Mi3’s top Marketing stories of 2023: Marketing, ad effectiveness debate rages; Prof Byron Sharp – agent provocateur or enfant terrible? In-housing and Australia’s CDP, martech ‘bender’

If Mi3’s fancied audience of senior industry leaders across brands, marketing, customer tech, media and agencies signalled anything this year it’s that the broad appetite for chasing better marketing and advertising effectiveness has not waned on the industry heat map over the past three years. Whether its Mark Ritson, Byron Sharp, Binet & Field, Karen Nelson-Field or flagship cases studies of marketers and brands applying the theory, effectiveness themes again dominated Mi3’s top stories for 2023. Mi3’s coverage of Ehrenberg Bass’ Prof Byron Sharp sparked much global debate over his “Singapore diss” of other marketing and effectiveness commentators – Mi3 loves an agent provocateur – or is the world’s leading marketing academic an enfant terrible? Outside those lofty themes, there was a newcomer that burst onto the marketer’s radar this year – customer experience and customer-facing tech. Interest in Mi3’s coverage of marketing technology, CDPs, decisioning engines, ecom, AI and the impact they’re having in the real world of business deployment and impact has surged this year – in no small part down to the arrival of Mi3’s Technology Editor Andrew Birmingham. Expect more tech and more marketing coverage on the stuff that matters next year with the recent arrival of Associate Publisher and Marketing Editor Nadia Cameron. For now, here’s the top 30 marketing stories for this year.

30.

We have seen match rates with two leading Australian insurance businesses at 45 per cent to 60 per cent, which is the first win.

To CDP or not to CDP, that is the (first) question. Clockwise from top left: Sean Cooper, Vanya Mariani, Richard Taylor, Nigel Dalton, Gagan Batra, Jo Gaines, Andrew Palmer, Adam Barty.

CDP Investigation Part 3: Buyer Beware – integration challenges far more difficult than vendors let on; ANZ, Carsales on where to start, hot tips; experts on industrial sized cans of worms

Part three of Mi3's investigation into the CDP market interrogated the difficult in-between moments marketers must navigate. Buyer beware – it’s much messier and more complicated than the slick sales pitches let on. Fights over data ownership, significant technical integration problems, and serious limitations with all those out-of-the-box connectors the vendors like to brag about creates risks to project deadlines, and in the worst cases, career advancement. Sometimes just identifying who has credentials and getting them to share can take months. And then there’s the simple (yet apparently not) question of whether you need a CDP at all. ANZ, Carsales and a host of other execs at the pointy end of CDP implementation weighed in on this one.

29.

Older age groups are spending ahead of inflation, which means that not just that they're spending more dollars, they're buying more stuff across many categories ... Conversely, younger people are reducing their consumption.

Old is cool again: Commbank iQ, Woolworths-owned Quantium mine 7 million account customers to uncover 50-plus segment now powering consumer economy, pressured younger set bunkers down, spends less…mostly

TV networks, with more than a sprinkle of self-interest around their ageing free-to-air TV audiences, have been saying what The Commonwealth Bank and Quantium proved back in May with millions of bank customer spending records. The free-spending, cashed-up, low-pressured 50-plus set have got all the discretionary spending bucks and they’re throwing them around. The younger set, prized by advertisers, are in retreat. While across the demographic board some of the richest, hippest suburbs are under most pressure. As interest rate hikes started to bite hard this year, Commbank's new quarterly consumer spending series, crunching Commbank-Quantium data from 7 million customer accounts, gave marketers a hard but robust picture of the changes coming down the track.

28.

We've seen a lot of developments where you just feed your business signals into the black box of the walled gardens and then you get your creative delivered and the AI is optimising… you can't really control it anymore – and that’s because of privacy laws.

Dream flight: How Virgin’s decimated marketing team launched an automated creative campaign with 80,000 'full funnel' ad variants, lifted revenues 30%... but now worries brands must cede more control to Google, Meta under new privacy regime

The killer combination of Covid and voluntary administration decimated Virgin Australia’s marketing team to a handful. But under new private equity owners, Bain Capital, Virgin’s head of paid media, Ben Will, was finally able to deploy a massively scaled and personalised programmatic ad campaign that he had been dreaming about for years, though he seriously stretched the Virgin team and its media and dynamic creative partners at PHD and Adylic in the process. After launch, it took months to fine tune but they survived. The team ultimately lifted revenues 30 per cent and won the MFA’s top award for real-time marketing for their efforts. But Will is worried new privacy laws will hand much of the control he currently has to "test and learn" to the walled gardens like Google and Meta, where their unknown tools and AI do all the optimisation without any visibility for advertisers.

27.

In the majority of cases, new customers don't have anything that's doing this, they're solving the problem with sticky tape and string, and with a number of non fit-for-purpose components.

