RECMA rankings: OMG, OMD hold top spot as billings contrast recent (and vanished) COMvergence report that pushed GroupM to top

Top three: Omnicom Media Group, GroupM and IPG Mediabrands are on the podium in RECMA's latest Aussie rankings

Omnicom Media Group (OMG) has the biggest media billings in Australia, per the latest RECMA agency rankings; its fifth straight year at the summit. GroupM and IPG Mediabrands were the next largest groups. The report contrasts a recent (and seemingly redacted) COMvergence report that placed GroupM on top, a result that had stunned – and riled – some. RECMA's results also show OMD well ahead on the agency list, though one independent agency has been powering up the growth charts for three years running.

What you need to know:

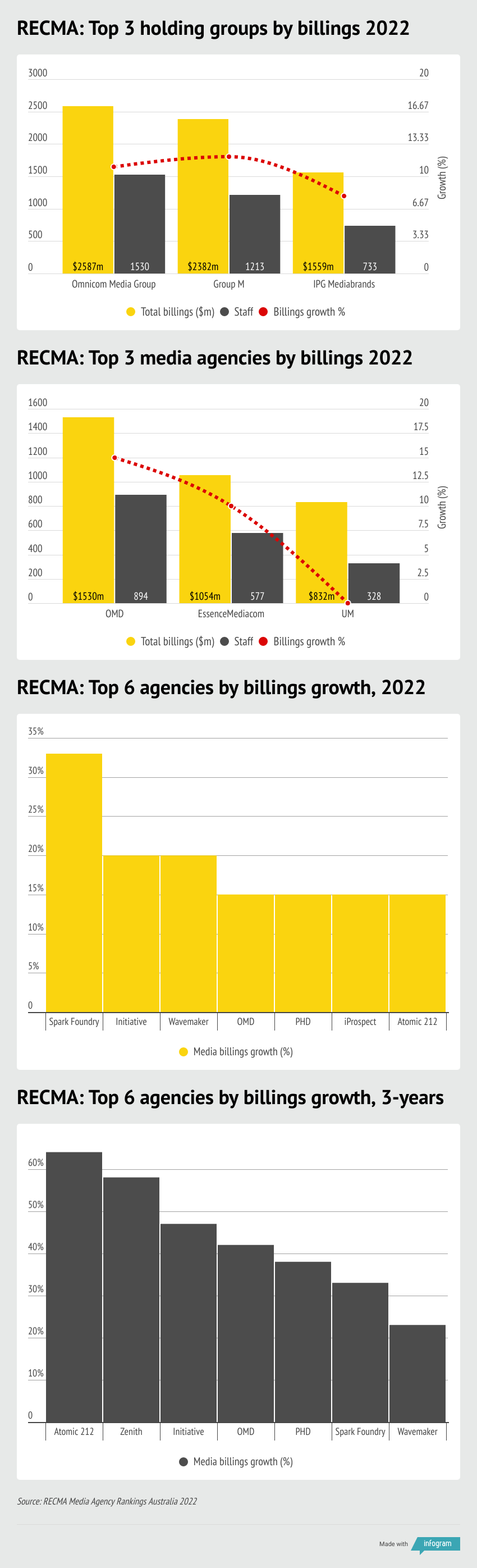

- RECMA rankings have Omnicom Media Group on top for the fifth consecutive year, growing billings by 11 per cent to nearly $2.6bn. GroupM is second with 12 per cent growth to $2.4bn.

