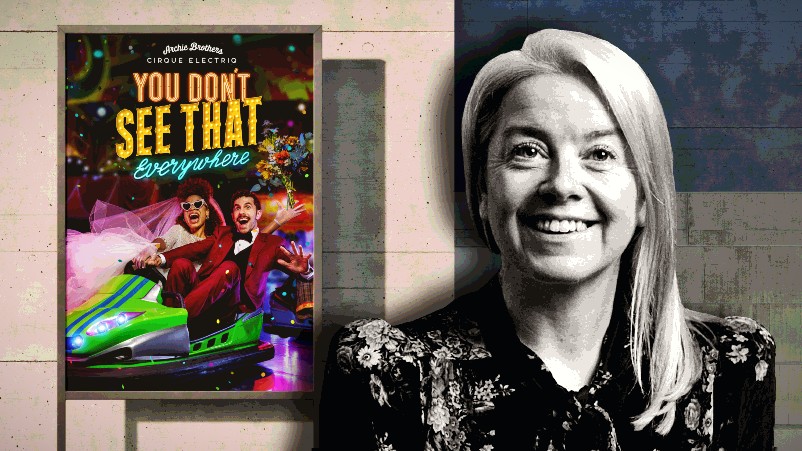

‘A baptism of fire’: Funlabs CMO emerges unscathed from three-year digital transformation, marketing overhaul as online bookings soar – backs free-to-air TV for next growth spurt

Oonagh Flanagan, CMO, Funlabs

“A baptism of fire, start to finish, and a much broader role than I anticipated going in.” Funlabs CMO Oonagh Flanagan isn’t kidding. She has driven a booking system rebuild, with online bookings at the leisure operator more than doubling as a result. She has replatformed the websites, implemented four Salesforce clouds, digitally rewired the phone system and has just completed the first phases of a customer resegmentation program, shifting from bucketing people by demographics to attitudes. Now she’s planning to do something a little less technical: Spend money on free-to-air TV.

What you need to know:

- A concerted and early effort in her role as CMO to drive digital transformation has paid dividends for Funlabs marketing chief, Oonagh Flanagan, who has seen online sales climb to 35-40 per cent of total revenue.

- The entertainment venue’s 18-month transformation plan started with online booking, but has since progressed into replatforming the websites of its portfolio of brands, which includes Holey Moley, Strike, Archie Brothers and Hijinx Hotel.

- Funlabs has also brought on Salesforce Cloud to connect the dots between marketing, sales and service and formulate a seamless view of customers that can drive its quest to improve lifecycle management and lift repeat visitation rates.

- The digital and tech improvements reflect a balanced combination of art and science for Flanagan at the entertainment brand, which has also seen her invest in brand strategy and refreshes, a new attitude-based segmentation project, and a media mix modern marketers know is critical to building long-term mental availability and brand distinctiveness.

- Against this, the CMO cites a softened market that’s seeing consumers continue to spend, but choose “one thing less” in their experiences. It’s a situation that’s putting pressure on where she puts her marketing and media dollars, but Flanagan is holding firm to her long-term plans.

- In FY25, that focus will hopefully extend to spending dollars in free-to-air TV, a channel Flanagan says has become more important to the Funlabs portfolio of brands given its strategic shift to build physical locations in mainstream locations such as shopping malls.

The best place to get the best possible reach on a broad level is still free-to-air TV. I think it’ll be a game changer for us ... I’ll be smart about where we appear, but to suggest people aren’t watching FTA TV anymore is a fallacy.

Flanagan is not afraid of tackling a challenge, nor is she one to shy away from the facts. And the fact right now is despite being in a high-growth phase, the CMO is facing a CFO wanting her team to do more with less.

So far, she’s kept focus and held firm, investing in a balanced combination of digital and technology capability delivering productivity, operational and shorter-term sales gains, with the data and insight, brand and media mix modern marketers know is critical to building long-term mental availability and brand distinctiveness.

But no one has any doubt there’s softer consumer conditions to contend.