Pavel Bulowski, Billy Loizou, Liz Adeniji, Michelle Weir, Tim Armstrong, Kevin Doyle, Will Griffith, Gabbi Stubbs and Simon Pereira unpack CDP business imperatives – and where the gaps still lie.

CDP Investigation Part Two: Identity, media efficiency and effectiveness, personalisation and privacy driving uptake – prepping for AI could fuel a second wave

There are north of 30 corporate use cases driving the current stampede for Customer Data Platforms (CDPs), per industry analysts like Gartner. But when Mi3 grilled tech industry heavyweights and their customers, only a few consistently emerged: digital identity, media efficiency and effectiveness, personalisation and regulatory compliance — especially privacy. And now there's a new incentive: It turns out the work required to get CDPs humming also helps organisations become more AI ready. Part two of Mi3's CDP deep dive packed-in insight from marketing and digital leaders from University of Tasmania, Nova Entertainment and Suncorp plus execs from CDP platforms Segment, Tealium, Adobe, Salesforce, Celebrus, Amperity, Meiro, and more to get a handle on what's driving demand – and where capability gaps remain a challenge.

26.

If I made 20 phone calls to CMOs at the top end town, none of them would be aware of the ANA ad fraud report – 80 per cent don’t give a shit. We still have marketers here that fundamentally rely on agencies to do their job. They are so stretched, they don’t have the resources or time for this.

From left to right: Atomic 212's James Dixon; Virgin's Ben Will; Tumbleturn Media's Jen Davidson; OMG's Philip Pollock; Penfolds-Treasury Wines' Ben Oliver and Trinity P3's Darren Woolley

‘It’s a goddamn lockbox’: History repeats as $20bn wasted in global online ads, Australian brands indifferent on scrutiny versus other media channels

Another year, another mind-bending report on the scale of wastage in the digital ad market – $20bn in the US alone. But most Australian marketers remain blissfully – or negligently – unaware. Scrutiny and understanding of programmatically-traded advertising is all but absent within most brands. Their media agencies are rarely challenged on digital ad schedules yet they will pursue line-item auditing of other media with rigour. Virgin’s Head of Paid Media Ben Will is one of the few to call it: “The ad industry is putting a lot of trust into data without really challenging it.” Ben Oliver, digital media lead at Treasury Wine Estates in-house agency Splash, is another. "When you're trying to get an insight into what's going on – and I won't name names – but there are some programmatic partners who just won’t give you any." Oliver is turning to outspoken US ad fraud analyst Dr Augustine Fou for answers he can't get here.

25.

Audi were able to get to a point where they could forecast within 32 units [i.e. 32 cars], what their campaign spend was going to get them in terms of sales ... We're aiming to beat Audi.

Michael McConville: Australia is only "scratching the surface" of what's possible with advances in econometrics. But that's about to change, putting CMOs back at the top table as growth's primary engine.

‘Binet & Field, Mark Ritson, Byron Sharp applied’: Cummins & Partners chief backs Mutinex deal to beat Audi’s famed econometrics prowess, charge brands less, earn more with new model; prove creative’s business impact

Cummins & Partners CEO Michael McConville returned home to Australia last year after five years at the helm of adam&eveDDB, home of effectiveness guru Les Binet – and where he was steeped in econometric modelling with the likes of John Lewis and Volkswagen. One marketer within the Volkswagen Audi Group, Benjamin Braun, nailed econometrics to the point that he could “forecast within 32 units [i.e. cars] what their campaign spend was going to get them in terms of sales”, per McConville. He’s aiming to go one better, probably with clients like Jeep and McCain although he won’t say just yet, after inking an exclusive creative agency deal with Mutinex for econometric modelling in real time. "This is a form of applied marketing science … and agencies won't have excuses anymore to not put this sort of thing forward to clients”, per McConville. Plus, he’s using it to change Cummins & Partners fee structures: less upfront, more of the client business upside later. “Creativity won't be talked about as a big bet anymore,” reckons McConville. “It's a sure thing.”

24.

Our historical challenge has been making digital experiences relevant for each individual customer. Our new decisioning engine can calculate hundreds of propensity scores in real-time, where we previously would have used pre-defined segments to make decisions. This didn’t give us the insight around what the customer was doing 'right now'.

Suncorp CIO Adam Bennett: Suncorp says it has deployed more than 465 robots, automated over 24 million transactions, and saved up to 600,000 hours in FY23

Suncorp technology chief says decisioning engine trumps segmentation as massive transformation program sees customers flip wholesale to digital

Suncorp is using a decisioning engine to drive real time one-to-one conversations with customers as part of a $30m customer experience management overhaul. But that investment is dwarfed by its Digital Insurer program, said to be an order of magnitude larger – and already paying dividends with customers making the shift wholesale to digital channels. Digital transactions increased for the group’s mass insurance brands across home, motor and CTP products while digital channels now deliver 68 per cent of all sales and 44 per cent of all service transactions. Meanwhile investments in AI and automation have already saved the equivalent of 300 full time equivalent positions, according to CIO Adam Bennett.

