‘The funnel is collapsing’: Coles360 launches agency unit as retail media paces 10x ad market growth; next up media alliances, blending brand and response tactics to grocery buyers

Funnel vision: Coles retail media boss Paul Brooks is moving for full brand to demand budgets – and now via agencies in earnest.

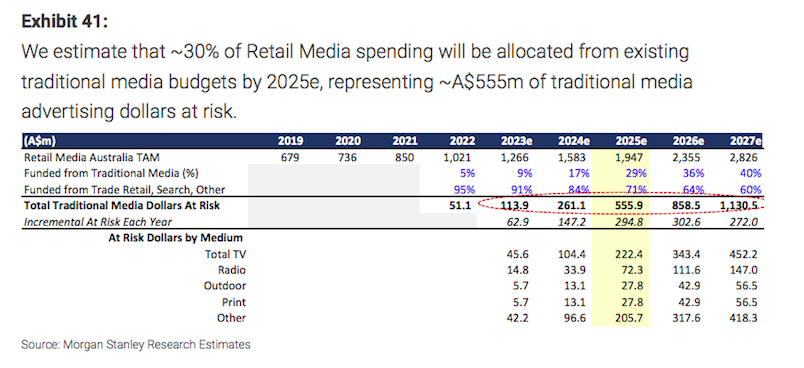

Expect more structural upheaval in the $14bn ad market in the next 12-18 months as more corporates like Commonwealth Bank’s move this week to monetise owned media assets join retailers in carving out new touchpoints to customers, says Coles360 boss Paul Brooks. Broad consensus has retailer media growing 10-20 per cent at present and will exceed forecasts of a $1.6bn to $1.9bn pool by 2025.

There's obviously a role for brand and there's a role for brand and performance marketing. With the rise of the retail media sector, what we'll start to see is that funnel collapsing.

The allure of intercepting grocery buyers in-store or online at the point of transaction and more sophisticated measurement proving incremental sales lift in test and control store environments is landing with the market, according to Coles360 General Manager Paul Brooks.

Quickly shifting demand to link business results with marketing and advertising activity and Coles360’s proximity to purchase is driving “very healthy” growth for the two-year old business, Brooks said – the supermarket’s 2024 annual earnings results pointed to Coles360 growing revenues 20 per cent.

Yesterday the supermarket’s bustling media unit announced it's set to move on the agency sector next year with a “lift and shift” 20-strong team pulled out of loyalty program Flybuys ready to start. Flybuys Unpacked, which bundles consumer insights and 450 target segments from 9 million loyalty members, moves across to become Coles360Empower. The former Flybuys Unpacked sales team is rebadged as the Coles360 Agency Team, led by Chris Scudder.

The business has also struck a deal with Nielsen for consumer segmentation and insights and media planning which Brooks said was a pre-cursor for plans to strike “off network” alliances with media companies to target new or existing Coles customers for brands buying Coles media space.

Off network means using that shopper/loyalty data to target customers via other media channels, i.e. not on the Coles website or app, or in store. A deal with Meta is first off the bat.

‘Our off network strategy remains the same,” Brooks said. “If you think about the way we structure our business, it’s around, what we do on site, in store with screens, point-of-sale and other components and then another important component of our suite is off-site. So that’s looking at potential to take our audiences and activate those in different environments and different platforms – either bring new audiences in and bring them back into our ecosystem or you push them out the other way. So you might be looking at different types of audiences that we might not be able to attract in our owned and operated assets. Launching 360Empower enables us to do both those things – accelerate what we're doing within agencies but also accelerate what we're doing off site.”

Sales or bust

Coles360 earlier this year launched a suite of measurement offers under Coles 360Impact, led by a new approach to incrementality testing of advertising campaigns. By measuring sales and category penetration for a brand in stores where customers have been exposed to Coles360 client advertising versus stores in areas where campaigns had not run, supplier sales and marketing teams have been able to to prove effectiveness. Or not.

Brooks said this was one of two high-demand areas for consumer goods brands. “Measurement and closing the loop [from ads to action] is definitely an evolving area. The way that we look at what we can do around our measurement suite is we ask two simple questions: How much incremental impact did the investment drive and where; and how should I invest for growth next time?” Brooks told Mi3. “I think we can deliver that proposition back to brands and advertisers.”

More broadly, Brooks, who was a former Nine executive and media agency investment chief, said structural advertising shifts are ongoing as retail media and owned media asset development by larger corporates gathers pace.

“Alongside ourselves, you've got Cartology [Woolworths], you've got Chemist Warehouse, you've got David Jones and you've got Commonwealth Bank now launching – and I think we'll probably see more retailers looking to understand what potentially they need to do in the retail media space,” Brooks said.

“I think what we'll see is other companies that own assets which are valuable start to emerge – whether that is retail media or that’s an organisation commercialising what they sit on. We'll probably start to see quite a bit of fragmentation and then probably consolidation will follow quite soon after that, because of the size of the market.”