“Customers are still there, they’re spending their money, but the way they choose to spend it can be different. You just have to open your eyes – places aren’t empty, people are just choosing different things,” Flanagan tells Mi3. She points to conversations with other entertainment and dining venues suggesting people are choosing fewer occasions – once a week, fortnight or month – and concentrating dollars on that.

“When I look at online sales, which is 35-40 per cent of total revenue, we’re seeing average transaction value is up year-on-year. But people are spending on slightly less, which says to me people are less likely to buy on behalf of their friends, as they’re worried about getting their money back. So they’re booking for 2-3 people over 4-5 people ahead of time.”

Then there’s the macro trend of younger generations drinking less alcohol. Flanagan cites a decline in booze spending in-venue as something the whole industry is witnessing, describing it as “the equivalent of one drink less”.

“Our venues are still pumping on Fridays, Saturdays and Sundays, it’s just that conscious decision people are making for one thing less than they may have done before,” Flanagan says. “But we know this is a moment in time.”

It’s one of the reasons why Flanagan is so keen to get Funlab’s brands on free-to-air TV in FY25, something she couldn’t stretch the budget to this year.

“Our brands are in the world of mainstream now and we are in shopping malls. For me, that means we’re for everyone,” she comments. “And the best place to get the best possible reach on a broad level is still FTA. I think it’ll be a game changer for us.

“We need to create mental availability and make sure we’re in front of them when they make that decision… We’re now in the situation where we’re playing in the right place, and I want to make we’re achieving those results. I’ll be smart about where we appear, but to suggest people aren’t watching FTA TV anymore is a fallacy. And it’s another channel in a mix; I’m not going to dedicate all dollars there but it’ll augment what we have done and give it a nudge to change that visitation number.”

Our venues are still pumping on Fridays, Saturdays and Sundays, it’s just that conscious decision people are making for one thing less than they may have done before.

Balancing the science and art of engagement

It’s been a balance of the science and art of marketing for Flanagan since she joined Funlab during Australia’s dance in and out of lockdown, when the only venues initially open were in WA. Since then, the group has scaled from 24 to 50 locations and opened three US locations under its Holey Moley golf entertainment brand under private equity ownership (TPG). Funlab has four key brands: Holey Moley, Strike, Archie Brothers and Hijinx Hotel, plus a couple of adjacent brands – La Di Darts and B Lucky and Sons.

In recent years, a strategic decision was made to move away from opening single brand locations to having a precinct model with three or more brands under one roof.

“The purpose was to encourage people to stay longer on their first visit and do more things but also have solid reason to come back and come back again after that,” Flanagan says, noting the strategy is paying off. “The penetration of multi-brand and multi-location visits has increased as well.”

As a whole, Flanagan describes her CMO posting as “a baptism of fire, start to finish, and a much broader role than I anticipated going in”. And it started firmly in the trenches of digital transformation, both a great opportunity and steep learning curve for the CMO.

The first milestone was $1.2 million funding to transform Funlab’s booking system. Working hand-in-glove with Merkle, Flanagan says the digital uplift fundamentally shifted conversion rates overnight, delivering massive impact on revenues. Online bookings went from circa 15 per cent to now sit between 35-40 per cent.

“Based on that being an immediate success, I went back to the board with what was our biggest ask on digital / tech. It was a journey to bring them onboard and give them confidence and I was grateful they gave me an opportunity,” she continues. “It was 18 months in total – we took the booking flow and extended it much further.”

Then came digitising smaller function bookings for up to 50 people, such as kids’ parties. “We built online all the bells and whistles you get talking to a human – upselling you the beverage package, buying a premium instead of standard 2-hour package – and it brings you through that journey,” Flanagan explains.

“We have doubled revenues from online functions booking since we launched that in November 2023. We now believe online functions in FY25 will account for more than 40 per cent of total function revenue, and functions are 18-20 per cent of our total business.”

Next up was replatforming the websites, moving away from Sitecore’s content management and digital experience platform to something “more pliable given nature and side of our business”. Funlabs opted for DatoCMS out of Europe.