23.

Westpac is not getting the bounce that the other three of the top four [banks] are enjoying. Westpac is certainly struggling in terms of turning it around ... The more brands you have [i.e. Westpac, BT and St George] can lead to dilution of effectiveness. Whereas CBA is investing into the one Commbank brand.

Brand Finance MD Mark Crowe: Declines in brand strength will have hard financial and negative growth impacts.

Qantas set for financial hit as brand strength drops; Jetstar worse, Westpac, Macquarie struggling; negative revenue, pricing, growth impacts – but Optus recovering; Australia's 20 brands facing steepest strength declines

Some of Australia’s biggest brands across airlines, banking, retail and telco are set to take a financial hit due to underinvestment in marketing, innovation and customer service, leading to significant declines in brand strength and value, according to the world’s leading brand valuation firm. That will play out over the next year or so as they lose some of the network effects and efficiencies delivered by strong brands – including pricing power and ability to command higher premiums, customer acquisition and loyalty, recognition, consideration and recommendation, directly impacting revenue. The good news for strong brands is that previous investments insulate them from economic downturns and systemic shocks, according to Brand Finance MD Mark Crowe. He’s compiled the 20 Australian brands with the biggest declines in brand value and brand strength for Mi3. Optus was recovering fast – at least it was until 8 November...

22.

A key takeout is that cost saving is factor, but not the main aspect for brands in-housing. I was expecting cost to be cited as the key benefit. But brands say it’s about speed, agility and responsiveness to business needs – and crucially ownership of data.

Report authors (l to r) Chris Maxwell, Lution; Alexander Concannon, Employment Hero; Vinetha Manthen, Optus; Dave Annesley, Youi; Ben Oliver, Treasury Wine Estates.

In-housing: AFL, Asahi, Betfair, MYOB, Optus, Seek, Specsavers, Sportsbet, Treasury Wine Estates, Youi bid to scale units, rate in-house agencies better on all key metrics bar one

Brands spending circa $600m in media – including AFL, Asahi, Betfair, Employment Hero, Keypath Education, MYOB, Optus, Seek, Specsavers, Sportsbet, Treasury Wine Estates, TTI and Youi are almost all scaling up in-house agency operations and expanding their remits. Per the first study of its kind in Australia, all brands surveyed on their in-house operations rate them higher than outsourced counterparts on all key metrics – bar one.

21.

Data coming through suggests that within Australia, 50 per cent of marketers haven't been trained in writing briefs and the briefing process. That's half of marketers that operate in this country. So invest in your staff.

Matt Davies (left) and Pieter-Paul von Weiler: Half of Australian marketers have not been trained on how to write briefs, or the briefing process. And that's a problem.

The $200bn black hole: Marketers wasting a third of budgets by giving agencies crap briefs with non-existent strategy; here’s the proof and how to fix it

Professor Mark Ritson was right all along: “90 per cent of marketers fail to brief agencies effectively, and their failures begin with a total lack of strategy.” The headline findings of the Better Briefs Project and its research spanning 1,700 marketers and agencies make for grim reading, with a third of ad budgets being wasted as a result of bad briefs. In Australia, the data shows 50 per cent of marketers have not been trained on how to write briefs, so half don't know what they are doing. Unless things improve, marketer tenures – and standing within boardrooms – will continue to decline. But there are some simple fixes, say Better Briefs co-founders Matt Davies and Pieter-Paul von Weiler. This story from 2021 is still picking up hits two years later – so hopefully those Better Briefs fixes are getting some traction. It's well worth a re-read for both marketers and agencies.

20.

60:40 is supposed to be the magic formula for you. Spend 60 per cent of your money on advertising, whatever that is, no one's really clear, and 40 per cent on activations. But people have no idea what activations really are and there's no guidelines. So really, you can spend whatever you like. But it sounds good to have a formula.

Byron Sharp: Focus on mental and physical availability to grow. Keep advertising and try to reach everybody, consistently.

Prof. Byron Sharp skewers Binet & Field’s 60:40 rule, smashes attention metrics, BVOD ad stacking, multi-channel amplification effect; tells marketers to sack agencies preaching share of voice quotas and bet the farm on always-on reach; Ritson backhanded

This one remains the most read story on Mi3 full stop, though will probably get overtaken by something AI related in the next year or so. In August 2022, Prof. Byron Sharp lobbed a few bombs at the Mi3-LinkedIn B2B summit, polarising one or two people. Marketers adhering to Les Binet and Peter Field’s formula around brand to performance budget ratios are basing investment decisions on questionable data per the Ehrenberg-Bass supremo, who also let rip on attention metrics, dynamic creative and cross-channel network effects while giving rival professor Mark Ritson a backhanded complement.

