Amazon's ad tier delivering on scale while Paramount+ builds for 2025 – but four streamers spells trouble for Meta and Google as well as TV

In market with Prime ads, Amazon is so far delivering on a promise to convert its 5m subscriber base, according to buyers. Paramount+ is likewise live but is building from scratch – and it's not yet sharing ads audience numbers. Alongside Netflix and Binge, the four streamers come with "very different" strategies per OMG investment chief Kristiaan Kroon. Ampere Analysis boss Guy Bisson said it's too soon to say who will come out on top – though Amazon's ecom through-line could swing full-funnel bucks. Either way SVOD is quickly coming for TV's ad spoils. But Bisson predicts Meta and Google will also take a hit.

What you need to know:

- Now live, Amazon Prime Video's ad tier is so far delivering on its promise of a 5m reach – but it has lowered prices and repackaged after agency feedback late last year.

- Paramount+ is taking the longer route, building up audiences from scratch since launching ads last month. Netflix took the same approach, whereas Foxtel's Binge and Amazon rolled users onto ads automatically – unless they pay more.

- After Netflix's teething issues last year – low user numbers after taking a big chunk of money from agencies, and basic targeting and analytics – advertisers are less gung-ho this time around.

- But Ampere Analysis' Guy Bisson thinks the money will follow the audiences and as the platforms ramp up, Google and Meta could take a hit as well as TV.

- OMG's Kristiaan Kroon said the four streamer are taking very different approaches – but Amazon's ecom capability marks it out from the pack.

Priming pump

Amazon’s Prime Video ad tier is so far delivering on what’s been promised, media buyers told Mi3.

