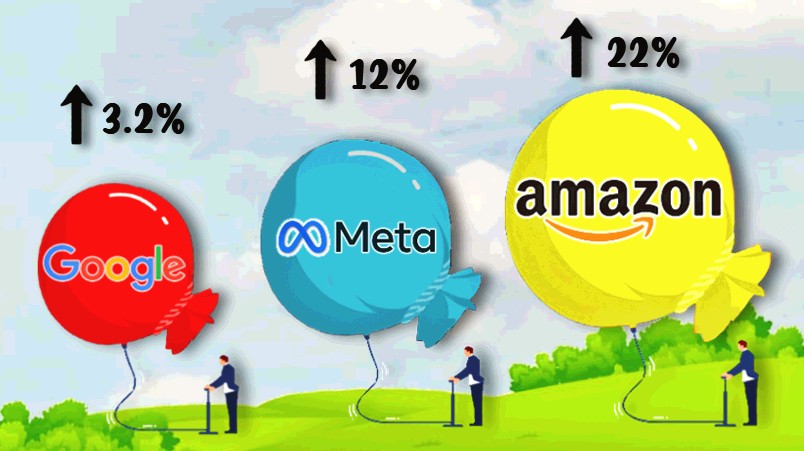

Reinflation: Revenues roar back for the digital giants in Q2 as Google rebounds, Meta surges, Amazon guns for $40bn ad business; Generative AI dominates every roadmap

All three of the digital advertising giants — Google, Meta and Amazon — revealed strong advertising growth for the second quarter. Pic: Image by Lauren Martin

Amazon's global advertising business is scaling aggressively, with the ecommerce and cloud computing giant reporting a $10bn ad revenue quarter off the back of 22 per cent growth. Meta and Alphabet also both delivered strong results in an encouraging sign for global advertising. The results may be a bellwether for the technology sector, which seems to be emerging from the deep freeze after watching share market gains made over the last decade all but collapse. In presentations to investors by the digital triumvirate, AI dominated, especially Generative AI. Amazon signalled a clear intent to play across all three layers – architecture, large language models, and applications. Meta outlined just how much AI broadly already influences its product set. Alphabet is backing Gen AI to drive search innovation – just as rival Bing starts to make headway via ChatGTP.

What you need to know

- Google, Meta, and Amazon reported much stronger advertising sales for the second quarter after the winter freeze.

- Beyond ads, all three delivered strong overall results for the quarter, suggesting the great global tech thaw is finally melting.

- That means its time for a new bubble – cue AI roadmaps.

- Amazon experienced the strongest advertising growth (off the lowest base) at 22 per cent, notching a $10bn ad revenue quarter. Its CFO Brian Olsavsky describes the ad business as the "largest contributor to growth." Amazon's annual ad business should comfortably exceed revenues of $40bn this year, especially given historically stronger second half performance.

- Google's ad revenues increased 3.2 per cent. Core search climbed 5 per cent to $42.6bn; YouTube gained 4 per cent to $7.7bn. Network sales were down again (5 per cent) to $7.9bn.

- Meta had a great result – quarterly ad revenues were up 12 per cent to $31.5bn with total revenues for the company now at $32bn. (Whatsapp business messaging made up most of the balance). It also reached 3.8bn monthly average users across all apps, and broke through 3bn MAUs on the Facebook mothership for the first time while holding daily average users above 2bn for the second quarter running.

- Meta emphasised its AI and Metaverse investments; Google its AI and search investments and Amazon its AI and supply chain investments (you can see a trend here).

- Generative AI dominated discussions in the earnings calls with investors.

- But revenue rises along won't pay for all those investments. Meta has cut 7,000 jobs, Google 10,000, and Amazon 23,000 since the technology sector's Great Involuntary Resignation era began late last year. That said, none are short of a quid. Meta is still on a cash pile of $53bn, and Amazon 65bn. Coincidently if you combine the two they equal Alphabets cash mountain of $118bn.

- All three companies gave a positive outlook for the next quarter.

Our performance-based advertising offerings continue to be the largest contributor to our growth. Third-party unit mix increased to 60 per cent during the quarter, the highest level we've ever seen, and we're continuing to see good growth in the number of sellers and the unit sold per seller.

