Market TV perceptions wayward: Ex-Seven CMO Mel Hopkins still backs 'Total TV', aligns with Nine CMO Liana Dubois warning marketers of 'dangerous swing' to platforms and dashboards over ROI

An Mi3 editorial series brought to you by

Mutinex

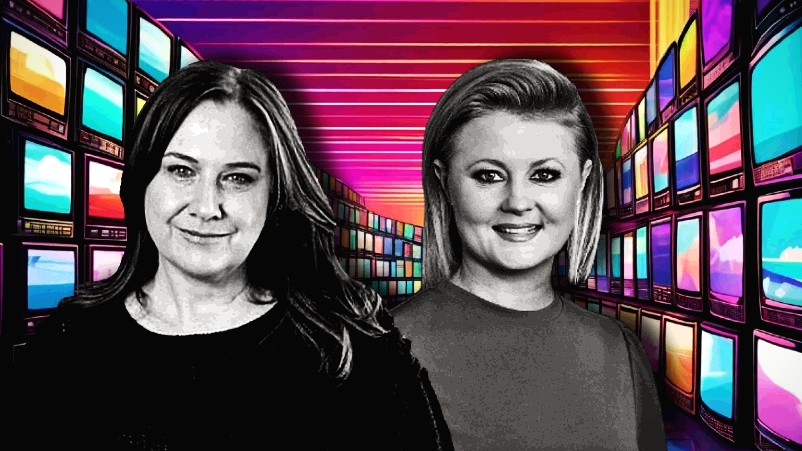

L-R: Former Seven CMO Mel Hopkins and Nine CMO Liana Dubois said the market's narrative around TV is wrong - 'Total TV' has the same audience as 10 years ago. .

An Mi3 editorial series brought to you by

Mutinex

Six weeks ago Mel Hopkins was rolled out of Seven amid a clinical round of cuts that added further fuel to the narrative that TV is in trouble as audiences bleed and revenue follows suit. But Hopkins, who as Optus CMO dumped the lion’s share of her media budget into Meta and Google, remains convinced TV is undervalued and undersold, says BVOD metrics and reporting are as good as anything the platforms can provide, and that the global streamers are likewise racing to “manage out cost”. Revenue challenges should therefore not be conflated with audiences, which Hopkins and Nine CMO Liana Dubois insist remain healthy – Dubois said TV reached 24.2m Australians last month. While media buyers last year said 2022 had marked “the biggest audience decline in the history of TV” and correctly forecast a 10 per cent revenue hit for linear TV as a result, Dubois said industry needs to get its terminology straight – literally – because TV delivered over the internet can still be linear TV. However it is delivered and consumed, “television today is reaching the same amount of people that it did 10 years ago,” per Dubois – and those numbers “are holding”. She warns marketers pulling out of TV for digital platforms and their dashboards are “dangerously” risking marketing effectiveness and should instead look beyond the shallow metrics they are being fed.

What you need to know:

- Mel Hopkins may be out of the Seven CMO hot seat but she’s still banging the drum for TV. She says it’s undervalued – and BVOD delivers targeted mass reach relatively cheaply if you know where to look.

- Hopkins admits she dumped 60 per cent of her media budget with Meta and YouTube when Optus CMO – because they had better data and measurement. She insists BVOD targeting and reporting is now at least their equal.

- Plus, while TV networks are cutting and restructuring, Hopkins said the global streamers are having to do the same. But nobody is punishing them as they are TV. Don’t conflate revenue problems with audience problems, she urged.

- Nine CMO Liana Dubois says TV is “reaching the same amount of people that it did 10 years ago”, but is just being delivered differently.

- Industry needs to stop talking about ‘linear TV’ declines, she suggests, because internet-delivered TV is also linear when consumed live and that aspect is growing.

- Dubois acknowledges strategic mistakes were made in culling youth programming, but insists younger audiences will tune-in if networks commission the right content.

