Streaming services have peaked as 2025 ad take set to surge to $200m; Amazon Prime, Kayo, Binge lead local market with ‘sophisticated’ human sales teams but too many streamers to support with ads - Omnicom, Telsyte

Getting beyond headline streaming numbers: Telsyte MD Foad Fadaghi (left) and OMG investment chief Kristiaan Kroon.

Latest analysis of SVOD growth rates from tech and telco analyst Telsyte proves one thing: fear of streaming services losing subscribers by pivoting to ads is overblown: They’re growing – though some more than others. MD Foad Fadaghi says ads, plus AI personalisation, integration and format innovation, will power the next cycle but streaming growth has peaked. Omnicom investment chief Kristiaan Kroon suggests Stan, Nine’s ad-free holdout, should heed that lesson because Nine has something globals like Netflix and others do not: “Sophisticated, at scale, sales infrastructure, which means they could make really good money.” That's crucial given the number of streamers selling ads is set to double within 12 months – and a market this size can't sustain all of them.

What you need to know:

- Australian's ad-funded streaming market is about to get crowded, with more competition incoming from HBO and Disney. But OMG investment chief Kristiaan Kroon thinks the best sales infrastructure and local capability will determine winners and losers – because unlike the US and UK, Australia’s premium end of town doesn’t operate on fully automated systems and open exchanges.

- Who’s winning right now? “Amazon Prime and then Binge and Kayo" – basically because they have that sales and data infrastructure plus scale.

- He thinks streamer ad tiers will eclipse his earlier predictions of $75-$100m take in 2024 with that trio taking most of it. Next year could top $200m, but there are questions about how big ad-streamers like Amazon and Netflix actually are.

- There’s also an effectiveness wrangle, with data from Adgile suggesting streamers can’t yet match TV’s results.

- Kroon says the MMM-effectiveness-ROI debate has become “very finger-pointy in recent months”, but agrees there’s a gap to close.

- Ultimately, he thinks local content integration could prove decisive in determining winners and losers. For some globals, Australia may prove too small.

- But Telsyte boss Foad Fadaghi predicts a 10m household streaming market within four years, “over a third” of which will be on ad tiers.

- There's more nuance and numbers in the podcast. Get the full download here.

I don't see how we can support that many BVOD, SVOD [players] – and we haven't really even talked about YouTube and the amount of ads that are served on CTV now. There's only going to be a certain number that can be supported.

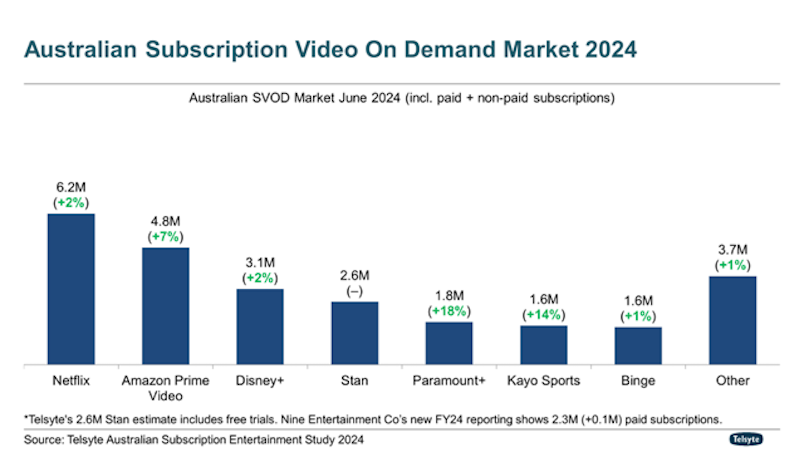

Tech and telco analyst Telsyte is usually closer than most on streamer subscriber numbers and growth. Its latest data shows they are almost all growing, though some are feeling the effects of gravity.

Paramount+ may be playing catch-up on larger rivals, but it’s powering, with the fastest growth for three years running, up 18 per cent to 1.8m subscribers. Foxtel-owned Kayo is next fastest, per Telsyte’s numbers. At the big end, double-digit growth is harder to come by with Netflix and Disney+ inching up circa 2 per cent. Amazon, estimated to have 4.8m Prime accounts in Australia, is up 7 per cent to 4.8m.

Across the piste, Telsyte MD Foad Fadaghi forecasts the first hyper-growth cycle is “coming to an end” for streamers. Now they have to get more creative. Fodaghi thinks that will require investments in smarter AI-driven experience and content recommendations, more immersive experiences – such as 3D movies, bundling gaming into the platform, as Netflix and others are pursuing, as well as going harder on their own marketing investment. With incumbent media owners trimming costs, now could be an opportune moment.