“Sites are more composable, the team is in more control of what they need to do, and we’ve done a lot of work on SEO and now seen SEO performance rocket,” Flanagan says. “Primarily it was about the team being able to make changes without needing a developer, which we were more reliant on before.”

Arguably, the biggest piece of the puzzle was implementation of four Salesforce Clouds, which went live in November 2023. Salesforce had been used by the sales team but “had been bastardised to the point where it was impossible and wasn’t efficient”, Flanagan says. Marketing was previously using Emarsys, while concierge was stuck on Excel spreadsheets.

“Our vision was the idea that we could eventually have our sales, service, concierge and marketing teams all on the same platform, so we could have these sewed up, seamless conversations with our guests,” she says.

As well as Salesforce Clouds for marketing, sales and service, Funlab brought on Amazon Connect as the phone system. Flanagan admits to a few teething problems.

“You had the sales team getting used to a different view in a system they were used to, then concierge getting used to having a system at all,” she says.

In concert, staff have shifted away from a brand-led structure – where they often competed and overlapped effort – into more specialised areas including acquisition, brand and campaign, creative, retention, then data and tech. Head of data, Ben Wild, has been promoted to CTO and oversees data and insights.

“We’re starting to see real benefit from having that level of insights – for example… we’ve gone from having zero visibility from a service point of view to seeing what’s driving all the calls in. We can now assess that to see what other technical or digital advancements we can make that will reduce those calls,” Flanagan says.

A lot is around guests wanting to make last-minute changes to bookings, which has a knock-on impact.

“Imagine if they could do that with live chat or a bot-based chat or online in an app – there is lots of potential for a future roadmap,” Flanagan adds. “We also know our sales peak strongly at the end of FY and Christmas. Those tend to be less busy for service teams, so now they’re in the same system, how can we get service to augment sales with those peak times and drive efficiencies there as well.”

Flanagan feels she now has the infrastructure required to do “all the incredible things we know we can do”. “FY25 is about proving out those things and showing value. Purely from increases in conversion rate online and increase in online function sales, the investment will pay back well within the time we had predicted,” she says.

What we’re hoping to see is consideration will translate to higher visitation over the next 6-12 months. It’s why I’m keen to keep us on the airwaves and in front of eyeballs, I feel we have given it [Holey Moley brand campaign] a red hot go since November but I’d like to see the campaign sustained for 18 months and measure its impact over that longer period.

A fresh take on segmentation and lifecycle management

For the marketing team, Salesforce Marketing Cloud presents the opportunity to drive more automation, personalised journeys, and a better customer lifecycle approach. To make that happen, Funlab has just completed the first needs and attitudes-based segmentation for Funlabs with agency, Nature. Previously, the team used demographic-based segmentation.

As of May, it’s tagged 87 per cent of the database. Marketing is up for first use cases.

“We now know more at a guest level what’s likely to drive behaviour. I think we have been single-minded in some of messaging around our brands and different activities. Segmentation has blown up for us how differently we need to talk about the same thing,” Flanagan says. “We’ve been workshopping what does segmentation mean from brand level, proposition and statement, language, what and how we say things.”

The segments weren’t particularly surprising in themselves, although Flanagan realised her team had been working under the assumption more people care about Funlab’s competition than might be true.

“Four segments are primary and we’ll really focus on those differently by brand. But really, you either have the people who care about the game and like to compete… then others who are more about the social vibe. These are the two most interesting for us,” she says. “These things co-exist but can be quite tricky as these consumers want different things. I think we cater a lot more to social vibers than the competitive piece even though it’s where we placed ourselves. So we have a lot of work to do.

“Some of it is operational but most is in how we position, and making sure we encourage the segments to choose the right days of the week, brands and time of day to get the experience they want.

“We know based on data we have we have already started that journey. For a business of our size with our number of locations, we need repeat visitation. We have to win at that.”

Brand uplift

That’s where brand uplift comes in. In 2023, Funlab worked with Dentsu creative team on strategic work about each brand, purpose and crystallise that.