After a tough start to the year, the global digital giants, Google, Meta and increasingly Amazon are trousering the proceeds of much healthier advertising revenue growth. In its This Year Next Year report published last month, GroupM said it expects global advertising to grow 5.9 per cent for the rest of this year and six per cent next year, with both digital (up 8.4 per cent) and retail media (up 9.9 per cent) outpacing the overall trend.

The latest quarterly financial reports from Google, Meta and Amazon lend credence to that optimistic assessment.

Amazon posted ad revenues of $10.68bn in Q2, following Q1's $9.5bn. By the end of the year Amazon's global advertising business – which barely rated a mention in its last quarterly earnings call with investors – is on track to exceed $40bn annual revenues. The smart money says it will do so comfortably: Last year Amazon posted stronger ad growth in the second half ($9.5bn in Q3 2022 and $11.6bn in Q4 2022) as advertisers piled into retail events in November and into the Christmas season.

Meta's ad revenues grew 12 per cent to $31.5bn while Alphabet's core advertising business was up 3.2 per cent to $66.3 billion, made up of search (up 5 per cent to $42.6bn), YouTube (up 4 per cent to $7.7bn) and Network (down 5 per cent to $7.9bn).

Amazon: performance push

McKinsey and Co's Quentin George told Mi3 earlier this year that without its advertising business linking ad impressions to a transaction, Amazon would loss-making (it posted net income of $6.7bn for Q2, mainly derived from AWS). At the time he said, "In the next year or two, when you say Amazon, you have to ask what business are they in? They’re in the advertising business because that’s where the majority of their profits will be derived."

According to Amazon chief financial officer Brian Olsavsky, "Our performance-based advertising offerings continue to be the largest contributor to our growth. Our teams worked to increase the relevancy of the ads we show to our customers by leveraging machine learning and improve our ability to measure the return on advertising spend for brands."

For product sold via Amazon.com he said third-party unit mix increased to 60 per cent during the quarter. "The highest level we've ever seen, and we're continuing to see good growth in the number of sellers and the unit sold per seller."

Olsavsky noted that Amazon is also making steady progress on improving its worldwide stores' profitability.

We will have to wait until early next year when Amazon files its results with ASIC to see how its advertising strength is translating down under, however we know its ad business tipped over $AUD100m in Australia last year per this year's filing.

Most of Amazon's ad revenue does not come from Amazon.com but rather from its ad network. However, the data it collects about buyers on its own site fuels the success of the campaigns that run off network – Amazon.com feeds the bigger beast. And a huge part of its ecommerce success is built upon its investment in distribution. Little wonder then that CEO Andrew Jassy spent so much time on the topic in the earnings call.

He stressed that regionalisation — shifting from one national network to eight separate regions with broad selection of inventory in each region — made it faster and less expensive to get products to customers.

Given the investment Coles and Woolworths have been making in their own distribution models, they are likely pouring over such details.

According to Jassy: "Regionalisation is working and has delivered a 20 per cent reduction in number of touches for our delivered package, a 19 per cent reduction in miles traveled to deliver packages to customers, and more than a 1,000-basis-point increase in deliveries fulfilled within region, which is now at 76 per cent. This is a lot of progress. Sometimes I hear people make the argument that Amazon is chasing faster speed while driving its costs higher and where it doesn't matter much to customers. This argument is incorrect."

Customers care about faster delivery, he insisted, and that having fulfilment centres closer to customers means deliveries "travel shorter distances, which cost less in transportation, get there faster, and is better for the environment."

Either way, the market likes what it sees: Amazon stock is trading close to a 12-month high off the back of the results.

Meta: More ads

Meta ad revenues hit $31.5 billion, up 12 percent. It would have been even higher – 13 per cent – except for what the company described as foreign currency headwinds.

Meta's CFO Susan Li said the online commerce vertical was the largest contributor to year-over-year growth followed by entertainment and media and CPG. "Online commerce benefited from strong spend among advertisers in China reaching customers in other markets. On a user geography basis, ad revenue growth was strongest in Rest of World at 16 per cent, followed by Europe, North America and Asia-Pacific at 14 per cent, 11 per cent and 10 per cent, respectively."

"In Q2, the total number of ad impressions served across our services increased 34 per cent and the average price per ad decreased 16 per cent. Impression growth was primarily driven by Asia-Pacific and Rest of World. The year-over-year decline in pricing was driven by strong impression growth, especially from lower monetising surfaces and regions."