In terms of revenue growth, the big platforms ramping up ad businesses see one major opportunity: selling ads. Despite fears of streamers shunning the ‘legacy’ model, data so far suggests only a minority of subs have balked to the extent of upgrading to stay untainted by marketer messaging – Fodaghi says the 80:20 rule broadly applies. Locally there’s more ad tiers incoming.

“Disney+ is not yet [live with an ad tier in Australia]; HBO and it’s offering [is] not yet in this market. We have Stan in market, but also not yet [for ads],” says Omnicom Chief Investment Officer Kristiaan Kroon. He reckons ‘yet’ is the operative word.

“I think there is a second wave, and it will come in the next six to 12 months. I don't think anyone will be launching before Christmas, but it's definitely coming. So it's interesting when you talk about a crowded marketplace and that end of that first growth cycle, because what we're going to see is probably twice as many providers in market at that top end before we get to this time next year.”

Hence Kroon backing streamers to double their ad takings in 2025. At the start of the year he forecast that streamers would take $75m-$100m, but now revises upwards. “I think we will finish the year above that $100m mark,” with Amazon, Kayo and Binge taking the lion’s share, circa 50-60 per cent, he suggests.

Omnicom will officially crunch the numbers over the next month or so, but “you could easily be saying it will go from more than $100m" this year, "and then I’d be looking at that $200m, either under or probably over [in 2025]”, says Kroon.

“It will partly come down to the unknown of how many services launch, and what type of model do they take – do they convert the bottom tier [like Amazon Prime and Foxtel’s SVODs] or start from zero [like Netflix]?”

Who's winning? Amazon Prime, and then [Foxtel’s] Binge and Kayo. Why? They have come to market with scale; both have sales teams; both have sophisticated data infrastructure ...That's why, for example, Paramount+ is so well positioned when they come to market and Stan – because they've got [sales] infrastructure.

Dear Stan…

Nine has held out on launching ads on Stan. Its argument is partially that advertisers can already target those subscribers on its BVOD channels. But Kroon’s keen and thinks it should take confidence from the numbers Telsyte and others are showing on ad tolerance on streaming apps. He says Nine has a natural advantage that risks being eroded if the global streamers get serious about local sales investment (though Netflix has told Mi3 it’s not yet going all out for boots on the ground).

“For me, it makes a lot of sense that Stan would be doing ads … we can see …. that advertising and the trade off for the consumer around a lower price plus ads is working," says Kroon. “Stan has all of the characteristics, they have great content – great local content. Most importantly from our perspective, they have a really sophisticated at-scale sales infrastructure, which means they could make really good money from an ad tier.”

While there is often merit in zigging when the market zags, and cannibalisation of BVOD and TV ad sales is a genuine risk, twitchy shareholders might back that view, given they are 37 cents on the dollar down so far this year. Either way, Kroon thinks Australian market dynamics favour – and will reward – those with strong media sales capability.

“It's just the structural reality of how Australian premium video – BVOD, SVOD … whatever you want to call it – is traded. We are dominated in this market by a small number of players. We are dominated in this market by a small number of players. We don't have a huge open exchange marketplace,” says Kroon, with the vast majority of BVOD, circa 90 per cent, traded via private marketplaces or programmatic guaranteed.

“When people say, ‘Oh, my algorithm buys my inventory’ [what it means is] you bought the inventory no one else wanted, because it was traded prior to that. And that is a structural difference to the US and Northern European markets, which are broadly comparable in terms of consumer behaviour and how we do other things,” adds Kroon. Whereas Australia, remains “a handheld market that then uses technology to deliver.” In other words, sales are human-driven, and programmatic automation applies primarily to execution.

“That's a very important difference. That's why a sales team matters,” says Kroon, which is why there are two players taking the lion’s share of current ad-funded streaming dollars locally.

“Who's winning? Amazon Prime, and then [Foxtel’s] Binge and Kayo. Why? They have come to market with scale; both have sales teams; both have sophisticated data infrastructure,” says Kroon, who estimates they are taking "50-60 per cent" of SVOD ad spend.

Whereas the likes of Netflix, “have had to build from scratch,” though “it doesn’t mean they won’t get there,” he adds. “That's why, for example, Paramount+ is so well positioned when they come to market, because they've got infrastructure. That's why I think Stan's a good one, because they've got infrastructure. Disney+ would have to build that in this market if they don't partner with someone, as with HBO,” per Kroon.

“So the quality of your front, mid and back-office sales team in terms of driving ad revenue is really important.”

We forecast it to grow massively again because of that Amazon activity. By 2028, we think [SVOD penetration] be up to close to 10 million [households], and a bit more than a third of subscriptions being ad supported. So that's only pointing to a very strong future in advertising in SVOD.

