Crunched CMOs task creative shops with running spiralling agency villages; full service rises for smaller brands, blue chips ditch retainers for projects

An Mi3 editorial series brought to you by

AMI, Tumbleturn Advisory, Qualtrics

Operational overhauls incoming: Tumbleturn's Jen Davidson outlines key operating model shifts as marketers bid to free-up bandwidth; Akcelo's Aden Hepburn sees opporunity for 'special ops' shops as brands signal preference for projects over retainers.

An Mi3 editorial series brought to you by

AMI, Tumbleturn Advisory, Qualtrics

Mi3 SPECIAL REPORT

Marketing & Customer Benchmarks: FY2025 Outlook

Three-speed marketing economy emerges. Remit creep, complexity crunch, KPIs shift, advisor-agencies consolidate. A new benchmark series for marketers and marketing.

Marketers are on average directly managing 10 agency partners – and Mi3's Marketing & Customer Benchmarks: FY25 Outlook suggests it's hogging too much bandwidth as their remits expand further into customer. Offloading roster management to a single lead agency is the single biggest shift in relative terms, per the survey of 105 marketers representing $3bn-plus in spend. Across the piste, the preference for project work is all but eclipsing retainers – especially across big spending brands. Tumbleturn Managing Partner Jen Davidson and Akcelo chief Aden Hepburn unpack the key FY25 trends, shifts – and opportunities.

Mi3 SPECIAL REPORT

Marketing & Customer Benchmarks: FY2025 Outlook

Three-speed marketing economy emerges. Remit creep, complexity crunch, KPIs shift, advisor-agencies consolidate. A new benchmark series for marketers and marketing.

Operating overhaul

Marketers already stretched by ever-broadening remits now have greater responsibility for customer being thrust upon them according to a broad sweep of marketer and customer chiefs conducted by Mi3 and the Australian Marketing Institute. That means even greater complexity – and Tumbleturn Managing Partner Jen Davidson sees knock-on implications for the agency supply chain.

Per 105 marketers surveyed by Mi3 – collectively representing $3bn-plus in marketing budgets – managing vast agency rosters is a time-sink many are now looking to reduce in order to free-up bandwidth.

The data shows marketers on average are working with 10 agencies “which is enormous”, said Davidson.

“So I think the big [FY25 focus] is going to be around the operating model of the future”. Davidson, whose firm manages agency pitches for brands, actually spends around half of her time trying to help marketers re-engineer those operating models.

Source: Mi3 Marketing & Customer Benchmarks FY25

Roster rethink

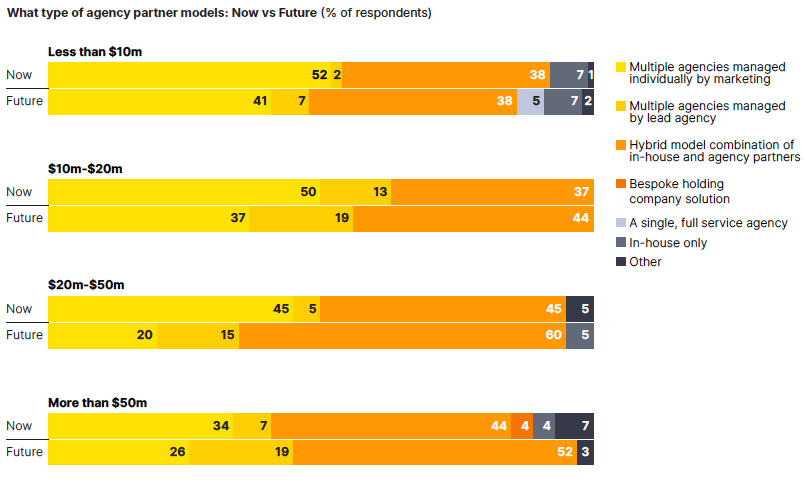

The Marketing & Customer Benchmarks FY25 report shows a "significant shift" in preference for one lead agency to manage the rest of the partners on the roster, said Davidson, “particularly for larger marketing teams”. The data suggests creative agencies are most likely to take that lead role.