19.

James likes to win … He doesn’t want us sitting as an old linear television station that is losing share.

Seven marketing and audience chief Mel Hopkins: Brand investment can turn TV's audience fortunes around and drive earnings growth – but there's a transformation job ahead to see off the streamers.

Why Mel Hopkins left Optus for Seven CMO gig: Not putting 'lipstick on a pig’; Big transformation plan looms – sharpening marketing, hitching it to the P&L – and her take on the Optus cyber attack

Mel Hopkins said back in May that she hadn’t gone to Seven “to put lipstick on a pig”. The former Optus CMO says CEO James Warburton wants “total transformation” and she’s hatched a four-point plan, which includes linking Seven’s marketing activity and investment directly to earnings and the P&L “in real time”. Anything less, she says, “and I am failing to do my job”. That means growing both the brand and its equity as well the number of eyeballs tuning into Seven's assets as a destination – fast. Hopkins thinks Seven Plus can outpoint the streamers and reckons their ad-funded tiers may fizzle as Covid-driven growth wanes. But she needs to build sharper digital marketing smarts. Hopkins also opened up on the Optus data hack, a cautionary tale for brands.

18.

Duplication of reach – are we reaching new buyers or paying more to reach the same people – was tricky to work through, but that is why we think agencies are best placed to handle that aspect. They have better tools [to stitch those things together].

Better use of dough: Goodman Fielder CMO Christine Fung and Initiative strategy and product chief, Chris Colter.

Goodman Fielder breaks ranks, hands trade marketing budgets to Initiative; CMO says retailer media ‘a significant opportunity for agencies’; Initiative plots dedicated retailer division

Goodman Fielder CMO Christine Fung is backing combined trade sales and marketing budgets to deliver better bang for buck. The FMCG firm has overhauled its investment approach to drive stronger returns via Australia's rapidly growing retailer media market – and handed trade budgets, usually handled by its sales team – to Initiative. Both brand and agency think it could be the shape of things to come, presenting a major growth opportunity.

17.

We see around 2,000 companies a year and last year we invested in six. Mutinex ticks all the boxes of what a great B2B software company in the early stage looks like.

Coming to America (L-R): Equity Venture Partners' Allen Zhu and Justin Lipman; Mutinex co-founders Henry Innis and Matt Faruggia. "Fundamentally, we have to win in the US market," says Innis.

Mutinex valued at $37m after VC buy-in, EVP eyes 10x return as CFOs back sharper marketing econometrics; founders join martech, CX swing to holdcos, consultants as SaaS resellers

Back in February marketing investment analytics platform Mutinex landed $5m backing with B2B SaaS specialist VC fund, Equity Venture Partners (EVP), leading a round that took the start-up to a $37m valuation. The fund thinks Mutinex can rapidly scale to become a $400m company as blue chip CFOs and CMOs rethink budget allocation and rewire processes around the platform. Founders Henry Innis and Matt Farrugia say competition from holdcos and consulting firms attempting to muscle-in is giving way to conversations around licensing the platform to their clients – effectively turning them into resellers. And lo, over the course of the year it came to pass, with Mutinex now valued at double that amount, EVP piling in harder and holdcos such as Dentsu becoming one of those resellers.

16.

Its trajectory will have competitors on alert ... No-one should be surprised if Amazon has closed the gap on Netflix in Australia despite Netflix having 2.2 million more users at the end of June 2022.

Amazon says it is now selling 200 million products on its Australian shopping site.

Amazon Australia cracks $100m in ad sales, $1.3bn from online store, $250m in Amazon Prime subscriptions; Total sales hit $2.6bn but posts loss of $1.5m

Amazon's Australian ad business cracked $100m last year, up 63 per cent on 2021 as net sales from its online store broke through the billion dollar barrier for the first time, growing 46 per cent for the calendar year to $1.3bn. The online juggernaut said in filings that it now has 200 million products listed locally. Amazon Prime's streaming and delivery subscription service delivered $250m in revenues, up 58 per cent on 2021 but it was third-party reseller services – where brands use Amazon's vast distribution and fulfilment infrastructure to sell and deliver products sold online – which was the fastest growing unit. It surged 75 per cent to $316m – a telling signal that the "closed loop" of combining an online shopfront and advertising to promote listed products with outsourced fulfilment and fast delivery is proving an efficient alternative to companies building stand-alone, direct-to-consumer ecom offers. Next year's filings will show just how rapidly its Australian business is finally starting to scale.

15.

Coles and Woolworths could dominate the entire ad market if they wanted to.

