Deep Dive

Deep Dive Library

Another salvo in the fast approaching privacy regime set for tabling in parliament in August was fired last week by the ACCC around how personal information is collected, used and sold by data firms – Experian, Nielsen, Publicis-owned Epsilon and Woolworths-owned Quantium were among those flagged by the competition regulator last week in its eighth interim report as part of the multi-year Digital Platforms Inquiry. But the regulator has gone much further than putting these companies in the spotlight - it originally called them ‘data brokers’ but industry players in their submissions to the ACCC protested at the descriptor because they asserted they did not trade in personal information. Rather, they enabled companies who bought their services to segment and target audiences with shared attributes through the use of information that wasn’t personally identifying. So the ACCC changed the term to “data firms” in last week’s Data Products and Services interim report and, for good measure, broadened the scope of what a data firm is to what UNSW’s Business School’s Professor of Practice and Principal at Data Synergies, Peter Leonard, says now makes “every firm in this economy a data firm.” And in the short-term, that’s not good news for most companies because their data readiness and maturity is not matched by the “fundamental change” which will force everyone to “rethink their understanding of what even defines personal information” according to ADMA’s Director of Legal and Advocacy, Sarla Fernando. Leonard and Fernando are joined by Capital Brief’s Legal and Regulatory Affairs Correspondent, Laurel Henning and Civic Data’s founder, Chris Brinkworth. And for a tantalising teaser, Future Media’s Ricky Sutton lays out the changes Google is making to its search engine which is already seeing organic referral traffic to publishers abroad drop 40 per cent – brands, he says, are facing similar declines. Here's the topline takeouts from this week’s podcast panel of experts on the ACCC’s new intent for tougher definitions, enforcement and prosecution. Listen to the podcast here, it's rich pickings.

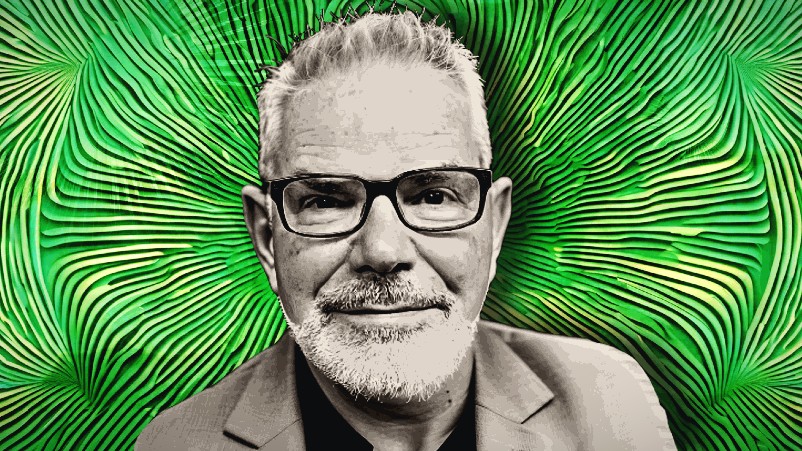

Five years ago media ecologist Jack Myers made a prediction in the second ever edition of Mi3: By 2025 media would be largely automated, almost totally AI-informed and just a quarter of sales would remain with people and ideas. It happened faster than even he thought. Now Myers predicts that within 12-18 months, most media planning will be entirely machine-led – and by 2030, “80 per cent or more of all media planning and buying will be done without human intervention”, with major implications for jobs. Meanwhile, AI is already being turned in on itself to spotlight where the money is being wasted amid a “programmatic backlash”. The “machines are actually checking on machines,” says Myers. He forecasts an incoming wave of consolidation across major media companies and a “collapse of the programmatic marketplace”. For agencies, “the re-emergence of consolidated agencies”, i.e. creative and media back together, “is the big story of 2025-26” with generative AI forcing the toothpaste back into the tube. “So I believe in 2024-25, we're going to see massive consolidation, massive contraction, and then in 2025, 26, 27 a rebirth of the advertising business.” But 2025, he warns, will be tough. Plus Myers – who likewise called out retail media’s impact early – sees a “can of worms” for the sector as analysts uncover instances of arbitrage of non-retail inventory within some retail media networks. He also has reservations on the surge by media owners into data clean rooms – Disney alone is operating 100-plus – “Who is cleaning the data? Who is validating that it is clean?”