Macca’s, fast food feel heat as ad market drops 6.3%; cinema, magazines rocket but digital and display slump

Cinema ad revenues surged 58.2 per cent in August as Deadpool and Wolverine created 'big cultural moments' that brands were ready for, unlike Barbie, said Val Morgan MD Guy Burbidge

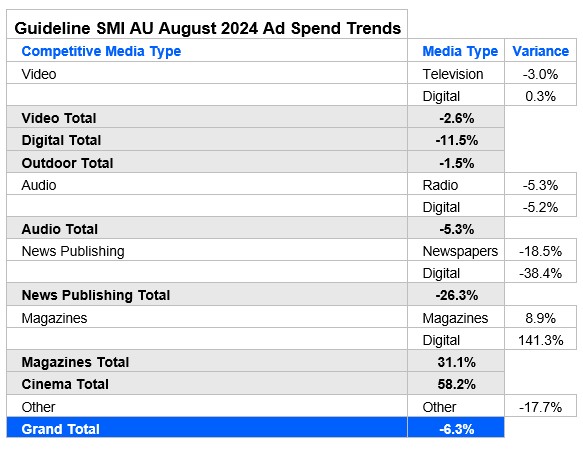

Stealth layoffs among marketing teams and media and agency groups since March were all signals for the crunch now hitting the advertising market with SMI reporting a 6.3 per cent decline in spending from the media agency sector and its largely blue chip and mid market clients. The restaurant sector led the retreat with a 24.2 per cent cut in spending in July – even the mighty McDonald’s and the powering KFC are said to be facing a material tightening in customer spend. But a digital ad decline of 10.6 per cent in August has been questioned by agency groups – a revised figure is expected.

If you look at global markets, [advertising] growth is around 6 per cent this year. Australia has an 18 month lag

With the exceptions from some of the oldest media in the advertising book – cinema and magazines – the ad market continued its pressure cooker status in July as media groups scramble for bookings and advertisers hunt growth.

GroupM CEO Aimee Buchanan said the market remained patchy in her portfolio with some advertisers tracking comfortably year-on-year and others hitting major headwinds. Overall she said Australia was lagging a global ad recovery – the US and UK ad sectors were tracking at circa 5 per cent annualised growth while GroupM’s local forecast for 2024 remains anaemic – flat to 1 per cent.

Nine and QMS reported share and growth gains from their Paris Olympics alliances – free-to-air TV’s decline of 3 per cent in August was one-third of the 10 per cent hit it took in July courtesy of its Olympics deal but tends to pull budgets forward, while globally advertiser Olympics budgets tend to land incremental increases, reflected in the US and UK markets, according to Buchanan.

One of the few bright spots were cinema and magazines – cinema rocketed 58.2 per cent, printed magazines were up 8.9 per cent and digital magazines up 141.3 per cent.

Cinema’s surge was due mostly to new releases – Deadpool will likely end up as the top box office hit for the year, already at $55m since it hit the screens on 25 July and Wolverine was also firing. Unlike the surprise Barbie hit, Val Morgan Managing Director Guy Burbidge said “we saw Deadpool coming a long time ago. Advertisers follow big cultural moments and audiences and Deadpool is one of them.” Another five big releases for the rest of the year means Burbidge is particularly bullish for cinema – Gladiator 2 and Wicked are among them.

More broadly, SMI reported a surprise 10.6 per cent decline in the digital ad market but that has been questioned by agency groups and a revised figure is expected after further reconciliations on late payments. Although fast food is off 24.2 per cent, government spending was the biggest growth category, up 33.4 per cent and household supplies and utilities up more than 20 per cent.

“The big factor in all this is we’re waiting for interest rate relief,” GroupM’s Buchanan told Mi3. Currently in New Zealand, Buchanan said interest rates were cut three months ago and green shoots were emerging in what has been all but carnage in the New Zealand media sector.

“If you look at global markets, growth is around 6 per cent this year. Australia has an 18 month lag. She said 2025 would bounce to circa 3.5 per cent growth and 2026 is currently forecast at 4-5 per cent growth. This year while Australia would be flat to 1 per cent, the US ad market would end 2024 at 5.8 per cent growth, the UK at 4.9 per cent and Canada up 5.7 per cent.

There have been some rumblings from media companies that SMI is not capturing media volumes from the rise of brands in-housing their media, particularly digital. Buchanan said while in-housing had surged about three years ago, she had “not seen any increase in in-housing across our client base.”