Breaking good: Netflix hits 800k for Australian ad tier, drops rates, bets on programmatic over local sales heft, hedges on currency breakaways

A better story to sell: Netflix Business Development Director, Ben Cox.

Netflix took $6m each off Australia's major media buying groups then left them fuming as it initially massively under-delivered on its ad tier. Rivals like Foxtel-owned Binge and Amazon shook their heads, instead rolling subs onto ads automatically unless they paid more – and took plaudits from buyers for hitting the ground running. But the fable of the hare and the tortoise may yet apply. Now Netflix is getting serious with an in-house sales team, ad stack, new formats and is acquiring reach at speed. Local business development chief Ben Cox hints there may be another incoming boost.

What you need to know:

- Netflix’s local ads business is gaining momentum. Ad tier monthly active users (MAUs) , per media buyers, are being touted by the platform at 800,000, a far cry from the 75k-90k that made a damp squib of its November 2022 launch.

- The streamer is parting ways - in part - with Microsoft, taking sales relationships in house. Netflix will retain Microsoft and others like The Trade Desk and Google as programmatic suppliers. Local business development chief Ben Cox reckons a lean unit will be competitive locally, with global deals being piped in and programmatic deals via a beefed-up partner roster doing the numbers. Private marketplaces are incoming, as are new formats.

- While rivals Binge and Amazon took plaudits for hitting the ground running with scale, not all headline numbers are equal, is the suggestion.

- Cox won’t disclose rates, but they have dropped. More inventory across the piste means that trend is likely to continue.

- Netflix appears to be hedging its bets on currencies.

- Other markets – like the UK and Canada – could indicate a numbers boost is incoming.

There is more scale in our business than people realise. There is more coming.

Netflix launched ads in Australia in November 2022 to great fanfare – and almost immediate disillusionment from agency investment chiefs choking on the bitter pill of buyer’s remorse.

The five major buying groups had splurged $6m each. In return, they got circa 75,000-95,000 ad tier customers as Australian take-up of Netflix’s $6.99 "Basic with Ads" subscription package missed pre-launch projections by 50-70 per cent.

They had to go back to their clients red-faced.

“What we tried to buy could only be delivered by half,” one agency exec told Mi3 in February 2023. “So of the 100 per cent of what we were offered in terms of impressions, we could only get 50 per cent away.”

By April 23, buyers were starting to question Netflix’s commitment to the ads model, given the lack of scale and local sales and marketing resource, while talking up the approach from rivals like Foxtel’s Binge and latterly Amazon Prime – i.e. rolling everyone by default onto an ad tier unless they pay more for no ads – as “a better model”.

Numbers games

At a headline rate, Foxtel and Amazon’s numbers were unquestionably larger. But local Netflix business development boss, Ben Cox, claims there is a crucial difference: “Think about a customer that's opted into their ads versus one that was forced into it. By opting in, you're a qualified customer that is happier to be watching the ads," he said. “The downside is you grow slower.”

Since then, Netflix has started to scale its ads business. Execs no longer have to creep around corners at conferences in fear of getting both barrels from buyers who now tell Mi3 that the streamer is selling to them based on circa 800,000 ad tier MAUs. Cox won’t confirm those numbers, but indicates Australian growth is in line with global rates – with the firm reporting 8x growth from the 5m paying ads subscribers in May 2023 to 40m in May 2024, and that ads now represent 45 per cent of all new sign-ups. Cox said that steepening trajectory continues.

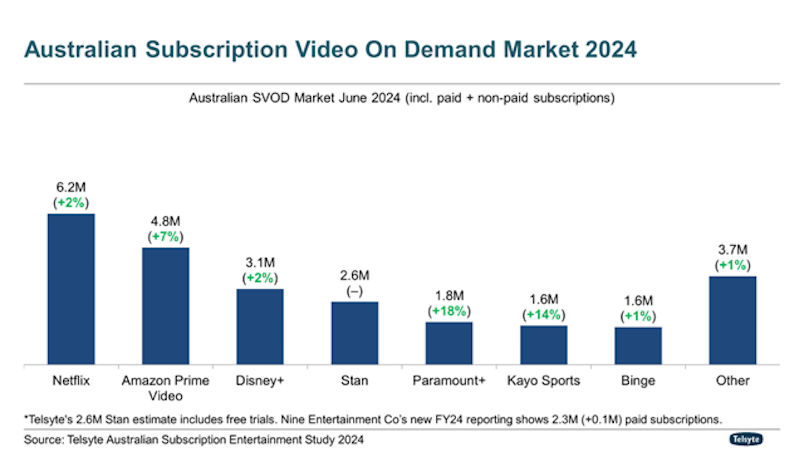

Locally the likes of Amazon Prime briefed agencies to expect a reach of circa 5m users from day one of its ad tier launch in July – with subs getting ads unless they upgrade. At face value, those numbers tally with latest data from Telsyte, which put Prime subscribers at 4.8m, with the analysts suggesting ad tiers are powering streamer growth as cost of living pressures bite (and as an aside, that Paramount’s claims of reeling in streaming rivals appear genuine – with Telsyte usually on the money).

