Flybuys pips Woolworths Everyday Rewards as local loyalty leader; Wesfarmers' One Pass closing fast; loyalty proves a bulwark for brands on the nose as latest data reveals 'emotional loyalty' payoff – but privacy clouds loom

Team Flybuys dominates the local loyalty leagues again as consumers lean into the economic gains during tough times

Consumers and politicians may be grumpy about prices at the grocery checkout, but that hasn't stopped Flybuys and Woolworths Everyday Rewards from locking in their spots atop the For Love or Money SPV Index in this year's loyalty study by Adam Posner. Wesfarmers OnePass was a strong third. And while direct comparisons with last year's index are not possible due to the changing mix of companies, it's also clear that Adair's Linen Lovers – one of the wooden spooners last year – has achieved a big improvement in its relative standing. The report this year unpacks issues such as emotional loyalty and the returns it brings to brands, as well as the impact of loyalty on the experience of a brand.

What you need to know:

- Flybuys is Australia's top loyalty program based on For Love or Money's SPV Index with Woolworths Everyday Rewards, Wesfarmers' OnePass, Amazon Prime, and American Express Member Rewards rounding out the top five.

- With family budgets tight, consumers are leaning into their rewards programs per report author, Adam Posner.

- The last six years have seen a significant and positive trend of members agreeing loyalty programs enhance the overall brand experience.

- Cash rewards remains the favoured loyalty currency, although less so than a year ago, as consumers now put a higher premium on choice.

- Security breaches are eroding confidence in consumer data sharing, but for now, loyalty members still seemingly vote reward over risk.

- But changes to the privacy laws being worked up by the Attorney General now loom large for loyalty economics.

With economic uncertainty and everyday living expenses increasing, it’s not surprising members are more actively engaged with programs they know and trust to earn more savings and rewards.

Flybuys has cemented its position as Australia's best-calibrated loyalty program according to the last For Love and Money report from Adam Posner, released this week.

This year's study confirms the importance of loyalty to overall brand experience and as an important bulwark for brands in industries like retail and travel which have felt the consumer and regulatory blowtorch over issues such as pricing and performance.

And for the first time, the report interrogates the impact of emotional loyalty. Posner told MI3 Australia he wanted to "test whether the idea was real or a myth."

"Emotional loyalty to a brand is a topic of wide and varied debate and the research adds some new insights to the discussions, giving brands a guide on how to foster a deeper emotional connection with their customers.”

Rankings

The For Love or Money report includes the SPV Index (Simple, Personal, Valuable). Flybuys beat Woolworth's Everyday Rewards by the thinnest of margins last year – this year its lead on paper a littler wider.

According to Deirdre Boyle, Chief Customer Officer, Flybuys, "We are thrilled to see Flybuys once again recognised as #1 in this year’s ‘For Love or Money report’. It is a wonderful acknowledgment of the tireless efforts of our team and partners in helping Australians get more of what they value beyond the check-out."

She told Mi3, "We’re proud to continue to be recognised for delivering a simple-to-use program, and personalised value to our members every day."

But though Flybuys seemingly gained altitude, Posner stressed that due to the methodology, it is not really possible to make direct 2023 to 2024 comparisons on the index score. Safer to assume that the relative standings are the same and the gap between the first and second remains tight.

Amazon has been pushed into fourth by OnePass.

OnePass is a core part of Wesfarmers' strategy. Discussing its half-yearly results earlier this year Wesfarmers said of its group-wide loyalty program that members continue to spend more, shop more frequently, and cross-shop at a higher rate than non-members. It added early results indicate that after joining the program, members meaningfully increase spend across Wesfarmers retailers, both in-store and online.

American Express Member Rewards rounded out the top five.

The three loyalty programs with the lowest index score this year were the T2 Tea Society, ChatTime Loyal-Tea, and HBF Member Perks. Of last year's Wooden Spooners, Adairs Linen Lovers appears to have achieved the strongest relative ranking improvement, and now sit more towards the middle of the pack than at the lonely end of the bell curve.

