The Long and the Short of It turns 10: Three contemporary ways to sell your CFO on brand building

Binet & Field's The Long and the Short of It now ten years old. But convincing CEOs and CFOs that investing in brand delivers ROI in just the same way as investing in new plant or machinery – and will deliver cheaper customer acquisition – remains a minefield. Atomic 212's James Dixon has three steps for marketers to arm themselves ahead of that conversation, from Google Trends to to past campaign analysis to market mix modelling – and crucially for those just getting started, in that order.

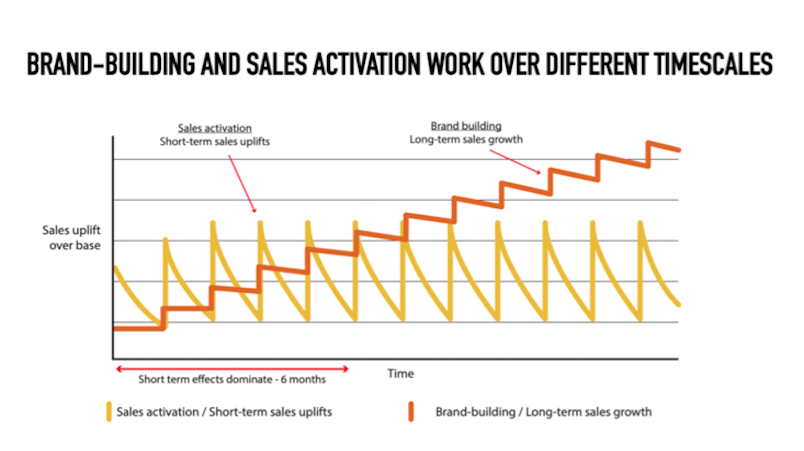

How time flies: 10 years since the IPA published Binet and Field’s now-seminal The Long and the Short of It. With a decade of peer review, the work has stood the test of time, still powering up the CMO for brand investment negotiations. The below image could very well be the album cover for its decade of best hits:

We know it works, but articulating and defending the ‘long of it’ is no easy task, even 10 years on. It requires a leap of faith from a CEO and CFO to sign off the abstract concept of brand building. With recessionary pressures on budgets and directives to move to the quick wins of the bottom of the funnel, can a CFO be convinced that a longer term brand building budget will provide better ROI?

I propose three mathematical ways to showcase the ROI of building a stronger brand below:

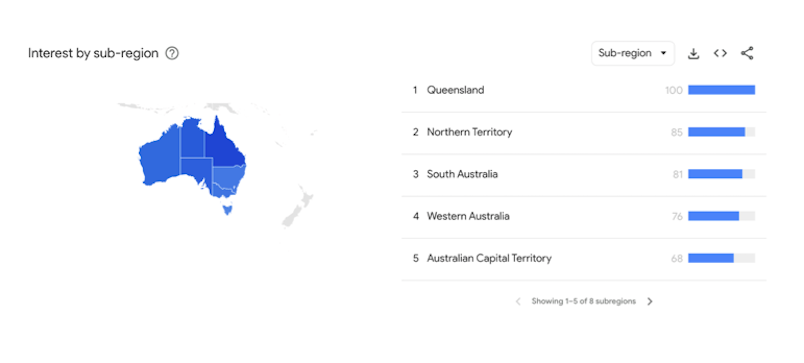

Method #1 Super Quick and Easy: Google Trends

A quick search of your brand name in Google Trends will reveal the relative search interest by state or region. Comparing this search intent to your cost of acquisition by state provides a quick validation of the theory. Consider below: Queensland has the strongest search interest and should therefore have lowest cost of acquisition.

We recently ran this for our agency client set and found a variable degree of correlation. Various interference comes into play such as product, price and competition per state, but as a quick 30 minute exercise, this simple method may give some substance to the case for more brand budget.

Method #2 Quick but fiddly: Testing with the past

The long standing scientific process of hypothesis, test, observation, can and should be applied rigorously to future marketing activity.

However, it is also possible to apply this process retrospectively where a business has previously actioned a marketing campaign to a specific region for non-testing purposes.

That is to say, where a brand building campaign has run, is there sufficient data to apply Long and Short analysis retrospectively?

If it can, the hypothesis is that the brand will be stronger and CPA lower.

Here’s a case study: two years ago we ran a Queensland-specific campaign to launch a product into market. In contrast to the BAU marketing campaigns in other states, the campaign’s ads skewed higher to emotional over rational communications.

Long and Short theory suggests that the emotional content of the campaign should now deliver more effective, long-lasting outcomes. In looking at the client’s historic data we were able to unpick something of a validation to the theory. It wasn't precise, but it pointed in the right direction, sufficient to provide the CMO with substance for the CFO conversation.

Method #3: Marketing Mix Models

A strong MMM model will show with unbiased science the ROI of marketing. It provides the absolute evidence required and will state the statistical strength of the evidence.

It should be noted however, that despite taking ad decay into account, MMM models are skewed to the short-term impacts of marketing. In order to evidence the long-term, take note of the ‘baseline’ in your MMM model.

The baseline represents the sales that accrue to the business IF marketing was not active. I advocate that this is a proxy for the value of the brand, i.e. the sales that occur from the historical awareness of the business. For established brands this baseline will be +50 per cent of total sales, equating to a significant risk to the CFO once understood, and if not invested in erodes at approximately 15 per cent per annum (see previous article here.)

With advances in AI, MMM is increasingly accessible and informative. It is a complex area but one that can provide the CMO with the data and language to convince the CFO that brand building has ROI much like other long-term investments in factories or machinery.

Conclusion:

If you’re just getting started, I recommend running the methods in order, from quick wins (Google Search correlation) to past campaign analysis and ultimately a longer term embrace of marketing mix models.

All three methods provide a CMO with a move from subjective to quantitative conversations on the ROI of brand building, proving that a stronger brand correlates to lower cost of acquisition – and hopefully – provide a way to defend or advance the brand budget for long term ROI.