“It was another great moment for the team in our marketing journey as we hadn’t had access to those kinds of creative and strategy people in this business before. It was a real aha moment – this idea brands can coexist and be different but also similar,” Flanagan says. “We stopped fighting against ourselves and cannibalising ourselves when we’re putting the brands out in market.”

Working with Futurebrand, Funlabs has also been working its way through several brands to breathe new life in market.

“Strike was looking old – some CX research we did a couple of years ago said it was feeling a bit masculine and exclusionary,” Flanagan says. “We’d gone down a pathway creatively and just hadn’t paid attention to this changing face of people using that brand. Because we moved into mainstream locations, we hadn’t thought enough about that. So we wanted to give it a ‘glow up’ – it’s still fundamentally the same Strike brand and there’s minimal changes to the brand mark. But we really thought about who comes to our venues from a photography style, talent, making it feel fresh. And we brought in additional colours to give it a pop and make it feel a little more inclusive.”

Futurebrand additionally supported Flanagan’s team with the Funlab corporate rebrand a couple of years ago. “This was received incredibly well by guests but more importantly, by our internal mother funners. Our employer brand was very dated and didn’t sing to the vibrancy of the business,” she says.

Holey Moley is the current focus and is spearheading the group’s international ambitions. Last year, an integrated campaign across cinema, out-of-home, BVOD, Meta and a number of digital lifestyle publications, 'A Fun Way To Test Friendships', gave Holey Moley a leg up in the market.

“When I look at the impact we have had on the Holey Moley brand since we launched that campaign back in week 20, it has been significant in terms of like-for-like performance and brand metrics are off the charts. It’s done everything we wanted that campaign to do,” Flanagan says.

Today, Holey Moley’s prompted awareness sits at 77 per cent while consideration is 88 per cent. Flanagan compares this to other golf recreation brands such as X Golf or Top Golf which admittedly aren’t offering the same experience. Preferred venue is 54 per cent, and those who have visited is sitting at 55 per cent.

“What we’re hoping to see is consideration will translate to higher visitation over the next 6-12 months. It’s why I’m keen to keep us on the airwaves and in front of eyeballs,” Flanagan says. “I feel we have given it a red hot go since November but I’d like to see the campaign sustained for 18 months and measure its impact over that longer period.”

Archie Bros, the brand that grew the most last year in terms of physical locations (from four to 10), is the brand that needs most love from a brand perspective in FY25 for Flanagan.

“We have gone from 27 to 37 per cent prompted awareness, so a 10 percentage point increase. But we need to creep that up and drive-up awareness of that brand,” she says. “If you compare, probably three times more people know about Timezone than Archie Bros. While they’re not like-for-like, it’s still that mental block that there’s another arcade brand you could go after.”

FY25 compromises and commitments

Compromises are part-and-parcel of the CMO’s role and it’s the same for Flanagan. The ability to do everything at localised level is getting tougher, for one, yet in this environment, every single venue could do with that localised support.

“I know we’re going to go through some pain at local level for a minute, but if we can continue to focus on this state, metro, national level campaigning and focus, with small localisations in paid search and social, it will pay off in the long run,” she says. “I’m saying no to a lot of those very localised pieces, which is really hard for this business.

“But when you have a set marketing budget and set resources, you have to stay true to what you know over the medium to long term will work better.

“In FY25, some brands will be more equal than others. In order to really hit the message home on Holey Moley and Archie Bros, Strike and Hijinx Hotel will probably take a back seat. That’s just the reality of the situation we’re in. It’s tough as we love all our babies, but sometimes some babies need more attention and that is where we’re at. But most marketers in this environment are having to make the same kinds of decisions I’d think.”

Through all this, Flanagan cites “amazing” support internally to get the work done. “As with anything in digital space, it’s never done. Now we have all that visibility, you can see all the glaring problems remaining. I’m working with our CTO on what we tackle next,” she says.

“Certainly, we are really happy with what we have seen. In FY25, there’s lot of pressure on certain aspects of my team to dig deep, able to tell the stories we need to be able to tell with those things from guest and data point of view.”