Mi3 was unable to reach Adairs before publication, however, the team is clearly feeling more upbeat. In a Linkedin post in February, Stef Draycott, GM at Adairs Retail wrote, "Our fabulous loyalty program, Linen Lovers, has been unveiled as a finalist in the Best Overall Loyalty Program Retail - ex grocery and beverage!

"Couldn’t be prouder of my passionate team who live and breathe for our Linen Lovers, ensuring market-leading customer experience and value every day. We love our Linen Lovers!"

Brand loyalty

With family budgets tight, consumers are leaning harder into their rewards programs said Posner. But there's room to go harder still – if operators can up the innovation ante.

“With economic uncertainty and everyday living expenses increasing, it’s not surprising members are more actively engaged with programs they know and trust to earn more savings and rewards.”

“However, 50 per cent activity means the other half of their programs are not being actively engaged in. This highlights the need for loyalty programs to be more financially relevant, useful, and joyful”, he said.

In a year when brands like Woolworths, Coles, and Qantas took fire over issues such as pricing and performance, it is worth noting how important loyalty programs are to enhancing brand experiences.

The last six years have delivered a global pandemic, followed by revenge spending, which of late has been fully reversed amid inflationary pain. Yet the data in the For Love or Money studies reveals a constant across that time, i.e. a significant positive trend of members agreeing that loyalty programs are enhancing the overall brand experience.

In 2024, 80 per cent of loyalty program members agree that the programs they are a member of generally enhance their overall experience with a brand – a 12 point rise since 2018.

According to Posner “A well-designed and managed loyalty program enhances the overall experience the member has with the brand. This means brands with programs need to nurture their programs to be profitable and sustainable for the brand – and meaningful and desirable for their members.”

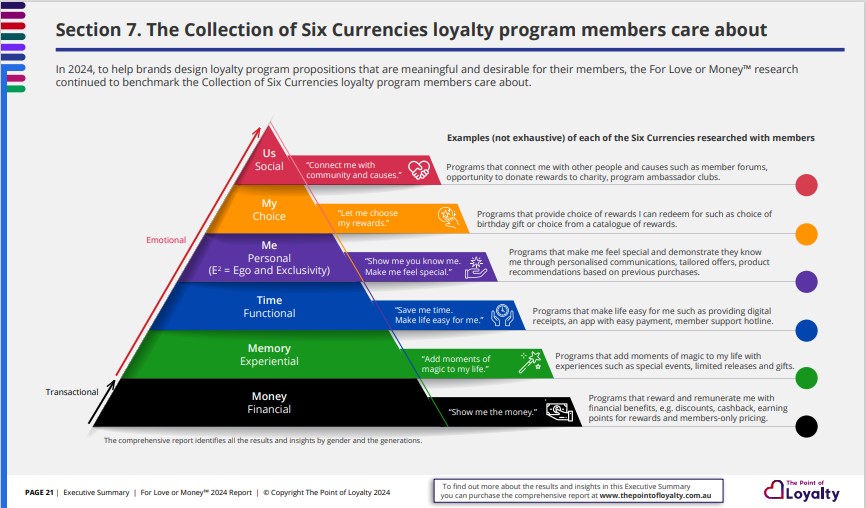

Image one: Six currencies

Cash is king

As to the benefits that most appeal to members it's a matter of 'show me the money ... but also a bit choice'.

While not specifically investigating the issue of relativities of rewards – something he has done in the past – Posner's report identifies the six currencies loyalty members most care about (see image 1).

The financial reward category remains the highest, flagged by 59 per cent of those surveyed, although that's a decline from 64 per cent in 2023.

The big mover this year is choice, up from 13 per cent to 20 per cent.

It's clear that loyalty businesses will need to foster close cooperation between privacy, legal, data science, marketing, product teams, and more, ensuring that personalisation efforts and omnichannel marketing strategies are designed with privacy and compliance at the forefront, given last weeks' update on the privacy reform here.

The finance of feelings

This year Posner also interrogated the issue of emotional loyalty.

"What I wanted to understand is the consumer's perception of loyalty," he told Mi3. "Is there such a thing as emotional loyalty? Are you emotionally connected to a brand or business? [Or does this have] has nothing to do with loyalty programs – [and more] about whether consumers are emotionally connected with certain brands?"

