Display slides as marketers defend brand, search; TV ROI rises – but ‘standard deviation’ the next measurement battleground: Mutinex boss

Henry Innis: Budget allocation and ROI shifting as more pressure incoming – and why standard deviation measurement could soon make defending brand investment and high quality creative much more quantifiable.

Marketing budget allocations are shifting as rate rises continue to bite – with display one of the biggest losers. Mutinex CEO Henry Innis thinks that's a good thing. He forecast greater budget swings as the economy “falls off a fixed-rate mortgage cliff” he warns is “comparable to the 2008 sub prime” crisis. Market dynamics are also affecting ROI across channels, per Innis, with TV gaining significant uplift. But that’s not necessarily good news for the networks. Meanwhile, Mutinex thinks measuring standard deviation – or how much effectiveness varies within campaigns across a channel and therefore the value of executional excellence – is the next metric hotspot.

What you need to know:

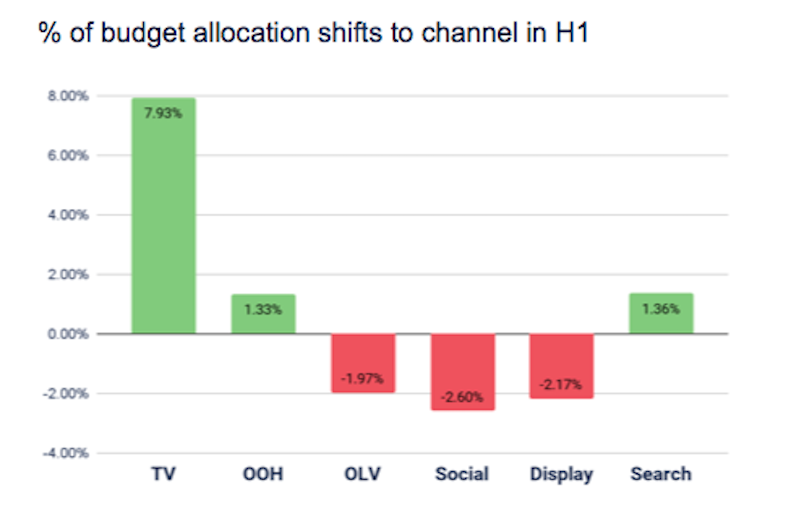

- Marketer budget allocations are moving away from performance channels as ROI declines, per Mutinex analysis across circa $1.6bn of spend across 65 brands. Display, online video and social among losers. Brand and search being defended in overall mix allocation.

- ROI falling in display and search as consumer demand falls and CPMs rise, according to CEO, Henry Innis. He thinks display must “quickly become more premium” amid broader market shift.

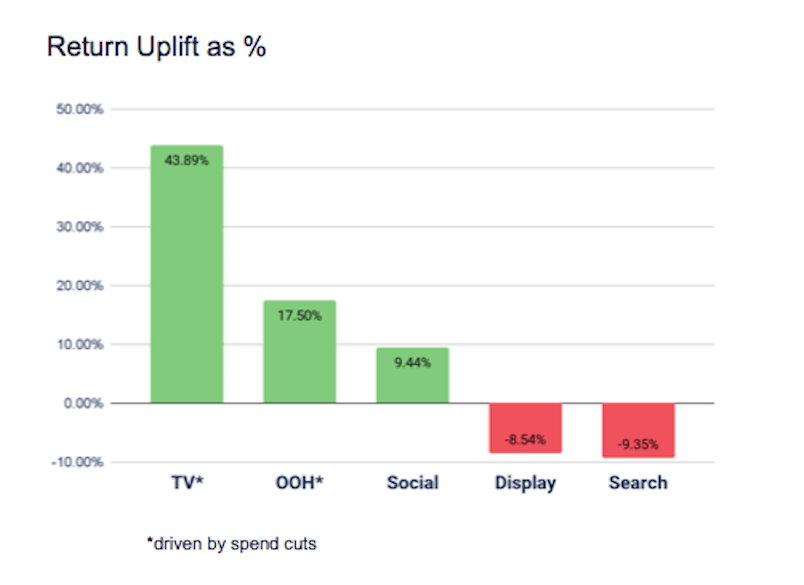

- Spend cuts are increasing ROI uplift in channels such as TV, OOH and social.

- Marketers increasingly asking how to defend creative budgets.

- Innis thinks measuring ‘standard deviation’ is the answer – and will ultimately prove investment in creative and execution in brand channels has far more impact than “fiddling” at performance channel edges.

Standard deviation is going to be a metric that people have to start to track to explain why executional brilliance is important to invest in ... One of the things that's really easy to cut right now is creative budgets ... standard deviation tells us that's an incredibly high risk strategy.

Channel mix moving

“Channel choices tend to change significantly as sales go down, because people gravitate towards short-term sugar hit channels – channels where they can see and prove ROI really quickly,” Innis told the IAB’s Measure Up conference, unpacking latest ROI trends across circa 65 brands collectively spending “$1.6, $1.7bn” per annum plugged in to Mutinex's platform

“What we’re seeing is marketers have been shifting budget – broadly defending brand and defending search,” with marketers “particularly defending brand budgets using measurement to justify its efficiency”, said Innis.

