Deep Dive

Deep Dive Library

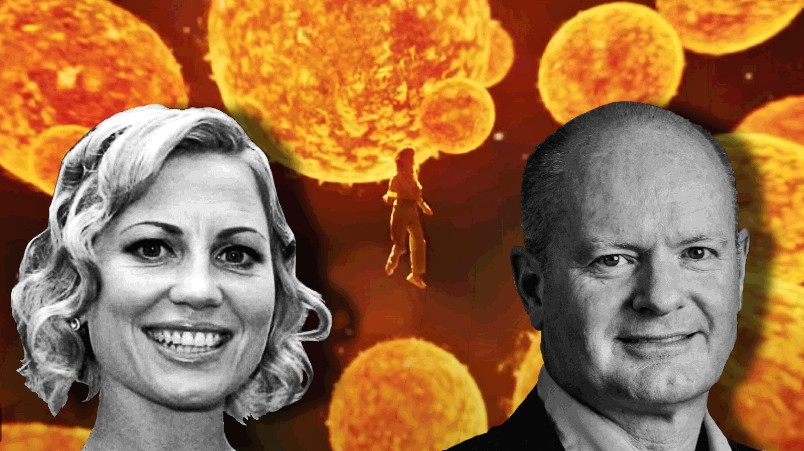

It’s taken a couple of years, but the LinkedIn-backed B2B Institute’s mission to flip business-to-business marketing’s focus from performance to brand building – encapsulated by the Ehrenberg-Bass Institute penned 95:5 rule – is starting to land, crucially in the boardroom and exec leadership echelons. LinkedIn’s polling of B2B CMOs and CFOs suggests most are planning to spend more on brand this year and are beginning to grasp that rational, product-focused messaging doesn’t cut it. The likes of MYOB, Canva and MailChimp are setting the creative standard, reckons LinkedIn’s Global VP of Customer Science and B2B Institute Global Head, Melissa Furze. But there’s still a long way to go, as Adobe’s APAC and Japan VP of Digital Experience Marketing, Duncan Egan will attest. Adobe, he admits, is challenged with brand awareness – or more accurately, category awareness, when it comes to being known as a CX company versus its Photoshop legacy. He’s hoping to change that with a full-funnel push – and convince the sales-focused short-termists that brand both fuels demand and ultimately speeds conversion.