Retailer media eyes 50-100% growth in 2023: Nestlé, Pepsico, Lion, Moccona, Steggles, v2food on where the money’s moving and what’s stopping the floodgates – 74 page deep dive report

In the last year or so, retailers have started to become media players in earnest, bidding to follow the lead of the likes of Chemist Warehouse and Cartology and add a fatter slice of brand budgets to the trade and performance pots. But FMCG brands say taking the big money will require big upgrades in data, measurement and rigour. Mi3's 2023 special report – Retailer Media Next – pulls together cross industry insight via 25-plus interviews with marketers, retailers, platforms, agencies and analysts. If you haven't already done so, download it.

14.

When I first arrived people used to say to me the brand stuff was all about creating awareness. But we don't need awareness. We actually need brand to create preference and consideration ... So we need to reposition the brand, but if you don't have the proof points in the product and experience to back it up, it's a real waste of money.

Tabcorp customer chief, Jenni Barnett: "We've played catch up. But [now] we want to leapfrog the competition. It comes down to customer experience, leading through that and creating differentiation.”

Tabcorp customer chief Jenni Barnett stems digital haemorrhage to snappier rivals; bins bad media deals, restructures teams, now gunning for 10x conversion via ‘contextual personalisation’

Since leaving Telstra to take on a wide-ranging c-suite role at Tabcorp – spanning product, data and data science, customer experience and personalisation, brand, marketing and sponsorship with revenue responsibility – Chief Customer Officer Jenni Barnett has hit the turf running. The betting firm was haemorrhaging customers and share to digitally-savvier, free-spending rivals like Sportsbet and Ladbrokes. One year in, she’s stemmed the flow after launching a new app and migrating nearly a million customers within months to make the Spring Racing Carnival, driving ten updates since and KPI-ing the whole firm on digital revenue share. Customer experience is the key battleground per Barnett – and she’s front-running regulation and pulling Tabcorp out of daytime TV. To reel-in rivals she’s undertaken a sweeping overhaul of the marketing, digital, data and product teams and their capabilities – and pushed talent to develop quickly. Game on.

13.

A lot of tech has turned up and a lot of it is point solutions. They are really struggling to deliver value from that, because there aren't the skills internally, there's a lack of integration, a lot of technology silos between all those things.

Martech shakeup: LendLease and Sydney Opera House latest in a broad corporate rationalisation of marketing and customer technology investments.

Opera House, Lendlease latest to cut martech spend; Adobe, Salesforce, Sitecore displaced by challengers Canva, Hubspot, Optimizely, Acquia as big cost-driven consolidations begin

Mid-year it emerged that The Sydney Opera House and Lendlease had jettisoned their tier one martech platforms – Adobe, Salesforce and Sitecore – the latter two in the Lendlease stable – as they look to bank significant savings from martech rationalisation. Both projects are comprehensive in scope. Lendlease for instance is moving to Hubspot from Salesforce for core marketing cloud and customer relationship management (CRM) capabilities, to Optimizely from Sitecore for its digital experience platform which is designed to deliver personalised customer experiences and to Canva from Adobe for its content creation needs. And both deals are part of broader trend Forrester Research reckons could see corporates shed a third of their “tactical revenue stack solutions” in 2023.

12.

The biggest compliance costs will fall on those making the most money out of loyalty data … those with the biggest databases that they are trying to convert into media channels – because their business proposition is based on getting data and permission. They didn’t need permission before, now they do.

People power: "This is a sweeping set of changes that need to be taken seriously. Every company that has a relationship with customers...that collects and manages people’s data will soon experience a new set of rules," says REA's Josh Slighting.

‘Data is the new asbestos’: Privacy reforms pit ‘underwhelmed’ consumer advocates with industry preparing for ‘radical change’, heavy data compliance burden; Geo location, ad targeting, data trading face new consent rules

Seismic change? If there was one underlying theme to 2023 it was privacy and in February the Federal Attorney General dropped a 300-page document outlining the biggest overhaul to Australia’s privacy regime in two decades. The marketing, tech and media sectors face some pretty fundamental change to how they do digital marketing, advertising, targeting and personal data collection – among the most aggressive proposals are explicit consent requirements for geo-location tracking and for the trading of personal data, which have been expanded widely versus current privacy law. The overhaul raises massive, sector-wide compliance burdens and will require new skills and capabilities for firms which will need to explain what data they collect, and how they use it, in the language of a person with “below average intelligence”. If not, they can't use it. Industry will also have to deal with an “unqualified right” for individuals to opt out. Here's Mi3 first sweep of the reactions – and there's plenty more to come.

11.

[The Marketing Academy Scholarship Program] was life changing … it enabled me to open my eyes, expand my horizons and build my leadership capability to step up from CMO to CEO.

