Pic: Midjourney

Editors' Note: Many Fast News images are stylised illustrations generated by Dall-E. Photorealism is not intended. View as early and evolving AI art!

Retirement's new beat,

Aware Super helps find rhythm,

In life's later feat.

Aware Super redefines 'The Rhythm of Retirement' in new campaign from Thinkerbell

Aware Super, in collaboration with Thinkerbell, has launched a new campaign highlighting the evolving nature of retirement and the need for retirees to find a new rhythm of living.

Titled 'The Rhythm of Retirement', the new campaign builds on the superannuation company's 'Super Helpful' platform, targeting Australians approaching retirement.

The campaign emphasises that members can continue earning even after retirement with Aware Super.

Aware Super's head of brand, Sally Gross, said: “Aware Super, is the Super Helpful retirement fund. This new work puts a focus on people approaching retirement and highlights the fact that they can keep earning even when retired with Aware Super”.

Senior brand manager, Jo Elford, said: “Not many Aussie’s are aware of this, so we’re keen to help as many as we can, have their best possible retirement. We’re really proud of this work and how it represents and reimagines retirement for this cohort."

The campaign will be rolled out across TV, OOH, radio, and other channels, with media handled by Atomic 212, production by MOFA, sound and music by Rumble Studios, editing by ARC Edit, and animation by Cadre Pictures.

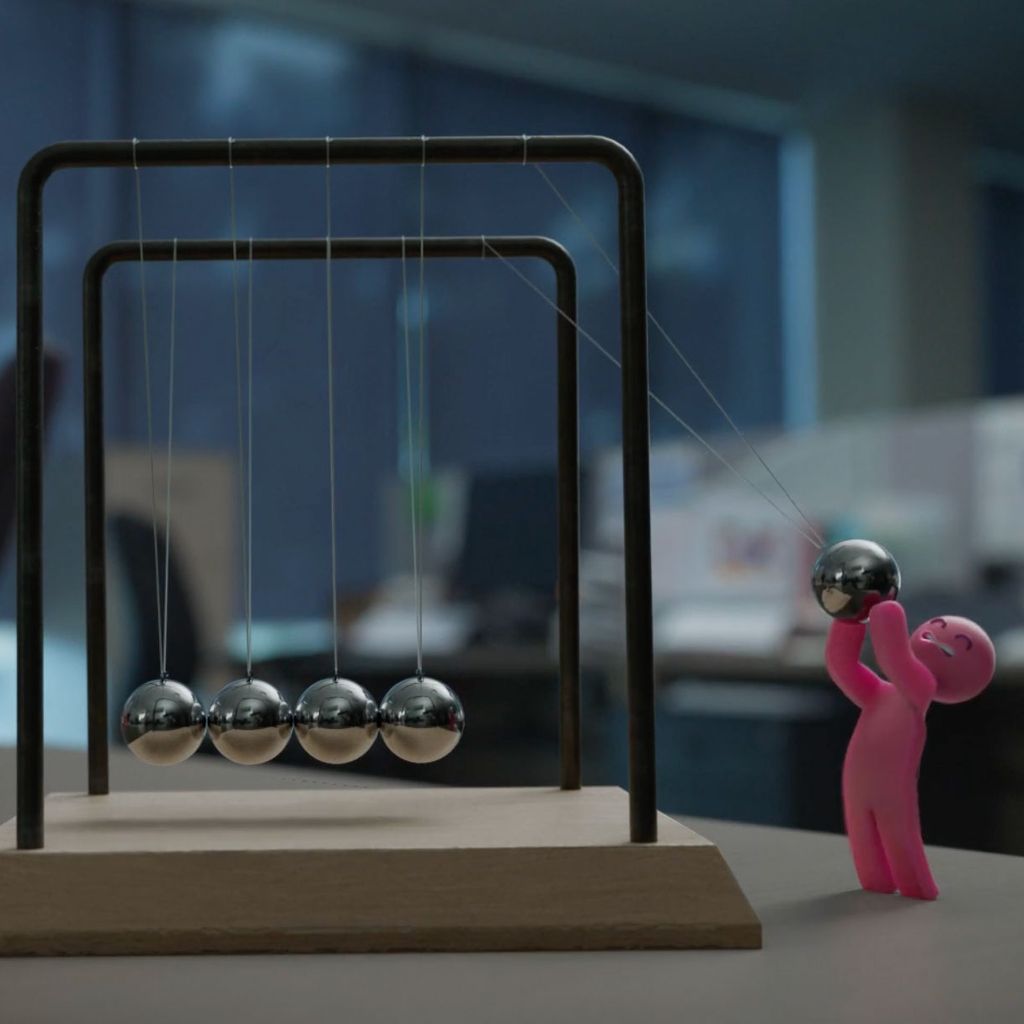

Head Thinker, Thinkerbell, Belle Thompson, said: “We’ve developed a strong platform in ‘Super Helpful’, and we’re really proud of this new work we’ve created together with the team at Aware Super. Building off the platform, and staying true to our use of distinctive brand assets, or Sam as we like to call them, the new work helps people navigate their new retirement needs.”