- Marketers shifting budget to digital channels on the basis of snappy dashboards instead of actual ROI are playing “dangerously” with marketing effectiveness, she warns – and need to look beyond “blunt” metrics.

- Get the full download via the podcast here.

We need to separate where audiences are from the businesses that are going through legacy shifts and managing cost out ... the big challenge with a lot of the media platforms at the moment is they have profitability problems – you just have to look at Disney and Netflix, who are going through the same thing.

Profitability problems

Australia’s TV networks may be grappling with strengthening financial headwinds – but audiences, execs insist, are holding. Don’t conflate the two says former Seven CMO Mel Hopkins. Flying the flag for TV despite being exited in a deep round of redundancies by Seven last month, Hopkins says the narrative around the death of TV is “bullshit” and that the global streamers now coming for ad dollars are working through the same pain.

“My own experience in television is we need to separate where audiences are from the businesses that are going through legacy shifts and managing cost out,” Hopkins told a packed room of senior marketers at Mutinex’s Marketers & Money conference.

Hopkins said it was the same at Optus, where she was CMO before last year taking the marketing hot seat at Seven. “We didn’t have a customer problem, we had a profitability problem. And the big challenge with a lot of the media platforms at the moment is they have profitability problems – you just have to look at Disney and Netflix, who are going through the same thing, they're having to do a lot of restructuring.”

Television, insists Hopkins, remains “underrated” by marketers and agencies – but she was guilty of the same under-appreciation when overseeing Optus' marketing budget allocation. Why?

“The industry wasn’t very good at modernising itself," she said. "[At Optus] we spent 60 per cent of our budget with two big platforms [Meta and Google] that were able to give us a lot of data and measurement.”

TV can now compete on that front via VOZ data, claimed Hopkins, arguing the OzTam total TV currency provides a much more complete audience picture than that provided by big tech.

“It is the only completely independent measurement system for media that actually considers reach on 60 seconds, not one second, which is what a lot of the digital players do. So if you're looking at what I call active attention, television is really, really important.”

BVOD on a budget

Misconceptions about the high cost of TV advertising also crimped her investment while at Optus. “One of the things that had been bandied around was that you couldn’t do an efficient reach and frequency campaign without spending any less than $3 million and that television was cost prohibitive – and that’s where I call BS,” said Hopkins.

“You can go on television for $250,000 and be very, very highly targeted,” she added, citing Seven’s long-running soap Home and Away by way of example.

“Home and Away, live, gets nearly a million Australians watching that episode every evening … you’re talking 25-34 year olds. Then on a Thursday evening, it’s the most streamed drama in Australia, where everyone is binging all of the episodes. So you can very cost effectively buy shows where you are buying what I call active attention.”

She advised marketers in the room to buy BVOD, “it’s way cheaper than linear TV and it’s a really great way to go in”. Meanwhile, she said the “analytics behind [BVOD] are just as good as YouTube”.

The reality of what's happening with audiences is that … television is consumed both via an antenna and also via the internet [and via that combination] television today is reaching the same amount of people that it did 10 years ago ... 24.2m people last month.

Linear misnomer, audiences 'holding'

Nine CMO Liana Dubois likewise said the narrative that TV audiences are in decline is false – claiming it is driven by those with vested interests.

“The cohort of people that have a perception that TV is dying are falling victim to the cohort that wish it was true,” per Dubois.

Media buyers last year stated 2022 had seen “the biggest audience decline in the history of TV” after a Covid boost to free-to-air numbers the prior year, with investment chiefs predicting “linear TV will be around minus 10 per cent”, or circa $300m in revenue, as a result. (That proved to be correct.)

But Dubois suggested language is a critical issue and that the term ‘linear TV’ also applies to shows delivered via IP. “Linear means in a line. It refers to scheduled programming. In the BVOD environment, live refers to scheduled. It's what you're seeing play out on your antenna television. So as an industry, we've got to get this language thing sorted out.”

