Mi3 launches FY25 Marketing & Customer Benchmarks: 105 companies, $3bn spend, three-speed marketing emerges

An Mi3 editorial series brought to you by

AMI, Tumbleturn Advisory, Qualtrics

$3bn in marketing and customer benchmarks unpacked: Akcelo chief Aden Hepburn, Australian Marketing Institute CEO, Bronwyn Heys, Tumbleturn Advisory Managing Partner, Jen Davidson and Qualtrics Customer Experience Solutions Strategy lead, Ivana Sekanic.

An Mi3 editorial series brought to you by

AMI, Tumbleturn Advisory, Qualtrics

Mi3 SPECIAL REPORT

Marketing & Customer Benchmarks: FY2025 Outlook

Three-speed marketing economy emerges. Remit creep, complexity crunch, KPIs shift, advisor-agencies consolidate. A new benchmark series for marketers and marketing.

A deep, senior marketer study and report by Mi3, The Australian Marketing Institute (AMI), Qualtrics and Tumbleturn finds hard evidence across 105 top marketers responsible for $3bn-plus of budgets of an emergent three-speed marketing economy and upended KPIs and priorities. There are big question marks in key sectors such as retail around the effectiveness of personalisation efforts: Just 15 per cent think their CX is performing, though telcos are confident they’re smashing it. There’s also a major swing to performance media as CMOs seek instant results. The good news is that after decades of being perceived as the colouring-in department, 83 per cent of marketers say that has now shifted, with boards and CEOs perceiving marketing as a critical growth driver – though B2B marketers are far less certain. Problem is, marketer remits are exploding and the FY25 Marketing & Customer Benchmarks report, polling top marketers across all B2C and B2B sectors, finds the majority feeling ill-equipped to tackle what’s rapidly coming at them. AMI’s Bronwyn Heys, Tumbleturn’s Jen Davidson, Qualtrics’ Ivana Sekanic and Akcelo’s Aden Hepburn unpack the findings and implications for marketers, agencies and the broader supply chain heading into FY25 and beyond.

Mi3 SPECIAL REPORT

Marketing & Customer Benchmarks: FY2025 Outlook

Three-speed marketing economy emerges. Remit creep, complexity crunch, KPIs shift, advisor-agencies consolidate. A new benchmark series for marketers and marketing.

What you need to know:

- A three-speed marketing economy is emerging per comprehensive data collected over the last five weeks from 105 marketers representing $3bn-plus in marketing spend across B2B and B2B markets.

- The FY25 Marketing & Customer Benchmarks report finds a three-way split on investment trends across those pulling back hard, those holding and those powering into the new financial year. For many (43 per cent) performance or lower funnel investment will rise.

- Marketers now have heightened responsibility for customer thrust upon them, adding to already complex remits that are leading many to rethink their agency supply chains and how they are managed.

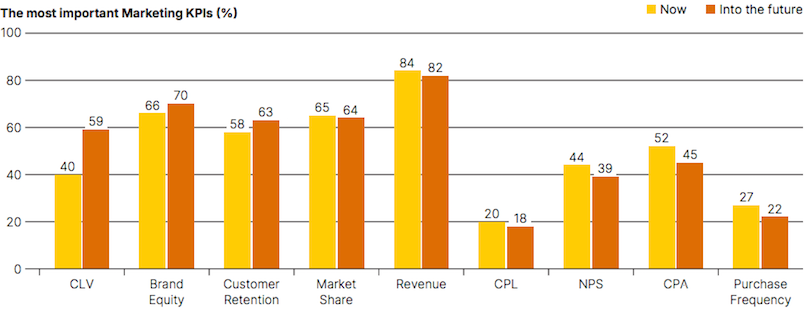

- In turn, KPIs are shifting hard to customer lifetime value (CLV) with metrics like net promoter score (NPS), cost per acquisition and purchase frequency in decline.

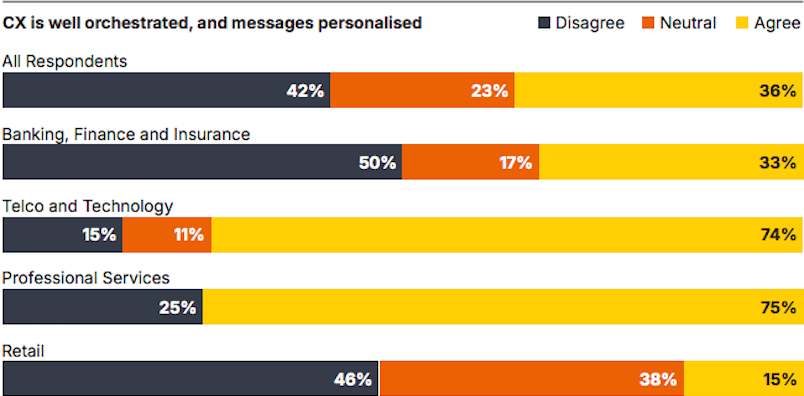

- Yet there is a customer experience disconnect. While telco and tech are confident their CX and personalisation investments are finely tuned and well executed, the retail sector is far less confident, with the banking, insurance and financial services marketers also split.

