Think twice before abandoning linear TV: Three-year study shows advertisers swapping out for video go backwards

An analysis of more than 500 Australian brands spanning three years found that most advertisers who jumped ship to VOD lost market share. What does this mean for advertisers as linear TV audiences decline? Especially those that have almost entirely swapped linear for VOD over the last year thinking it will do the job. Risky strategy, per Adgile Media boss Shaun Lohman, who unpacks findings that run counter to the narrative brands are being fed.

What you need to know:

- Adgile mapped the performance of over 500 Australian brands over the last three years.

- It found when an advertiser moved a greater share of their budget from linear to VOD than its competitors, in most instances an immediate corresponding quarterly drop in consumer demand (share of search) followed.

- Market share (share of web traffic) also showed a strong correlation, with a decline materialising between three and 12 months after budget was shifted from linear to VOD, depending on the category.

- QSR and financial services saw some of the biggest falls in consumer demand.

- Meanwhile, more VOD channels coming to market has significant reach implications.

- Buying expensive VOD – but too little of it – and trying to offset it with masses of cheap YouTube is a highly questionable strategy.

You can’t just move TV money to YouTube and expect the same brand outcomes.

With audiences switching to streaming, many advertisers are asking themselves if they should bother with linear TV at all? It’s a fair question, especially as video on demand (VOD) platforms now reach more Australians than linear TV and offer much welcome flexibility. So, if you’re planning TV primarily based on campaign reach goals, and you can achieve this with VOD alone, why should you add the extra hassle and cost of linear?

Well, there’s a huge element missing from a pure reach debate – effectiveness. While the industry has been firmly focused on deduplicated audiences and hybrid currencies, far less time has been spent addressing an arguably more important consideration for advertisers: how effective is advertising on VOD, and how does it compare with linear TV?

The danger of jumping feet first

A comprehensive study conducted by Adgile, leveraging its proprietary Maximise AI machine learning models, examined the performance of over 500 Australian brands over the last three years. Monthly share of TV investment between linear and VOD was correlated against key business performance indicators: 'Share of Search' and 'Share of Web Traffic'. These indicators serve as proxies for consumer demand and market share, respectively.

Across the whole dataset, we found that when an advertiser moved a greater share of their budget from linear to VOD than their competitors, in most instances they experienced an immediate corresponding quarterly drop in consumer demand (share of search).

Market share (share of web traffic) also showed a strong correlation, with a decline materialising between three and 12 months after budget was shifted from linear to VOD (depending on the category). This decline was in comparison to competitors who shifted budget more cautiously.

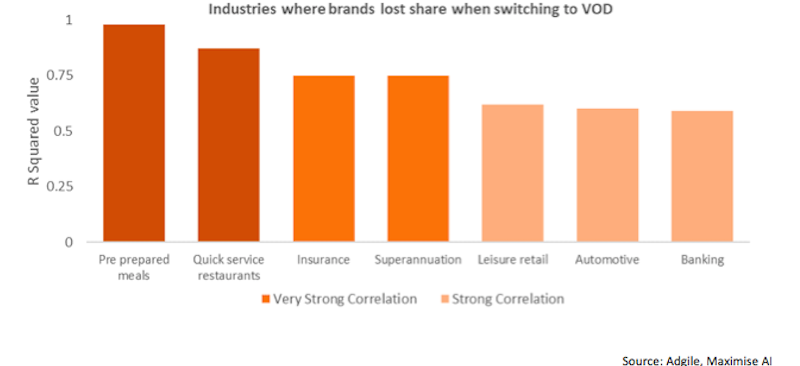

Advertiser industries experiencing the greatest loss in consumer demand when switching budget from linear to VOD included some of the biggest traditional TV spenders including QSR and Financial Services:

The data is compelling. Brands who spent more of their budget on linear performed better than those who shifted budget more aggressively to VOD.

It’s TV, but it’s not TV

Why would VOD not deliver similar business outcomes to linear? Well prominent academic studies over the years have consistently identified VOD as being less effective than linear at delivering brand metrics.

Recent studies have reinforced and built on the notion of linear TV being a ‘lean back’ medium, whilst digital media is ‘lean forward’. VOD, through its varied platforms, is a ‘spectrum of leaning’ ranging from the extremes of lean-back BVOD through to lean-forward YouTube and TikTok.

The academics argue that because YouTube and TikTok require more interactivity from users they are more cognitively demanding on viewers. The more attentional capacity needed for the media activity, the less will be left for ad processing.

Basically, when compared to linear, VOD adverts struggle to cut through. It also means that you can’t just replace linear reach with YouTube and expect the same brand outcomes.