The Benchmarks study finds just six per cent of marketers employing a lead agency management model today. But the data indicates it is set to be the fastest growing model in relative terms – and the shift is even more pronounced at bigger brands with budgets above $20m. But across all sectors and all budget sizes, marketers stated they aim to significantly reduce hands-on individual agency management.

“The headline number of 10 agencies that clients are managing – we see that every day, and it's so difficult to get rid of the silos and have the village working together. So I'm not surprised that there has to be another solution … If you're trying to manage 10 agencies and 10 different silos, having one lead agency [manage that], particularly creative, is a pretty significant shift, as is the move to hybrid – a combination of in-house and external [partners],” said Davidson.

“Interestingly the move to [pure] in-housing is flat … There is definitely nothing happening there.”

But the Benchmarks data highlights a marked trend towards full service agencies at smaller marketing organisations, those spending less than $10m.

“That is a shift. We haven't seen that before and it's only for the smaller clients, but it makes sense when you've got so many different channels and creative outlets that you need to cover. Having an extension of your team and one agency that can do everything is really appealing.”

Source: Mi3 Marketing & Customer Benchmarks FY25

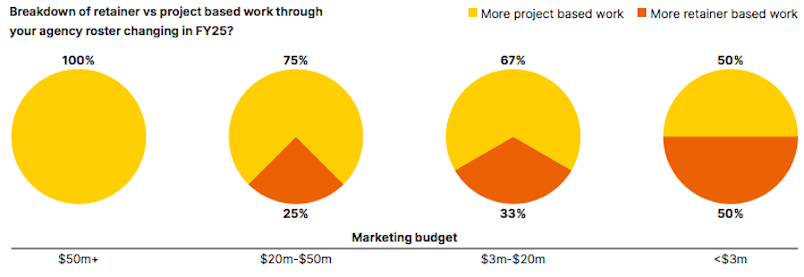

On the flip side, a major shift towards project work across the market – and particularly at the large end of town – creates increasing opportunity for ‘special ops’ shops to deliver high-grade specialist work, suggests Akcelo co-founder Aden Hepburn.

“We work with people like CUB and Asahi – they’ve gone probably outside their traditional roster and we’re now partnering with their in-house agency One House to deliver specialist projects as well,” said Hepburn. “I think that is happening across the board, where we [and other specialists] are brought in alongside large, established agencies to bring in some extra firepower.”

Hepburn said the Benchmarks report – which finds that 77 per cent of marketers see agencies as key partners – provides a counterpoint to a narrative that agencies are perhaps losing some relevance. He thinks that percentage will climb further if marketers bring their partners deeper inside the tent.

“The further upstream you can bring an agency, the more impact and the more powerful they can be inside your organisation,” said Hepburn. “It's super motivating to the strategists and the creative teams and the account group leaders to be able to take your problems, sit around the table and help co-create them or solve those problems with you. It really energises the agency behind it – and you'll get more bang for your buck every day of the week.”

Hepburn and Davidson, alongside Australian Marketing Institute CEO Bronwyn Heys and Qualtrics CX solutions strategy lead Ivana Sekanic unpack the reports key findings via this week's podcast.

Download the full FY25 Marketing & Customer Benchmarks report via the button below.

Mi3 Special Report:

Marketing & Customer Benchmarks: FY2025 Outlook

- Three-speed marketing economy emerges for budget settings

- B2B execs markedly upbeat v B2C peers

- Customer Lifetime Value (CLV) surges in future KPIs

- NPS retreats

- More in-housing & simplification coming for advisors, agencies

- AI: top five uses cases now and next

- Swing to performance marketing from brand investment

- "Brand" remains top KPI with CLV

- 18 marketers vox pop their top personal - not professional - CX moments, brand campaigns and loyalty programs they actually use. And do they actually "love" any brands... surprising

Three-speed marketing economy emerges. Remit creep, complexity crunch, KPIs shift, advisor-agencies consolidate. Read all about it in a new benchmark series for marketers and marketing.

DOWNLOAD THE REPORT HERE