Size matters: Media agencies dispute billings rankings, question discrepancies after GroupM leapfrogs Omnicom Media Group; COMvergence backs numbers, cites brand sign-offs, CFO statements

A wide gap between the media agency billings reported by holdcos and the net value of new business wins compiled by COMvergence has left some groups crying foul. According to the benchmarking firm, GroupM has substantially outgrown the competitive set and leapfrogged into top spot, despite Omnicom Media Group last year winning and retaining the largest accounts. COMvergence backs its figures – the firm told Mi3 that agencies must back-up any claims their figures have been underreported with client and CFO statements – and it has no plans to reissue them. But it said the methodologies between its two reports differ – and may revise the numbers in its forthcoming September report.

Latest media agency billings figures compiled by COMvergence have created further friction between Australia's largest media agency holding groups after WPP-owned GroupM leapfrogged rival Omnicom Media Group to claim the biggest number.

COMvergence – which analyses new business wins, losses and retentions – released two reports that rank new business success, billings and market share of Australian media agency holding groups.

The benchmarking firm's Media Agency Billings Rankings & Market Shares Final 2022 report, released late June, compiles total billings data that is self-reported by holding companies.

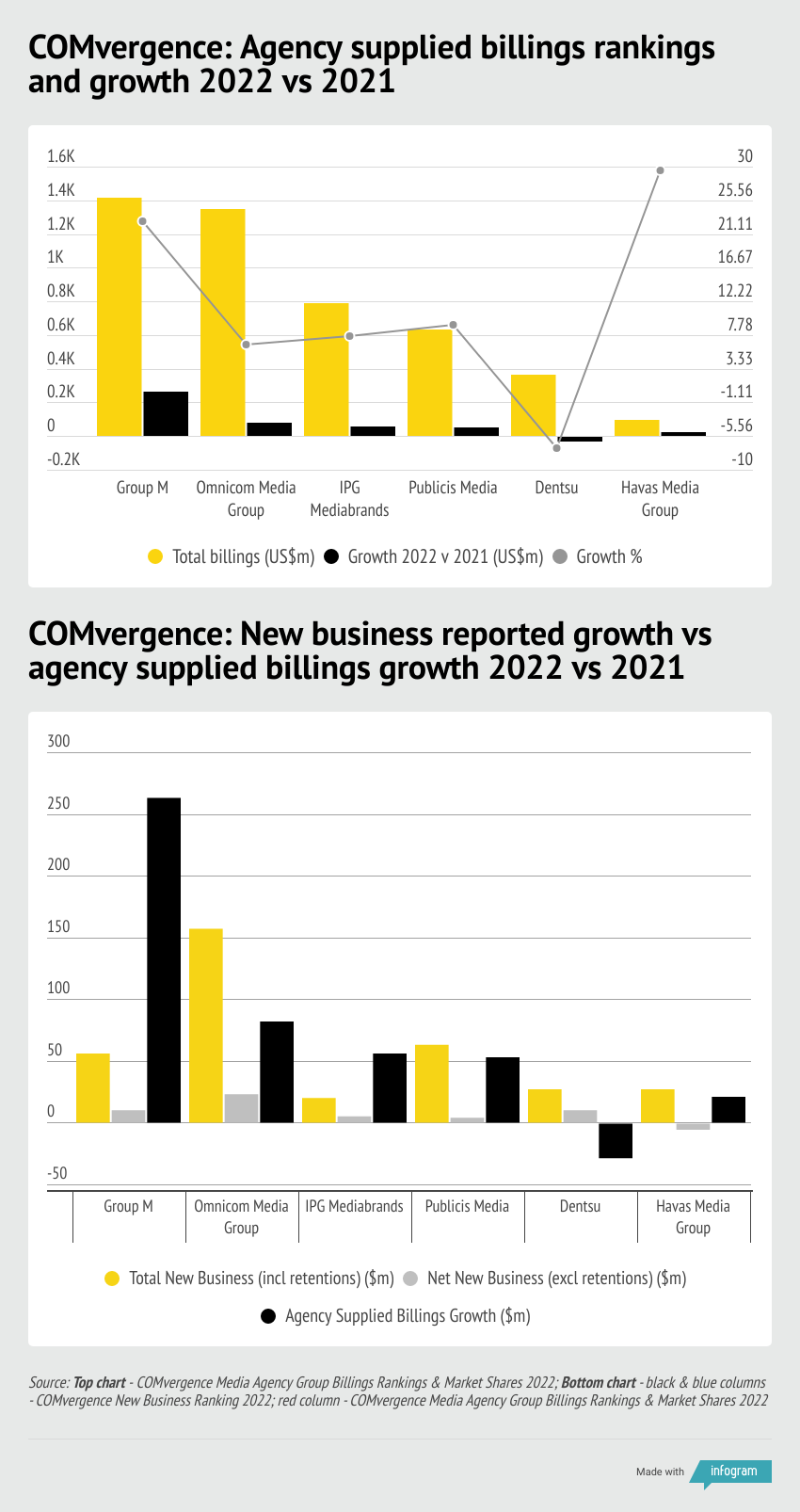

Per its submitted figures, GroupM grew total billings by a whopping 23 per cent to US$1.416bn in 2022, up from US$1.153bn in 2021, leapfrogging previous market leader Omnicom Media Group, which reported 6.5 per cent growth to US$1.346bn. That suggests GroupM powered way beyond its circa 6 per cent ad market growth forecast for 2022.