Whether a 1+ reach goal can be translated literally to VOD within the modern Total TV landscape is an open question.

It’s not just the viewing experience that’s different

Blame cannot simply be placed on platform nuances or that YouTube makes it more challenging to drive brand metrics. The fact is many marketers are yet to fully grasp the inherent technical differences and biases between linear and VOD.

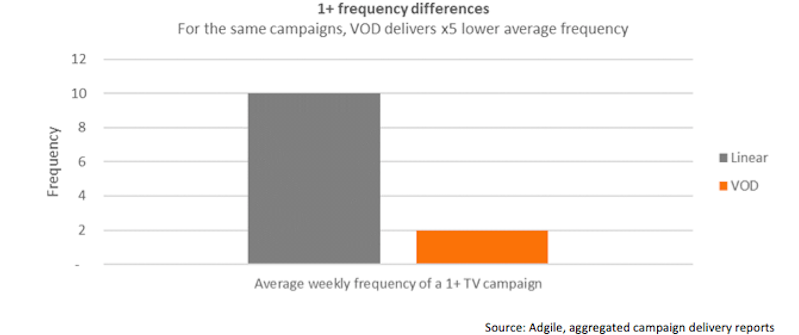

Take campaign frequency as an example. It remains a major issue with a fundamental misalignment between linear and VOD. A typical linear campaign with a 1+ weekly reach goal has an average frequency of about 10, whereas the equivalent VOD campaign is capped at 2, generating an average weekly frequency 5 times lower than linear.

Many brands adopt proven reach-based TV planning principles (Ehrenberg Bass et al) and employ a 1+ reach goal. However, quite whether this can be translated literally to VOD within the modern Total TV landscape is an open question.

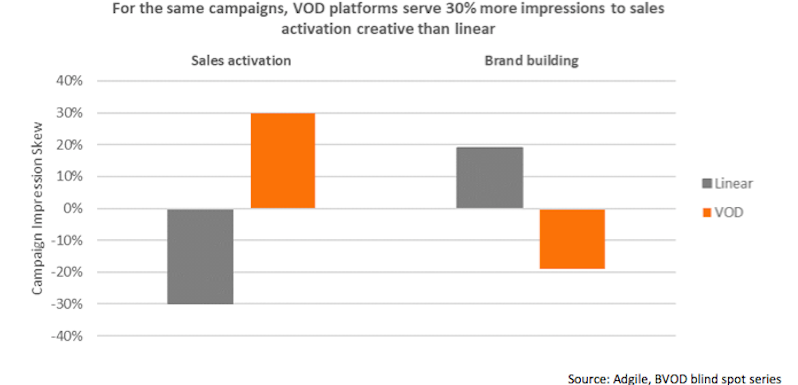

VOD campaigns also continue to favour sales activation creative over brand building ads. Adgile’s VOD benchmarking study showed that when brands ran both sales activation and branding creative, VOD campaigns would direct 30 per cent more impressions towards sales activation creative versus the equivalent linear campaign.

Sales activation creatives, with their direct call to action and urgency, generate a higher initial response from viewers and therefore optimisations (manual or automated) would likely divert more impressions their way. In these instances, overall campaign R&F metrics may appear to be comparable to linear, however it would play out very differently across the two channels.

Marketers believing that they can replace a 1+ linear reach campaign easily online need to be cautious. This is especially true if their plan includes expensive VOD at too low a frequency, offset with masses of cheap YouTube impressions that struggle to cut through.

Achieving effective reach

The growth of streaming audiences backed by linear’s decline shows no signs of slowing down, thus to achieve the reach enjoyed historically via linear will involve adding more and more VOD platforms.

Not only is each VOD platform fighting over audience, but also over a revenue pot that has historically only supported four commercial TV entities. This is contributing to the average CPM for VOD being significantly higher than linear. Higher media costs on VOD may well be justified, but only if the medium and the execution is more effective than linear. At present our data suggests that most brands have work to do in this area.

It’s critical that advertisers accelerate their understanding of the dynamics that drive TV performance for their brands. The key is to understand how each individual TV platform contributes to brand outcomes when used on its own and in combination. Successful brands will employ each platform’s strengths to its fullest, optimising marketing content and context to meet the needs of different consumer segments.

Marketers believing that they can replace a 1+ linear reach campaign easily online need to be cautious. This is especially true if their plan includes expensive VOD at too low a frequency, offset with masses of cheap YouTube impressions that struggle to cut through. Although their overall campaign R&F metrics may look similar to linear, the business results could be very different.

As ever, the devil is in the detail.