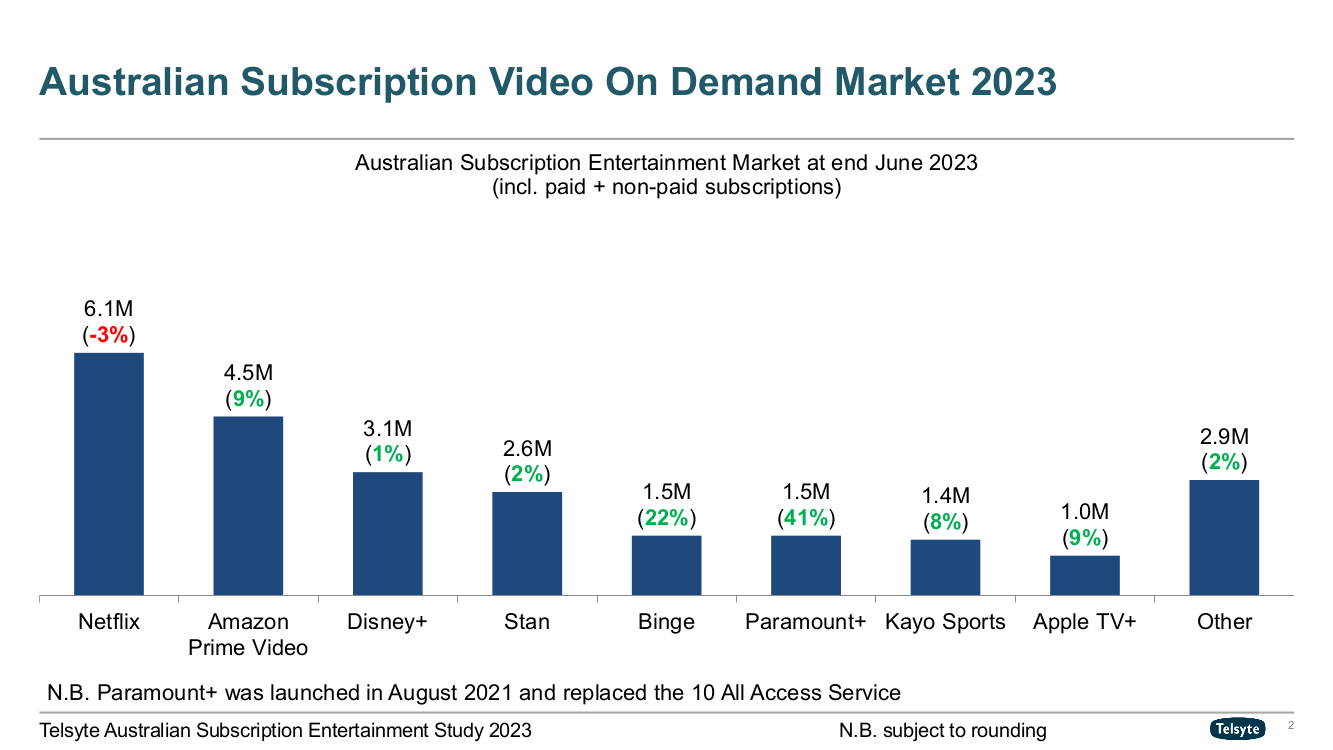

Less than two weeks into its Australian market debut, initial audience numbers are stacking up against Amazon’s Australian subscriber base – at least 4.5m according to Telsyte figures from June 2023, though media buyers say firm is now quoting a reach of 5m .

The numbers may shift depending on how many Prime users opt to pay $3 a month more not to see ads. Amazon appears confident most won't. Rolling all subscribers onto ads by default is a more aggressive approach than the likes of Netflix and Paramount, who’ve introduced their ad-supported options as a cheaper alternative – and will build reach more slowly as a result.

Australian advertisers including AAMI, Hungry Jacks, Dominoes, Airbnb, and Dynamo are among the launch advertisers on the platform.

The e-commerce giant is said to have restructured its packages since doing the rounds with media buyers and brands at the end of last year, abandoning initial plans to introduce fixed pricing tiers and tinkering with CPMs to make packages more palatable for local advertisers. It reportedly did the same in the US when buyers baulked at prices that were initially higher than Youtube's US CPMs of circa $25.

Meanwhile, Paramount+ is into its second month with ads, but with a more conservative strategy, and so far, less to show for it. Whether that approach changes under a slated merger with Skydance Media remains to be seen. For now, the business has been reticent to share audience figures and is unlikely to expect material revenue potential until 2025.

However long it takes the individual streamers to hit big ad tier number, LA-based Ampere Analysis director, Guy Bisson, said four platforms now ramping up locally is a major worry for network broadcasters – but he reckons Google and Meta should be watching their backs too.

Telsyte's 2023 data puts Netflix firmly in the lead in the Australian market, with Amazon Prime Video and Disney+ following ahead of network SVOD plays Pic: https://www.telsyte.com.au/announcements/2023/8/28/australias-subscription-entertainment-market-growth-eases-but-remains-vital

Commerce streaming

As Bisson tells it, it’s very much still a case of early days for the ad streaming market making it “very difficult to forecast” how things will play out in terms of the “relative share that Netflix is going to get versus Amazon”. Locally, buyers point to a "wait and see" sentiment amongst advertisers, and one agency executive said they're yet to see any clients commit budget to either of the two newest arrivals.

Even in the US, despite its relative head start, Bisson said advertisers and streamers are both still “learning” and on-platform targeting is “only just beginning, as far as we can tell”.

What is clear though, is that Amazon is going to have an edge from a first-party data perspective courtesy of its giant e-commerce unit, which last year drove $1.6bn in revenue for the juggernaut’s Australian business while its ad revenue surged 51 per cent to $153m.

Amazon’s online store also presents the opportunity to drive audiences right through the marketing funnel to deliver the “last mile connection between the advertisement and the and the purchase”, per Bisson. Plug that in with an already booming retail media business – and crucially, deliver solid attribution – and the end-to-end proposition delivers what very few others can hope to match.

Loads, rates, prices

Amazon has gone light on ad loads, understood to be matching Binge at a cap of 4 minutes per hour. Per Bisson, the majority of that – based on monitoring on the US platform – is appearing pre-roll, i.e. before the content plays rather than in-show.

“When we compare Amazon to others at the moment, they are definitely pursuing, or seem to be pursuing, a strategy of very low ad load,” he said. “Whether that is because they're not selling it, or it's a definite strategy, I'm not entirely sure, but I would suspect it’s the latter.”

“Certainly in the early months of their ads rollout, they'll be wanting to see how it performs, how advertisers are reacting, how their customers are reacting,” added Bisson. “At the end of the day, their interest is to protect the Prime account.”

