Peak media fatigue? Australians call time on all content: streamers, socials, TV lead 10% decline; Gen Z slumps 25% – Deloitte

Time warped: "In 2024 we're probably a bit fatigued. How much higher could (time spent on media) go I guess was the question I was trying to work out, because it's just been inching up every year," says Deloitte's Peter Corbett.

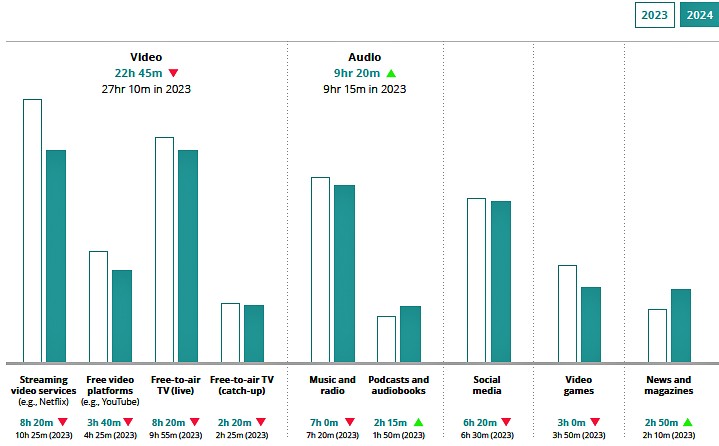

In perhaps the first trend break in decades, Australians appear to have finally maxed out on how much content they can consume across scores of different channel options, cutting the time they spent with all forms of media in the past 12 months – hardest hit were subscription streaming services with nearly 2 hours less of viewing each week than 2023. In the 13 years Deloitte has conducted its annual Media & Entertainment Consumer Insights report, this is the first where consumers say they have cut the overall time they spend on media – by 10 per cent. “I thought it might have come back but not 10 per cent,” says Deloitte Media & Entertainment Lead Partner Peter Corbett. More surprising is that Gen Z – 16-24 year-olds – is pacesetting with a 25 per cent cut in total media time in the past 12 months and is the only group to have cut back materially on social media. But there will be some tension elsewhere in the report between Meta and news publishers – Gen Z and millennials (25-38) say social media is their primary source of news per Deloitte – contradicting Meta’s line to government in dumping involvement with the Media Bargaining Code that news is of marginal interest to Meta’s users.

The big implications for this year ... include having a serious look at media fatigue and specifically where we are spending, still a large amount of time, six hours per day, in media and entertainment formats.

Tipping point?

Deloitte’s lead media and entertainment partner Peter Corbett is not yet committing to a tipping point in the time Australians are spending on media and content. But he’s close.

In the past 12 months, according to the consulting firm’s annual Media & Entertainment Consumer Insights report, every channel from subscription streaming video services to music, video gaming and free video platforms like YouTube and free-to-air TV have all been hit with falls in the amount of time consumers say they’re spending with them.

Only podcasts, news and magazines were spared – podcasts and audiobooks increased their consumption by 25 minutes each week to 2.15 hours while news and magazines lifted their consumer time by 35 minutes per week, according to the report. Newsmedia also saw subscription churn fall by two-thirds in the past six months to 16 per cent of consumers saying they had changed (down from 45 per cent in 2023). For subscription video, 49 per cent had changed their paid subscriptions in the past six months. Magazines showed similar movement to newsmedia with churn falling by more than half – 21 per cent said they had switched in the previous six months, down from 52 per cent a year earlier.

Corbett wants another year before he says we’ve hit peak media but admits it’s not far off – he posits the US writers' strike may have impacted on the volume of new shows coming through, which could have affected SVOD and some TV viewing.

Fatigue intrigue

Still, he said, “in 2024 we're probably a bit fatigued. How much higher could it go I guess was the question I was trying to work out, because it's just been inching up every year. So perhaps we've seen a bit of a reversion to what might be the norm. The big implications from this year's report is having a serious look at media fatigue and specifically where we are spending, still a large amount of time, six hours per day, in media and entertainment formats.”

Corbett suggested more work is now required by media companies in how to engage a more “nuanced, sophisticated” Australian consumer, whether for a free-to-air TV network, an SVOD player or a social media platform.

“Australians are more discerning about their media than they were a year ago and they will be even more so in the next year,” he told Mi3. “There are real questions in fatigue and trust and the ability for these platforms to continue to engage at the levels which they are. So we'll see if that 10 per cent comes down even more next year – but I think that's really a telling tale from this year and one to watch.”

Younger set on time jet

The likely potent of a longer term pattern is the widespread consumption shifts among the younger sets. Gen Z has apparently hacked the time spent on social media by 2.4 hours each week – millennials, Gen X and boomers are rising, however, in social media.

For brands and the advertising market, there are more likely trend breaks – advertising tolerance is one, along with the rise of “shopping websites” into the top three channels consumers say they are most influenced by. And Corbett suspects lower adloads in digital video services is behind another fast flip in consumer attitudes toward ads on TV versus mobile devices. Last year 47 per cent of consumers in Deloitte’s study said they were willing to engage with TV ads – it dropped to 30 per cent this year. At the same time, mobile phone ads have jumped in favour – 40 per cent said in this year’s study they were willing to engage in mobile, up from 29 per cent in 2023.

“You see that data flipping and you're saying ‘what is going on there?” Corbett said. “Free-to-air still continues to be the medium that is most influential overall, but the willingness to engage with ads seems to have shifted from more traditional devices to the smartphone. It is partly driven by the fact that people are watching more long form content on a small device, versus potentially on a large screen. So whether that be Netflix, whether that be the BVOD channels, they all have good smartphone [advertising] experiences.” (Essentially read lower adloads.)

Advertising influence

Overall though, the channels consumers say they are most influenced by are free-to-air TV, social media and shopping websites – the latter a new entrant.

“If you're younger – Gen Z and millennials – you're rating social media as your most influential,” said Corbett. “If you're Gen X or a boomer, you're rating free-to-air TV. And then shopping websites are a close second across the board for all of them. But what was interesting, just to keep an eye on, was streaming video content, which popped up as being an influential platform for Gen Z, but nowhere else. And then radio and sports content lands for older generations.”

Media trust is an ongoing, simmering debate, fuelled by studies from the likes of Edelman’s Trust Barometer, YouGov and the University of Canberra showing concerning signs of erosion in public trust towards media and journalism. But Deloitte’s study paints a more upbeat picture – while TV news is the top source overall at 34 per cent, followed by social media at 17 per cent and newsmedia on 12 per cent, nearly three-quarters (73 per cent) put their highest trust levels in news publishers.

“It's clear that the major news publishers are still the most trustworthy,” Corbett says. “It’s a statistic that backs up the concept of the news media bargaining code in so much as they’re describing the trustworthiness of that content. Social media needs to perhaps do a better job of describing what's myth on their platform, or fact checking on their platforms, which is one the major news publishers are under scrutiny for themselves.”

Overall, Corbett says media should be on alert for rising content fatigue in the next 12 months but is holding out for another year and a full pipeline of content returns to the streaming services, particularly, given their slump in viewing time.

“We'll get a bit of a view on what it is next year and in a perhaps a more normal year, as content comes back onto these services in full steam,” says Corbett. “But there's also a changing landscape of subscription providers out there, with HBO Max coming in and the like.”