In third place was IPG Mediabrands (up 7.6 per cent to US$791m) followed by Publicis Media (up 9.1 per cent to US$632m) and Dentsu (down 7.2 per cent to US$366m).

In a separate COMvergence report, Media Agency New Business Barometer FY 2022 – which measures won, lost and retained media accounts across the same period – Omnicom Media Group had the largest net gain of new business wins, excluding retentions, adding US$23m in billings.

GroupM and Dentsu placed equal second, adding net US$10m in billings from pitching activity, followed by Mediabrands (up US$5m). Omnicom (gains of US$157m), Publicis (US$63m) and (GroupM US$56m) were the top three when retentions are included.

Comparing the two reports highlights some discrepancies.

The difference between how much GroupM claims it grew billings versus the net billings that COMVergence has tracked in pitching activity is US$253m. Other groups also reported differences: Omnicom (+US$59m), Mediabrands (+US$51m), Publicis Media (+US$49m) and for Havas it is +US$26m. On the flip side, Dentsu reported its billings had declined by US$23m compared with the figures COMVergence tracked through pitch activity.

Oranges with apples?

On the surface, the discrepancy between the sets of data appear difficult to explain, but there are important caveats that should be considered when comparing the figures.

Firstly, agencies often grow their media organically with current clients for additional scope and services. For example, if a GroupM agency substantially increased the scope of work with a client it would not be captured in net new business wins. Conversely, pitches in which accounts are retained, which are captured by COMVergence, may result in a reduced scope of work.

Another important consideration is when an account transitions from one group to another. If a large account loss remains with an agency for three quarters of the year, that revenue would count towards their total billings of that calendar year.

There are also some challenges in accurately assessing digital media spend. Nielsen, which COMVergence uses for offline media spend in Australia, is often questioned about its inability to capture digital media spend. Notably, in the figures supplied by agency groups, GroupM’s media channel split in digital grew by 10 percentage points to 55 per cent of its overall pie.

Nonetheless, OMD won and retained some of the largest pitches in 2022, holding onto Coles (with billings of US$88m) and winning the NSW Government (US$69m) in a review that consolidated media strategy, planning and buying from five agencies into one. Atomic 212 won the betting group Entain (US$41m) from GroupM's Essence towards the end of the year; Wavemaker picked up Mondelez (US$40m) and Zenith retained Aldi (US$33m) in October.

According to COMvergence, there were 155 account moves and pitches with a total media spend of US$814m on the line. Of this, US$256m in billings were from multi-market reviews and $559m from local. Media agency networks won and retained 112 pitches worth US$612m in billings.

At an agency level, OMD led the pack winning or retaining accounts with circa US$164m in billings (of which more than 90 per cent was local), followed by Wavemaker (US$88m) and Atomic 212 (US$65m), Zenith (US$55m) and Initiative (US$35m).

Holding firm

COMvergence told Mi3 that it is "still in discussion" with OMG and GroupM "but the main concerns have been solved", per CEO Olivier Gauthier.

"We won’t release any updated version of the report 2022, but we will release a new report next September based on projected 2023 billings figures and including (sightly adjusted) billings figures 2022," he added.

Asked to explain the differences in methodology between the two reports, COMvergence said that the key aspect is around timings. The New Business Barometer (pitches won, clients retained etc.) is based on when the account win is made official. But the Agency Billings & Market Shares report is based on the effective date, i.e. when the winning agency starts onboarding the client. "The gap between the two 'dates' can be up to four to five months," according to Gauthier.

Asked to explain the difference in GroupM's claimed billings growth versus the net billings growth COMvergence tracked for the group – a difference of US$253m – Gauthier said the reports use different methodologies and frequencies, and therefore were not comparing "apples to apples".

"Having said that, GroupM did see a considerable growth in their organic billings (of their existing clients) which led in great part to their estimated growth rate 2022."

COMvergence said that its billings estimates "are based on in-depth analysis of the agency feedback to the client lists and billings figures preview we sent them prior to publication".

Where agencies disagree with its estimates – i.e. when they think COMvergence has underestimated their billings, "they must support their claims with client statements and [a] CFO certification letter for COMvergence to validate them – considering that our media spend estimates (per advertiser) are based on Nielsen data (for offline media) and our own methodology for digital media consisting in applying average digital shares per category," per Gauthier.

Despite suffering some notable account losses last year, GroupM suggested strong organic growth had boosted its billings.