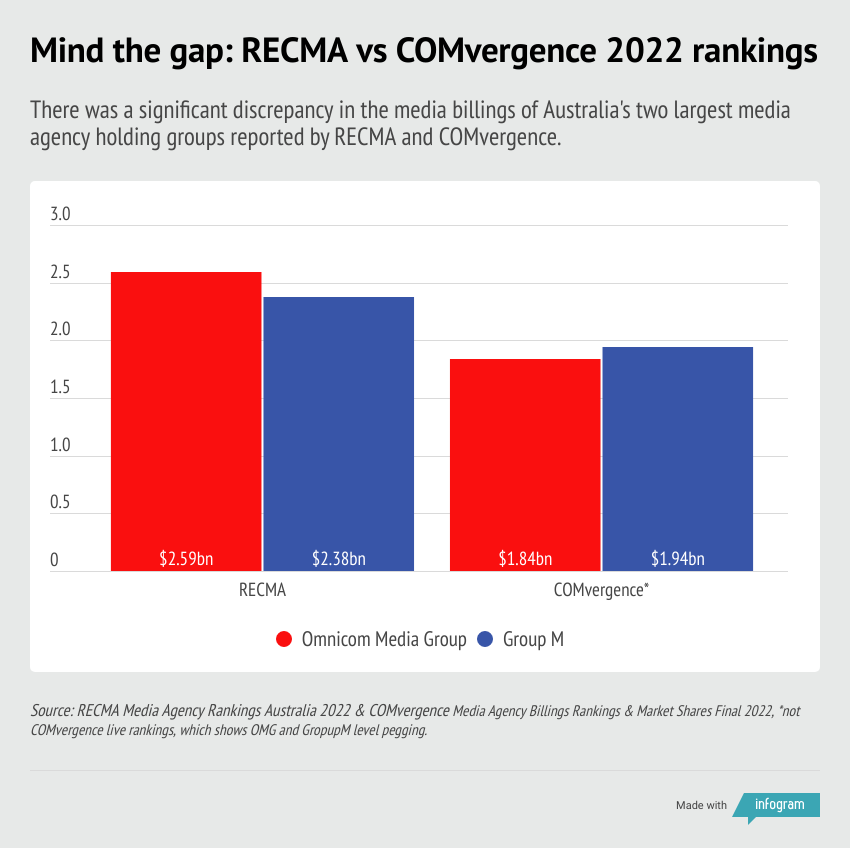

- The RECMA rankings contrast a report by rival COMvergence, which had placed GroupM on top, but has since been pulled.

- On the agency front, market leader OMD grew billings by 15 per cent to more than $1.5bn, followed by EssenceMediacom ($1.1bn) and UM ($832m).

- Spark Foundry is the fastest grower in 2022, but the indy Atomic 212 tops the growth chart over the past three years.

Omnicom Media Group (OMG) has consolidated its position as the largest media agency group in terms of media billings for the fifth straight year, according to RECMA’s latest rankings report. The holding group’s agency OMD also claimed top spot in the media agency rankings list.

In Australia, OMG’s billings grew 11 per cent to nearly $2.6bn, accounting for circa 28 per cent of the market. Across Australia and New Zealand, OMG’s combined billings topped $3.6bn.

GroupM was ranked second, though is narrowing the gap – it grew billings by 12 per cent to $2.4bn. IPG Mediabrands placed third after increasing billings 8 per cent to nearly $1.6bn.

OMD is comfortably the largest media agency, growing billings 15 per cent to more than $1.5bn, followed by GroupM’s EssenceMediacom (up 10 per cent to $1.1bn) and IPG Mediabrands’ UM (down 1 per cent to $832m).

The RECMA figures are in stark contrast to a recent COMvergence rankings table – compiled with figures supplied by agency groups – which reported GroupM had overtaken OMG to take the top slot. Mi3 understands the COMvergence report no longer appears on its website and has sought clarification from the research firm.

“With the withdrawal of the 2022 Australian COMvergence report, RECMA provides advertisers with the only market insight into the billings performance of holding groups and agencies. OMG retains the number one position for the fifth consecutive year because of the consistency of our delivery, by our people, for our clients,” OMG Chief Investment Officer Kristiaan Kroon told Mi3.

“This result is consistent with RECMA’s February 2023 Qualitative Report and the most recent Media i survey capturing media owners’ feedback on the strategic quality, transparency and delivery of media agency holding groups. Against all of these measures, OMG was placed number one in the market.”

Omnicom's position at the top of the pile aligns with the performance of its two largest agencies. In 2022, under joint CEO's Sian Whitnall and Laura Nice, OMD retained Coles Group, Frucor Suntory and Beiersdorf, expanded its relationship with Michael Hill, and added Amart and Leukaemia Foundation. Notably, it was appointed as the consolidated media agency for NSW Government – one of the largest domestic media accounts in Australia.

Sister agency PHD also put runs on the board, adding Virgin Voyages and MailChimp, and extending briefs with PepsiCo, 7-Eleven and Asahi Beverages.

GroupM, which slightly closed the gap on its rival, benefitted from a powerful performance by Wavemaker, which grew billings 20 per cent on the back of winning L’Oreal, Audible and Swyft, and organic growth from Paramount Viacom.

Initiative was another notable riser (see charts below), increasing billings by 20 per cent with wins including IAG, Afterpay and Kleenheat. It helped Mediabrands hold onto third position, although Publicis Media – which grew billings by 13 per cent – is breathing down its neck after Spark Foundry's reported 33 per cent billings growth.

Mind the gap

The RECMA figures contrast a recent COMvergence report, Media Agency Billings Rankings & Market Shares Final 2022, which claimed GroupM had leapfrogged OMG into top spot. In the report, GroupM’s 2021 billings grew 23 per cent to $2.2bn (US$1.416bn) compared with OMG’s 6 per cent growth to $2.09bn (see comparison below).

Both the COMvergence report and RECMA's use a mixture of agency self reporting and billings estimates in calculating the figures.

At the time of the COMvergence report, CEO Olivier Gauthier told Mi3 the media billings and market shares report was based on when media billings became effective, which could be four to five months after an account was won or lost. RECMA’s report also factors in when billings come into play rather than when an account is won or lost.

While not directly comparable, among the top five holding groups the gap between the RECMA billings and COMvergence billings was highest for Dentsu (RECMA’s billings figure is 205 per cent higher), followed by Publicis Media (153 per cent), IPG Mediabrands (143 per cent), OMG (140 per cent) and GroupM (123 per cent).

Mi3 has approached COMvergence for further clarification.