Linear and on demand audience reach combined, she insisted, is not declining

“The reality of what's happening with audiences is that … television is consumed both via an antenna and also via the internet [and via that combination] television today is reaching the same amount of people that it did 10 years ago,” said Dubois. “In the last month, 24.2 million people were reached by television … [either] through an antenna … through the internet, on phones, iPads, connected TVs,” she added.

While monthly reach figures and overnight audiences are two different things, Dubois said overall free-to-air audiences watching via antenna or internet were “flat” from FY23 to FY24. “It’s holding,” she added.

Youth reprogramming?

Yet all the signals are that younger audiences continue to migrate to other channels – as they have been for years. Dubois acknowledged some strategic collective mistakes, but suggested that if networks build it – content-wise – youth will return to TV.

“There absolutely is a conscious awareness from all of the television industry, that probably one of the errors we made some years ago – some decades ago now – was to deprioritise youth and children's content,” said Dubois.

Some of the rationale was that content had become “harder to commercialise as government legislated and advertisers self-regulated”. While channels like YouTube and TikTok have since become go-to channels for younger audiences, “we still see that if you build it they do come,” per Dubois.

“I've never seen so many teenage boys pile into North Sydney when the Today Show had [influencers] Logan Paul and KSI on for the launch of [their sports drinks company] Prime.” Likewise she said the kids are tuning in to newer Olympic sports like BMX, breaking and surfing.

Perhaps creating FAST channels around those categories would be a good start.

What you're seeing – quite dangerously, in some ways – is a swing of marketing dollars into [big tech] platforms simply because they can lift a dashboard that helps them to tell the uninitiated or uneducated C-suite around them that, with the greatest respect, don't understand marketing.

Dashboards vs. effectiveness

Dubois suggested a “significant” reason TV networks have seen revenue eaten by the likes of YouTube is "we have not kept pace nor led in measurement, with the exception of the arrival of VOZ and VOZ streaming”. Plus, “we've made TV quite complex and quite hard to buy, and it's actually not and it shouldn't be”, she added.

“We also, as an industry, need to get better at proving the efficacy and the impact and the return on investment of our asset,” per Dubois. “If you ask any of the global experts in marketing effectiveness, whether it's Dr Grace Kite from Magic Numbers, Les Binet and Peter Field, Adam Morgan from Eat Big Fish, James Herman [founder of Previously Unavailable], John Bradshaw [founder of Brand Traction] – ask any of those independent third parties … and they will tell you that television today remains the number one most effective channel to return dollars to a marketer. Yet we've not been very good at telling that story, nor have we been very good at having platforms and systems that can spit out that truth on a dashboard at the push of a button. Whereas our global competitors have been able to develop technologies that can do that for marketers,” Dubois continued.

“So what you're seeing – quite dangerously, in some ways – is a swing of marketing dollars into those platforms simply because they can lift a dashboard that helps them to tell the uninitiated or uneducated C-suite around them that, with the greatest respect, don't understand marketing. It's easier for them to tell the story that those channels work, because they can prove the attribution or the ROI … much easier than they can in television.”

Hopkins suggested marketers “need to take some responsibility,” in resetting KPIs and buying criteria for their agency partners.

“If you are treating CPMs across all premium video the same, it becomes really difficult,” said Hopkins, urging marketers to incentivise agencies on other metrics such as attention and engagement, and ultimately outcomes. But she said turning the tide will require TV networks to ensure they are as busy as the platforms in training buyers and pushing them towards their channels with better tools and data. “Google and Meta do that brilliantly.”

With the session being hosted by an econometric modelling platform, Dubois urged marketers to look beyond the metrics they may be being fed to what is actually delivering hard returns.

“If impact and ROI is important to you, go and measure that. Don't be beholden to the blunt, dull instruments that the television industry has been bound by for decades. Measure what is important to your business strategy … look for the facts, based on good quality data.”