The Marketing Academy's new scholars for 2023

Top guns: The Marketing Academy Australia picks 30 execs to hone next marketing, media, agency leaders

Making The Marketing Academy Australia's intake is always highly prized. The selective scholarship program is designed to equip the next generation of top talent across marketing, media and agencies to become business and industry leaders, with mentoring from CMOs at ANZ, Commbank, NAB, Pernod Ricard, Lion, Telstra, Tourism Australia and Hipages. Here's the 2023 intake.

10.

These banks are going to spend three, five, eight million a year, every year for the next five, seven or ten years. I've talked to banks that have been getting half a billion dollars in return. Huge, but it's massive investment.

Pete Avery, Liz Miller and Rusty Warner on why real time decisioning is winning favour in banking and finance.

Huge returns, but huge investments: Why Commbank, Suncorp, NAB, BUPA and more are betting on real time decisioning engines; marketing clouds can't compete, for now

A select cadre of Australia's banking, insurance and telco brands including Commbank, NAB, Suncorp, BUPA and Optus are spending millions each year on real time decisioning. The pay off can be massive. Forrester's Rusty Warner says some firms are realising half a billion dollar returns by boosting customer lifetime value over and above increasing transactions and revenue. But he thinks selling to CMOs could be a mistake. Meanwhile, don't discount the impact of regulation, warns Constellation Research's Liz Miller. Pete Avery, former Program Director, CXM for Suncorp, says there are specific characteristics for the kinds of companies where the model make sense, but says many have not yet grasped the cultural shift required to make the tech work. All agree that traditional marketing clouds – the typical competitor set – can only carry real time decisioning so far. Which may be why Australia's top-end are unplugging them.

9.

If you [as a CMO] can figure out ways to unlock innovation in product, in digital technologies, I think you're going to survive, [be it as] chief marketing officer, chief innovation officer, chief supply chain officer whatever you want to call it … But if you’re in the business of media, I think it’s a difficult place right now.

Professor Scott Galloway: "I think the CMO is a little bit like having someone called chief electricity officer."

Scott Galloway: Why CMOs are ‘dead in 18 months’, work from home is a ‘fucking disaster’ for young men, which jobs will be usurped by AI – and why you shouldn’t worry about it too much

Professor Scott Galloway thinks 'traditional' CMOs are heading for the great gig in the sky. The only ones left standing will be those knee deep in the "boring shit" of supply chain, product and analytics. He's also bleak on the prospects of mid-weight graphic designers, social media managers and programmers as AI renders them obsolete. Longer term, AI will create more jobs than it takes, per the NYU professor of marketing. But in the short term, brace for the full impact of disruption. Galloway is also deeply concerned about the effects of work from home, particularly on young men: no mentors, no social skills, maybe no families of their own as a result. "Between porn and AI, are men ever going to leave the house? I fear we are raising a lost generation." More broadly, Galloway urges marketers – and everyone else – not to be too hard on themselves and be present in the now. That way, when we eventually do kick the bucket, we can at least be sure our lives really happened.

8.

I do think a CDP is the way to go, especially us as a multiple brand business. We’ve done some research which shows a strong affinity with our customers shopping other brands in our portfolio – but we just don’t know that through our own data. A CDP will help us to understand high value customers and how they’re shopping across our brands.

‘The whole economy is on a CDP bender’: NAB next to move, picks Tealium over Salesforce, Adobe; retailers, marketplaces piling in

At the start of the year, demand for CDPs – customer data platforms – was running hot, and only got hotter as businesses grasped the full implications of the government's sweeping privacy reforms. NAB was one of the early movers, choosing Tealium ahead of incumbent martech providers Adobe and Salesforce. Experience provider Big Red Group also made a CDP central to its major stack overhaul while Mosaic and Alquemie, owners of retail brands such as Surf Stitch, General Pants, National Geographic and Pumpkin Patch, have underlined that the tech is central to its growth ambitions – and to navigate a "very fragile" retail outlook in 2023. This was the story that seeded Mi3's multipart CDP investigation.

7.

What [Tourism Australia] is doing is demonstrating that the effectiveness book that's built, when you just follow the bloody instructions, is a really mighty and influential thing.

Unmistakably Australia: Susan Coghill and Mark Ritson on why Ruby the kangaroo is moving the marketing effectiveness needle, building brand and demand – and confounding critics – for years to come.