She told investors "While overall pricing remains under pressure from these factors, we believe our ongoing improvements to ad targeting and measurement are continuing to drive improved results for advertisers."

B2B push

As to the other non-advertising chunk of $500m there was an interesting nugget: $225m of it came from growth in strong business messaging revenue from its Whatsapp Business Platform. CEO Mark Zuckerberg described business messaging as a key part of the company's monetisation strategy. "We recently announced that the 200 million users of our WhatsApp Business app will now be able to create Click-to-WhatsApp ads for Facebook and Instagram without needing a Facebook account. This is a pretty big unlock, particularly in countries where WhatsApp is often the first step to bringing a business online.

"Paid messaging is a bit earlier but is also showing good adoption. The number of businesses using our paid messaging products has doubled year over year."

Reeling in advertisers

The real monetisation gold however is in reels, those addictive short form videos on Instagram. Per the firm: "Reels continues to grow and drive incremental engagement. On Reels, we are making good progress on monetisation, with more than 3/4 of our advertisers now using Reels ads. We remain focused on further reducing the Reels revenue headwind and narrowing the monetisation efficiency gap with our more mature surfaces. However, we continue to expect time on Reels will monetise at a lower rate than Stories and Feed for the foreseeable future since people scroll more slowly through video content."

Locally, Helen Black, Head of Connection Planning, Meta ANZ told Mi3: "Reels is the gateway into the Instagram ecosystem. It leads to deeper engagement across Instagram, from profile pages, stories, direct messages and of course transactions with businesses. An interesting stat we found from the (Shift to Short Form) report, was 74 per cent of Australian users went on to purchase from a Reel after seeing Reels on Instagram.”

As an example of a local campaign, she flagged how Carlton United Brewery (CUB), used Reels to drive relevance with Gen Z audiences, using creators from a range of backgrounds. "The campaign allowed CUB to connect with a younger generation with a refreshed image, in a way that included inclusivity and authenticity. As a result it drove a 58 per cent higher incremental reach, compared to usual campaign and a 5.5-point higher incremental lift in affinity, compared to usual campaign," claimed Black.

Metaverse: not dead?

Boss Mark Zuckerberg insisted the metaverse is not dead. He said Meta remained fully committed to the the digital industry's previous repas du jour. Which is just as well given the tens of billions the firm has sunk into its Reality Labs unit.

According to the Meta founder, "The metaverse content and software vision continues coming together as well. We recently announced that Roblox is coming to Quest with an open beta on App Lab. For Horizon, the team is focused on retention right now and we're making good progress on that. We've made big improvements on avatars as well, and that’s going to be a bridge between our mobile apps and our VR and mixed reality experiences."

He promised to share more details at the company's Connect conference in late September.

Google: Back in black

In Google Advertising, Search & Other revenues grew 5 per cent year-on-year, led by solid growth in the retail vertical, according to Philipp Schindler, SVP and chief business officer at Google. The company also benefited from a turn around in YouTube advertising which last quarter suffered an 8 per cent reversal.

"In YouTube Ads, revenues were up 4 per cent year-on-year, driven by growth in brand, followed by direct response, reflecting further stabilisation in advertiser spend. In Network, revenues declined 5 per cent year-on-year. Google Other revenues were up 24 percent year-on-year, led by strong growth in YouTube subscriptions revenues."

Just as Meta relies heavily on the health of Facebook, Google Search remains the revenue engine room at Alphabet and for the first time in decades that market looks contestable.

CEO Sundar Pichai seemed to acknowledge the point while claiming the company's core business remained solid and sustainable. "We’re in a period of incredible innovation for Search, which has continuously evolved over the years. This quarter saw our next major evolution with the launch of the Search Generative Experience, or SGE, which uses the power of generative AI to make Search even more natural and intuitive. User feedback has been very positive so far. It can better answer the queries people come to us with today, while also unlocking entirely new types of questions that Search can answer."

Bouncing back. Digital giants rake in the revenue after a tough first quarter, and expect the next wave of growth to be AI fuelled, despite the technology's current immaturity and limitations. Pic: AI enhanced image by Lauren Martin

Generative imperatives: Google

Generative AI dominated the earnings calls of all three of the digital giants. That's because it – and other forms of AI – increasingly dominate their respective product roadmaps.