- There is deep cross-category concern that marketers do not have the capabilities to deal with what is rapidly coming at them.

- The good news is that across the piste, marketers seem to have won over the CEO and the board. Now they just have to deliver across whatever FY25 throws up.

- Download the report – here – to accompany the nuanced podcast expert view.

[The Benchmark report underlines] the need to be a master of data and analytics. That remains a cornerstone of effective marketing. If you can't [master] that, you can't be an effective marketer … You need to be able to use your data in the right way to be able to tell the right story.

Three-speed marketing budgets

The big headline on FY25 marketing budgets is the three-way even split between those increasing investment (31 per cent), those holding (34 per cent) and the companies that are cutting (34 per cent). In other words, 66 per cent of marketers in this study, conducted late May to late June, will either hold or increase budgets – or 64 per cent will hold or decrease. Take your pick.

Some companies see an opportunity to move on competitive retreats by lifting marketing investment in a tightening consumer economy. An elite set of marketers – five per cent of the total – say budgets for the coming 12 months are up 20 per cent or more.

Within categories, the media and entertainment sector is hurting most – and ongoing restructures and cost cutting underline the challenged environment: Half are reducing budgets, with the bulk by more than 10 per cent. (Which may be related to the study’s finding that 43 per cent of marketers are increasing performance channel activity and expenditure, with global platforms likely winners.)

A surprise decline is the travel sector where almost half (43 per cent) of companies are likewise looking to decrease expenditure.

At the other end of the scale, telco and tech is powering, with 47 per cent of companies increasing budgets by up to 20 per cent. Half of firms in building supplies and manufacturing are also ramping up FY25 spending, as are 41 per cent of those in the retail, QSR and wholesale sector.

It's one thing to be strategically aligned [with the CEO and board] but the operating model isn't supporting where the strategy is going. So that's the tension point for marketing.

C-suite mindset shift

Marketers’ perennial fear of being undervalued and overlooked by the c-suite appears to have almost fully reversed. Across the study, 83 per cent said their CEO and board “prioritises marketing” and view it as a “critical business driver”.

“That is a huge shift,” says Tumbleturn’s Jen Davidson.” And it’s not sector specific – it was pretty much across the board.” That’s especially true within B2C with 87 per cent of marketers increasingly confident of senior business influence and backing – but less so in B2B, fully 24 points behind.

The challenge is now fully delivering on the growth mandate being handed to marketers by top management. Davidson thinks that requires an overhaul of organisational structures – a challenge she sees day-to-day for marketers, which can exacerbate problems all the way through marketing’s supply chain.

“It's one thing to be strategically aligned, but the operating model isn't supporting where the strategy is going,” per Davidson. “So that's the tension point for marketing.” She thinks there remains much work to do to rework operating models to fit both the current and emerging environment – especially as remits continue to broaden and KPIs shift.

Source: Mi3 Marketing & Customer Benchmarks FY25

KPI new world order

The report strongly suggests a wholesale swing to customer and customer lifetime value (CLV) accountability across the market – ushering in a change of KPI world order and accelerating marketers’ remit to either own customer experience or partner more closely with those that do. B2B marketers predict CLV to become the single most important KPI, surging 21 percentage points to usurp even revenue as top KPI. B2C marketers also forecast CLV to climb 20 points, but it remains behind brand equity and revenue KPIs in consumer marketing by some margin.

Australian Marketing Institute CEO Bronwyn Heys thinks that’s a healthy indicator of marketing’s trajectory.

“I'm very happy to see that brand equity is a very much a foundational piece in terms of predicting the future success for the brand,” she says.

But however metrics shift, she urges marketers not to get caught up in the micro at the expense of the macro: “We need to remember why we're here: to grow brands, organisations and businesses.”

We went through a wave of having a traditional chief customer role who were custodians of customer experience. But more and more – as the report is pointing to – the marketing function has a really big role to play in how customer experience is being delivered … their roles are expanding.

CX disconnect

Qualtrics’ Ivana Sekanic thinks brand equity’s upward KPI trajectory suggests a much closer link between brand promise and customer experience – and measuring it, regardless of who ‘owns’ the customer.

“We went through a wave of having a traditional chief customer role occurring in the organisations who were custodians of customer experience. But I think more and more – as the report is pointing to – the marketing function has a really big role to play in how customer experience is being delivered … their roles are expanding.”

She also thinks that the drive to increase customer lifetime value means marketers will place even greater emphasis on building loyalty through “great, effortless experiences” that simultaneously deliver more data to keep the CX wheels turning.

Yet execution of CX appears to be underwhelming many. Per the Benchmark study, 42 per cent of companies expressed doubts about the effectiveness of their CX strategies being well orchestrated or personalised. Telco, tech and professional services were most confident in their execution, retail the least.

Personalisation problems

Akcelo’s Aden Hepburn thinks personalisation remains under-served, because too many brands are failing to map out what can and should be done.

“I think everyone is personalising, per se, but saying ‘happy birthday’ or ‘welcome back’, isn't true personalisation. Customers genuinely expect you to know more about them and as you build your experiences, you're collecting really meaningful data. There is an expectation of the end consumer, or the end customer, to have a brand leverage that data and help make their experience better across the board – and not everyone's truly doing that.”