Let the marketing effectiveness rulebook do the talking: Tourism Australia CMO Susan Coghill and Mark Ritson on why Say G’Day’s success has silenced doubters – and will keep rolling for years

The naysayers scoffed when Tourism Australia made a CGI kangaroo and 1984’s Say G’Day tagline the main roll of a $125m tax-funded bet to bring the world back to Australia after three years of fire and plague. One year on, those “doofuses” are eating their words, per Mark Ritson, as the kangaroo eliminates misattribution, boosts consideration 18 per cent, delivers travellers in droves, primes high spending tourists to plan trips for next year and beyond, and remains at the very top end of System1’s effectiveness league table. Funnily enough, say Ritson and Tourism Australia CMO, Susan Coghill, following the marketing effectiveness playbook actually works – and the armchair critics were never the intended target. While Tourism Australia is now heading into a statutory review of its creative agency roster, don’t expect much to change – which means more budget to keep hammering the message home, building brand and delivering demand. Ritson reckons it could run for 20 years without wear out. Coghill’s planning for at least four. Here’s how Coghill did her homework, sold it in to stakeholders, went to market and how it’s tracking – and why, per Ritson, 20-30 per cent of marketers will never make the top grade if they cannot get comfortable with imperfect marketing datasets.

6.

Sales leaders are not shrinking violets. They have a very loud voice, they carry a number, they will be generally listened to. It takes a strong personality with a sound strategic argument, and the commitment and conviction that goes with that to fight their corner.

LinkedIn's Amy Mills, Forrester Researcher's Daryl Wright, Autodesk's Ljubica Radoicic and Green Hat's Joel Thomson on brand challenges facing B2B marketers

B2B bust-up: Third of B2B marketing budgets globally now spent on brand, says LinkedIn study, but Australian sales teams rule roost on performance marketing warn marketers, agencies

When it comes to investing in brand, Australia's B2B marketers know they are doing the wrong thing by over-investing in performance and demand generation marketing. Sales voices shout them down each time and B2B marketers lack the internal clout to fight back. It's an especially acute problem in the technology sector and for subsidiaries of international brands. B2B marketers know they need to prime 95 per cent of their prospects and customers who are not in market to buy at any given time for when they do become active – and to be in the consideration set for B2B buyers that are often 70 to 80 per cent along their purchase decision journey before vendors even know they are in the market. A global B2B marketing study by LinkedIn demonstrates how important brand is to B2B marketing around the world. For local marketers battling the shorter-term agenda from powerful sales teams, a new benchmarking tool pledges to help them mount better business – and sales – impact counteroffensives inside their organisations.

5.

My problem as usual with Ehrenberg-Bass is that they are right but they go too far: ‘Past worldview: positioning. New worldview is all about salience and distinctiveness’. They claim to be scientists at Ehrenberg-Bass – but there's a whiff of aftershave behind the white coat; commercial driving intent.

Mark Ritson: "It’s not an impossible mission. You don’t need to trade off differentiation and distinctiveness. You can have both – and you need both – to be successful."

‘Don't call it science, call it what it really is: consulting, dogma, ideology’: Mark Ritson on why Ehrenberg-Bass has distinctiveness v differentiation wrong – and how brands grow better with both

Distinctiveness versus differentiation is a non-binary fight, per Mark Ritson. Brands need both to grow faster – and he thinks Ehrenberg-Bass has it wrong in picking the former over the latter. To get it right, the virtual professor says marketers must change their approach to positioning – and massively strip it back. “It is the biggest action item I would recommend that you follow. Get rid of your complexity ... It’s making your brand less and less clear.” Pick one concept, two or three key brand attributes, then go to market with a simple, clear message – and hammer it as broadly as possible for years, maybe even decades.

4.

CRM had unfortunately become just very disjointed. It was a very poor experience for internal business units.

Everybody hurts: "It actually was really painful in the end for everybody," says Marc van den Berg, Global Head of IT Development & Innovation at Lendlease. So it went full stackageddon with a major martech consolidation – in seven months.

Rip and replace: All the winners and losers from Lendlease's massive martech consolidation; total cost of ownership slashed 78 per cent; few functional sacrifices in Salesforce-Hubspot swop

Massive martech licensing cost reductions have seen Lendlease slash total cost of ownership of its stack by almost 80 percent within months. The multinational developer earlier this year abandoned Salesforce after a decade's worth of collaboration, replacing it with Hubspot – and new details came to light after a presentation in the US by a key executive. Overall, it cut the number of providers from 20 to just five, and only two incumbents, DocuSign and Stripe survived 'stackageddon'. The timeframe was equally impressive – the project was delivered in seven months, a schedule the implementation partner described as 'insane'. But Lendlease's Marc van den Berg, Global Head of IT Development & Innovation, attributed success to that truncated timetable and a brutally honest acceptance of the state of play. Per van den Berg, it was better to just rip the band aid off technology debt that had become "really painful" for the business.

3.

Meta will tell us one thing, Google will tell us something else, and Criteo Offsite will tell us something. But what we want is an aggregated, holistic view on what people were doing.

Simon Hilton, Lizzy Foo Kune, Cam Strachan, Ben Hoefel, Pippa Leary, Kent Len and Keelan Howard.

