oOh! still confident on retail media play to join brand-demand dots, defend against rival incursions

Out of home firm oOh!media is hoping to scoop up mid and smaller sized retailers and sell their media assets on network and off, as well as set up in-store screen networks. Now it just needs a local client to land amid heightening competition. Maybe one or two will land before Christmas. Either way, marketing-content-creative lead Neil Ackland is confident it can deliver brand to demand for marketers while “turbo charging” its own core business.

What you need to know:

- oOh!media has identified retail media as its next major growth lever, evolving its specialist unit, Reo (formerly Reooh), into an end-to-end sales partner for retailers hoping to cash in on the fast-growing channel.

- It means that as well as delivering the infrastructure required by retailers to build their own retail media network, Reo will also help them monetise it via new, ready to go retail media sales team the unit has recruited from the likes of Zitcha, MixIn and Criteo.

- It's both an offensive and defensive move, per oOh!'s chief marketing, content and creative officer, Neil Ackland, securing a new revenue stream in a channel that PwC expects to be worth $2.6 billion by 2026, and offsetting any future revenue leakage that might be scooped up by the burgeoning channel. The approach meshes with Cartology boss Mike Tyquin's views on the upside of retail media partnerships for the legacy cohort.

- With plans for Reo to package up retail media and OOH assets via a single access point, Ackland says that oOh!'s success in retail media will only further "fuel" growth across its core assets.

- With many of the major retailers having already made their move, Reo has set its eyes on the mid size and smaller retail businesses that are looking to get in on the action, but lack the scale to go it alone.

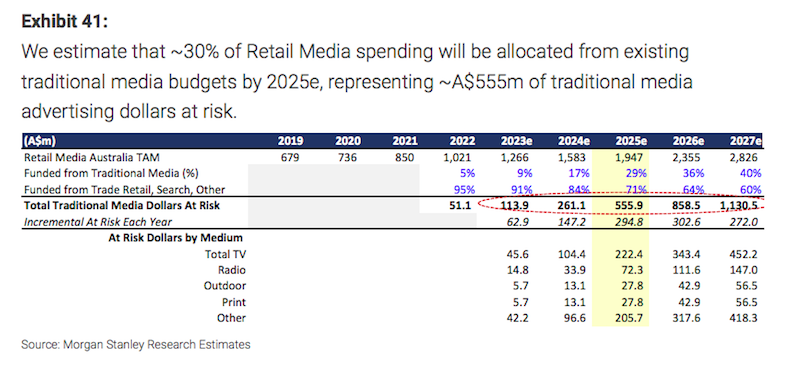

oOh!media is turning its eyes to the demand side of retail media i.e. selling space for shops as well as setting them up as media businesses in a market Morgan Stanley forecasts will be worth $2.83bn by 2027, with $1.1bn coming out of traditional media.

Hence marketing, content, creative chief Neil Ackland claiming the move is both offensive and defensive, though he reckons overall "out of home really stands to benefit". Which could be true – the likes of Cartology chief Mike Tyquin have criticised some of the cannibalistic assumptions being thrown around by investment banks. "People need to think about partnerships [when running the numbers]," he told Mi3 earlier this year. And even without factoring in upside, Morgan Stanley's numbers suggest OOH will be least affected.

If it can “stitch together the entire path to purchase”, Ackland reckons success in retail media will “fuel and turbo charge” oOh!’s core network, and vice versa.

“We can reach [consumers] all the way through that journey online, in the real world, and all the way to the cash register, and that’s a really compelling advertiser proposition.”

Which is true - but there are challenges even the biggest retail media players, with purchase data, loyalty schemes and a direct read on customers through the line are grappling with in closing that loop.

Meanwhile, other first party data and audience rich non-retailers are eyeing the same spoils. Nine is reportedly going head to head with oOh! for Metcash’s business, as the IGA and Mitre 10 parent company looks to set up its own retail media network in a bid to beef-up earnings.

Retailers are also heading in the opposite direction, with Woolworths building a significant OOH business of its own assets, and partnering with others, like shopping centre operator Vicinity. Coles is also now operating circa 600 screens and eyeing partner deals.

Morgan Stanley's estimates on how retail media will hit traditional revenues – partnership upside excluded.

Sales boon

The retail media team sits at 20 heads. While it’s got no Australian clients to show for it so far, word is that two major wins may soon be on the horizon – though oOh! won't speak on the progress of the Metcash pitch.

It's now adding specialist capability to sales muscle with hires from the likes of Zitcha, MixIn and Criteo. to fill out gaps in data, technology and digital products to better sell assets across owned channels, websites, apps, and off-network extensions using retailer data (i.e. targeting people using shopper data on CTV or social as other retail media players now do).

Plus, the combined team can package up retail media assets with the broader oOh! network, which creates a through-line bundle from brand to performance.

Fast-moving market

oOh!’s been eyeing the US retail media market for circa three years, per Ackland, but says the broader ecom landscape differs locally.

“The growth of ecommerce in Australia has probably not been as rapid as it was in the US in terms of the percentage of overall spent. Aussies love bricks and mortar; they love going into their big box retailers or their shopping centers and actually making their purchase. So while omnichannel is growing, it’s certainly not the biggest percentage of overall sales,” says Ackland.

Hence oOh! expects the screen component of retail media – versus the other components – to be “proportionally a much bigger slice” than it was in the UK or US.

“It felt like a very logical play for us…We wanted to start in a space that we felt we had a very distinct advantage, and then build out from there.”

So far it has landed New Zealand’s Warehouse Group as a foundation client, which needed a partner to help build out a screen network in store.

Since the initial hype of retail media, Ackland said it’s become clear that the success of a retail network lies in its “ability to generate the demand” from advertisers with oOh! targeting the medium and small retailers that lack the resource muscle and sales infrastructure to "stand up on their own" but that will gain scale benefits from being part of a bigger network

How many mid-tier retail media networks the local market can handle is another question.

Oversaturation is already an evolving issue in the larger US market, where questions regarding quality of inventory are starting to be raised. Per media ecologist Jack Myers, it could soon see the sector facing similar Made For Advertising accusations that have dogged the broader programmatic market - i.e. "whether they are in fact, arbitraging non-retail media inside the retail media networks”.

US-based analytics provider Adalytics has already levelled such claims at a long list of major brands, but Myers suggested exposure of such behaviour would risk “opening [another] can of worms”.

There are also some questions about the ROI delivered by retail media for advertisers as the channel matures, but that has not deterred retailers – particularly those facing increasing threat from Amazon – seeking to build moats and improve unit economics from gearing up for launch.

Ackland said Reo is geared up for growth.

"We've invested. We've built out a team that's ready to go right now, to scale quickly."

Now it just needs those wins on the board.