Pic: Morgan Stanley

Morgan Stanley has forecast Australia's retail media market could top $1.9bn by 2025, with a pipeline of firms aiming to tap in. In the last year Kogan has launched into retail media, as has Metcash, while owned media consultancy Sonder reckons there could be dozens primed to enter the fray – and to date has been largely on the money.

Meanwhile Uber has positioned its Uber Ads business – which wrote circa $1bn in revenues globally last year, leading the company to turn a profit – as a retail media network. Madison and Wall analyst, Brian Wieser, recently pointed out the firm's Q3 ad revenues are up 80 per cent year on year. Though whether it is 'retail' or 'commerce' media (which likewise applies to Commbank and others) is now a point of debate.

When asked if that was a correct definition, Brooks said: "That's up to them to decide in terms of what they define themselves."

Per Brooks, success or failure will be defined by having the fundamentals in place.

"We said a while ago is that if you get into retail media just for the sugar rush around the crowd, you’re getting into it for the wrong reasons. You've got to have a really strong customer base with a loyalty program. You've got prove at the point of transaction that you prove a result then you can build a business around that. There will be businesses that can't do that that will look to move into the sector.”

Brooks' counterpart at Woolworths, Cartology boss Mike Tyquin, has made similar observations.

“There's a lot of activity and a crush of people that want to be involved. At a category level, I’m all for people promoting the virtues of retail media. But if you want to do the job you think you can do for brands, retail media is about three things,” Tyquin told Mi3 earlier this year.

“First, you've got to have a retail context. Otherwise the customer position and how you connect brands with that becomes quite… interesting.

“Second, you must have first party customer access; you must have a customer franchise. Because if you don't have the customer franchise, you'll never have permission to work for and with those customers to derive the data, and to do the things that you want to do for the benefit of your clients,” he added. “And when I mean customers, I mean the people that walk in the door of the store or go online.

“Third you must have those endemic client partnerships, really deeply invested partnerships where there's a real alignment around the importance commercially of that relationship, even beyond advertising,” said Tyquin.

“But what we're seeing is a lot of [players] popping up in retail ad placements, in retail contexts or environments, that lack a couple of [those] things."

Maturity curve

But Brooks said the market is now starting to mature. More brands and advertisers are taking a “holistic” view around the customer and communications journey – “not just the media market but from a retail media market, the role that tech players and everybody else plays in there,” he said.

In advertising investment terms, it means “you're going to see a shift of expenditure.”

Brooks said retail media networks are benefitting from the current economic environment because of proximity to purchase and better measurement capabilities to demonstrate business impact. I.e. brands seeking runs on the board and demonstrable through-lines to sales.

“If you look at that traditional [advertising] buy-sell model, when a market is suppressed, it ends up becoming a cost conversation,” Brooks said. “You need to be focusing around the growth that you can provide for suppliers and brands, and the outcomes based on their investment. That's where retail media plays a really strong role. What we've done around the launch of Empower and our agency team, partnering with Nielsen, is set ourselves up to provide, hopefully over time, an end-to end-service with the ability to prove the outcomes across the entire retail media and media sector.”

(Which is pretty much what Brooks said two years ago at Coles' retail media launch: First woo brands, then build out measurement, then move into agency deals – while taking second mover advantage and avoiding the first mover's mistakes.)

'Collapsing funnels'

But there are challenges to what traditionally is know as the sales or marketing “funnel” – mostly applied for media environments that don’t have direct purchase or transaction data.

Branding campaigns serve to retain, remind or prompt buyer’s “mental availability” in the lead-up to a purchase occasion – but retail media threatens to usurp the process, or in Brooks view, collapse the funnel. Retailer media can do both simultaneously, he said.

“There's obviously a role for brand and there's a role for brand and performance marketing. With the rise of the retail media sector, what we'll start to see is that that funnel collapsing. So you'll start to see companies that traditionally played in that lower funnel performance marketing area start to look around for how they can play a role within brand. And equally, you've got the big brand players who are looking to try and provide and prove outcomes. What Nine came out with at its upfronts is a good example.”

Brooks said the retail media sector “needs to evolve its capability to deliver on that brand proposition, that's where the sector is headed. We've started to see some of the work that's been done in the US and some of the partnerships that they’ve done in trying to make sure they can provide both ends of the funnel – and everything in between.”

He cited Walmart’s acquisition of Vizio, a TV set manufacturer which has an advertising model embedded in its operating system, and an alliance between US grocer Kroger and Disney as examples.

“The combination of a retail media network partnering with either a content business [media], or a facilitator of that, like a Trade Desk – that opens up those brand conversation,” Brooks said. “A combination of those partnerships are going to work and play out. So the Nielsen [partnership] is a key component of that for the agency sales team. Nielsen enables them to plan and buy and understand net reach across traditional media and retail media," he said. "Nobody else at the moment can do that in market."