man acknowledges he let off the leash in building his new firm. Like pricing S4Capital’s services to clients and not giving it away.

The issue we have is how well we run our business. We have not been running it as well as we should be.

Beware bubbles

But first, the great global tech cost-out wave after Covid that included hacking their own marketing and advertising budgets while the rest of the world spent up with double-digit advertising lifts to their platforms. S4Capital is hand-in-glove with Google on enterprise tech and digital media buying, pouring client budgets into the search and video giant along with the handful of global digital platforms now taking the lion’s share of the $US700bn worldwide digital ad market.

But the money flows both ways – S4’s global operating brand, .Monks, is rostered on the agency books of those same tech firms, servicing their tech, content and media briefs. It was the pullback from tech spending exuberance during Covid that hit the business hard.

“There was pressure as growth slowed after Covid and Covid sucked – to your point about our market cap and performance – Covid sucked demand forward, with the benefit of hindsight,” he says. Post-Covid, there's been a relaxation of that.”

Sorrell cedes the irony of the global tech platforms slashing their own advertising and marketing expenditure while being the primary beneficiaries of other categories, from packaged goods to banking, dumping large budget increases into their platforms – think Meta, Amazon, Google, Tiktok and its Chinese rivals.

“They wanted more efficiency,” Sorrell says of the tech hacks while revenues were firing. “You remember Mark Zuckerberg came under very heavy criticism for spending plans about two years ago. He then announced the year of efficiency, which probably has now morphed into a longer period, maybe even a decade of efficiency,” Sorrell says. “Therefore they were much more parsimonious in their ad-marketing spending, and they didn't really have to do it [spend on ads], because the tide was with them. The force was with them.”

Process problems

For Sorrell, that was the key external pressure on S4Capital’s business but he almost acknowledges some rookie errors in building his new empire. Today .Monks operates across a recently razored operating structure of content production and distribution, data and digital media and technology services (digital transformation). S4 cut its global headcount by 13 per cent to circa 7,700 along with its first revenue decline – 4.5 per cent – for the 12 months to December 2023.

After outlining the financial rationale for S4Capital’s market valuation being three to six times higher than today’s £300m, Sorrell, in another mea culpa of sorts, declares: “The issue that we have is how well we run our business”. And how well has he been running it? “I have to take responsibility for it, we have not been running it as well as we should be,” he says. “Pricing is an issue. I would say utilisation, 'billability', pricing are the areas, the boring process issues. I think we give things away too easily, for free. That's not naivety," he insisted, "it's because we're so in love with the business from a technology point of view that we often do things without being remunerated for them.”

Sharer capital

And then the big one – the very structural challenges facing the big holding companies Sorrell is still trying to crack – organisational silos.

“If ever I was to write a book, which I will never do, about our business, clients and agencies, I would say the biggest impediment is the political structure, or the structure of the companies – they are organised basically into silos. Good people tend to put their arms around things. There are exceptional people who are good, who are sharers. Those are the jewels … find good people who are good by definition, but also who share. We do have them inside our company, but to be frank there are not as many as there should be.”

AI will be a catalyst for silo breakdown and is already busting them, per Sorrell, pointing to the CEO of AI darling Nvidia, Jensen Huang, who has 50 direct reports: “McKinsey would say 12 or 13 people, not 50 or 51,” he says.

Holdco scorecards

A conversation with Sir Martin Sorrell is not complete without a cast across S4Capital’s competitors – his prognosis is a tale of two leagues. Publicis, Omnicom and “Havas I guess” are now the holdco players in the “Premier League”. Dentsu, IPG and his old horse WPP are “second division”, per Sorrell. Why?

"The reason [his 'premier league' picks] are doing well is their media operations are doing well. The creative side of the business, the traditional creative side of the business, is in trouble.”

The "second division" consists of WPP, IPG and Dentsu, with Sorrell firmly stirring the Dentsu pot: “Dentsu is having a particularly tough time here in Australia,” he says. “I'm told they've lost more money here than their investment. And actually, somebody suggested, to be a little bit controversial, that Japanese companies operate, I’ve never heard this before, in seven year cycles, and this is the seventh year. They (Dentsu) might disgorge their international operations. I think the usual commentary is that the Japanese loss of face is so important to them that they wouldn't do that – but it's an interesting thought.”

And what of his favourite dartboard, WPP?

“One of the things that I must admit to being amazed at – I'm still a shareholder in WPP – is that nobody has made a play for it. Because if you look at the value there's its market cap of £10 billion roughly, a bit less now given what's happened in the last few days. GroupM on its own, which an article in AdAge said that their revenues were £5.7 billion. You should just break it up – but no activist, no shareholders have come in.”

Sorrell’s final nod is to Accenture Song: “I understand they're not interested in a media operation – interestingly here The Monkeys have hired, was it three or four people from IPG and seem to be starting a media operation so that's interesting. But that's, I think, atypical of what I understand Accenture or Accenture Song want to do – but The Monkeys have done very well here and it's a great agency.”

Accenture has been linked in some circles as a possible buyer of IPG outright, although Sorrell thinks the current timing for big M&A deals in the marketing services sector is too early.

“When interest rates come down there's a lot of dry powder,” he says. “The debt markets are accessible. They're not accessible with the prices that perhaps would be needed, but they are accessible. I don't think that's a problem, but I think interest rates have to come down.”

Part Two: Sir Martin Sorrell will be back next week for the final instalment, in which he responds to the consolidation of the $700 billion global digital ad market down to a handful of global tech media players. Is that dangerous for brands and the broader marketing supply chain? And we delve into mass personalisation, Netflix-style, which Sorrell thinks AI will usher in for everyone – along with the opaque, inaccurate but thriving online user data trade that was revealed a month or so ago on this podcast by UM's former US chief privacy officer, Arielle Garcia.