The short answer is yes – the study found 85 per cent of consumers identified with a feeling of emotional loyalty (in a positive way) to a brand at any one or multiple moments.

But what really interested Posner was whether there's money in it for a brand to create emotional loyalty, a concept he calls "the finance of feelings". He thinks so – and identified myriad benefits.

"Number one, they remain for longer as a customer with the brand, so retention. They also said they purchase more often if they feel more emotional towards the brand. And they said they would be advocates of the brand: 'I'll tell other people if I feel emotionally connected to the brand,'" per Posner's findings, which back-up the likes of System1 and Previously Unavailable and Magic Numbers findings for emotional connection in brand messaging more broadly.

Importantly the study also found consumers said they would spend more and be more trusting of a brand with whom they were emotionally connected.

Security and privacy

Despite widely publicised data security breaches in recent years such as Optus and Medibank, and more recently the news that the details of over a million NSW Club patrons were published online, more than one in five loyalty program members (21 per cent) remain confident in the security protocols of loyalty programs and are happy to share their data, knowing they are gaining benefits and rewards from the program.

But that means 79 per cent don't. Something regulators are acutely aware of as government prepares new laws that now appear set to go harder and faster than anticipated.

Publicity over data breaches has undoubtedly had an impact in both public and regulatory circles. The report found that the loyalty program members (54 per cent) are now more concerned about sharing their data with programs but will still do so, knowing they are gaining benefits and rewards from the program.

But for all that, the number of people who say they will no longer join any loyalty programs as a result of their concerns over data breaches is just 2 per cent.

According to Posner: “While there is sensitivity to sharing their data, members will still share when there is a fair value exchange. On the other side of this, there is a level of trust in loyalty programs being more focused on data protection now.”

Beyond data security, if there's a dark grey cloud on the horizon for the loyalty sector, it's privacy.

In the year since the last report came out, the outlook for the new Australian privacy regime, as reflected in discussions led by the Attorney General's Department, has crystallised. The rhetoric from the AG and the new Privacy Commissioner on the definition, treatment, and transparency of personal information is firming against many current and emerging industry practices.

According to Chris Brinkworth, Managing Partner at Civic Data, "It's clear that loyalty businesses will need to foster close cooperation between privacy, legal, data science, marketing, product teams and more, ensuring that personalisation efforts and omnichannel marketing strategies are designed with privacy and compliance at the forefront, given last weeks' update on privacy reform."

He said that recent comments by the Attorney-General Mark Dreyfus emphasise the immense value of personal information. "It's clear that loyalty programs must shift their mindset and treat member data as a responsibility to be protected, rather than just an asset to be leveraged."

The problem for operators – and the marketing supply chain – is that nobody really knows what 'fair and reasonable' use of data being stipulated by policymakers actually looks like. Which ramps up the risk of legal challenges and class actions under privacy proposals. And where there is a no fee win, there is usually a way for such actions.

Brinkworth told Mi3, "Next year, it would be great to see a 'fair and reasonable' or 'pub test' score put into this report, given Privacy Commissioner Carly Kind and the OAIC's focus on the 'fair and reasonable' standard."

That's because Brinkworth believes many businesses will need to reassess their data practices, ensuring they align with consumer expectations and prioritise transparency, ultimately building stronger trust with their members across all product and marketing areas.

"The very likely prospect of 'the right to erasure' and the required ability to 'allow consumers to update their consent preferences at any time and be very clear on how they can do that', should underscore the importance of loyalty programs developing robust data governance frameworks that empower members to exercise control over their personal information 'pre, during and post consent'," per Brinkworth.

On the flip side, that value exchange, provided operators can very simply articulate it within the incoming new rules, so far appears to be working.

Clarification: In the Mi3 newsletter this morning the introduction to this story erroneously said OnePass was not included in last year's study. It was actually listed in the Index under another title - Kmart/Target/Catch.com.au/Bunnings – OnePass. The story has been edited to correct the mistake - AB