Hepburn says McDonald’s is one brand that is getting closer to the grail of genuine personalisation at scale – and in turn continuously greasing its CX data grill.

“When we look at the whole McDonald's restaurant experience, we're thinking about everything from the mobile ordering app and it remembering your favourite order to going through the drive-thru and that welcoming you back and allowing you to log in to the loyalty program so you can redeem points for products, through to being in a known state in the actual kiosk experience. That means you are able to collect or redeem at that point [of sale] – which is very atypical to what brands and retailers can typically do,” says Hepburn.

“McDonald's has spent a lot of money investing in their tech stack … and they're now really starting to see the benefits of how you can design incredible customer experience across all of those touch points where they're all connected.”

Source: Mi3 Marketing & Customer Benchmarks FY25

Conversely fully half of those in banking, finance and insurance think their CX and personalisation efforts are falling flat, per the Benchmarks report.

Qualtrics’ Sekanic thinks financial services in particular is “still really burdened by some of the older systems that they have”, but she says the broader market doesn’t need to boil the ocean in a single burst – and underlines that personalisation at scale does not mean thinking about customers at an individual level. She uses another global burger chain, Shake Shack with circa 500 locations globally, by way of example.

“Through better consumer listening and really tailoring their message and their research, and stacking the three together, they've identified ways in which they can personalise taste for different customers … at a regional level.

“So they've got consumers they know that like to be told that it's 100 per cent Angus beef, for example. In other regions, consumers want to know that they don't use any antibiotics. That is an example of personalisation at a very large scale that appeals to that particular consumer set.”

Source: Mi3 Marketing & Customer Benchmarks FY25

Complexity hits capability

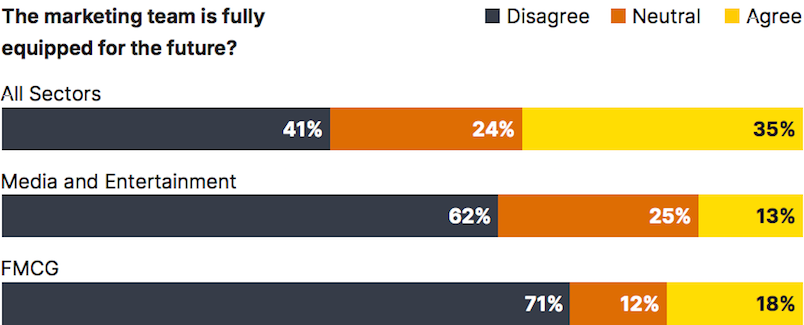

Just 35 per cent of marketers in this study say their team is “equipped for the future” as marketing remits continue to rapidly expand.

FMCG marketers are most acutely conscious of the looming capability gap – 71 per cent don’t believe their team is yet equipped and future-ready. Media and entertainment marketers feel only slightly better – 62 per cent say they’re not prepared yet with the capabilities needed for next.

AMI’s Bronwyn Heys says recognition of the problem is the first step – and marketers are now actively mobilising to address it, with rapidly increasing demand and uptake of the Institute’s marketer competency framework. The framework covers “25 major competencies that marketers need for the future – and for their future success,” says Heys.

While there is demand for upskilling across the piste, the Benchmark report underlines “the need to be a master of data and analytics”, she adds. “That remains a cornerstone of effective marketing. If you can't [master] that, you can't be an effective marketer – particularly today, where there is such an abundance of data … You need to be able to use your data in the right way to be able to tell the right story.”

In tandem, “what we're seeing at the Australian Marketing Institute is a real drive around commercial acumen – a real drive for CMOs wanting their teams to actually upskill so they can speak the language of business – and demand for that is really high.”

Which could explain the upturn in board and CEO confidence in marketing as a critical strategic function. Whatever FY25 throws up, and however metrics and KPIs shift, says Heys, "make sure you're commercial and make sure you're an adaptable talent – because then you're the talent who someone will be looking for when there's a role to be filled".

Get the full download – including what’s next for the agency supply chain as marketers take steps to cut complexity – via the podcast.

For $3bn-plus of hard data, download the Mi3 Marketing & Customer Benchmarks report via the button below.

Mi3 Special Report:

Marketing & Customer Benchmarks: FY2025 Outlook

- Three-speed marketing economy emerges for budget settings

- B2B execs markedly upbeat v B2C peers

- Customer Lifetime Value (CLV) surges in future KPIs

- NPS retreats

- More in-housing & simplification coming for advisors, agencies

- AI: top five uses cases now and next

- Swing to performance marketing from brand investment

- "Brand" remains top KPI with CLV

- 18 marketers vox pop their top personal - not professional - CX moments, brand campaigns and loyalty programs they actually use. And do they actually "love" any brands... surprising

Three-speed marketing economy emerges. Remit creep, complexity crunch, KPIs shift, advisor-agencies consolidate. Read all about it in a new benchmark series for marketers and marketing.

DOWNLOAD THE REPORT HERE