Gen AI upending martech order as stacks shrink, apps explode, composability rises – Scott Brinker and Frans Riemersma's 2024 State of Martech report signals upheaval ahead

Chiefmartec's Scott Brinker and Martech Tribe’s Frans Riemersma

The martech ecosystem is expanding aggressively thanks to gen AI, even as martech stacks are shrinking, and as software composability's moment looks like it has finally arrived, according to the sector's most anticipated annual technology stocktake. Old models of parsing the martech ecosystem, such as build vs. buy are melting away as a result. In the future CMOs might be making best-of-feature choices driven by everything from pricing, usability, and governance considerations.

What you need to know:

- The martech ecosystem has experienced dramatic growth in the last twelve months, with almost 3,000 new apps added to the mix according to the latest State of Martech Report from chiefmartec's Scott Brinker and Martech Tribe’s Frans Riemersma.

- There are now 14,106 martech apps for time-poor, cash-starved CMOs to consider, up from 11,308 a year ago

- The reason, put simply, is generative AI.

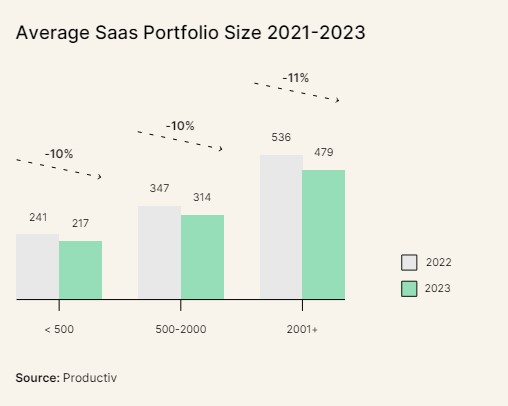

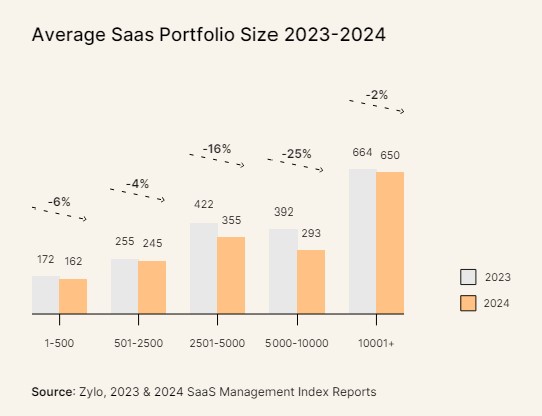

- But while ecosystem growth might be surging, tech stacks are actually shrinking, down by 10 per cent. The falls are even more dramatic in the mid and mid-to-upper-tiers that more commonly reflect the Australian enterprise experience where there are declines in the number of SaaS apps in the fleet of 16 per cent and 25 per cent respectively.

- While Gen AI is obviously the story of the moment, Brinker and Riemersma also highlight the emergence of composability as a key trend, while describing why some of the old standing dichotomies such as suite vs best-of-breed or build vs. buy are melting away.

- And Sam Altman's prediction of a one-person, $1 billion business may not be so far-fetched – or distant after all.

SaaS businesses are hard to kill if you have a product and subscribers, and the operating costs are very low when you are just in 'keeping the lights on' mode.

Growth in the martech ecosystem is accelerating dramatically, even as the size of the organisational technology stack is retreating according to the State of Martech Report from Chiefmartec’s Scott Brinker and Frans Riemersma.

But while generative AI may have driven strong underlying growth in the martech ecosystem to over 14,000 apps (14,106 for the sticklers) it’s the impact of composability that caught the attention of Brinker and Riemersma, the authors of the report. (Composability being Lego-like, best-of-breed, multivendor tech deployments using modular systems versus bundled stacks.)

Released early this morning Australian time, Brinker and Riemersma write in State of Martech 2024, “With such a fury of flashy AI features flying at us every week now, we believe an important structural change in martech stacks is being under-recognised: composability.”

According to the report, “Composability held the hype cycle for a brief moment in martech, with composable CDPs and composable DXPs, before the buzz of AI drowned out everything else. But it’s a concept that is bigger than any one category of marketing platforms.”

“Composability defines the architecture of most martech stacks today. And most customer experiences, when you peel back the covers to see how they were constructed, are composed of data and services coalesced from sources and systems across the business.”

Tipping point

A tipping point has arrived for most martech stacks and AI is providing perfect storm conditions by “enabling apps, agents, analyses, and automations to be quickly composed by marketers and marketing operations professionals without hardcore engineering skills.”

“Composition is being democratised by AI, which results in more composed creations, which drives more demand for composability in martech products, which enables more innovative ways of composing your operations and experiences, and so on in a virtuous cycle. A flywheel that is spinning faster and faster.”

There are myriad reasons for the appeal of composability to marketers, Brinker told Mi3 in the run-up to the report’s release; the obvious being the ability to pick and choose best-fit functionality for specific tasks.

But he also flagged better usability, along with governance and cost control. The latter might seem counterintuitive where it involves replicating a capability already available in a core app. But pricing tiers, or even usage pricing models could change the economics, he said.

“And where a team needs a limited set of functionality – that tool becomes a very clean sandbox that could potentially be isolated from other forms of governance risks,” according to Brinker.

Never-ending story

It’s the headline number of martech apps identified in the report each year (and the almost unfathomable martech ecosystem map that falls out of it) which captures the attention and imagination of marketing and CX professionals.

