Image by DALL·E Pic: Midjourney

Editors' Note: Many Fast News images are stylised illustrations generated by Dall-E. Photorealism is not intended. View as early and evolving AI art!

Ad spend shows rebound,

Outdoor media in lead,

Market finds its ground.

May ad spend down 5.3% YoY, but market shows signs of recovery: SMI

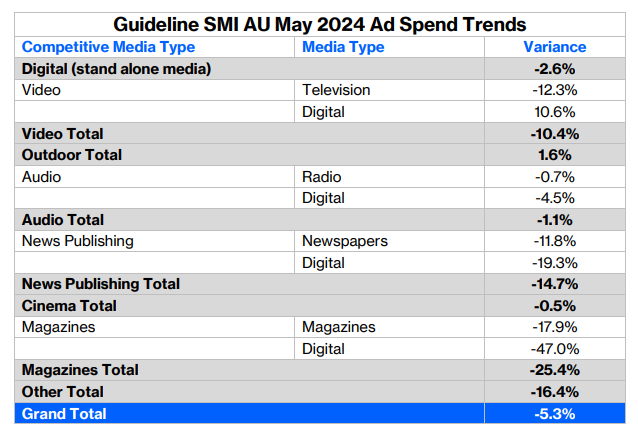

The latest figures from Standard Media Index (SMI) have shown that the Australian ad market appears to be slowly tracking back towards growth, with ad spend back only 5.3% year-on-year (YoY) for the month of May, compared to 5.6% and 6.6% in the two months prior.

SMI APAC Managing Director, Jane Ractliffe, said that the figures are liking to keep moving in the right direction, according to pre-liminary spending figures for June.

"The latest ad spend extracted from the payment systems of our agency partners shows that 90.5% of last year’s June ad spend has already been confirmed (excluding Digital) with a week of trading still to come, and that’s the highest level of forward pacings a month out that we’ve seen this year," she said.

The May figures saw digital magazines (-47.0%), print magazines (17.9%) digital news publishing (-19.3%) and television (-12.3%) witness the steeps declines in ad spent compared to the previous year. Total video saw a overall decline of 10.4%, offset by a 10.6% growth in digital video, while news publishing fell 14.7% overall.

There were some more positive stories, however, with cinema only down 0.5% YoY, radio down 0.7% and standalone digital 2.6% under May 2023 levels.

"Already we can see Regional TV and Regional Radio are reporting flat ad spend in June and Cinema bookings are up 11% year-on-year so there are definitely strong signs of market improvement," said Ractliffe. "We’ve noticed throughout 2024 growing demand for regional media with regional press being the star performer with double digit growth so far this year while regional radio ad spend is up 0.1% over the same time."

The outdoor media sector also continues to buck the trends, reporting a 1.6% growth in total bookings, the Streaming sector lifted 9.7% (mostly due to growth at SBS on Demand and YouTube) and bookings to Social Sites were up 3.2%.

"And in the linear TV world the decline in ad spend is the lowest in Regional TV with the total back 6.2% so far this year," said Ractliffe.

Among the key product categories, the growth drivers in May were Government (+13% YOY), Retail (+5.7%), and Automotive Brand (+6.7%). The insurance category ad spend is back 6.6%, while Communications ad spend is back 20%.

Year-to-date results show the market is back just 2.1%, with both the Digital (+4.2%) and Outdoor (+3.9%) sectors outperforming. As the financial year-end draws near, the total market is back just 1.8% from last year’s record total, with the largest growth being recorded by Outdoor (+10.3%).