Meanwhile, buyers have suggested Netflix’s ‘Basic with Ads’ package has made some audience progress since its faltering Australian debut in late 2022 had some questioning its long-term commitment to the ads business and complaints over $65 CPMs.

At its 2024 upfront presentation in May, the streamer said it had 40m monthly users were on its ad tier globally – near double the 23m figure it was touting just four months earlier. and 8x its claimed launch figures. On a similar trajectory, its Australian numbers would be in the low to mid hundreds of thousands. The company claims that 40 per cent of sign-ups in the countries were ads are live are now to its ads tier.

The first-mover in this market, but the only one without existing ad infrastructure, Netflix has now taken steps to iron out issues with its buy-side UX and in May said it would build out its own adtech, after initially partnering with Microsoft. In the meantime, it's also brought Google, The Trade Desk and Magnite into the programmatic buy-side fold.

Taking on the global platforms are Binge and Paramount+, led locally by sales teams from Foxtel Media and Paramount. That presence and sales knowhow means they’ve been able to cast the net wider on advertising clientele compared to the much leaner local sales arms belonging to Netflix and Amazon.

Binge took the instant-scale route when it launched its ad tier last March, rolling circa 400,000 users onto an ad-supported plan – and from initial buyer feedback, the offering landed well.

Paramount, meanwhile, was prepared for a much slower build, offering packages that sit across both Paramount+ and its Network 10 assets to ensure delivery. As global president of ad sales for international markets, Lee Sears, told Mi3 earlier this year, the company will be hoping that a low price point will see ad tier subscriptions move quickly – at $6.99, it’s the cheapest streaming offering in market (see how the others stack up below).

| Service | Ad tier | Standard (no ads) | Premium |

|---|---|---|---|

| Amazon Prime Video | $9.99 | $12.99 | NA |

| Binge | $10.00 | $18.00 | $22.00 |

| Disney+ | NA | $13.99 | $17.99 |

| Netflix | $7.99 | $18.99 | $25.99 |

| Paramount+ | $6.99 | $10.99 | $13.99 |

| Stan | NA | $12.00 | $21* |

Pick n 'flix

The differences between ad-supported streamers comes down to more than the numbers, according to Omnicom Media Group chief investment officer, Kristiaan Kroon.

He said the four players currently in market are far less “interchangeable” than much of the industry commentary would suggest. “There are very different strategies playing out,” Kroon told Mi3, with four distinct propositions that appeal to different types of clients.

“In the case of Amazon, they've got that scale, they've got the tech in place – which Binge has and Netflix has had to bring in – and then they've got the phenomenal data offerings behind that, whether it's the data they pull from Amazon's website all the way through to Amazon Marketing Cloud.”

For Kroon, that’s “really compelling for certain verticals and certain clients” i.e. those who sell on Amazon or utilise AMC.

For Paramount+, he reckons the opportunity is in “their ability to integrate into content in the long term, particularly with a large tech sector in this market”. It’ll have a “tighter” offering that sits closer to Binge and Netflix, with the three focused more on “content and delivery” than Amazon – whose huge capability is comparable only to Google, per Kroon.

That means brands will likely pick and chose platforms depending on requirements.

“We will see an increase in client-led decisions around which SVOD or BVOD provider is right for which campaign and client and the ad technology that goes with it.”

