Adland left with $150m ad spend hole - but SMI boss says election anomaly distorting picture

$153m headline hole, but SMI's Jane Ractliffe says underlying market stable once last year's government and political party spending splurge factored-in.

Underlying demand returns, but Australia’s ad market has taken a heavy hit in spend due to the effects of last year’s Federal election and Covid campaigns. When government and political spending are stripped, the underlying market reported 0.1 per cent growth in spend, though that does not account for spiralling inflation.

More than $150m in advertising has been taken out of the ad market in the first five months of 2023, with channels taking another year-on-year hit in May due to abnormally high government and political party ad spend last year, per SMI data.

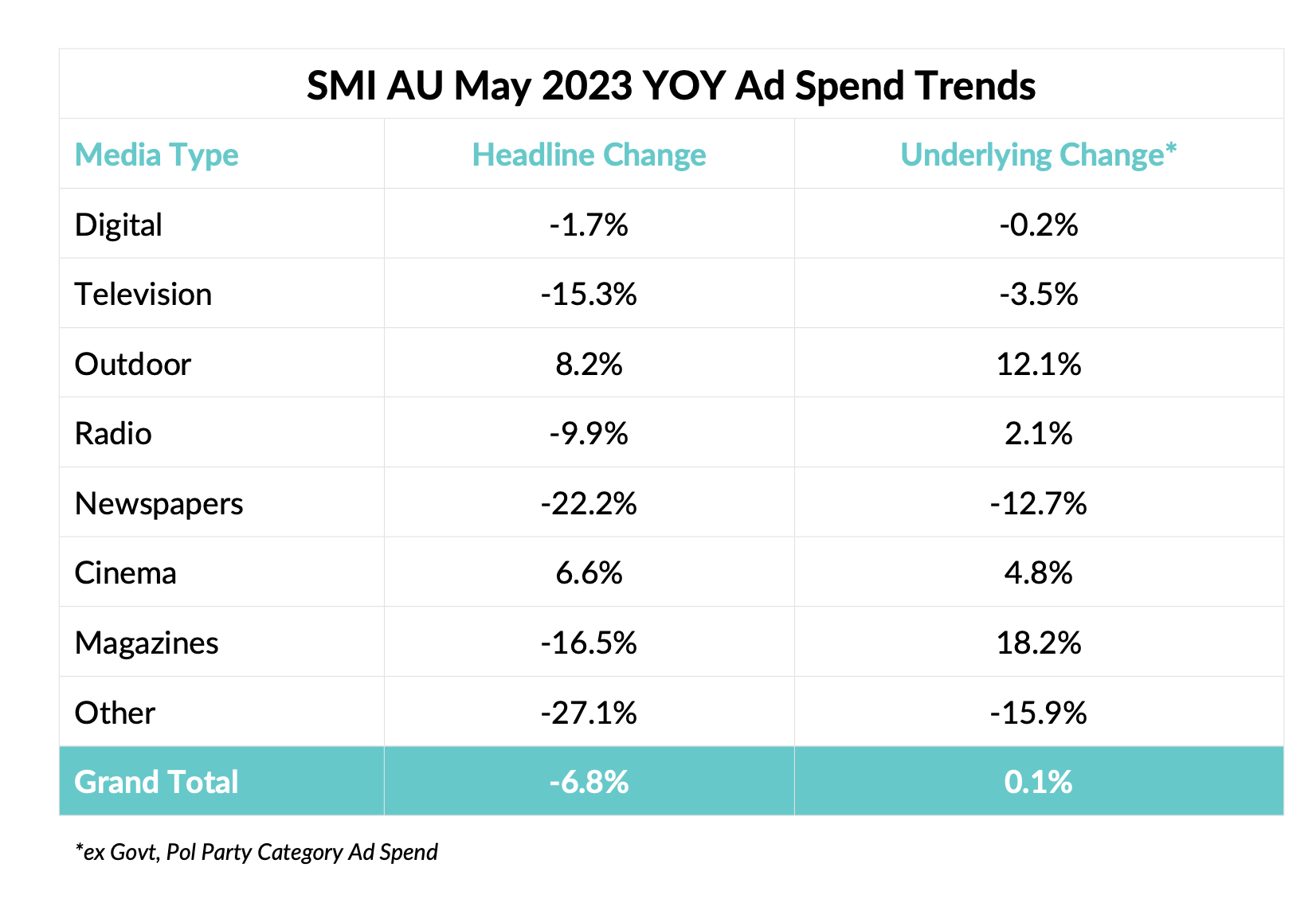

The firm – which compiles bookings made by media agencies – reports a monthly headline decline of 6.8 per cent, but that includes a $41.2 million fall in political party category ad spend and a $12.4 million hit from Government advertising.

The channels most impacted include newspapers (down 22.2 per cent this year), television (down 15.3 per cent) and magazines (down 16.5 per cent). Regional newspaper groups, such as Australian Community Media, are feeling the impacts as both federal and state governments pull back spend.

Cinema (up 6.6 per cent) and outdoor (up 8.2 per cent) showed the strongest growth. All channels fared better aside from outdoor when the impacts of Federal election and government advertising were stripped out and SMI boss Jane Ractliffe underlined that the market is in relatively sound health.

“SMI’s data quantifies the size of the abnormal impact the extra spending within these categories has had on our market, propelling it to record levels of ad spend last year but now creating a $153 million hole in ad spend since January which is affecting all major media,’’ said Ractliffe.

“Ad demand for both radio and magazines returns to growth when we remove the government and political party categories, while linear TV’s decline reduces from 15.3 to 3.5 per cent. These are huge swings that prove underlying ad demand remains stable for most media," she added.

“And there’s another sign the market is returning to normal as SMI’s Forward Pacings data for June shows 87 per cent of the value of last year’s June ad spend is already confirmed (ex Digital) and that’s back to levels we would normally expect to see in a growth market.”

However, with inflation running high, there are arguments to suggest that spend is in real term decline.