According to Google's Pichai, "We found that generative AI can connect the dots for people as they explore a topic or project, helping them weigh multiple factors and personal preferences before making a purchase or booking a trip. We see this new experience as another jumping-off point for exploring the web, enabling users to go deeper to learn about a topic... Since the May launch, we've boosted serving efficiency, reducing the time it takes to generate AI snapshots by half. We’ll deliver even faster responses over time."

He also stressed Gen AI's role in creativity and architecture.

On creativity he focussed on ongoing developments in Bard, Alphabet's ChatGPT rival. "Since launching in March, it continues to get better. We rolled out a number of exciting features and capabilities earlier this month. Bard is now available in most of the world and over 40 of the most widely spoken languages. We also added Google Lens capabilities, so you can take an image and ask all kinds of questions, turn it into code, and more. This new feature has been really popular, and it’s been great to see people sharing their experiences.

"Bard can now read its responses aloud, and you can adjust them for tone and style. We continue to see great interest in using Bard for coding tasks. On productivity, earlier this year, we introduced Duet AI in both Google Cloud and Workspace. It helps people collaborate with AI to code, write, and get better insights from data and more. Today, more than 750,000 Workspace users have access to the new features in preview," he said.

Inside Amazon, every one of our teams is working on building generative AI applications that reinvent and enhance their customers' experience.

Amazon's AI triple play

"Inside Amazon, every one of our teams is working on building generative AI applications that reinvent and enhance their customers' experience," Amazon's CEO Andy Jassy told investors identifying what he described as three layers of generative AI.

The ecommerce, advertising and cloud provider will play in all of them, he said.

First is the compute level which Amazon addressed through its AWS cloud business. According to Jassy, "At the lowest layer is the compute required to train foundational models and new inference or make predictions."

Next come the large language models: "We think of the middle layer as being large language models as a service. Stepping back for a second, to develop these large language models, it takes billions of dollars and multiple years to develop. Most companies tell us that they don't want to consume that resource building themselves," per Jassy. "Rather, they want access to those large language models, want to customise them with their own data without leaking their proprietary data into the general model, have all the security, privacy, and platform features in AWS work with this new enhanced model, and then have it all wrapped in a managed service."

The final tier is the applications layer which are programs that run on top of the large language models. "As I mentioned, ChatGPT is an example. We believe one of the early compelling generative AI applications is a coding companion. It's why we built Amazon CodeWhisperer, an AI-powered coding companion, which recommends code directly in the accelerating developer productivity as they code. It's off to a very strong start and changes the game with respect to developer productivity," added Jassy.

"But while we will build a number of these applications ourselves, most will be built by other companies, and we're optimistic that the largest number of these will be built on AWS."

Meta: AI powering engagement, discovery, ads

Meta's Zuckerberg outline the broad sweep of AI initiatives which the company has been developing and implementing now over several years.

"We’re leveraging AI to move our systems towards using fewer, larger models that enable us to leverage learnings across product surfaces and deploy improvements more quickly, broadly, and efficiently. We’re also leveraging AI to power advanced ads products, like Advantage+ shopping, which continues to gain adoption. We’re seeing this work translate into results for advertisers as conversion growth remained strong in Q2."

For Facebook users, AI is driving content recommendations. "AI-recommended content from accounts you don't follow is now the fastest growing category of content on Facebook's feed. Since introducing these recommendations, they have driven a 7 per cent increase in overall time spent on the platform," Zuckerberg said.

He described Reels as a key part of the company's Discovery Engine, and said Reels plays already exceed 200 billion per day across Facebook and Instagram.

"We're seeing good progress on Reels monetisation as well, with the annual revenue run-rate across our apps now exceeding $10 billion, up from $3 billion last fall. Beyond Reels, AI is driving results across our monetisation tools through our automated ads products, which we call Meta Advantage."

He claimed almost all of Meta's advertisers are using at least one of its AI-driven products. "We've also deployed Meta Lattice, a new model architecture that learns to predict an ad's performance across a variety of datasets and optimisation goals. And we introduced AI Sandbox, a testing playground for generative AI-powered tools like automatic text variation, background generation, and image outcropping."

Year ahead: return to mean?

With the pain of recent quarters seemingly behind them, all three tech behemoths provided largely positive forecasts for the rest of the year. As GroupM's numbers suggest, better days lie ahead, and those numbers don't include the impact of the looming US election season.