Meta and Google too

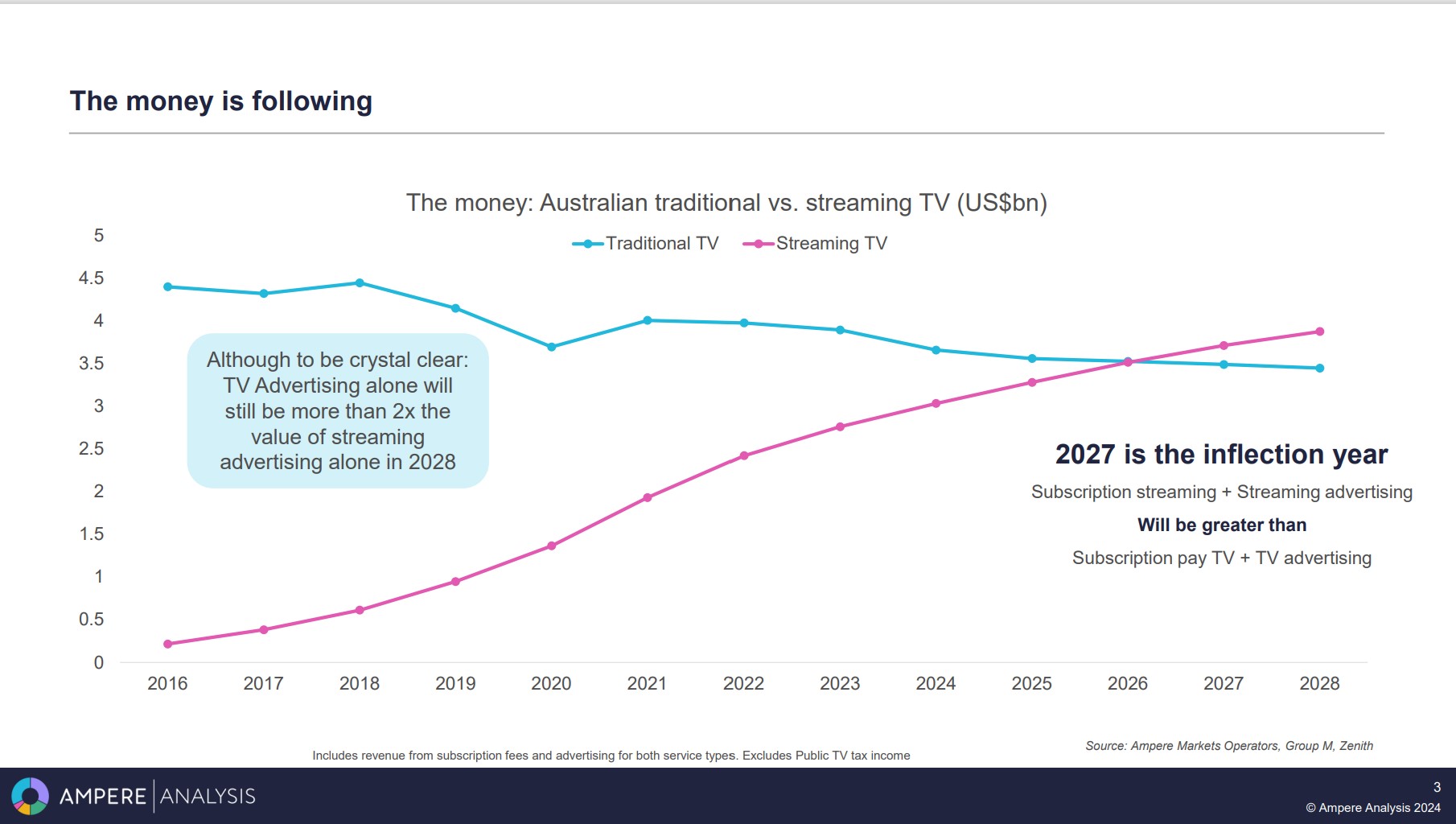

According to Ampere Analysis' predictions, Australian broadcasters could be set to lose a further 18 per cent market share to Netflix and other ad-supported video players by 2028. The firm has also predicted 2027 will be the 'inflection year', where streaming ad revenue and streaming subscription revenue combined will be more than TV ad revenue and subscription TV revenues combined.(Though Bisson caveats that on a standalone basis, TV advertising will still be twice as big as streaming ad revenue in 2028, per table above).

But its not just broadcasters who are in danger. Bisson said the big platforms could likewise be in for a shock.

“The opportunity that the streamers see here is actually to really begin to pull market share from television, but also from online – from Google and Facebook," per Bisson.

Streaming, he suggested, brings together a 'best of both worlds' type proposition that taps all the advantages of the online and the TV environments in a way that's not been done before.

"What you've got with Netflix and Amazon is a brand safe environment, which you haven't always got with online advertising. Plus you're able to wrap around premium, long-form content, which you haven't got with online advertising, but you have with TV. Plus, it's generally still viewed on the main screen in the living room – which you don't get with online [i.e. the platforms] but you do with TV," said Bisson.

"If you took all of the advantages of each medium, put them in one basket, you'd end up with what we've got now on Netflix and Amazon."

If he's right, they could pull off what not even Facebook and Google have managed: Get us all to pay to watch ads, while also being the product.