Prime numbers

Netflix chose to start its ad tier from scratch and copped heat for under-delivery at launch. Foxtel pushed all of it’s lower tier subscribers onto ads by default, as did Amazon Prime, delivering instant scale. Whether Netflix holds with that approach locally remains to be seen, though has hinted it may yet roll basic tier subscribers onto ads as it is now doing in other markets.

But there is some debate about how many SVOD streamers are now actually being shown ads. For example, Foad Fodaghi says his survey data suggests circa 80 per cent of Telsyte’s estimated 4.8m local Amazon Prime subscribers are now on the ad tier. There are questions around how many of those subscribers are active month to month – Fodaghi says its research suggests “around two thirds watch Prime weekly … but that doesn’t specify the amount or volume of content [they are watching]. That is the tricky thing, to extrapolate from a subscription how much content is consumed to therefore figure out what kind of revenue can be generated and the yields associated”.

The numbers being bandied around by different platforms and buying groups, “are quite wild”, per Kroon. “They're either very high, or they're very low". But he says Omnicom’s proprietary data indicates market claims that Amazon Prime is only showing ads to 1.4m are undercooking it. “It is significantly higher,” per Kroon.

“I won't tell you what the exact number is, but let's call it two and a half million people who are switching on and watching Prime and therefore receiving ads … [At that level] you're playing with the likes of Nine and Seven, who will be lower in some months, higher in other months. Again, that then depends on whether you have sport content on or not, or does a platform have a new release of a really important series,” he adds.

Ultimately, Kroon says it’s all about what platforms and publishers are delivering when an advertiser’s campaign is live, not claimed average annual numbers, “and that’s the granular piece that I think somewhat been lost in the advertising discussion”.

Telsyte’s Fodaghi thinks the overall number of Australian streamers regularly being shown ads may be somewhat lower, suggesting roughly 2.5m across all SVOD ad tiers. But he couches that with a major caveat: Telsyte’s latest data only covers up until June 2024, just before Amazon launched its ad tier locally.

Hence: “We forecast it to grow massively again because of that Amazon activity,” per Fodaghi. “By 2028, we think [SVOD penetration] be up to close to 10 million [households], and a bit more than a third of subscriptions being ad supported. So that's only pointing to a very strong future in advertising in SVOD.”

Effectiveness questions

Another hot debate – at least in trade press circles – is the effectiveness of ads on SVODs versus TV. Adgile is the latest firm to wade in, indicating incumbents are delivering better effectiveness bang for buck, though in fairness the firm suggested that was down to advertisers failing to adapt to nuances.

Omnicom’s Kroon admits there are differences – but said some nuance is also required when debating relative merits and getting to grips with new channels.

“When people talk effectiveness, MMM and ROI, it's become very finger pointy in recent months,” Kroon suggests, before embarking on his own succinct Q&A session.

“We have been doing linear television for over 50 years. It has been optimised to the highest degree of any channel in Australia. We've been doing SVOD for 18 months, if you take Netflix's launch [as year zero]. So are there ways to improve it, optimise it, improved pricing? [Yes]… There are so many ways that SVOD advertising will improve in the coming years. So I don't disagree … we're a big fan of the Adgile product. Is there a gap? Yes. Is that surprising? Absolutely not. Will everyone work together – brands, vendors, adtech, agencies – to improve that? 100 per cent.”

SVOD Darwinism

Telsyte’s Fodaghi forecasts a further “$1bn in subscription revenue” for streamers over the next four years, “but that’s going to be peppered with a fair bit of advertising revenue over that period as well – it’s only going to grow”. Meanwhile, he thinks the major streamers are now actively eyeing commerce opportunities and tie-ups with local retailers as additional revenue streams.

But Omnicom’s Kroon thinks there will be some market exits – and while marketers at the Future of TV Advertising presented a jaundiced outlook for Australia’s incumbents, Kroon thinks there is still opportunity to outflank global competitors by leveraging existing sales infrastructure, carving out content verticals and differentiating on local integration – and crucially moving faster and more adeptly than interlopers.

“It'll be interesting to see what Netflix and Amazon do … For some there will be a question whether in some smaller markets for them globally, Australia continues to be a profitable, high growth market, as they have assumed,” says Kroon.

“I don't see how we can support that many BVOD, SVOD [platforms] and we haven't even talked about YouTube and the amount of ads that are served on CTV now … that's just too many. We're just not a market of that scale like the US or even the UK.

"So I think what it comes down to is the content and quality that drives overall audience numbers, and then the importance of that high quality sales team to deliver above market revenue that makes you a winner – because there's only going to be a certain number that can be supported.”

There's more nuance and numbers in the podcast. Get the full download here.