YouTube upfronts: Cadbury flicks TV, leads Christmas with YouTube, ups spend 150% – claims sales singing

YouTube's kicked off its upfront with a welcome to country performance by Jannawi Dance Clan, and also invited Mark Ritson plus Uber and Modelez marketers to sing its praises.

Mark Ritson’s discussions with Cadbury and Uber marketers pushed a powerful message to 750 advertisers and media buyers, with YouTube claiming it is not only more effective than TV, but does the job of every other media channel. Cadbury last year went all-in, cutting TV budgets entirely for its Christmas portfolio and claiming 15 per cent sales and 5 per cent sales growth, per marketer Kathy De Lullo. So it's upped YouTube spend 150 per cent. Heavy on bravado, the platform giant's upfront was light on new product releases. Although buyers scoffed at YouTube's claims it is 67 per cent more effective than TV, a new 30-second ad format on connected TV signalled a clear intent – the platform is coming for BVOD dollars too. But buyers think user-generated content remains the flaw in that plan. Others think trying to be all things to all advertisers creates a cloudy funnel and a muddled go-to-market strategy.

What you need to know:

- YouTube wants advertisers to know that it can deliver their top to bottom marketing funnel needs, and everything in between.

- But it's TV ad dollars that are firmly in its crosshairs.

- YouTube claims it is 67 per cent more effective than linear TV, driving an ROI that is 43 per cent higher, per a Nielsen MMM meta-analysis. Media buyers are not convinced.

- At its upfront, YouTube's pushed 30-second ads on Connected TV, more YouTube Shorts brand slots and AI-powered tools enabling “endless iterations” of ads across YouTube, display and Google Ads. That level of connectivity piqued the interest of at least one investment chief.

- Marketers from Cadbury and Uber swear by YouTube's effectiveness, with one claiming a digital Christmas campaign on a TV-sized budget outperformed previous TV-led campaigns.

- Media buyers have noted YouTube's intent to eat more of TV's pie, but would have liked more details on how YouTube performs in an integrated campaign.

The need for advertisers to invest greater time and capability in finding content and audiences they need [on YouTube], and avoid the rest, has only increased year-on-year. Essentially, have you got the capability to find a needle in the haystack?

Money talk

YouTube remains laser-focused on trousering more TV ad dollars and is hammering marketers with claims of higher effectiveness.

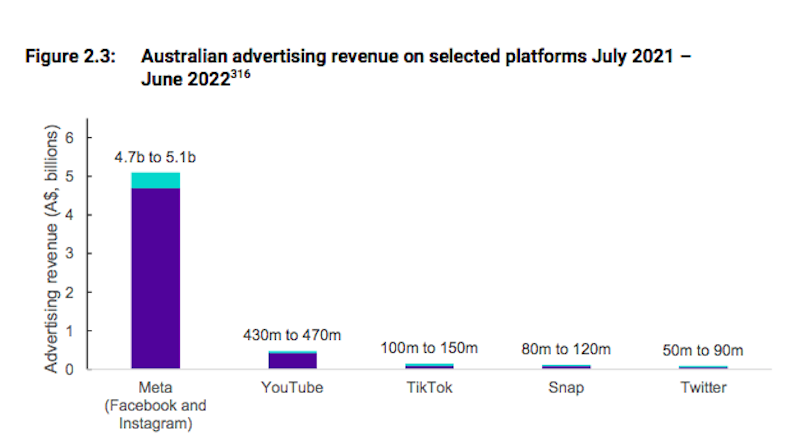

Some estimates suggest the Google-owned platform is raking in upwards of $1.5bn in Australia from video ads, though Youtube execs insist its numbers are closer to the $430-$470m estimated by the ACCC in the year to June 22.

Either way, the platform is sufficiently confident of increasing its share to launch little in the way of new products for advertisers at its Sydney upfront.

Its Brandcast event did provide a few new tools, such as a 30-second ad format for YouTube on Connected TV, branding opportunities when videos are paused on the big screen and Gen AI-powered capability enabling advertisers to curate “endless iterations” of ads across YouTube, display and Google Ads, which will be scaled across DV360 in Australia and New Zealand early next year.

But the real ‘wow’ moments came from Mark Ritson’s interviews with the senior marketers at Mondelez and Uber, who ran YouTube-specific campaigns that they say delivered better year-on-year results than TV.

Google Australia boss Mel Silva is spruiking YouTube as a 'one stop shop' for advertisers

'We're worth it'

While Nine is attempting to take the fight to YouTube via a new self-serve platform for SMEs, YouTube responded at the other end of town, wooing the big brands who spend big bucks on TV by doubling down on the leakage of linear eyeballs that in turn is leading an estimated $300m to shift out of terrestrial free to air TV this year.

While some agency forecasts suggest broadcasters' BVOD channels are on track to pick up circa $161m of that outflow, Google's not letting up on the TV narrative – and it's aiming harder at BVOD revenues too.

“Audiences have shifted. The channels that you've relied on in the past are simply not delivering the same sort of impact,” Google Australia Managing Director Mel Silva said, citing a Kantar/Google study that suggests that 42 per cent of Australians don't watch linear TV.

“I think there's a strategic imperative for everyone to start to reassess, to start to experiment, and to think about how you're going to continue to drive the same results that your business has been used to in the past.”