And despite talk of market consolidation due to the tough trading conditions SaaS vendors faced over the last two, the ecosystem grew from 11,308 to 14,106 this year, largely fuelled by the arrival of new AI tools.

That’s a net increase of 27.8 per cent. The original 2012 landscape had 150 apps and as the report notes, “Since that first landscape in 2011, the overall count of martech solutions has grown a mind-boggling 9,304 per cent. Annualised, the industry has expanded at a 41.8 per cent CAGR.”

The most ubiquitous elements of the martech stack are marketing automation (88.1 per cent), CRM (84.5 per cent), analytics and business intelligence platforms (69.1 per cent), digital experience platforms (53.5 per cent), and cloud data warehouses at 48.2 per cent.

Not surprisingly given the numbers, most of the marketers surveyed for the report considered CRM or marketing automation to represent the centre of the stack. There was an interesting difference though between B2B and B2C companies. B2B firms were very much centred on CRM, but B2C firms more commonly nominated CDPs as the core platform.

And across all businesses, about 72 per cent said at least 50 per cent or more of the tools were integrated with the platform at the centre of the stack.

Hatches, matches, dispatches

The churn rate from last year was only 2.1 percent or 263 products removed from the ecosystem due to acquisitions, pivots, or business failures.

CMOs waiting on the invisible hand of the market to manage away complexity by taking the vast bulk of suppliers back up into the food chain will be disappointed.

“Consolidation is happening. But it’s happening at a slower pace,” according to the report.

Brinker put it more succinctly. “SaaS businesses are hard to kill if you have a product and subscribers, and the operating costs are very low when you are just in 'keeping the lights on' mode,” he told Mi3.

Even the retreat of the VCs during the funding crunch earlier in the decade hasn’t slowed the rising tide. That’s because the “largest number of martech startups are already not institutionally funded,” the report notes.

Indeed, the martech ecosystem has added more companies in the last 12 months than in the first five years that it was being measured.

The report suggests some key trends have materialised and indeed are now accelerating. The ‘suite vs. best-of-breed’ argument is giving way to open platform ecosystems; build vs. buy is being disrupted by the trend to build customer applications on top of commercial platforms; and the distinction between software vs. services companies is giving way to more blended models incorporating elements of both.

Brinker and Riemersma write, “As technology continues to advance and evolve — and marketing practices race to adapt to new implications and opportunities from those changes — inventors, experimenters, and entrepreneurs continually develop new martech ideas and innovations in the long tail.”

In my little group chat with my tech CEO friends, there's this betting pool for the first year that there's a one-person, billion dollar company which would have been unimaginable without AI – and now it will happen.

Billion-dollar one-man (or woman) band

And AI is set to accelerate the change. The report suggests, “More and more ‘services’ businesses will be powered by AI agents and models. If evaluated purely on their functionality, these would qualify as martech products. They will give these firms enormous technological leverage.”

All of this might conceivably see the market deliver on the prediction of Open AI founder Sam Altman that we will soon see the world’s first ‘1-person, 1 billion dollar company’.

During an interview with Alexis Ohanian for a JP Morgan | Robin Hood investor conference, Altman revealed, "In my little group chat with my tech CEO friends, there's this betting pool for the first year that there's a one-person, billion dollar company which would have been unimaginable without AI – and now it will happen."

As the State of Martech 2024 suggests, “While that scenario might sound like science fiction at the moment, it’s much less of a leap to imagine small agencies, consultancies, and managed solutions providers wielding AI software to amplify their unique talents and expertise to build multi-million dollar firms with only a handful of employees. All of them offering serviced products or productised services.”

And as the authors themselves note, such a trend may also render the headline number of apps meaningless in the years ahead.

Stack consolidation

The market may currently be allergic to consolidation, but tech stacks are not.

The report quotes data from Zylo and Productiv, platforms that help brands manage their SaaS licences, that reveals an average 10 per cent reversal in the size of a typical corporate SaaS stack over the last year. That’s all software not just martech.

And it's a number that the State of Martech authors characterise as “modest stack consolidation.”

Perhaps, but there is some serious immodesty buried beneath the averages.

While at the high end (companies over 10,000 people), and the lower and low-mid tiers (companies with less than 2,500 employees) the reversals in the number of apps in the stack are limited to single digits (2, 4, and 6 respectively), in the mid and upper-mid tiers consolidation looks more like bloodletting.

Companies with between 2,500 and 5,000 employees cut the stack size by 16 per cent, while companies with 5,000-10,000 employees went slashing and burning with a huge 25 per cent reduction according to Zylo's data.

That’s not a characterisation Brinker and Riemersma would necessarily agree with, although neither do they deny reality in their report.

According to the State of Martech 2024, “As with the supply, people have been predicting that the size of tech stacks was going to shrink over this past year as demand tightened. From a high point in the peak pandemic years — when companies madly rushed to add all kinds of new digital capabilities — the leaner macroeconomic environment of the past couple of years has forced companies to take a more disciplined approach to managing their tech stacks. They’ve worked to eliminate duplicate apps, reduce the number of under-utilised apps (or at least the number of unused seats in those apps), and shut down apps that they believe aren’t providing sufficient ROI.”

The authors describe the change as stack rationalisation rather than stack consolidation, although as Mi3 has reported in the past that’s not necessarily how marketers on the receiving end of instructions from their CFOs have seen it.

Whichever way you want to characterise it, the point Brinker and Riemersma make is that the process should be about “optimising for the right capabilities in your stack, rather than blindly saying that less is always more.”