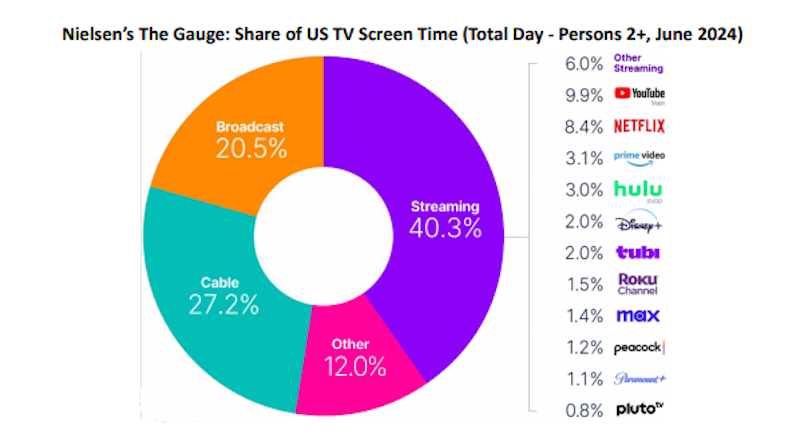

Cox is reluctant to comment on competitor claims, but Netflix’s latest shareholder letter lifts Nielsen data to assert a commanding lead over all streaming rivals (bar YouTube) in the US.

“They are very similar markets,” per Cox, with the implication being raw claimed numbers may not translate to active users and actual eyeballs watching shows, with knock-on effects for what a streamer can, or cannot, deliver in terms of impressions.

“You live and die buy your content and we're only a content business,” said Cox.

Apart from ads.

Nielsen data included in Netflix's latest letter to shareholders.

Netflexes

Netflix is getting serious about ads as ad-free subscriber growth tapers. Launch partner Microsoft remains in its programmatic supply chain with Google’s DV360 and The Trade Desk coming into the fold. “Google and The Trade Desk are used by 90 per cent of industry, in terms of agencies. We just want to make it easier for people to transact with us,” said Cox. “If a media buyer is buying a whole campaign and they want to buy four different publishers – and we're one of them – we don't want them to have to go off their media plan and to create something else.”

Likewise sharper automated reporting, both for agencies and direct with brands. “It just makes the process simpler,” he added.

“Partners can be great and help you allow for speed, but they're never going to know your business like you know your business,” said Cox of the decision to ditch Xandr and go it alone. “And they're not in the business” – especially when brands want to go beyond spots and dots and into deeper integration. “You get a lot more control of what you’re selling.”

Plus, it means Netflix can launch new ad units – including shorter duration units – faster.

“It just gives us more flexibility. The video marketplace is still a very strong advertising environment, but linear operators and YouTube are still the dominant players at the moment – and in a lot of cases, the environment's not that great,” he added.

“As well, there's not the audiences there anymore,” Cox suggested, though Nine and Seven would dispute that after seemingly arresting declines and notching growth. “Audiences are shifting to digital environments, and you don't have the targeting ability [in linear TV] to really get into the right audiences,” a statement incumbents would likewise counter, arguing that the definition of linear equally applies to live BVOD.

Either way, Cox claimed “90 per cent” of Netflix’s 10,000 hours of local content has now been approved for ads, but that unlike “cliff-hanger” broadcaster shows, the ad breaks are inserted at “the exact right spot where the ad should go, so you're not halfway through the episode like some broadcasting services ‘and the secret ingredient is…’ boom, and a Youi commercial drops right in. It comes at a natural point where there's no sex scene … no music playing … we're finding a natural point,” he said.

“It's irregular, which means that when the ad comes, people are there and paying attention. And the mid-rolls are only 60-75 seconds – so it's barely enough time to pick up your phone and start scrolling TikTok. Why does that matter? Because that’s what an advertiser is paying for, attention.”

Plus, said Cox, “there's only four to five minutes [of ads] an hour, not 12 or 13 plus sponsors. So you get fewer ads. Better experience means that people take action more. That's the pitch to market.”

Are they buying it?

“I think so.”

CPMs, headcount

Locally the ad sales unit will be relatively small. Some may question that approach, given the highly competitive nature of media sales and the expertise, relationships and facetime required to seal premium deals. But Cox is confident.

“It's not going to be an enormous team because we think we can leverage our global business,” he says, with worldwide deals with major brands then piped into the local market.

How many people?

“We’re still working out the numbers … Australia is a very programmatic market. We won’t need huge teams… but you do want some localisation,” said Cox.

In terms of costs – i.e. CPMs – Cox won’t disclose rates, but indicates they have dropped from last year when agencies were baking-in a 50 per cent premium to BVOD equivalents. “The pricing now is more competitive with market,” is all he will say – and with more streamers selling ads, that downward pressure will likely continue across the piste.

Currency clash

Netflix has unofficially been touted as one of the parties involved in the Video Futures Collective, the Foxtel Media-led coalition aiming ultimately to build an alternative currency to OzTam.

Cox won’t comment on how that’s progressing. But he points to Netflix’s involvement in OzTam-equivalent Barb in the UK, as well as alternative mechanisms, and says the same applies in the US. The impression is that Netflix is open to both currency approaches locally.

Ultimately, he says agencies will trade off what they have been trading off for the last 20-odd years.

“I do think the currency in digital is impressions.”

Now Netflix could be about to unleash more of them. It started slowly in Australia, but in the UK and Canada has since rolled basic tier subscribers onto ads.

“There is more scale in our business than people realise,” said Cox. “There is still a lot of opportunity to grow."