CDP investigation Part 1: ANZ market closes in on 500 sites; Jetstar, News Corp, SCA, Chemist Warehouse, Karbon and CIAA unpack business impact; Segment dominates with over 330 customers, Tealium strong in enterprise, Lexer in retail, Adobe on the rise

The CDP market in Australia has ramped up massively with circa 500 companies now using customer data platforms or currently implementing. Segment dominates in volume terms with more than 330 customers, up from 50 just three years ago. But Tealium is capturing a big chunk of the loot thanks to its enterprise dominance. Together with Lexer (70-80 clients covering almost 110 brands) and Adobe, these four vendors have over 90 per cent of the installed base that Mi3 has identified. But it's the brand stories that really explain the appeal. The experience of Jetstar, Chemist Warehouse, News Corp, Moët & Chandon, SCA and a bunch of others suggest major marketing efficiency gains, strong customer growth, more effective advertising and the ability to save a packet by avoiding wastage. Plus better using all that first party data in an ad ecosystem in the middle of major structural upheaval. Here is the first instalment of Mi3's deep dive into the what, where and how of Australia's CDP market – and where it's headed.

2.

If Ehrenberg-Bass were as committed to scientific integrity as they claim to be, they would never have published the 95/5 rule prior to applying due rigour. And yet that doesn’t make 95/5 misleading or unhelpful.

James Hurman (left): "Ehrenberg-Bass' 'we're more scientific than you' posturing is not useful at all."

It’s not enough merely to win – others must lose: Why the Ehrenberg-Bass Institute’s MO is destructive to the marketing profession

The University of South Australia's influential Ehrenberg-Bass Institute (EBI) is back at it again – out in the world denouncing anything marketing effectiveness-related that hasn’t been produced by about 100 of its own marketing science researchers and academics. This time at the World Federation of Advertisers’ Forum Connect event in Singapore, following a similar spray at the B2B Next event in Sydney last year in which most advertising, media or marketing effectiveness thinking developed outside the EBI received brisk dismissal. Mi3 decided to publish the full audio of the original broadside event alongside this piece, in which James Hurman says the EBI risks misleading its clients, soiling the legacy of its namesakes, and undermining marketing effectiveness.

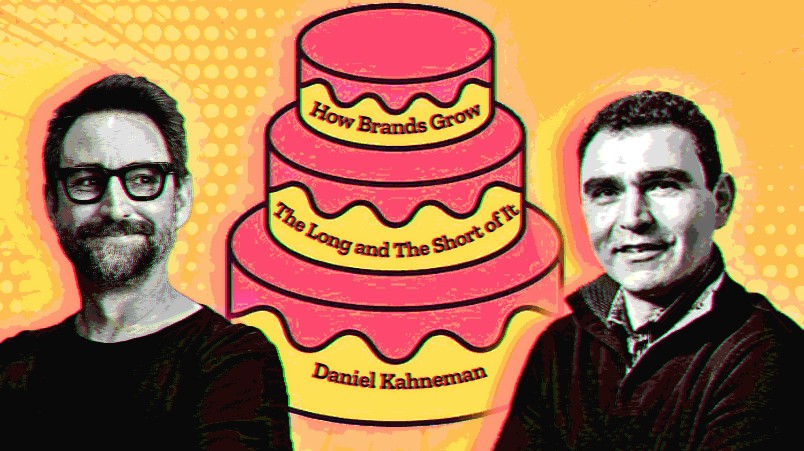

1.

We needed a marketing philosophy and approach that everybody would understand, buy-into and be able to activate. That was a massive challenge and I was almost overwhelmed. How the hell am I going to do that? I’ve got a department of about 80 people. I’ve got four to five agencies, about 40 people there too...

“It’s like baking a [marketing science] cake. Use all of the ingredients, it turns out brilliant. Leave any out, it's a mess.” James Hurman (left) and Douwe Bergsma are using every key marketing science ingredient – and watching KPIs rise nicely.

'Almost overwhelmed': How an ex-P&G US marketer ditched cohorts, personas, blended Ehrenberg-Bass, Binet & Field textbooks word for word, landed biggest marketing budget in $7bn company’s history – and all KPIs are powering

Douwe Bergsma was a veteran consumer goods marketer long frustrated with the light fodder served up at marketing industry conferences, and by big tech and the trade press. But he found enlightenment in the dense and dreary of marketing and behavioural science and advertising effectiveness studies. It’s not often Australia or New Zealand can teach the big US dogs new tricks but Bergsma’s agenda to reinvent healthcare and his $7bn organisation was a risky, and at the time, radical roll of the dice that spurned embracing everything new for the sake of it. The strategy and results so far are textbook stuff. Everything worked. KPIs are powering. Nobody is asking him any more hard questions, they just want more. Here's how it was done – and hats off to James Hurman for taking out the number one and number two spot in Mi3's most read marketing stories of 2023.