“What's been really interesting is we've seen online video have slight declines, social have slight declines – and thankfully, display have some declines, and we'd like to see some more for any marketers in the room.”

Channel budget allocation shifts do not factor in inflation. Per Mutinex's Innis: “These are absolute numbers, not normalised”. Plus, putting FTA TV and BVOD in the same bar skews the picture. Pic: Mutinex

Performance under pressure

Innis thinks programmatic display’s convoluted supply chain delivers little incremental ROI, though clarified that going direct or “intentionally” buying display ads with premium publishers is a different story. The problem is, per Innis, the industry tends to take the opposite approach.

“In display, we seem to do it the other way around. We pour the money into programmatic and then we decide we're going to do some intentional things. So I think that's probably the challenge for this area.”

“Display as an asset has to quickly become more premium, or get better at cutting through to audiences”, he told Mi3. Either way, he thinks the industry will likely shift away from blind to defined buys as marketers focus on channels that deliver demonstrable incrementality.

Performance channels are under pressure across the board as supply and demand economics sharpen, per Innis: fewer people buying goods because their mortgage repayments have doubled means throwing more marketing budget at reduced short-term demand can only lead to diminishing returns.

“There's some big challenges to traditional performance channels, particularly as some spend in the more conventional areas drops marginally. So what we're seeing is, as the CPMs have been going up, it's been harder to get efficiency in those channels.”

Increasing media spend and falling demand risks creating a negative “cyclical effect,” per Innis.

“If there's fewer people in market for a particular product, or in market for a particular targeting element, but spend is piling up against a smaller audience, that creates an ugly effect where the spend is increasing, but the incremental value isn't tracking along with it – and we are seeing those kind of [ROI] differences starting to pull through.”

Return uplift: BVOD booster?

On the flip side, marketers are achieving significant “return uplift” in certain channels – with Innis highlighting TV, out of home and social driving stronger ROI.

ROI uplift for TV, he said, is driven by falling overall TV spend but increasing BVOD investment, which is both cannibalising free to air budgets as well as some performance pots.

He also suggested regional TV is playing a role. “Regional television as a way to reach audiences at scale is holding up really well,” per Innis. “We've seen that play out in ROI opportunity quite nicely.”

Return uplift per channel H1 this year versus H1 2022. Note TV and OOH's return uplift is driven by spend cuts, per Mutinex.

‘Creative beats fiddling’

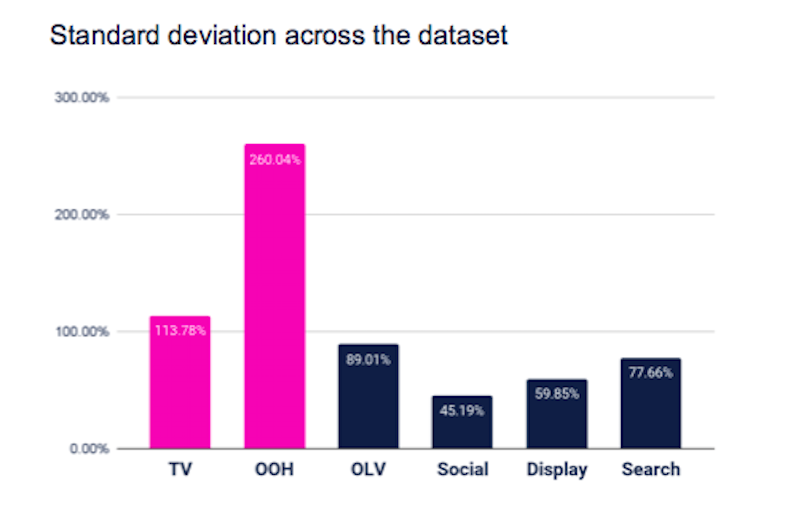

With budget under pressure, marketers are increasingly asking how they can justify greater investment in creative and better execution within channels, said Innis. So Mutinex is starting to work out how to measure what Innis calls standard deviation.

In short, “how much does effectiveness on average vary across the [total customer] data set within a channel”.

He presented some early evidence at the Measure Up event (see slide below).

“Standard deviation is going to be a metric that people have to start to track to explain why executional brilliance is important to invest in,” per Innis. He thinks the evidence will likely show that “executing well in certain channels has a lot more value than executing well in others – and the quality of your execution within brand channels tends to matter a lot more than the quality of your execution in performance channels.”

Which will be music to marketers' – and creative agencies' – ears.

“One of the things that's really easy to cut right now is creative budgets, and investing in strong optimisation or strong first principles thinking. But increasingly, standard deviation tells us that's an incredibly high risk strategy,” said Innis.

"So standard deviation is increasingly a metric we're going to be tracking. We're looking to benchmark across channels on an annual perspective, because we think it will start to tell us the value of execution at scale within channels – and why in the middle of a recession, you should be making decisions to defend executional excellence.”

Or in other words, he told Mi3, the importance of “concentrating on the big creative stuff rather than fiddling at the edges.”

Mutinex's early 'standard deviation' modelling essentially shows that investing in creative and execution across brand channels has a far greater impact than in performance channels. Pic: Mutinex