Google’s Head of YouTube, Deals and Programmatic Sales, Caroline Oates, continued to press the case by drawing on data from a Nielsen MMM analysis that found YouTube is 67 per cent more effective than linear TV, drives 43 per cent greater ROI, and is also 40 per cent more effective than other digital channels.

“Despite this,” she added, “We still say two-thirds of digital video plans are under-invested. So if we want to keep moving with audiences, it's about finding the right level of investment on platforms that can help you effectively reach your goals.”

A plug and a half

Comparisons between YouTube and TV’s effectiveness were the most common theme throughout the 1.5 hour long presentation, with 'virtual professor' Mark Ritson’s panel featuring Mondelēz International Senior Marketing Manager – Gifting and Seasonal, Kathy De Lullo, and Uber Senior Director and Head of International Marketing, Lucinda Barlow (YouTube's former Global Marketing Director), almost evangelical.

Barlow said Uber’s Get Almost Almost Anything campaign, which leant heavily on YouTube activity, drove Uber’s “strongest ever” brand health scores, including salience, consideration and preference and is now being scaled globally.

Mondelēz's Kathy De Lullo and Uber's Lucinda Barlow - an ex-Google marketer - walk through their YouTube success with Mark Ritson

Christmas comes early

De Lullo’s example of a Cadbury’s Christmas campaign probably turned most heads. She is massively ramping up spend on the platform – and for YouTube, Christmas has come early.

“We've seen continued ROI growth on the YouTube platform. So as a total portfolio, we have actually increased our spending by 49 per cent, but specifically on the Christmas portfolio, we have actually increased it by 150 per cent,” she said.

With declining linear TV audiences and ROI, Mondelēz chose to run last year’s Cadbury’s Christmas campaign as purely digital, with the lion’s share invested in YouTube. The hypothesis was to see whether a TV-sized budget in digital could deliver TV-sized results using a combination of longer creator-led videos and short 15-second commercials that could run across the YouTube network.

“Leaving TV off the schedule made my heart pump quite a bit. But actually, it was a big call and it was the right call. As it turned out, the effectiveness of YouTube actually trumped TV by 36 per cent. And aside from that, we were able to grow our sales by 15 per cent and also gained five points of market share.”

I think they're probably targeting a certain audience with this event, those very traditional brands that still absolutely prefer and preference TV in their plans.

Wooing traditionalists

Media buyers found the rhetoric and focus on hard numbers – albeit often Google's own hard numbers – more assertive than usual.

But Atomic 212 CEO Claire Fenner told Mi3 she takes any claims from media vendors with “a pinch of salt”.

“I think they're probably targeting a certain audience with this event, those very traditional brands that still absolutely prefer and preference TV in their plans,” she said.

“They have covered all bases tonight to try and show that they literally provide the same product that you can buy on TV. So that is a really easy transfer of audience and reach so that advertisers can just take the TV investment and shift into YouTube. It will be interesting to see how that plays out for them as it keeps pushing to steal more and more share from those bigger TV advertisers.”

Fenner said that the Cadbury’s and Uber case studies were compelling for brands that were “big believers in YouTube”. But she said more detail about YouTube’s impact in a cross-channel campaign is required to substantiate its claims.

“I think there's opportunities to do significant measurement led by Google that can actually help demonstrate and prove the impact of YouTube within a mix," per Fenner, "not just trying to push YouTube as the only option.”

Creator Mike's Mic (right) tells YouTube's Culture and Trends lead Ash Chang how his videos have shifted culture

'Multitrick pony'

OMD Australia Chief Investment Officer Marelle Salib said YouTube could have better explained how YouTube fits within a broader screens mix and was light on brand safety and suitability.

She suggested YouTube has a pass with advertisers when it comes down to new products, or lack thereof, because it already has “many tools within its arsenal that haven’t been used to their full potential”.

She thinks advertisers could benefit by better harnessing those features: “Youtube isn’t a one-trick pony, the benefits extend beyond reach,” per Salib. But she thinks the platform may be picking up bad habits from those it seeks to usurp.

“Tonally, it would be nice throughout the upfront season if everyone focussed on showing up as their best selves, showcasing their wares without having to knock anyone else down in the process," Salib added.

Not there yet

Omnicom Media Group’s Chief Investment Officer Kristiaan Kroon said that rolling out a 30-second non-skippable ad for connected TV was a clear sign YouTube is coming after BVOD and SVODs with ad tiers, “but they didn't close the gap tonight”.

“One of the reasons you go to BVOD and SVOD is because of the content type and that premium nature. And I think Brandcast wasn't around the premium nature of YouTube, it's around its effectiveness, which is different,” he said.

“The key takeaway from that is the need for advertisers to invest greater time and capability in finding content and audiences they need, and avoid the rest, has only increased year-on-year. Essentially, have you got the capability to find a needle in the haystack, because the content pool is almost endless.”

Kroon said the industry would welcome advances in Google DV360, such as being able to frequency cap and connect different video ecosystems, even though little was mentioned about it on the night.

“Almost blink and you would have missed it, but DV360 could play a very important role in how that interconnectivity continues to grow next year with so many different content and audience types for an advertiser to grapple with,” he added.

Kroon also pointed out the tightrope that YouTube is walking between being unique and different from its competition, while often leaning into direct comparisons with TV, could leave it “caught in between the two”.

Nonetheless, there is little doubt about where Google smells blood. Whatever the true number of its video takings in Australia, the likelihood is that it will keep going up.